About the Company

CreditAccess Grameen Limited (formerly known as Grameen Koota Financial Services Pvt. Ltd.) is a microfinance institution providing a wide range of financial services to the rural poor and low-income households, particularly women. It is registered with the Reserve Bank of India under the NBFC-MFI category. The company provides loans primarily under the joint liability group (JLG) model. Its primary focus is to provide income generation loans which comprised 87.02% of its total JLG loan portfolio, as of March 31, 2019. It also provides other categories of loans such as family welfare loans, home improvement loans, and emergency loans to existing customers.

CreditAccess Grameen is also an aggregator of the National Pension Scheme (NPS) of the Government of India. As of June 30, 2019, CreditAccess Grameen had 753 branches across various districts in the states of Karnataka, Maharashtra, Madhya Pradesh, Chhattisgarh, Tamil Nadu, Odisha, Kerala, Goa, and the union territory of Puducherry.

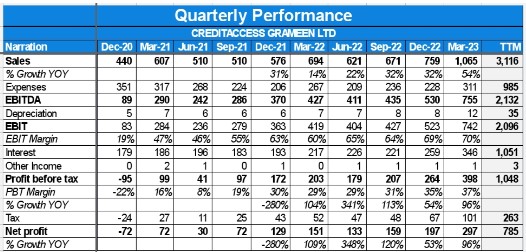

Q4FY23 Updates

Financial Results & Highlights

Detailed Results:

- Achieved annual performance guidance with 26.7% YoY growth in AUM to INR 21,031 Crores, serving 42.6 Lakh customers.

- Added over 12.3 lakh customers during FY ’23, and 8.3% QoQ as it added nearly 5.5 lakh customers in Q4 FY ’23 towards its pursuit of creating women entrepreneurs.

- Collection efficiency remains normalized at 98.2% (excluding arrears) efficiency levels similar to the last quarter.

- GNPA at 60+ DPD reduced to 1.21% in March 2023 from 1.71% in December 2022, while PAR 90 reduced from 1.34% in December 2022 to 0.96% in March 2023.

- NIM improved further from 11.9% in Q3 FY ’23 to 12.2% in Q4 FY ’23, one of the most competitive in the microfinance industry, and is expected to remain in the range of 12% to 12.2% going forward.

- Credit cost in Q4 FY ’23 stood at INR 105 Crores, including INR 14 Crores management overlay on the legacy book of MMFL amounting to INR 131 Crores or 0.6% of total AUM.

- PAT grew by 86.4% YoY and 37.5% QoQ to INR 297 crores during Q4 FY ’23, resulting in ROA and ROE of 5.5% and 24%, respectively.

- Anticipating a credit cost of 1.6% to 1.8% and aims to achieve a ROA of 4.7% to 4.9% and an ROE of 20% to 21% in FY ’24.

Investor Conference Call Highlights:

- The company crossed INR 20,000 crores AUM, becoming the first pure-play microfinance institution to achieve this milestone.

- CreditAccess Grameen was the only NBFC (Non-Banking Financial Company) to feature in the top-five of the Fortune India Next 500 list.

- The company recorded the highest-ever quarterly disbursement of INR 7,171 crore, supported by robust customer additions.

- New customer additions and increased business from 500 plus branches were emphasized to improve productivity.

- The company stated that the merger between CA Grameen and MMF (Madura Microfinance) was approved, and all operational and financial parameters will be reported on a consolidated basis.

- The customer base grew 11.5% year-on-year, with 12.2 lakh consumers added during FY ’23 and 8.3% quarter-on-quarter growth with nearly 5.5 lakh customers added in Q4 FY ’23.

- The company diversified its customer base, with 46% of new customers coming from outside the top three states.

- The company’s collection efficiency remained normalized at 98.2%, and asset quality was strong with GNPA (gross non-performing assets) at 1.21% and NNPA (net non-performing assets) at 0.42%.

- The marginal and average cost of borrowing for Q4 FY ’23 stood at 9.4% and 9.5% respectively.

- The company aims for loan portfolio growth of 24% to 25% in FY ’24, maintaining NIMs around 12.2%, and a credit cost of 1.6% to 1.8%.

- The company aims for an ROE (return on equity) of 4.7% to 4.9% and an ROA (return on assets) of 20% to 21% in FY ’24.

- CreditAccess Grameen maintains a comfortable capital adequacy ratio of 23.6% as of March ’23.

- The company plans to have 10-12% of the non-microfinance book within the next four to five years.

- The company stated that approximately 70-75% of customers have a power (indebtedness) of less than 40%

- The branch expansion plans for the year are expected to be around 8-10% or 12% of the existing back site.

- The company aims to maintain a cost-income ratio of 30-35% through optimal cost management and pricing based on risk.

- The company has witnessed positive signals and reinforcement from geographies like Uttar Pradesh (UP) and plans to continue opening branches in border districts of UP, Rajasthan, Gujarat, Bihar, and other areas.

- The company aims to achieve 8-10% portfolio growth from an increase in average ticket size in FY ’24, driven by vintage and customer renewal.

- The CEO mentioned that they have not conducted in-depth analysis based on income data yet, as it has only been two quarters. It will take more time to understand how debt is being managed in households.

Analyst’s View:

Credit Access Grameen has emerged as one of the most reliable microlenders in the country. Their revolutionary JLG model has helped bring communities of borrowers together and helped reduce overall risk from their lending to a very large extent as seen in their low NPA numbers. It remains to be seen whether the company will be able to deliver on its guidance of 20-25% CAGR for the next 4-5 years, how the market will perceive potential stake sales of promoters & given the issues in the microfinance industry and how will the RBI rate hike affect the demand from its target market. Nonetheless, given its strong market position and exemplary operating and risk management practices, Credit Access Grameen remains one of the must-watch stocks in the Microfinance sector for any interested investor.

Q3FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a great quarter with consolidated PAT rising 53% YoY.

- GLP grew 21.9% YoY while Standalone GLP grew 21.7% YoY. MMFL GLP grew 23.2% YoY.

- Disbursements grew 2.7% YoY with CAGL up 4.6% YoY and MMFL down 5.9% YoY.

- The customer base grew 1.2% YoY & by 3% QoQ to 37.98 Lakh. The standalone customer base stood at 29.96 lakh while MMFL’s customer base stood at 8.3 lakh.

