About the Company

Aavas Financiers Limited provides housing loans to customers belonging to low and middle-income segments in semi-urban and rural areas in India. The company offers home loans for flats, houses, and bungalows, as well as resale properties; land purchase and construction loans, including finance for self-construction of the residential houses; and home improvement loans, which include loans for tiling or flooring, plaster, painting, etc. It also provides home equity loans; and micro, small, and medium enterprise loans for business expansion, purchase of equipment, working capital, etc., as well as balance transfer products. The company was formerly known as AU Housing Finance Limited and changed its name to Aavas Financiers Limited in February 2017.

Q4FY23 Updates

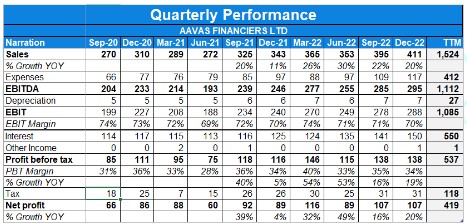

Financial Results & Highlights

Detailed Results:

- Q4 FY ’23 was the strongest quarter ever, with disbursements of INR 15,818 million, a 23% YoY growth.

- For the full year, disbursements reached INR 50,245 million, a 39% YoY growth.

- The company has maintained sufficient liquidity of INR 32,747 million as of March 31, 2023.

- The average borrowing cost is 7.61%, and the company has raised INR 47,631 million at an average rate of 7.25% during the year.

- The company had a good quarter with revenue growth of 30% YoY and 6% QoQ & PAT growth of 49% YoY and 30% QoQ.

- AUM growth for the company was 24.8% YoY to Rs.1,41,667 Cr.

- Disbursements for FY23 increased by 39.5% YoY to Rs.50,245 Cr.

- Gross Stage 3 loans were decreased by 7 bps% YoY. Net stage 3 stood at 0.68%

- Profit after tax increased by 19.8% YoY to INR 4,282.8 million in FY ’23.

- NIM in FY23 has gone up 5 bps YoY to 8.28%.

- ROA for the year is down by 7 Bps to 3.51%

- Product breakup was 69.9% Home Loans & 30.1% Other Mortgages Loans at the end of FY23.

- 99.7% customers of company are retail customer where as remaining 0.3% corporate customers.

- Around 60.1% of existing customers are self-employed while the rest are salaried.

- The company has kept the yield spread at 13.12% at the end of the year.

- Opex to AUM in FY23 is 3.68%.

(Numbers to be changed below from slide no. 26-29 from Investor ppt)

- It has surplus funds of Rs.3065.2 Cr as of 30th June 2022.

- It maintained a CAR of 50.46% with Tier 1 capital 49.8%.

- Book value per share was at Rs.367.9.

- 1+DPD stood at 4.67%.

- The company Incremental Q1 FY23 borrowings stood Rs. 898.4 Cr for 121 months at 5.65%.

- The company maintained a positive ALM surplus across all time periods and has an average tenor of outstanding borrowings stood at 127 months for this quarter.

- ICRA Limited upgraded the company’s Long-Term credit rating from AA-/Positive to AA/Stable on 17th June 2022.

Investor Conference Call Highlights

- The former MD, Sushil, has stepped down for personal reasons, and the Board appreciates his contributions.

- Promoter shareholders have not sold any shares in the past two years and do not plan to sell any in the coming year.

- The company has a deep and talented management team committed to long-term growth.

- The company has implemented the Salesforce platform and is focusing on its technology evolution.

- Assets under management (AUM) grew by 24.8% YoY to INR 1,41,667 million, excluding the impact of subsidies.

- The company has a well-diversified borrowing mix, including term loans, assignment/securitization, NHB, and debt capital markets.

- Gross Stage 3 assets stood at 0.92% and net Stage 3 assets at 0.68% as of March 31, 2023.

- Total ECL provisioning, including COVID-19 impact and Resolution Framework 2.0, stood at INR 716.1 million.

- The company has demonstrated strong asset quality and low credit costs during the COVID-19 period.

- The cost of borrowing may increase in the next two quarters due to the recent rate hikes, but the company aims to maintain competitive pricing.

- AUM growth trajectory remains strong, with new business growing around 40% YoY in FY ’23.

- The company is investing in technology, branches, and new products to support future growth.

- The ideal loan mix in the near term includes a blend of home loans and non-home loans.

- Management, employees, and board members own about 3.9% equity in the company as of March 31, 2023, excluding recent ESOPs.

- The underwriting model will not undergo fundamental changes but will be supported by new technology tools to enhance efficiency and decision-making.

- The company is focused on building skills, technology, and culture to integrate analytics into the system.

- Deloitte has been engaged to help with the digital strategy roadmap exercise.

- Salesforce has been rolled out to the entire organization, and further transformation is ongoing with Oracle Flex Cube and Oracle Fusion on Oracle Cloud

- The company stated that most branches achieve break-even within six months, and 1-year-old branches provide a return on equity (ROE) of 12% or higher & Three-year-old branches deliver a ROE of approximately 20%.

- The company has seen around 25% to 30% growth in Rajasthan and other states like MP, Gujarat, and Maharashtra in terms of disbursements.

- PLR (Prime Lending Rate) was increased by 160 basis points, but the overall impact on the AUM (Assets Under Management) is not directly proportional due to the mix of fixed rate borrowing and fixed rate contracts.

- The increase in interest rates takes time to translate into new business, and the impact on AUM yield may not be immediate.

- PLR hikes are effective immediately for contracts with floating rates.

- Technology investments are expected to accelerate growth in the next two years, improve TAT (Turnaround Time), and enhance operational efficiency and customer experience.

Analyst’s View

Aavas Financiers is a fast-growing housing finance company in India. What sets it apart from the large housing finance players like HDFC, LIC Housing Finance & Repco is the space they cater to. The average ticket size of loans is less than 9 lacs against more than 14 lacs for others. Aavas caters to smaller towns where the population is less than 10 lacs. Aavas has a good quarter that saw both YoY growth and QoQ growth. It remains to be seen how the stepping down of the MD affects the company & whether the company will be able to sustain its lofty growth momentum. Nevertheless, it is a good business to track in the housing finance space, especially given its consistent and steady growth while maintaining good asset quality and underwriting standards.

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a good quarter with revenue & PAT growth of 20% YoY.

- Sachinder Bhinder was elevated to the role of CEO (earlier CEO of Aavas’ MSME Business).

- Disbursements for 9MFY23 stood at 48.7%.

- Gross stage 3 stood at 1.13%.

- NIM improved by 12 Bps to 8.23%.

- ROA for 9M improved by 6 bps to 3.43%.

- Home loan: other mortgage loans stood at 29.9:70.1.

- Self-employed: salaried stood at 60.3:39.7.

- Q3 Cost of borrowings stood at 7.29% while yields stayed at 13.04% leading to a yield degrow of 11 bps to 5.75%.

- Asset under management grew 23.3% year-on-year.

- 9M OpEx stood at 3.75% while NIM stood at 8.23%.

- ALM mismatch was positive(surplus) across all time frames.

- Avg. tenor of O/S borrowings stood at 127 months.

- 9M ROE stood at 13.59% while CAR stood at 49.22%.

- Book value per share stood at Rs.398.4.

Investor Conference Call Highlights

- Sushil Agarwal will continue to be the Managing Director of the company, and continue to focus on its overall business strategy for the future.

- After witnessing a 190 basis point increase in the repo rate in the first half of the year, RBI has further increased the repo rate by 35 basis points during the third quarter. Consequently, the company increased its prime lending rate by 125 basis points during the first 9 months of FY ’23 and further increased 35 basis points with effect from January 5, 2023.

- During the quarter, the company borrowed an incremental amount of INR 13,364 million at 7.15%.

- Overall borrowing mix as on December 31, 2022, is 42.2% from Long-term loans from banks: 22.3% from assignment and securitization, 22% from National Housing Bank, and 13.5% from debt capital market.

- Liquidity stood at INR 27,882 million as of December 2022 while Cash and cash equivalent balance of INR 14,682 million & Unavailed cash credit limit of INR 1,100 million, documented unavailed sanction from other banks of INR 12,100 million.

- The management states that its non-home loan portfolio is around 28%-30%, And two-three years back most of this portfolio was LAP, and 3 years back, they started converting this into MSME. Now, 40% of that non-home loan portfolio is an MSME portfolio.

- MSME portfolio is different from LAP because of tenure wherein the MSME portfolio is seven years while LAP can be up to 15 years. MSME portfolio can be used by business guys only, LAP can be used for personal use also & lastly, an MSME loan is basically a priority sector loan, so it gets funding accordingly.

- The management is targeting 70-30 home loans and nonhome loans, most of which would be MSME loans.

- The management is confident of growing despite competition due to its distribution and reach of up to 2,500 towns in Tier 2-5 regions.

- Sachinder (the New CEO) has contributed towards building an MSME business in the parent company, coupled with involvement in affordable housing and some of the direct government-led businesses in the company.

- The company’s digital transformation project has a capital outlay of around INR 120 crores to INR 150 crores.

- The company’s new initiative will help to bring turnaround time down by 30%- 40% in the first phase and maybe second phase it can be further better out coupled with better customer experience & productivity enhancement.

- Conversion of files to the digital version from hardcopy (used by underwriters) will lead to a cost saving of INR10-12 Crs per year.

- In the LMS space, the company will be adopting Flex cube (which is used by large banks) which will help to scale its branch network.

- In the ERP systems space, the company will adopt Oracle Fusion which will help in getting better cuts on profitability product-wise, branch-wise, people-wise & different segments-wise. It will also help in bringing IndAS accounting on a fully automated basis.

- The company is also working on analytics, where it is creating an architecture that can sustain 100x growth on data from the current level with seamless integration and speedy decision-making.

- The yield on NHL is around 14% and the home loan is around 12%, And they break even from the very first year since the company takes a 2% to 2.5% upfront fee on its loan book.

- The average ticket size is around 11 lac and INR 1,200 crores disbursement has happened out of which 70% is about INR 8,400 crores i.e. around 9,000 cases are in the home loan category and around 3,000 cases in the non-home loan category.

- In the current year, the company opened 7 branches and another 23 will be opened in this quarter.

- The management expects Opex % to decrease from Q3FY24 by a trending 25-30 bps on a YoY basis.

- The company will open 30-35 branches every year & open branches in 4 new states every 5 years. The company has already opened branches in Karnataka & Orissa & plans to open in 2 new states (currently it has penetrated 13 states) in the next 3-5 years.

- The management explains its customer split by stating that “Aavas has more customer focus on business customers, the salaried customer is 39%, and 62% is self-employed. In the self-employed category we cater to around 40 profiles from kirana merchants to medical shops to hardware to halwai to cargo, so everything which you will see on the state, but mostly it’s D2C business”

- The company even in its MSME lending space funds against property, where normally 99% of securities are self-occupied residential properties in this segment.

Analyst’s View

Aavas Financiers is a fast-growing housing finance company in India. What sets it apart from the large housing finance players like HDFC, LIC Housing Finance & Repco is the space they cater to. The average ticket size of loans is less than 9 lacs against more than 14 lacs for others. Aavas caters to smaller towns where the population is less than 10 lacs. Aavas has a good quarter that saw both YoY growth and QoQ growth. It has also maintained AUM growth of >20% and improved its FY22 NIM to 8.23% and 8.17% in Q3. It remains to be seen how the new CEO will lead the biz to new heights & whether the company will be able to sustain its lofty growth momentum and what challenges will it face when expanding into new states like Odisha where housing loan penetration is very low. However, stretched valuations may have factored in most of the positives. Nevertheless, it is a good business to track in the housing finance space, especially given its consistent and steady growth while maintaining good asset quality and underwriting standards.

Q2FY23 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 395.08 | 325.46 | 21.39% | 352.88 | 11.96% | 1,305 | 1,105 | 18.10% |

| PBT | 137.79 | 118.32 | 16.46% | 114.67 | 20.16% | 455 | 353 | 28.90% |

| PAT | 106.82 | 92.12 | 15.96% | 89.22 | 19.73% | 357 | 289 | 23.53% |

| Consolidated Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 395.18 | 325.45 | 21.43% | 352.95 | 11.96% | 1,305 | 1,105 | 18.10% |

| PBT | 137.55 | 118.03 | 16.54% | 114.43 | 20.20% | 455 | 353 | 28.90% |

| PAT | 106.64 | 91.90 | 16.04% | 89.04 | 19.77% | 357 | 289 | 23.53% |

Detailed Results:

- The company had a good quarter with revenue growth of 21% YoY and 12% QoQ and PAT growth of 16% YoY and 20% QoQ.

- During the quarter, the company’s long-term credit rating was updated from AA minus positive outlook to AA stable outlook by CARE in line with the ICRA.

- In Q2 FY2023, the company disbursed Rs.1146.7 Crores, registering a 27% year-on-year growth and achieving 89% of the disbursement done in strong Q4 last year.

- In H1, the company has disbursed around Rs 2300 crores.

- Rs.7200 Crores is a floating rate loan and Rs.5300 on a fixed side, out of which Rs.1300 Crores is getting reset this year.

- PAT growth of 29% year-onyear for H1 FY2023.

- 1 + DPD stood at 4.45% with an improvement of 22-basis point from first quarter.

- 90 day past due stood at 0.93% in September 2022, Gross Stage 3 is 1.10% in September 2022.

- During the quarter, company borrowed an incremental amount of Rs.9467 million at 7.55% as of September 2022, average cost of borrowing stood at 6.99% on an outstanding amount of Rs.109711 million.

- As on September 30, 2022 total number of live account stood at Rs.166639 that is 23% year-on-year growth

- Total number of branches was 321, 24 new branches added in last 12 months.

- Employee count 5702, 23% year-on-year growth.

- Asset under management grew 24% year-on-year to Rs.125437 million as on September 30, 2022.

- During the half year, we borrowed Rs.18451 million at an average rate of 6.62%.

- Assets Quality and Provisioning: 1 day past due stood at 4.45%, Gross Stage 3 stood at 1.10%, Net Stage 3 stood at 0.84% as on September 30, 2022;

- Gross Stage 3 of 1.10% includes 0.17% up to 90 day DPD assets, which have been categorized as GNPA following RBI notification dated November 12, 2021.