- The consolidated employee count increased by 8.6% to 16,807

- The Active Borrowers stood at 39.39 Lakh (+5.3% YoY)

- NII has risen 37.7% YoY to Rs 567 Cr. PPoP grew 38.7% YoY at Rs 380 Cr.

- Provisioning for CAGL & MMFL stood at 1.94% & 2.57% respectively.

- Overall RoA and RoE were at 4.6% and 18.8%.

- GNPA & NNPA of CAGL stood at 1.5% & 0.4% respectively while the same for MMFL stood at 2.9% & 1.5%.

- CRAR: CAGL 28.4% (Tier 1: 27.7%), MMFL 22% (Tier 1: 15%).

- Collection efficiency at 98% for CAGL in March excluding. MMFL collection efficiency excluding arrears was at 95%

- Consolidated debt to equity was at 2.9 times. MMFL debt to equity was at 5.6 times.

- Consolidated cost-to-income ratios were at 36.3% in Q3. Opex to GLP was at 5% in Q3.

- The cost of borrowing for CAGL was 10.2% in Q3.

- The consolidated cost of borrowings stood at 9.6% while the portfolio yield stood at 19.6%.

- Branches increased by 11.1% YoY for CAGL standalone taking the branch count to 1251.

- NIM of standalone business stood at 12% while MMFL was at 10.4% in Q3.

- Positive ALM mismatch with an average maturity of assets at 18.3 months and average maturity of liabilities at 25.4 months in CAGL.

- IGL loans accounted for 96% of total loans.

- Karnataka remains the biggest market for the company with 34.7% of GLP. Maharashtra comes in second with 21% of GLP and Tamil Nadu is third with 20.8% of GLP.

Investor Conference Call Highlights:

- The Y-o-Y disbursement growth appears to be a little lower, because of a higher base on Q3 FY 22 where it already resumed growth encashing the opportunity of pent-up demand post-COVID 2.0

- As a result of a higher write-off witnessed from the legacy book which is currently at 8% of MMFL book and 1.3% of the consolidated book, the estimated FY23 gross credit cost is at 2.3% – 2.4% while On a net basis, including bad debt recoveries, the credit cost should be in the range of sub 2.0% as per management.

- The company reiterated its FY23 guidance of 4.0% – 4.2% ROA and 16.0% – 18.0% ROE.

- The management while highlighting the positive impact of the budget stated that “ A host of measures – i) Rs.2 Lakh Crores central govt. scheme to supply free food grain to all poor and priority households, ii) digital public infrastructure for agriculture, an agriculture accelerator fund for increasing productivity and profitability, Rs.20 Lakh Crores agriculture credit target, iii) 66% increase in PM Awas Yojana corpus to Rs.79,000 Crores, iv) revamped credit guarantee scheme for MSMEs, etc., are aimed towards strengthening the rural ecosystem and will benefit the rural financing opportunity over coming years and are a big positive for the microfinance business.”

- The NCLT, Bengaluru Bench, has pronounced the order approving the Scheme of Amalgamation between CA Grameen and MMFL which means that it can now proceed toward the amalgamation of MMFL with CA Grameen and present its FY23 Annual Financials as a merged entity.

- The company didn’t do the complete write-off in the current quarter since it doesn’t want to take an accelerated position & expects to do a complete write-off by Q4FY23.

- The management states that among all the major players, its maximum customer overlap is only with Bhafin, which is about 14% – 15% Other than that, it is less than a 5% overlap.

- The management reiterates that the strategic view of the promoter remains to keep holding a clear majority stake in the company above 55% – 60% over the long term despite minor dilutions.

- Out of 9.05 lakh customers acquired in the last 12 months, about 47% of customers are acquired from the core geography of Karnataka, Maharashtra, and Tamil Nadu And the new to credit is between 25% – 30%.

- The management states that when the branch is overgrown beyond 7- 8 thousand customers in a single location, it normally creates one more branch so that it can transfer and service better.

- The management is seeing a good performance in Northern states especially Bihar, where it is getting 40% to 50% new to credit customers because it operates in Tier 3, and Tier 4 kind of traditional villages.

- The company expects to grow at a CAGR of 20% to 25% over the next four to five years.

- The company is piloting the following products- One is an individual loan for the matured customers, which is already piloted & located in about 192 branches, disbursing almost nearly a crore every day. 2) two-wheeler loan, 3) Loan Against Property book of almost Rs.5 Crores per month, 4) piloting gold loan in about five-seven branches.

- The borrowing costs in Q4FY23 are expected to remain the same as it is planning to borrow the majority from the banks, local banks, and domestic borrowings.

- The management states that with the legacy books getting cleaned up this year, it should be able to get about 1.5% to 1.6% of credit cost going forward.

- The management expects the NIM to rise by 50-70 Bps in FY24 to 12.5%.

- The company expects the share of the top 3 states to be less than 60% by the next 3 years timeframe if there is a stable environment.

- The management explains that 60% to 65% of growth comes from existing borrowers, About 20% to 25% growth comes from new borrowers in the existing branches And the balance of 10% to 15% growth comes from the new customers from the new branches. Therefore, it is planning that about 10% to 15% or 12% to 15% will be the borrower growth &Then 20% to 25% will be the portfolio growth.

- The management succinctly explains the huge market size for this form of lending -”, if you look at the overall potential market. If you take any calculation, almost 170 million-odd customers are supposed to be within this threshold for microfinance lending. Even if you count 6-7 Crores or 60-70 Million in excess, you still have about 90 million to 100 million borrowers who are yet to get formal finance. So, a majority of them are rural. So, with all things in place, with the legitimate under the improved business environment. We believe that this will be a good opportunity for the sector to grow. We strongly believe we have a very long highway to grow here.”

- The company at a consolidated level has a capital adequacy of about 24% which is sufficient for the next four or five quarters after which it might do fundraising through the QIP route.

- The company’s internal policy is to maintain the overall liquidity of about 7% of the AUM, which will be ideally sufficient for a stable period.

- The company’s ideal borrowing mix for good ALM positioning is- 30%-35% international borrowing which is long-term and stable, 15% from BFIs in India or public NCD & 40%-45% will be stable domestic bank borrowings.

Analyst’s View:

Credit Access Grameen has emerged as one of the most reliable microlenders in the country. Their revolutionary JLG model has helped bring communities of borrowers together and helped reduce overall risk from their lending to a very large extent as seen in their low NPA numbers. The company has delivered a mediocre performance in the form of low disbursement growth due to a higher base & a subsequent write-off of the legacy book of MMFL. The company remained conservative and focused on servicing existing customers which led to higher average loan outstanding, but it has been able to add new borrowers in the past few months. It remains to be seen whether the company will be able to deliver on its guidance of 20-25% CAGR for the next 4-5 years, how the market will perceive potential stake sales of promoters & given the issues in the microfinance industry and how will the RBI rate hike affect the demand from its target market. Nonetheless, given its strong market position and exemplary operating and risk management practices, Credit Access Grameen remains one of the must-watch stocks in the Microfinance sector for any interested investor.

Q2FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a great quarter with consolidated PAT rising 195% YoY.

- GLP grew 24% YoY while Standalone GLP grew 23.1% YoY. MMFL GLP grew 28.8% YoY.

- Disbursements grew 12.5% YoY with CAGL up 6.8% YoY and MMFL up 52.8% YoY.

- The customer base grew 1.2% YoY & by 3% QoQ to 37.98 Lakh. The standalone customer base stood at 29.96 lakh while MMFL’s customer base stood at 8.3 lakh.

- The company wrote off 1 lakh borrowers in Q2FY23.

- NII has risen 39.9% YoY to Rs 516 Cr. PPoP grew 52.9% YoY at Rs 334 Cr.

- Provisioning for CAGL & MMFL stood at 2.46% & 3.35% respectively.

- Overall RoA and RoE were at 4% and 16%.

- GNPA & NNPA of CAGL stood at 2.17% & 0.77% respectively while the same for MMFL stood at 4.37% & 2.27%.

- CRAR: CAGL 25% (Tier 1: 24.1%), MMFL 22.5% (Tier 1: 14.8%).

- Collection efficiency at 98% for CAGL in March excluding. MMFL collection efficiency excluding arrears was at 94%

- Standalone debt to equity was at 2.7 times. MMFL debt to equity was at 5.7 times.

- Consolidated cost-to-income ratios were at 38.2% in Q2. Opex to GLP was at 5.1% in Q2.

- WA–cost of borrowing for CAGL was at 8.8% in Q2.

- The consolidated cost of borrowings stood at 9.2% while the disbursement rate stood at 20.8%.

- Branches increased by 9% YoY for CAGL opened in Q2 taking the total branches count to 1684.

- NIM of standalone business stood at 12%. Consolidated NIM was at 11.2% while MMFL was at 10.4% in Q2.

- Positive ALM mismatch with an average maturity of assets at 17.9 months and average maturity of liabilities at 22.6 months in CAGL.

- IGL loans accounted for 96% of total loans.

- Karnataka remains the biggest market for the company with 27.6% of GLP. Maharashtra comes in second with 20.3% of GLP and Tamil Nadu is second with 22.5% of GLP.

Investor Conference Call Highlights:

- The company is aiming to achieve 25%-30% from foreign funding. During this financial year,it received sanctions of around USD 195 million from prominent foreign financial institutions and governing bodies including Blue Orchard, International Finance Corporation (IFC), syndicated loan by HSBC and United States, and the International Development Finance Corporation (DFC).

- In Q1 FY2023, India Ratings upgraded its credit rating from A+/Stable to AA-/Stable, and ICRA upgraded its rating outlook from A+/Stable to A+/Positive. This was followed by CRISIL upgrading the rating outlook to A+/Positive from A+/Stable in Q2 FY2023.

- The company is planning to raise up to Rs.1,500 Crores in multiple tranches over the coming year & This issue will be the first public NCD issue to be launched by any NBFC-MFI.

- The company’s marginal cost increased by 50 bps in the last six months and the average cost of borrowing increased by 30 bps in the last six months however the costs decreased QoQ due to liability management.

- The company is targeting branch addition of 10-12% on base.

- The NIM expansion is because of increased pricing, lesser derecognition & reduction of negative carry because of higher liquidity maintenance.

- The management expects NIM to remain in the range of 12-12.5% for the current FY.

- The ECB’s cost is around one percent more than the normal cost of borrowing but Since it is three years of funding, therefore because outfit’s long-term nature & stability, Management is willing to pay an extra 1%.

- The company’s guidance is customer growth of about 10-12% and portfolio growth of about 24-25%.

- The management believes that it has a competitive edge by pricing lower and borrowing at a lower price Vs its peers leading to a retention rate of almost 85%.

- The company incurred a loss of 4.5% annually during the two Covid struck years.

- The reduction in customers in Madura is due to a write-off of a large number of customers during the last 2 years. However, the management expects improved numbers in the coming 2 quarters.

- The management explains that Microfinance involves lending to people whose income should not be more than Rs.3 lakhs. It also involves evaluating all the borrowings of the family and the outflow should not be more than 50% of the household income.

- The company’s customer profile involves about 43% of its customers being unique for Grameen, about 39% of the customers have one other lender and the balance has either two or three lenders.

Analyst’s View:

Credit Access Grameen has emerged as one of the most reliable microlenders in the country. Their revolutionary JLG model has helped bring communities of borrowers together and helped reduce overall risk from their lending to a very large extent as seen in their low NPA numbers. The company has delivered a great Q2 performance which saw GLP, revenue, disbursement & profits growth. The company remained conservative and focused on servicing existing customers which led to higher average loan outstanding, but it has been able to add new borrowers in the past few months. It remains to be seen whether the company will be able to come back to its pre-covid growth rate of 30-40% CAGR given the issues in the microfinance industry and how will the RBI rate hike affect the demand from its target market. Nonetheless, given its strong market position and exemplary operating and risk management practices, Credit Access Grameen remains one of the must-watch stocks in the Microfinance sector for any interested investor.