- Liquidity of Rs.28370 million as on September 30, 2022, cash and cash equivalent of Rs.13270 million, un-availed CC limit of Rs.1100 million, document un-availed sanction limited from other banks Rs.14000 million.

- ROA was 3.42%, ROE was 13.44% for H1 FY2023.

- As on September 30, 2022, the company has a net worth of Rs.30314 million, book value per share stood at Rs.383.6.

Investor Conference Call Highlights

- The company has increased prime lending rate by 75-basis point during H1 FY2023 and further increase of 50-basis point with effect from October 5, 2022.

- The management stated they will continue strategy of controlling early delinquencies and strive to maintain 1+ DPD below 5% and 90 day past-due below 1%.

- The company continued to maintain zero exposure to commercial papers.

- Product-wise breakup of AUM:

Home loan 70.9%,

Other mortgage loans 29.1%; - Occupation-wise breakup AUM:

Salaried 39.8%,

Self-employed 60.2%. - Overall borrowing mix as on September 30, 2022

41.8% from term loans,

23% from assignment and securitization,

20.5% from National Housing Bank,

14.7% from debt capital markets. - During FY2022, resolution plan was implemented for certain borrower accounts as per RBI’s Resolution Framework 2.0 dated May 5, 2021. Some such accounts with an outstanding amount of Rs. 1012.5 million as on September 30, 2022 have been classified as Stage 2 and provided for as per the regulatory guidelines. The ECL provisioning including that for COVID-19 impact as well as Resolution Framework 2.0 stood at Rs. 649.1 million as on September 30, 2022.

- The management stated from April 1, 2022 they have stock mark in cases AFS which was earlier whenever any asset repossessed in the sarfaesi, they used to mark AFS and it will go away, but now AFL will remain in the book, so this Stage 3b amount is an addition, otherwise it is around 0.9.

- This year the company is spending a lot much amount on the digital transformation and last quarter, the company started implementing LOS which is SFDC and now it has signed up for LMS which is core banking system, and for accounting software also which is now called ERP in the banking parlance, so the company is shifting to Oracle Fusion which is used by the large banks. Once all these things we will be maintained in six to nine months, we will see again the downward trend of opex.

- The management stated they will open 35 branches this year; they opened 7 in H1, rest will be there in H2.

- The management stated in next three years if the balance sheet gets double, so the company will be spending money for leadership development like this year it has tied up with IIM Ahmedabad, company’s 35 officers got that training and certification and this will be a second line, third line creation in the organization, so continuous investment in people process and technology.

- In Q2, the company not borrowed any money from NHB, but it has got sanctioned of around Rs.900 Crores from NHB for the next fiscal year.

- The company has been able to reduce attrition rate in Q2 by 20%.

- The company’s BT-out have come down, earlier it was around 0.6% per month which has reduced to now 0.5%.

- The management expects and is okay with 20-25% yearly growth in AUM.

- The company’s HL pricing is around 11.7% to 12% and non-HL rates are from 14% to 14.25% average, these are new business rate.

- The management stated mostly in a normal year 40% to 45% disbursement happen in first half and another 55% to 60% in second half.

- The management stated 1% to 1.25% kind of applications come in every month in BT-out and the company has a strong team and DNA at branch head level and everybody KRA is linked to the customer that good customer should always be with the company. So out of 1.25% around 0.25-0.3% customers where the company want them to go, because they will then continuous delinquency; another 0.5% may be 60% may need to offer the rate, 40% the company need to offer either grievance redressal or maybe if they want some top up, the company provide that.

- Breakup of loan book by ticket size:

72% customers are less than 10 lakh

23% are between 10 to 25 lakh

4% to 5% customers are more than 25 lakhs - The company’s home loan fixed rate is 12% and floating rate is 10%; between fixed and floating, the differential on average would be 200 to 300-bps.

Analyst’s View

Aavas Financiers is a fast-growing housing finance company in India. What sets it apart from the large housing finance players like HDFC, LIC Housing Finance & Repco is the space they cater to. The average ticket size of loans is less than 9 lacs against more than 14 lacs for others. Aavas caters to smaller towns where the population is less than 10 lacs. Aavas has a good quarter that saw both YoY growth and QoQ growth. It has also maintained AUM growth of >20% and improved its FY22 NIM to 8.23% and 8.17% in Q2. The company continued its growth journey & added 34 new branches in the current fiscal. It remains to be seen whether the company will be able to sustain its lofty growth momentum and what challenges will it face when expanding into new states like Odisha where housing loan penetration is very low. However, stretched valuations may have factored in most of the positives. Nevertheless, it is a good business to track in the housing finance space, especially given its consistent and steady growth while maintaining good asset quality and underwriting standards.

Q4FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 365 | 291 | 25.4% | 343 | 6.4% | 1305 | 1105 | 18.1% |

| PBT | 146 | 95 | 53.7% | 115 | 27.0% | 455 | 353 | 28.9% |

| PAT | 116 | 88 | 31.8% | 89 | 30.3% | 357 | 289 | 23.5% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 365 | 291 | 25.4% | 344 | 6.1% | 1305 | 1105 | 18.1% |

| PBT | 146 | 95 | 53.7% | 115 | 27.0% | 455 | 353 | 28.9% |

| PAT | 116 | 88 | 31.8% | 89 | 30.3% | 357 | 289 | 23.5% |

Detailed Results:

- The company had a good quarter with revenue growth of 25% YoY and 6% QoQ & PAT growth of 31% YoY and 30% QoQ.

- AUM growth for the company was 20.1% YoY to Rs.1,13,502 Cr as of 31st March 2022.

- Disbursements in FY22 increased by 35.6% to Rs.36,022 Cr.

- Gross Stage 3 loans were at 0.99%. Net stage 3 stood at 0.77%

- NIM in FY22 has gone up 52 bps YoY to 8.23%.

- ROA for the year is up by 8 Bps to 3.58% while ROE was at 13.72%

- Product breakup was 73.5% Home Loans & 26.5% Other Mortgages Loans.

- Around 60.2% of existing customers are self-employed while the rest are salaried.

- The company has kept the yield spread at a stable 5.77% in Q4.

- Opex to AUM in FY22 was to 3.45%.

- It has surplus funds of Rs.3844.9 Cr as of 31st March 2021.

- It maintained a CAR of 51.41% with Tier 1 capital at 50.73%.

- Book value per share was at Rs.355.8.

- 1+DPD improved from 6.45% to 4.47% in the last quarter.

- The company in the current fiscal year borrowed incremental amount of Rs.4388.4 Cr at 6.04% for 102 months and overall average cost of borrowing stood at 6.88%.

- The company registered a growth of 20% YoY in total number of live accounts and employee count increased by 31% YoY.

- The company maintained a positive ALM surplus across all time periods and has an average tenor of outstanding borrowings stood at 126 months for this quarter.

Investor Conference Call Highlights

- The company has categorized 0.31% of up to 90 DPD assets as GNPA following RBI’s notification dated 12th November 2021 to harmonize IRACP norms across all lending institutions.

- The total no. of branches stood at 314 after 34 new additions in the current FY.

- The management believes that the market is huge & it can continue to grow for the next 20-25 years sustainably.

- The Opex numbers for the current quarter were relatively high due to a lower base of employee salaries in the previous FY, high expenditure being incurred towards digital & technology infrastructure & higher depreciation due to 30-35 branches being added every year.

- The employee base for the current year stood at 5,222.

- The management expects cost efficiency of 30-35 Bps in FY23.

- The assets held for sale in March are Rs.23 Cr while the same stood at Rs.20 Cr in December.

- The management expects ROE to improve by 100-150 Bps on a YoY basis.

- The company invested Rs.15 Cr in AAVAS FINSERV as per the regulatory requirement of minimum capital.

- The company’s acquisition yields in the current fiscal for the housing & non-housing segment stood at 11.7% & 14.2%.

- The management states that the company’s efforts towards investing in technology will help it serve at a larger scale coupled with reduced TAT by around 50-75%.

- The management maintains its growth guidance of 20-25% on a YoY basis.

Analyst’s View:

Aavas Financiers is a fast-growing housing finance company in India. What sets it apart from the large housing finance players like HDFC, LIC Housing Finance & Repco is the space they cater to. The average ticket size of loans is less than 9 lacs against more than 14 lacs for others. Aavas caters to smaller towns where the population is less than 10 lacs. Aavas has a good quarter that saw both YoY growth and QoQ growth. It has also maintained AUM growth of >20% and improved its FY22 NIM to 8.23%. The company continued its growth journey & added 34 new branches in the current fiscal. It remains to be seen whether the company will be able to sustain its lofty growth momentum and what challenges will it face when expanding into new states like Odisha where housing loan penetration is very low. However, stretched valuations may have factored in most of the positives. Nevertheless, it is a good business to track in the housing finance space, especially given its consistent and steady growth while maintaining good asset quality and underwriting standards.

Q3FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 343 | 310 | 10.6% | 325 | 5.5% | 940 | 814 | 15.5% |

| PBT | 115 | 110 | 4.5% | 118 | -2.5% | 308 | 258 | 19.4% |

| PAT | 89 | 85 | 4.7% | 92 | -3.3% | 241 | 202 | 19.3% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 343 | 310 | 10.6% | 325 | 5.5% | 940 | 814 | 15.5% |

| PBT | 115 | 110 | 4.5% | 118 | -2.5% | 307 | 248 | 23.8% |

| PAT | 89 | 85 | 4.7% | 92 | -3.3% | 240 | 201 | 19.4% |

Detailed Results:

- The company had a decent quarter with revenue growth of 10% YoY and 5% QoQ & PAT growth of 4% YoY and -3% QoQ.

- AUM growth for the company was 20.3% YoY to Rs 10612.6 Cr as of 31st dec 2021.

- Disbursements in H1FY22 increased by 40.8% to Rs. 2315 Cr.

- Gross Stage 3 loans were at 1.72%. Net Stage 3 loans were at 1.33%.

- NIM in 9MFY22 has gone up 69 bps YoY to 8.1%.

- Product breakup was 71.6% Home Loans & 28.4% Other Mortgages Loans.

- Around 60.3% of existing customers are self-employed while the rest are salaried.

- 9% of customers are retail driven.

- The company has kept the yield spread at a stable 5.76% in Q3.

- Opex to AUM in 9M was to 3.34%.

- ROA for 9MFY22 was at 3.37% & ROE was 12.7%

- It has surplus funds of Rs 2833.7 Cr as of 31st dec 2021.

- It had a CAR of 51.6% with Tier 1 capital at 50.9%.

- Book value per share was at Rs 337.7 7 EPS was 30.4.

- 1+DPD for the quarter was 6.45%.

- The company borrowed incremental amount of Rs 2679 Cr at 5.91% overall average cost of borrowing stood at 7.03% on outstanding loans of Rs. 9220.6 Cr.

- The company registered a growth of 19% YoY in total number of live accounts, branches increased by 35 and employee count increased by 34% YoY.

- The company maintained a positive ALM surplus across all time periods and has an average tenor of outstanding borrowings stood at 127 months for this quarter.

Investor Conference Call Highlights

- The management expects to reduce Opex by 25-30 bps soon.

- NIM for the business has increased because as per the available balance sheet size, the cash proportion has reduced so income-generating assets have increased.

- The company aims to maintain a yield spread of 5% & pass on any excess spread back to the customers.

- The was an impact of around Rs 20-21 Crores on this quarter’s balance sheet due to additional provisioning of Rs.16 Cr and Rs.5 Cr of interest reversal.

- The company’s LCR is much higher than the regulatory requirement due to Rs.1300 Cr of fixed deposit.

- The management is comfortable maintaining stage 3 provisions of 23-24%.

- Assignment income for this quarter is Rs.45 Crores vs. Rs.33 Crores in the last quarter but reversal for previous transactions was at Rs.21 Cr for the current quarter vs. last quarter Rs.18 Cr.

- The management states that 35% to 40% of Opex is disbursement linked and since disbursement has grown nine-month basis by 40%, the variable cost has also increased in that proportion leading to higher Opex.

- The 0.89% increase in NPA due to the RBI circular involved a total of Rs.76 Crores out of which Rs.4 Crores is in 1 to 30 DPD, around 12 Crores in 31 to 60 DPD, and 60 Crores in 61 to 90 DPD.

- Assets held for sale for 9M were at Rs.20.4 Cr.

- Alternative channels for lead generation contributed 6% to 7% of total business & the management intends to take it to 15% in the next two to three years.

- The management provided guidance of maintaining ROA of 2.5-2.6% with 6-7 times leverage in the balance sheet & NIM of 6.5-7%.

- The management believes ROE will inch upwards from 13.6% to 15-16% once the market scenario improves and covid provisioning goes off.

- The management states that operating leverage will start to kick in from the next 12-18 months.

- The company’s 35% of costs are variable costs which are inching up in tune with disbursement growth and around 65% of costs are the fixed nature cost.

- The company infused additional capital of Rs.8 Cr in its NBFC arm to meet the minimum capital requirement.

- 9M write-offs from its NBFC stands at Rs.1.9 Cr.

Analyst’s View:

Aavas Financiers is a fast-growing housing finance company in India. What sets it apart from the large housing finance players like HDFC, LIC Housing Finance & Repco is the space they cater to. The average ticket size of loans is less than 9 lacs against more than 14 lacs for others. Aavas caters to smaller towns where the population is less than 10 lacs. Aavas has a mixed quarter that saw YoY revenue growth of 10% & PAT growth of only 4% YoY. It has also maintained AUM growth of >20% and improved its 9M NIM to 8.1%. The management is also looking to increase the contribution from alternative lead generating channels to 15% of total business from the current 6-7%. The management also expects the RoE for Aavas to improve as the business becomes stable. It remains to be seen whether the company will be able to sustain its lofty growth momentum and what challenges will it face when expanding into new states like Odisha where housing loan penetration is very low. However, stretched valuations may have factored in most of the positives. Nevertheless, it is a good business to track in the housing finance space, especially given its consistent and steady growth while maintaining good asset quality and underwriting standards.