Q4FY22 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 694 | 609 | 14.0% | 577 | 20.3% | 2291 | 2031 | 12.8% |

| PBT | 203 | 99 | 105.1% | 172 | 18.0% | 513 | 194 | 164.4% |

| PAT | 151 | 72 | 109.7% | 129 | 17.1% | 382 | 142 | 169.0% |

| Consolidated Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 824 | 726 | 13.5% | 690 | 19.4% | 2750 | 2466 | 11.5% |

| PBT | 218 | 78 | 179.5% | 155 | 40.6% | 481 | 180 | 167.2% |

| PAT | 160 | 56 | 185.7% | 117 | 36.8% | 357 | 131 | 172.5% |

Detailed Results:

- The company had a great quarter with a 14% YoY rise in standalone revenues. The consolidated revenues were up 13% while PAT was up 185% YoY.

- GLP grew 22.2% YoY to Rs 16,599 Cr. Standalone GLP grew 21.1% YoY. MMFL GLP grew 27.7% YoY.

- Disbursements grew 22.5% YoY with CAGL up 12.2% YoY and MMFL up 96.2% YoY.

- The customer base fell 2.2% YoY & increased by 2.3% QoQ to 38.2 Lakh. The standalone customer base stood at 29.2 lakh while MMFL’s customer base stood at 9.3 lakh.

- The company added 6.9 lakh new borrowers in FY22.

- NII has risen 12.1% YoY to Rs 519.6 Cr. PPoP grew 12.1% YoY at Rs 369 Cr.

- Provisioning for CAGL & MMFL stood at 3.19% & 4.57% respectively

- Overall RoA and RoE were at 3.7% and 15.9%.

- GNPA & NNPA of CAGL stood at 3.1% & 0.9% respectively while the same for MMFL stood at 5.8% & 3%.

- CRAR: CAGL 26.5% (Tier 1: 25.9%), MMFL 20% (Tier 1: 12.5%).

- Collection efficiency at 96% for CAGL in March excluding. MMFL collection efficiency excluding arrears was at 92%

- Standalone debt to equity was at 2.7 times. MMFL debt to equity was at 6.7 times.

- Consolidated cost to income ratios was at 33.8% in Q4. Opex to GLP was at 4.8% in Q4.

- WA cost of borrowing for CAGL was at 8.8% in Q4.

- Consolidated cost of borrowings stood at 8.9%.

- 38 new branches of CAGL opened in Q4 while MMFL opened 4 new branches in Q4 and the total branches stand at 1635.

- NIM of standalone business stood at 11.5%. Consolidated NIM was at 11.3% while MMFL was at 10% in Q4.

- Positive ALM mismatch with an average maturity of assets at 18.1 months and average maturity of liabilities at 22.5 months in CAGL.

- IGL loans accounted for 96% of total loans.

- No district accounts for >4% of the total loan portfolio currently.

- Karnataka remains the biggest market for the company with 35.9% of GLP. Maharashtra comes in second with 21.5% of GLP and Tamil Nadu is third with 20.8% of GLP.

Investor Conference Call Highlights:

- The management foresees NIMs improving by 50 to 60 bps in FY2023 compared to FY2022 due to allowing of risk-based financing by RBI in its new microfinance guidelines.

- The management expects portfolio growth to remain muted during Q1 FY2023 as it will implement the new RBI guidelines on the field and ensure required training on new processes and controls to its employees.

- The company doesn’t expect to raise capital in the next 1-2 years to meet its growth targets.

- The management plans to increase its active client base by 8% to 10% in the coming year.

- The company believes that demand in rural areas will remain unaffected despite higher interest rates & inflation.

- The management states that MMFL’s borrowing cost is higher than CREDAG leading to the yield difference meanwhile 65% of MMFL portion is underwritten as per CREDAG.

- The management states that as a rule of thumb the company’s growth should not exceed its customer acquisitions by more than 25% otherwise that would mean leveraging.

- The company’s market share in its industry is about 5.6% and among NBFCs, it is about 18%.

Analyst’s View:

Credit Access Grameen has emerged as one of the most reliable microlenders in the country. Their revolutionary JLG model has helped bring communities of borrowers together and helped reduce overall risk from their lending to a very large extent as seen in their low NPA numbers. The company has delivered a great Q4 performance which saw GLP, revenue, disbursement & profits growth. The company rising collection efficiency but a few states like Maharashtra are expected to remain subdued for some time where the company is charging higher rates due to higher risk in that region. The company remained conservative and focused on servicing existing customers which led to higher average loan outstanding, but it has been able to add new borrowers in the past few months. It remains to be seen whether the company will be able to come back to its pre-covid growth rate of 30-40% CAGR given the issues in the microfinance industry and how will the RBI rate hike affect the demand from its target market. Nonetheless, given its strong market position and exemplary operating and risk management practices, Credit Access Grameen remains one of the must-watch stocks in the Microfinance sector for any interested investor.

Q3FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 577 | 440 | 31.1% | 510 | 13.1% | 1598 | 1422 | 12.4% |

| PBT | 172 | -95 | 281.1% | 97 | 77.3% | 310 | 95 | 226.3% |

| PAT | 129 | -72 | 279.2% | 72 | 79.2% | 231 | 70 | 230.0% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 690 | 543 | 27.1% | 618 | 11.7% | 1926 | 1740 | 10.7% |

| PBT | 155 | -105 | 247.6% | 79 | 96.2% | 263 | 102 | 157.8% |

| PAT | 117 | -79 | 248.1% | 60 | 95.0% | 197 | 75 | 162.7% |

Detailed Results:

- The company had a great quarter with a 31% YoY rise in standalone revenues.

- GLP grew 18.4% YoY to Rs 14,587 Cr. Standalone GLP grew 21% YoY. MMFL GLP grew 13.6% YoY.

- Disbursements grew 2.8% YoY with CAGL down 4.1% YoY and MMFL up 53% YoY.

- The customer base fell 4.3% YoY to 3.739 million. The standalone customer base fell to 2.8 million down 1.9% YoY. MMFL’s customer base fell by 8.2% YoY.

- NII has risen 11.5% YoY to Rs 368.9 Cr. PPoP grew 60.6% YoY at Rs 274 Cr.

- Provisioning for CAGL & MMFL stood at 4.4% & 7.83% respectively

- Overall RoA and RoE were at 1.6% and 11.9%.

- Overall GNPA was at 6.02%. with PAR 90+ being 4.67%

- CAR: CAGL 29.4% (Tier 1: 28.8%), MMFL 17.7% (Tier 1: 14.3%).

- Collection efficiency at 95% for CAGL in December excluding arrears. MMFL collection efficiency excluding arrears was at 89% in December

- Standalone debt to equity was at 2.4 times. MMFL debt to equity was at 5.7 times.

- Consolidated cost to income ratios was at 39.3% in Q3. Opex to GLP was at 5.1% in Q3.

- Consolidated cost of borrowings stood at 9.4%.

- Consolidated branches increased by 14.7% YoY to 1593 & employees increased by 5.3% YoY to 15,483

- NIM of standalone business stood at 11.7%. Consolidated NIM was at 11.4% while MMFL was at 10.2% in Q3.

- Positive ALM mismatch with an average maturity of assets at 19.8 months and average maturity of liabilities at 20.2 months in CAGL.

- IGL loans accounted for 93% of total loans.

- No district accounts for >4% of the total loan portfolio currently.

- Karnataka remains the biggest market for the company with 36.5% of GLP. Maharashtra comes in second with 22.3% of GLP and Tamil Nadu is third with 20.7% of GLP.

Investor Conference Call Highlights:

- Monthly disbursement has grown to Rs 1400 Cr for CAGL and Rs 360 Cr for MMFL in Dec.

- The company has added 5.4 Lac new borrowers in the last 12 months.

- The company added 193 new branches this year primarily in new markets.

- Consolidated GLP crossed the $2 billion mark in Jan.

- 40% of the customers are new which are from non-core states like Bihar, Jharkhand, UP, Gujarat, Rajasthan, and Odisha. The initial ticket size for these new states is Rs 32,000.

- The management doesn’t expect any write-offs due to the omicron wave.

- The company is the lowest priced MFI today due to the 10% margin-cap of RBI.

- The management states that field operations are back to normal with 75-80% of JLGs paid back in full.

- The management expects a long runway for growth in the future as well as only 35-40% of the addressable market has been achieved by the industry.

- The company is doing 90000 new customer additions every month and is planning to increase infrastructure by 10-15% yearly.

- The management believes that the industry’s competitive intensity doesn’t affect the business as it Is the sole lender for 43% of its customers & one of the two lenders for 39% of its customers.

- The management expects the loan book of the industry to grow at 20-25% CAGR in the next 3 years with CAGL expected to grow 17-19% in FY21.

- In MMFL, only 45% of the total book is from the CAGL model while the rest 55% is from the old MMFL model before the acquisition.

- The management states that the company will be looking to add 10-15% infrastructure each year as it has done so far.

- The company’s new initiative includes pilot products like A) customers can withdraw their bank balance at central meetings B) secured products for affordable homes or home improvement or secured assets through retail platform C) vehicle insurance or 2-wheeler insurance.

- The management is rethinking its retail strategy since its investment in Madura was treated as a non-qualified asset leading to less headroom for growth & is restricting the contribution of retail to only 2%. So the management is more focused on secured loans in its portfolio. Secured book is expected to contribute 10-12% by 2024.

- The company has less than 10% of its borrowings from the less than 12-month maturity segment and more than 45% is of greater than 3 years.

Analyst’s View:

Credit Access Grameen has emerged as one of the most reliable microlenders in the country. Their revolutionary JLG model has helped bring communities of borrowers together and helped reduce overall risk from their lending to a very large extent as seen in their low NPA numbers. The company has delivered a good Q3 performance which saw GLP, revenue, disbursement & profits grow substantially. The company remained conservative and focused on servicing existing customers which led to higher average loan outstanding, but it has been able to add new borrowers in the past few months. It remains to be seen whether the company will be able to come back to its pre-covid growth rate of 30-40% CAGR given the issues in the microfinance industry and how a possible 3rd wave of COVID-19 will affect near term operations. Nonetheless, given its strong market position and exemplary operating and risk management practices, Credit Access Grameen remains one of the must-watch stocks in the Microfinance sector for any interested investor.

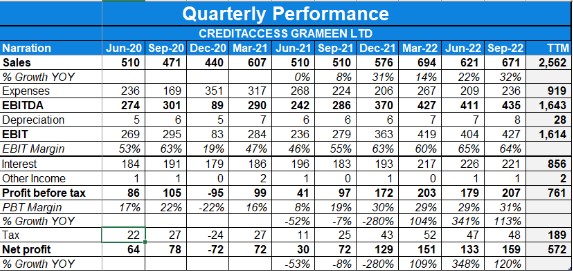

Q2FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 510 | 471 | 8.28% | 511 | -0.20% | 1021 | 982 | 3.97% |

| PBT | 97 | 105 | -7.62% | 40 | 142.50% | 138 | 190 | -27.4% |

| PAT | 72 | 78 | -7.69% | 30 | 140.00% | 102 | 142 | -28.17% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 619 | 577 | 7.28% | 617 | 0.32% | 1236 | 1197 | 3.26% |

| PBT | 79 | 107 | -26% | 29 | 172.41% | 107 | 207 | -48% |

| PAT | 60 | 80 | -25% | 20 | 200.00% | 80 | 154 | -48.05% |

Detailed Results:

- The company had a mixed quarter with a 8% YoY rise in standalone revenues. The consolidated revenues were up 7% but PAT was down 25% YoY.

- GLP grew 19% YoY to Rs 13,333 Cr. Standalone GLP grew 21% YoY. MMFL GLP grew 9% YoY.

- Disbursements grew 136% YoY with CAGL up 140% YoY and MMFL up 109% YoY.

- The customer base fell 3.3% YoY to 3.751 million. The standalone customer base fell to 2.754 million down 1.7% YoY. MMFL’s customer base fell by 8.2% YoY.

- NII has risen 11.5% YoY to Rs 368.9 Cr. PPoP grew 11.1% YoY at Rs 218.7 Cr.

- Provisioning for CAGL & MMFL stood at 5.51% & 7.83% respectively

- Overall RoA and RoE were at 1.6% and 6.2%.

- Overall GNPA was at 7.67%. with PAR 90+ being 5.78%

- CRAR: CAGL 30.9% (Tier 1: 30.3%), MMFL 20.4% (Tier 1: 16.8%).

- Collection efficiency at 94.3% for CAGL in March excluding arrears & including it collection was at 98%. MMFL collection efficiency excluding arrears was at 87% and including it was at 90%.