Q2FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 325 | 270 | 20.37% | 272 | 19.49% | 597 | 504 | 18.45% |

| PBT | 118 | 85 | 38.82% | 75 | 57.33% | 193 | 148 | 30.4% |

| PAT | 92 | 66 | 39.39% | 60 | 53.33% | 152 | 116 | 31.03% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 325 | 270 | 20.37% | 272 | 19.49% | 597 | 504 | 18.45% |

| PBT | 118 | 84 | 40% | 74 | 59.46% | 192 | 147 | 31% |

| PAT | 92 | 66 | 39% | 59 | 55.93% | 151 | 116 | 30.17% |

Detailed Results:

- The company had a good quarter with revenue growth of 20% YoY and 19% QoQ & PAT growth of 39% YoY and 55% QoQ.

- AUM growth for the company was 21% YoY to Rs 10148.1 Cr as of 30th Sep 2021.

- Disbursements in H1FY22 increased by 55% to Rs. 1364 Cr.

- Gross Stage 3 loans were at 0.96%. Net Stage 3 loans were at 0.72%.

- NIM in H1FY22 has gone up 98 bps YoY to 7.8%.

- Product breakup was 72.1% Home Loans & 27.9% Other Mortgages Loans.

- Around 60.2% of existing customers are self-employed while the rest are salaried.

- 9% of customers are retail driven.

- The company has kept the yield spread at a stable 5.73% in Q2.

- Opex to AUM in H1 was to 3.21%.

- ROA for Q2 was at 3.25% ROE was 12.25%

- It has surplus funds of Rs 2695 Cr as of 30th Sep 2021.

- It maintained a CAR of 52.14% with Tier 1 capital at 51%.

- Book value per share was at Rs 325.7.

- 1+DPD improved from 12.67% to 8.88% in the last quarter.

- The company borrowed incremental amount of Rs 889.9 Crs at 6.48% for 101 months and overall average cost of borrowing stood at 7.17%.

- The company registered a growth of 20% YoY in total number of live accounts and employee count increased by 31% YoY.

- The company maintained a positive ALM surplus across all time periods and has an average tenor of outstanding borrowings stood at 125 months for this quarter.

Investor Conference Call Highlights

- The long-term rating outlook for Aavas was revised upward to AA- / Positive by ICRA in Q2.

- The total number of live accounts was 1,35,453 which is up 20% YoY.

- Total COVID provisioning stood at Rs 14.8 Cr while total ECL provisioning stood at Rs 70 Cr.

- 1+DPD saw a decrease of 4% this quarter and the management expects this to decrease further by 0.5% per month if the third wave doesn’t appear.

- Aavas has added 18 new branches in H1, and the management is hopeful of reducing opex to AUM by 25-30 bps in the next 2-3 years.

- The management states that 40% of disbursements take place in the first half of the year and the remaining 60% will take place in the second half.

- The company is entering into Odisha & Karnataka market as a part of its philosophy of entering into 4 new states for every 5 years of operations.

- The management expects to maintain an AUM CAGR of 20-25% for the coming years which would be driven by

- opening of 100 new branches in the next 3 years

- Improvement in efficiency in its previously opened branches which should reach 85-90% efficiency in the third year of opening.

- Increased efficiency due to investments in technology

- Decreasing borrowing costs that will allow the company to tap the formal salaried employee’s market

- The management expects to reach Rs.1.5 Cr per branch in the coming years with the total branch count of 300 and capacity utilization being 85-90%.

- The management focuses on MSME and LAP loans in the first half and more on the self-construction housing side in H2 after monsoons. So, the company expects to have 70-75% disbursements for home loans and 20-25% on non-home loans in H2.

- The company’s current portfolio of MSME loans is 100% backed by housing mortgages.

- In the non-home loan segment, the company expects a 40% share each for MSME and LAP and 20% for top-up loans. The top-up loan segment should decline back to 4-5% as the normal business scenario comes back.

- The company has increased its due diligence for giving loans in the non-housing part by increasing its underwriting system from 3 filters to 6 filters after covid.

- The management is focused on launching 30 new branches each year for the next 5 years out of which 50-55 will be in new states and the rest 90-100 in the existing states.

- The management expects the salaried portion of the loan book to remain stable at around 40%.

- The incremental loan yields are 11.92% for home loans and 14.78% for non-home loans currently.

- The company wants to pivot from LAP to giving loans to MSME as even though loan yield is 100 basis points less in the MSME segment, the tenure is only for 5-7 years as compared to 10-14 years for LAP and the MSME segment. Additionally, the borrowing costs in MSME are 100-150 basis points less thus ensuring that the spread of 5% will be maintained.

- The securitized portfolio is mainly LAP & MSME with a spread of 7.5%.

- The management states that Aavas has entered into Karnataka with 11 branches as it is easier for understanding the local market in the districts adjacent to the Kohlapur district where the company has been there for a while. In these 11 branches around 5 can be counted as new state expansion while 6 is just horizontal expansion adjacent to existing branches.

- The management is giving guidance of 20-25% of business growth, margin spread of 5.5-6%, net NPA of below 1% for the next 3 years which should lead to improvement in RoA & RoE.

- The company has lower ROE primarily due to excess capital in the balance sheet and the company’s focus on survival leading to lower leverage thus driving lower ROE. However, the management expects to increase the leverage component in the future if the situation gets stable.

- The company has 39% salaried customers with an average ticket size of 9-10 lakhs, an average installment level size of Rs.11600, and an income to installment ratio of 33%. The average salary level is around Rs 30,000-35,000.

- The company’s current employee strength growth was faster than AUM growth due to its emphasis on investing in distribution and creating bench strength. However, the management also expects the employee strength growth to moderate to 15-20% as compared to AUM growth of 20-25% in the coming years as it believes that employee growth should be less than AUM growth due to leveraging technology.

- The management states that it will be able to maintain its margins even if spreads decrease by reducing the Opex costs by 20-25 basis points.

- The management considers a branch as mature when it starts earning positive ROE. It takes roughly 5-12 months for a branch to become mature and in the case of a branch in metros, it takes 2 years. Currently, around 85% of the branches have positive ROE and this is expected to increase to 90% in the next 12 months.

- The company has filed for a subsidiary named “AAVAS FINSERV” for doing MSME business however the application is pending with RBI.

Analyst’s View:

Aavas Financiers is a fast-growing housing finance company in India. What sets it apart from the large housing finance players like HDFC, LIC Housing Finance & Repco is the space they cater to. The average ticket size of loans is less than 9 lacs against more than 14 lacs for others. Aavas caters to smaller towns where the population is less than 10 lacs. Aavas has a good quarter that saw both YoY growth and QoQ growth. It has also maintained AUM growth of >20% and improved its H1 NIM to 7.8%. The company has begun its 3rd 5-year block by expanding into Karnataka and Odisha and it has already opened 18 branches in H1. Aavas also expects to see more disbursals in H2 as the management states that typically around 60% of disbursals for Aavas have taken place in H2. It remains to be seen whether the company will be able to sustain its lofty growth momentum and what challenges will it face when expanding into new states like Odisha where housing loan penetration is very low. However, stretched valuations may have factored in most of the positives. Nevertheless, it is a good business to track in the housing finance space, especially given its consistent and steady growth while maintaining good asset quality and underwriting standards.