- Standalone debt to equity was at 2.2 times. MMFL debt to equity was at 5.3 times.

- Consolidated cost to income ratios was at 43.9% in Q2. Opex to GLP was at 5.3% in Q2.

- WA cost of borrowing for CAGL was at 9.3% in Q2.

- Consolidated cost of borrowings stood at 9.5%.

- 121 new branches of CAGL opened in Q2 and the total branches stand at 1566.

- NIM of standalone business stood at 11.3%. Consolidated NIM was at 11.2% while MMFL was at 10.6% in Q2.

- Positive ALM mismatch with an average maturity of assets at 18.5 months and average maturity of liabilities at 20.1 months in CAGL.

- IGL loans accounted for 90% of total loans.

- No district accounts for >4% of the total loan portfolio currently.

- Karnataka remains the biggest market for the company with 38.1% of GLP. Maharashtra comes in second with 22.9% of GLP and Tamil Nadu is third with 19.3% of GLP.

Investor Conference Call Highlights:

- The company added 2 Lac new borrowers from July to Oct.

- The management expects delay in collections in Maharashtra.

- Restructuring stands at 1.4% of the consolidated book.

- The average loan size has increased from 35000 to 40000 due to increase in the proportion of existing customers in the loan book from 33% to 48% due to lower growth in new customer acquisitions. The company has also written off almost 3 lakhs customers where the average

portfolio per customer was low which also contributed to the rise in average loan size. - The company’s new initiative includes pilot products like A) customers can withdraw their bank balance at central meetings B) secured product for affordable homes or home improvement or secured assets through retail platform C) vehicle insurance or 2-wheeler insurance.

- The management is rethinking its retail strategy since its investment in Madura was treated as non-qualified asset leading to less headroom for growth. So the management is retaining its existing employees to create more weightage of secured loans in its portfolio.

- The management believes that customers are taking loans prudently since they have a average loan size of Rs.54,000 even though the company can extend credit line up to Rs.1 lakh.

- The loan growth was little low because management believes that its customers are apprehensive about a possible third covid wave and are thus restricting borrowing till stable condition comes.

- The management states that company is now operating at pre-covid levels since collection efficiency is close to 98-99% (including 4.2% delinquent customers who haven’t paid in 90 days) and disbursements are also at Rs.1100 Cr per month since the last 4 months.

- The company has no plans of converting into Small finance bank and will continue to stay as an NBFC focused on the large highway of growth in rural region.

- The management is managing its liquidity position by increasing the contribution of liabilities outside India as a proportion of total borrowings to 14% and further plans to increase the mix to 25-30% in the next 2 years.

- The company is the sole lender to 43% of its customers & one of the 2 lenders for its other 45% of customers.

- The company has a policy that if a branch has more than 10% delinquency, that branch is not allowed to acquire clients rather only focus on collections. So 30% of company’s branches are currently not acquiring new MFI customers.

Analyst’s View:

Credit Access Grameen has emerged as one of the most reliable microlenders in the country. Their revolutionary JLG model has helped bring communities of borrowers together and helped reduce overall risk from their lending to a very large extent as seen in their low NPA numbers. The company has delivered a mixed Q2 performance which saw GLP, revenue, and disbursement growth but profits remained subdued due to high provisioning. The company rising collection efficiency but a few states like Maharashtra are expected to remain subdued for some time. The company remained conservative and focused on servicing existing customers which led to higher average loan outstanding, but it has been able to add new borrowers in the past few months. It remains to be seen whether the company will be able to come back to its pre-covid growth rate of 30-40% CAGR given the issues in the microfinance industry and how a possible 3rd wave of COVID-19 will affect near term operations. Nonetheless, given its strong market position and exemplary operating and risk management practices, Credit Access Grameen remains one of the must-watch stocks in the Microfinance sector for any interested investor.

Q4FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 609 | 461 | 32.10% | 440 | 38.41% | 2031 | 1684 | 20.61% |

| PBT | 99 | 30 | 230.00% | -95 | 204.21% | 194 | 451 | -57.0% |

| PAT | 72 | 23 | 213.04% | -72 | 200.00% | 142 | 328 | -56.71% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 726 | 482 | 50.62% | 543 | 33.70% | 2466 | 1705 | 44.63% |

| PBT | 79 | 41 | 93% | -105 | 175% | 180 | 462 | -61% |

| PAT | 56 | 31 | 81% | -79 | 170.89% | 131 | 335 | -60.90% |

Detailed Results

- The company had a good quarter with a 32% YoY rise in standalone revenues. The consolidated numbers are not comparable due to the addition of Madura MFI revenues in FY21 which was not present last year.

- The standalone PAT for the company saw a profit of Rs 72 Cr.

- GLP grew 13% YoY to Rs 13,587 Cr. Standalone GLP grew 14.6% YoY. MMFL GLP grew 7% YoY.

- Disbursements grew 42% YoY with CAGL up 42% YoY and MMFL up 41% YoY.

- New disbursals (June 2020- March 2021) accounted for 69% of GLP.

- The customer base fell 3.5% YoY to 3.912 million. The standalone customer base fell to 2.871 million down 1.2% YoY. MMFL’s customer base fell by 9.7% YoY.

- NII has risen 58.7% YoY to Rs 463.7 Cr. PPoP grew 83.3% YoY at Rs 329 Cr.

- Total ECL provisions were 5% in CAGL and 5.07% in MMFL.

- Overall RoA and RoE were at 1.5% and 6%.

- Overall GNPA was at 4.43%.

- CRAR: CAGL 31.8% (Tier 1: 30.5%), MMFL 20.9% (Tier 1: 17.7%).

- Collection efficiency at 94% for CAGL in March excluding arrears & including it collection was at 97%. MMFL collection efficiency excluding arrears was at 90% and including it was at 91%.

- Standalone debt to equity was at 2.4 times. MMFL debt to equity was at 5.3 times.

- Standalone cost to income ratios was at 29.2% in Q4 & 34.8% in FY21. Opex to GLP was at 4.6% in Q4 & 4.5% in FY21.

- WA cost of borrowing for CAGL was at 8.9% in Q4.

- Positive ALM mismatch with an average maturity of assets at 18.5 months and average maturity of liabilities at 22.7 months in CAGL.