Q1FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 272 | 234 | 16.24% | 291 | -6.53% |

| PBT | 75 | 63 | 19.05% | 95 | -21.05% |

| PAT | 60 | 50 | 20.00% | 88 | -31.82% |

| Consolidated Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 272 | 234 | 16.24% | 291 | -6.53% |

| PBT | 74 | 63 | 17% | 95 | -22.11% |

| PAT | 59 | 50 | 18% | 87 | -32.18% |

Detailed Results:

- The company had a mixed quarter YoY rise in revenues and profits due to the low base in Q1FY21 while it also saw a QoQ fall in both due to the 2nd wave of COVID-19.

- AUM growth for the company was 21.2% YoY to Rs 9615.6 Cr as of 30th June 2021.

- Disbursements in Q1FY22 rose 117% YoY.

- Gross Stage 3 loans were at 1.14% vs 0.46% a year ago. Net Stage 3 loans were at 0.86%.

- NIM in Q1FY22 has gone up 78 bps YoY to 6.93%.

- Product breakup was 72.7% Home Loans & 27.3% Other Mortgages Loans.

- Around 60.3% of existing customers are self-employed while the rest are salaried.

- 8% of customers are retail-driven.

- The company has kept the yield spread at a stable 5.74% in Q1.

- Opex to AUM in Q1 was to 2.88%.

- ROA for Q1 was at 2.64%.

- The company has no CP exposure and has recently raised borrowings of Rs 692 Cr for 43 months at 4.62%.

- The company maintains a positive ALM mismatch across all time periods and has an average tenure of outstanding borrowing at 127 months.

- It has total liquidity of Rs 2355 Cr as of 30th June 2021.

- It maintained a CAR of 53.81% with Tier 1 capital at 52.7%.

- Book value per share was at Rs 314.4.

Investor Conference Call Highlights

- 1+DPD as of June 2021 was at 12.67%. It is expected to decline gradually as it did last year after the removal of the national lockdown.

- The average cost of borrowing for Aavas as of June 2021 is 7.25%.

- The total number of live accounts was 128,000.

- Total COVID provisioning stood at Rs 14.8 Cr while total ECL provisioning stood at Rs 66.2 Cr.

- Around 3000 customers or 2.5% of the book have not paid the June installments. Although 12.67% of people had not paid their installments in time in Q1, almost 10% of them have already normalized and only 2.5% remain unpaid according to the management.

- The company has seen collection efficiency of 98-99% and it has restructured around Rs 110 Cr of loans in Q1.

- Top-up loans are minuscule at no more than 1% for Aavas. The management expects the disbursement trajectory for home loans to be at 70-75% of total disbursement while the rest is for non-home loans.

- The management reiterated that Aavas’s model is concentrated around branch opening and state penetration. Thus, it will expand into 3-4 new states every 5 years and expand in these states as much as it can for the next 5 years after which it will look to expand into other new states.

- In the first 5 years, it opened in Rajasthan, Gujarat, Maharashtra, & MP. In the 2nd set of 5 years, it expanded into Haryana, Uttar Pradesh, Chhattisgarh, and Uttarakhand. In the third Aavas has already expanded into Karnataka and Odisha.

- It will open 5-6 branches initially in Odisha of which 1 has already been opened in Q1.

- The company is looking to target states with low housing loan penetration and the real estate market in an upswing for expansion.

- Around 60-70% of branches in each 5-year block will be opened in old states while 20-30% of branches will be opened in new states.

- The company was offering restructuring to customers on request as lockdown conditions tightened in India at the start of May. The moratorium on offer was flexible and dependent on the customer’s requirement.

- Most of the funding raised in Q1 was from the NHB.

- Despite the rise in NPAs above the historical levels to near 1%, the management remains confident of the portfolio resilience.

- 75-80% of the restructured book is more than 2 years old for Aavas.

- The management insists that maintaining a swift turnaround time is an essential part of the customer experience even if Aavas is the only lender for a large proportion of borrowers. The company is aiming to bring it down ultimately to 1-2 days.

- The company has its branch classification dependent on demographic factors like the population of the town, the number of families living there, and branch potential in the next 15 years. It aims to achieve conversion of 5% of the addressable market in terms of population in the 15 years.

- The company provides loans for a tenor ranging from 3 years to 20 years. The average tenor of the loan book is at 14 years.

Analyst’s View:

Aavas Financiers is a fast-growing housing finance company in India. What sets it apart from the large housing finance players like HDFC, LIC Housing Finance & Repco is the space they cater to. The average ticket size of loans is less than 9 lacs against more than 14 lacs for others. Aavas caters to smaller towns where the population is less than 10 lacs. Aavas has a mixed quarter which saw YoY growth but QoQ decline. It has also maintained AUM growth of >20% despite all the challenges from the pandemic. It saw a restructuring of around Rs 110 Cr due to moratorium requirements for customers owing to the 2nd wave of COVID-19. The company has begun its 3rd 5-year block by expanding into Karnataka and Odisha where it has very low competition in this space. It remains to be seen whether the company will be able to sustain the sky-high valuations that it is currently going at and what challenges will it face when expanding into new states like Odisha where housing loan penetration is very low. However, stretched valuations may have factored in most of the positives. Nevertheless, it is a good business to track in the housing finance space, especially given its consistent and steady growth while maintaining good asset quality and underwriting standards.

Q4FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 291 | 235 | 23.83% | 310 | -6.13% | 1105 | 903 | 22.37% |

| PBT | 95 | 66 | 43.94% | 111 | -14.41% | 353 | 302 | 16.89% |

| PAT | 88 | 60 | 46.67% | 86 | 2.33% | 289 | 249 | 16.06% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 291 | 235 | 23.83% | 310 | -6.13% | 1106 | 903 | 22.48% |

| PBT | 95 | 66 | 44% | 110 | -13.64% | 353 | 302 | 16.89% |

| PAT | 87 | 60 | 45% | 85 | 2.35% | 289 | 249 | 16.06% |

Detailed Results

- The company had a good quarter with a 24% YoY rise in revenues and 45% YoY rise in PAT.

- AUM growth for the company was 21.3% YoY to Rs 9454.3 Cr as of 31st Mar 2021.

- Disbursements in FY21 have fallen 9.3% YoY mainly due to the tough Q1.

- Gross Stage 3 loans were at 0.98% vs 0.46% a year ago. Net Stage 3 loans were at 0.71%.

- NIM in FY21 has gone down 45 bps YoY to 7.71%.

- Product breakup was 73.5% Home Loans & 26.5% Other Mortgages Loans.

- Around 60.4% of existing customers are self-employed while the rest are salaried.

- 99.8% of customers are retail-driven.

- The company has kept the yield spread at a stable 5.76% in Mar ’21.

- Opex to AUM in FY21 was down to 3.01% from 3.38% a year ago.

- ROA for FY21 was at 3.49%.

- The company has no CP exposure and has recently raised borrowings of Rs 729 Cr for 119 months at 6.31%.

- The company maintains a positive ALM mismatch across all time periods and has an average tenure of outstanding borrowing at 130 months.

- It has total liquidity of Rs 2836 Cr as of 31st Mar 2021.

- It maintained a CAR of 54.54% with Tier 1 capital at 53.33%.

- Book value per share was at Rs 305.9 vs Rs 267.9 a year ago.

Investor Conference Call Highlights

- Aavas disbursed Rs Rs 1012.7 Cr in Q4 which was up 17% YoY and 30% QoQ.

- The company has reduced its prime lending rate by 10 basis points with effect from January 1, 2021. It has also decided to further reduce Aavas Financial’s Limited prime lending rate by 15 basis points with effect from April 1, 2021.

- The total number of customers was 125,591 which was up 20% YoY as of March 2021.

- Aavas added 30 new branches in FY21 bringing up the total to 280 branches overall.

- Employee count rose 22% YoY to 4336.

- Overall borrowing mix as of March 31, 2021, is 34.1% as term loan from banks, 24.2% from assignment and securitization, 22.6% from National Housing Bank, and 19% from other debt capital markets.

- As of March 31, 2021, Aavas had an average borrowing cost of 7.40% against the average portfolio yield of 13.16% resulted in a spread of 5.76%.

- Total COVID-19 provisions stood at Rs 19 Cr.

- The management has stated that the company now has enough capacity to originate loans of Rs 400 Cr per month while keeping its underwriting standards high as always. So, it is easy to maintain a quarterly run rate of Rs 800-900 Cr of disbursements if the demand outlook remains steady.

- The tax rate in Q4 was lower than the rest of FY21 as the tax refund was processed in Q4.

- The 1 day past due number has improved to 6.37% from >8% in Q3.

- Given current lockdowns and economic situation, the management has admitted that 1+DPD will indeed rise before coming down to guided numbers in subsequent quarters.

- Collection efficiency increased to >100% as 1+DPD fell QoQ.

- The total write-off in FY21 was Rs 2.84 Cr vs Rs 3.88 Cr last year.

- The salaried yield is 12.24% and the self-employed yield is 13.75%.

- The company has very less exposure to ECLGS of around Rs 54 Lac only.

- Most of the employee additions were in sales and collections in the 30 new branches added in FY21.

- The management has guided that Opex to AUM should improve by 25-30 bps in the next 2-3 years depending on the environment.

- The 1+DPD in Maharashtra was at 10.3%.

- The company always plans to have contiguous growth of 50 km in each branch which takes around 2-3 years of operations to reach. Thus, once the growth potential of existing branches was reached in terms of the above metric, the company decided to add a further 7-8 branches in Rajasthan.

- The company is aiming to expand to 4 new states in the next 5 years and add around 30-40 branches each year. 40-50% of these new branches are to be in the new states while the rest will be in existing states.

- The income derived from direct assignment activities is volatile as it depends on the loan assignment mix. LAP has a yield spread of 7.5% while pure home loans have a yield spread of 3-4%. Thus, actual profitability in the quarter from direct assignment depends on the volume of which type is sold in it.

- According to RBI issued guideline in 2012, any assignment transaction is directly booked as upfront profit and not recognized as book income.

- NPA number for housing loans is 1%, for non-housing it is 1.9%, for salaried it is 0.44% and for self-employed it is 1.3%.

- The management maintains that Aavas has not had any impact on its operations from the expiry of the CLSS scheme in Pradhan Mantri Awas Yojana.

- The company has a fixed policy of hiring a risk team at first before hiring a business team when expanding to a new state and for the first 3 years of operations, it guides the new teams to try and understand cash flow patterns, income, seasonality, asset behaviour, judiciary behaviour, etc and thus has no targets in the initial 3-year period.

- The management expects city penetration to hit a ceiling of 10-20% in 15 years since opening a new branch. Thus, it is confident that Aavas can disburse around Rs 50,000-60,000 Cr in the next 10 years from the 180 branches it has opened in the last 5 years.

- The management clarified that Aavas has very clear tenets that it follows to keep high collections and good quality underwriting. They always choose a market with <5% housing finance penetration and do not do any risky assets like builder financing, under construction financing, or loans of Rs 1 Cr+.

- The main approach here is to have a fixed but efficient underwriting process while avoiding the obvious risky ones and scaling up this underwriting process as Aavas expands. Thus, at present, 85% of financed properties are individual homes and 95% of customers are living in those homes that they financed.

Analyst’s View

Aavas Financiers is a fast-growing housing finance company in India. What sets it apart from the large housing finance players like HDFC, LIC Housing Finance & Repco is the space they cater to. The average ticket size of loans is less than 9 lacs against more than 14 lacs for others. Aavas caters to smaller towns where the population is less than 10 lacs. Aavas has done very well in Q4 with 24% YoY revenue growth and 45% profit growth. It has also maintained AUM growth of >20% despite disbursements falling 9.3% YoY in FY21. It also managed to do >100% collections in Q4 owing to falling 1+DPD in Q4. But the management admits that the collections will indeed fall as a result of local lockdowns and the overall impact of 2nd wave of COVID. It remains to be seen whether the company will be able to sustain the sky-high valuations that it is currently going at. However, stretched valuations may have factored in most of the positives. Nevertheless, it is a good business to track in the housing finance space, especially given its consistent and steady growth while maintaining good asset quality and underwriting standards.

Q3FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 310 | 239 | 29.71% | 270 | 14.81% | 814 | 668 | 21.86% |

| PBT | 111 | 80 | 38.75% | 85 | 30.59% | 258 | 236 | 9.32% |

| PAT | 86 | 68 | 26.47% | 66 | 30.30% | 202 | 189 | 6.88% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 310 | 239 | 29.71% | 270 | 14.81% | 814 | 668 | 21.86% |

| PBT | 110 | 80 | 37.50% | 85 | 29.41% | 258 | 236 | 9.32% |

| PAT | 85 | 68 | 25.00% | 66 | 28.79% | 201 | 189 | 6.35% |

Detailed Results

- The company had a good quarter with a 29% YoY rise in revenues and 25% YoY rise in PAT.

- AUM growth for the company was 22.6% YoY to Rs 8822.6 Cr as of 31st Dec 2020.

- Disbursements in 9M have fallen 20.5% YoY mainly due to the tough Q1.

- Gross Stage 3 loans were at 1% vs 0.57% a year ago. Net Stage 3 loans were at 0.72%.

- NIM in 9M has gone down 124 bps YoY to 7.42%.

- Product breakup was 73.4% Home Loans & 26.6% Other Mortgages Loans.

- Around 60.7% of existing customers are self-employed while the rest are salaried.

- 8% of customers are retail-driven.

- The company has kept the yield spread at a stable 5.74% in Dec ’20.

- Opex to AUM in 9M was down to 2.82% from 3.42% a year ago.

- ROA for 9M was at 3.22%.

- The company has no CP exposure and has recently raised borrowings of Rs 935.6 Cr for 144 months at 7.04%.

- The company maintains a positive ALM mismatch across all time periods and has an average tenure of outstanding borrowing at 131 months.

- It has total liquidity of Rs 2670 Cr as of 31st Dec 2020.