- GL loans accounted for 96.4% of total loans for CAGL with the rest being retail finance.

- GL loan usage breakup was:

- Animal Husbandry: 45.7%

- Trading: 26.6%

- Partly Agri: 15%

- Production: 7.9%

- Housing: 1.6%

- Others: 3.2%

- Only 1 district for CAGL & 2 districts for MMFL have >4% of the total loan portfolio currently.

- Karnataka remains the biggest market for the company with 38.2% of GLP. Maharashtra comes in second with 23.4% of GLP and Tamil Nadu is third with 18.9% of GLP.

Investor Conference Call Highlights

- The consolidated customer base declined from 40.55 lakhs to 39.12 lakhs primary due to the write-off of over 2.4 lakh delinquent borrowers.

- The company added a total of 4 lakh new borrowers at CAGL primarily during H2 and 1.6 lakh borrowers at MMFL during the same period.

- Consolidated NII grew by 59% YoY.

- The company decided to recognize accelerated write-off of accounts worth Rs 273 Cr with 180 DPD and no payment since Jan 2021, resulting in an additional credit cost of Rs 64 Cr in Q4.

- The process integration of MMFL is expected to be complete in H1FY22.

- The company maintained liquidity of over 15% of gross AUM and holds undrawn sanctions over Rs 2614 Cr.

- It is seeing a decline of 5-6% in collections in April due to localized lockdowns.

- The drop in customer base is due to customer attrition, where 5% to 8% natural attrition is there accounting for 2.4 lakh, & a rise in portfolio per customer due to vintage linked increase.

- Q1 should stay subdued in terms of collections if customer accessibility is restricted, but any normalization here should lead to a revival in collections.

- Maharashtra continues to lag other states in terms of revival in collections due to the early lockdowns announced in the state.

- MMFL & CAGL collections are not comparable as they have different models with MMFL having a lag in collections due to the monthly model which leads to a delay in recognition.

- New customer loan size is Rs 30,000-35,000. The majority of new customer acquisition is taking place in Gujarat, Rajasthan, UP, Bihar, Jharkhand, and Odisha while there is Karnataka & Maharashtra is seeing customer set decline, particularly in Maharashtra as CAGL is not allowing employees to add new customers because wherever the collection efficiency is less than 90%.

- 61% growth comes from the new branches according to the management.

- Older customers have loan sizes of Rs 35000-50,000. 12-14% of old customers have loans of > Rs 50,000.

- 70-80% of MFI customers are in essential services. Thus this set remains resilient especially given that it has already gone through the tough period at the start of the pandemic and persisted through with good repayment behaviour.

- CAGL has suspended all group meetings at present, keeping the 2nd wave of COVID in mind. It is only asking one group member to keep the money ready with them and 1 collection agent will come to pick it up only from that member. This is because, despite the option of online payment, its adoption has remained low among customers given that it has become harder to go to banks to deposit cash.

- MMFL has not done any restructuring.

- The management hopes that MFIN will be able to convince the regulatory body to relax the cap on spread for MFIs to create a level playing field for everyone engaged in the MFI business.

- Only 20-25% of vintage customers eligible for an additional loan have availed of the benefit.

Analyst’s View

Credit Access Grameen has emerged as one of the most reliable microlenders in the country. Their revolutionary JLG model has helped bring communities of borrowers together and helped reduce overall risk from their lending to a very large extent as seen in their low NPA numbers. The company has delivered a good Q4 performance which saw robust GLP, revenue, and disbursement growth but profits remained subdued due to high provisioning. The company rising collection efficiency till March but it is expected to drop due to the rise of the 2nd wave of COVID-19. The complete integration of Madura Microfinance is expected to be done in H1FY22. It remains to be seen whether the company will be able to come back to its pre-covid growth rate of 30-40% CAGR given the possible integration issues with MMFL and how the 2nd wave of COVID-19 will affect near term operations. Nonetheless, given its strong market position and exemplary operating and risk management practices, Credit Access Grameen remains one of the must-watch stocks in the Microfinance sector for any interested investor.

Q3FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 440 | 454 | -3.08% | 471 | -6.58% | 1422 | 1223 | 16.27% |

| PBT | -95 | 146 | -165.07% | 105 | -190.48% | 95 | 421 | -77.43% |

| PAT | -72 | 108 | -166.67% | 78 | -192.31% | 70 | 305 | -77.05% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 543 | 454 | 19.60% | 577 | -5.89% | 1740 | 1223 | 42.27% |

| PBT | -105 | 146 | -172% | 107 | -198.13% | 102 | 421 | -75.77% |

| PAT | -79 | 108 | -173% | 80 | -198.75% | 75 | 305 | -75.41% |

Detailed Results

- The company had a dismal quarter with a 3% YoY decline in standalone revenues. The consolidated numbers are not comparable due to the addition of Madura MFI revenues in FY21 which was not present last year.

- The standalone PAT for the company saw a loss of Rs 72 Cr.

- GLP grew 39% YoY to Rs 12,321 Cr. Standalone GLP grew 15% YoY. MMFL GLP fell 0.9% YoY.

- The customer base expanded 41% YoY to 3.906 million. The standalone customer base grew to 2.837 million which is up 1,65,194 in Q3. MMFL’s customer base grew by 70120 in Q3.

- NII has risen 23% YoY to Rs 416.7 Cr. PPoP declined 15% YoY at Rs 170.3 Cr after de-recognition of INR 68.5 crore interest income (on Stage 3 portfolio @ 60+ dpd).

- Total ECL provisions were 5.94% in CAGL and 4.6% in MMFL.

- Overall RoA and RoE were at -2.3% and -9.4%.

- Overall GNPA was at 6.14% while NNPA was at 0.9%.

- CRAR: CAGL 31.4% (Tier 1: 30.7%), MMFL 23.3% (Tier 1: 19.2%).

- Collection efficiency at 91% for CAGL in Dec excluding arrears & including it collection was at 96%. MMFL collection efficiency excluding arrears was at 86% and including it was at 87%.

- Standalone debt to equity was at 2.2 times. MMFL debt to equity was at 4.4 times.

- Standalone cost to income ratios was at 43.5% and Opex to GLP was at 4.7%.

- The weighted average cost of borrowing was at 9.4% for CAGL & 10.8% for MMFL.