- It maintained a CAR of 52.98% with Tier 1 capital at 51.12%.

- Interest Income has risen 27.6% YoY in Q3 while interest expenses have risen 23.6% YoY.

Investor Conference Call Highlights

- Aavas’s long-term credit rating continues to be AA- with a stable outlook from ICRA and CARE.

- As on 31 December 2020, the average borrowing cost 7.68% against the average portfolio yield of 13.42%, resulting in a spread of 5.74%.

- Additional ECL provisioning of Rs 4.29 Cr was created to consider the impact of COVID-19 during Q3. Total provision for COVID stands at Rs 19 Cr.

- Book value stands at Rs 294.6 per share.

- Collection efficiency in Dec was at 98.8%.

- As of December, only 2,000 accounts were there who have not paid the December installment down from 5,800 such accounts in Sep.

- The company has done securitization of almost 23% of total AUM. The management has stated that it aims to bring it down and keep this figure in the range of 15-20% depending on the yield available.

- The increase in salaried % should not be seen as a decrease in self-employed disbursements and this % will keep on changing depending on market conditions.

- The management is confident of maintaining AUM growth guidance of 20-25% and has stated that Aavas will remain cautious in lending till Q4 and will start on a normal growth path from FY22 onwards.

- Normally, the company keeps only 3-4 months of disbursement as cash in hand but due to COVID-19, the management decided to be more conservative and maintain cash at 6 months disbursement level.

- Despite operating in similar geographies as Gruh, Aavas is not getting any yield pressure as both have different customer sets to cater to. Gruh finances apartment properties and has a 70% salaried customer set while Aavas finances mostly independent houses and have a 70% self-employed customer set. The management has stated that the market is large enough for both to co-exist.

- The management has identified 3 main priorities for Aavas which are maintaining asset quality, maintaining the spread, and maintaining growth pace.

- The management has clarified that the 1% NPA figure is without the Supreme Court freezing decision and with this decision, the NPA is at 0.3%.

- The management has clarified that the disbursement in salaried have been normal while disbursements in self-employed will increase naturally as the economy opens up.

Analyst’s View

Aavas Financiers is a fast-growing housing finance company in India. What sets it apart from the large housing finance players like HDFC, LIC Housing Finance & Repco is the space they cater to. The average ticket size of loans is less than 9 lacs against more than 14 lacs for others. Aavas caters to smaller towns where the population is less than 10 lacs. Aavas has done well in Q3 with 30% YoY revenue growth and 25% profit growth. It has also maintained AUM growth of >20% despite the pandemic and is back to collections above 98%. Given the positive cues from the real estate sector in recent times, Aavas could be a big beneficiary going forward. However, stretched valuations may have factored in most of the positives. Nevertheless, it is a good business to track in the housing finance space.

Q2FY21 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 270 | 231 | 16.88% | 234 | 15.38% | 504 | 429 | 17.48% |

| PBT | 84 | 91 | -7.69% | 63 | 33.33% | 147 | 155 | -5.16% |

| PAT | 66 | 76 | -13.16% | 50 | 32.00% | 116 | 121 | -4.13% |

Detailed Results

- The company had a mixed quarter with a 17% YoY rise in revenues and 13% YoY fall in PAT.

- AUM growth for the company was 23.9% YoY to Rs 8366.9 Cr as of 30th Sep 2020.

- Disbursements in H1 have fallen 33.1% YoY mainly due to the tough Q1.

- Gross Stage 3 loans were at 0.47% vs 0.62% a year ago. Net Stage 3 loans were at 0.32%.

- NIM in H1 has gone down 187 bps YoY to 6.82%.

- Product breakup was 73.5% Home Loans & 26.5% Other Mortgages Loans.

- Around 64.9% of existing customers are self-employed while the rest are salaried.

- 8% of customers are retail-driven.

- The company has kept the yield spread at a stable 5.62% in Sep ’20.

- Opex to AUM in H1 was down to 2.8% from 3.28% a year ago.

- ROA for H1 was at 2.89%.

- The company has no CP exposure and has recently raised borrowings of Rs 519.9 Cr for 167 months at 7%.

- The company maintains a positive ALM mismatch across all time periods and has an average tenure of outstanding borrowing at 130 months.

- It has total liquidity of Rs 2587 Cr as of 30th Sep 2020.

- It maintained a CAR of 53.08% with Tier 1 capital at 50.84%.

- Interest Income has risen 29.2% YoY in Q2 while interest expenses have risen 35.8% YoY.

Investor Conference Call Highlights

- ICRA has updated the long-term credit rating for AAVAS from A+/Positive outlook to AA-/Stable during this quarter.

- The total number of live accounts stands at 1,12,500.

- Around 0.5% of the total portfolio has not paid a single installment since March.

- Total moratorium as of August was at 10% while this number came down to 3.2% in Sep.

- The company will continue its pace of branch expansion and will finish its 5-year block in March. From March onwards it will embark on a new 5-year block to expand into 4-5 states.

- The management hopes to reach pre-covid sourcing & disbursement levels in the coming quarters.

- 1+DPD is around 5-6% in this business currently.

- The company has an NPA of Rs 31 Cr currently against which around 22% is normal NPA. The company has also done additional COVID provisioning of Rs 15 Cr. Overall provisioning is sufficient to cover up to NPA of 2%.

- The company is always aiming to achieve improvement in Opex to AUM of 35-40 bps each year and the management is confident that this will be achieved this year as well. This should continue for 2-3 years.

- Currently, there haven’t been any requests for the restructuring of loans from any customer.

- In Q2, top-up loans were less than 1% of total disbursement in the quarter.

- The company has around 800 people in underwriting and collections combined. The breakup is around 50-50.

- 94% of customers have paid in full while 3% have not paid even part installment in Oct.

- The company aims to maintain ROA above 2.5% and has been successful in doing so for H1.

- The company aims to reach Opex to AUM of 1.75-2% in the next 2-4 years.

- In business terms, the company is sourcing around 9,000, 10,000 files per month. The company has a policy of continuously invest into capacity ensuring that it always has spare capacity for an uptick in demand.

- Today 100% of leads come from mobile app & 99% of repayments are from digital means.

- The company has also implemented a 100% CRM. It has also ensured that 85% of customer requirements can be gathered through a mobile app without any need to go to a branch.

- The company is also cybersecurity compliant with a bank-level kind of security framework.

- The company is also constantly investing to stay at the forefront of technology for the long term in this field.

- The average cost of borrowing is at 7.9%.

Analyst’s View

Aavas Financiers is a fast-growing housing finance company in India. What sets it apart from the large housing finance players like HDFC, LIC Housing Finance & Repco is the space they cater to. The average ticket size of loans is less than 9 lacs against more than 14 lacs for others. Aavas caters to smaller towns where the population is less than 10 lacs. Throughout the financial crisis which started after the IL&FS default, Aavas has managed to sail through without any major hit on the books. Given the positive cues from the real estate sector in recent times, Aavas could be a big beneficiary going forward. However, stretched valuations may have factored in most of the positives. Nevertheless, it is a good business to track in the housing finance space.

Disclaimer

This is not investment advice. Please read our terms and conditions.