- Positive ALM mismatch with an average maturity of assets at 18 months and average maturity of liabilities at 23.7 months in CAGL.

- Consolidated Disbursements in Q3 rose 54% YoY to Rs 4590 Cr with CAGL at Rs 4032 Cr and MMFL at Rs 558 Cr.

- GL loans accounted for 96.1% of total loans for CAGL with the rest being retail finance.

- GL loan usage breakup was:

- Animal Husbandry: 46.2%

- Trading: 24.5%

- Partly Agri: 14.9%

- Production: 8.2%

- Housing: 2.2%

- Others: 4%

- Only 1 district for CAGL & 2 districts for MMFL have >4% of the total loan portfolio currently.

- Karnataka remains the biggest market for the company with 38.3% of GLP. Maharashtra comes in second with 24.8% of GLP and Tamil Nadu is third with 19.5% of GLP.

Investor Conference Call Highlights

- The collection efficiency excluding Maharashtra was 93%. Collection efficiency in Maharashtra was at 86%.

- Full paying customers increased to 88% in Dec from 81% in Sep.

- Partial paying customers were at 7%. Nonpaying customers were at 5% only from 8% in Sep.

- Maharashtra business is expected to come back to normal by Q4.

- New disbursements since June is now at 45% of GLP.

- CAGL is expected to surpass its GLP target for FY21.

- The company has written off Rs 111.9 Cr and has not recognized interest income of Rs 61.2 Cr on stage 3.

- The management admits that MMFL is growing at a slower rate than the industry.

- MMFL has written off Rs 19.9 Cr and not recognized interest income of Rs 7.3 Cr of Stage 3 portfolio.

- The company has cash and cash equivalents of Rs 1586.94 Cr. It also has Rs 1599 Cr of undrawn facility and Rs 4113 Cr of sanctions in the pipeline.

- The management states that COVID stress is now over for CAGL and it should now resume normal growth momentum.

- Most of the additional provisioning in Q3 is towards Maharashtra which is still under stress according to the management.

- The management states that most of the provisions should get reversed when Maharashtra stress goes away.

- Even in the 0 payment segment of 5%, the company is expecting a recovery of 10-15% at least.

- The management has stated that the company will probably not need additional provisions in Q4.

- The management is not worried by the industry trend of going cautious and it will maintain its normal growth rate in its operations in FY22.

- The management has stated that normal provisioning will indeed increase in absolute terms as the GLP rises but it will stay at below 1% of GLP which is normal for CAGL.

- The management is stated that Maharashtra recovery is slower than other states due to the extended lockdown as compared to other states. There aren’t any pending challenges in Maharashtra for CAGL.

- The share of Karnataka will keep coming down due to the rising share of new states like Gujarat, Rajasthan, Bihar, etc. Around 1/3rd of branches are in new states. Although the company will be stressing on geographical expansion, it will ensure that the GLP concentration remains low in % terms at the district level.

- MMFL collection model is monthly and thus there is a lag in recognition of collections. The management is looking to enhancing the on time collections and not changing the model for faster collection.

- The management maintains that elections and political promises do not cause much material impact on MFI business.

- The company is also allowing customers who are in good standing and have maintained repayment behavior to pre-close existing loan and move on to a new loan. This has resulted in a difference in disbursements and the rise in GLP. Older loans were running at rates above 21% while new loans are now issued at a lower rate of 19.35%. This a benefit for customers who want to close the old loan and get a new loan.

- The growth in mature states should slow down to 10-15% and the share of Karnataka should come down to 25% in the next 2-3 years.

- The credit losses in COVID should be similar to that in demonetization which was close to 4%.

- The company has reversed interest income for all partially paid customers beyond 60 DPD.

- The management is confident that there shouldn’t be any issues with its lenders due to the credit loss as it is an industry issue and this has already occurred before with demonetization when the company was not penalized.

- The industry growth for the next 4-5 years should be near to the normal range of 20-25% CAGR and CAGL can see growth of 30-40% CAGR in the same period.

- The management states that the company has enough capital to last till the second half of FY23 conservatively without any additional capital raise.

- NIM was down due to the reversal of interest income. Without the reversal, it would have been close to 12%. Similarly, portfolio yield was down due to the same reason.

- The company will keep liquidity at 12-15% of AUM and it will come down to 8% by Q2 next year.

- Any fall in the cost of borrowing will be passed on to customers and NIM will be kept stable at above 10%.

- New borrowing cost is at 8-8.5% and average borrowing cost is at 9-9.5% and this is expected to continue for the next 3-4 quarters according to the management.

- The management target branch expansion of 20-25% in new geographies but this was eased in FY21 due to COVID. This pace is expected to be carried on going forward.

- The behavioral change from the moratorium can result in credit losses rising by 50-60 bps. But this is not fixed currently and the management hopes that it doesn’t come to pass.

- The company is providing relaxation in terms of repayment as putting pressure on non-payers for repayment will start putting pressure on paying members in the same JLG.

- The company has simplified the application process so that the customer doesn’t need to visit the branch for completion and it has expanded payment process options to digital options to reduce customer travel and maintain their safety.

- Around 15-18% of disbursement was given to new customers in Q3.

- MMFL process integration should see the alignment of the operating model by March and the majority of the loan book will move to the Grameen model in 3 stages starting from Feb. The legal consolidation should take 3-4 months to complete. The process merger should be ready before the legal merger.

- The management reiterates that the company doesn’t have any plans to become a bank and it will continue on its mission to provide loans to low income segment especially in rural regions.

Analyst’s View

Credit Access Grameen has emerged as one of the most reliable microlenders in the country. Their revolutionary JLG model has helped bring communities of borrowers together and helped reduce overall risk from their lending to a very large extent as seen in their low NPA numbers. The company has delivered a mixed Q3 performance which saw robust GLP, revenue and disbursement growth but profits remained subdued due to high provisioning. The company rising collection efficiency even in the stressed region of Maharashtra. The company’s acquisition of Madura Microfinance is expected to be done in the next 3-4 months in terms of both the process and legal. It remains to be seen whether the company will be able to come back to its precovid growth rate of 30-40% CAGR given the possible integration issues with MMFL and the ongoing COVID-19 pandemic. Nonetheless, given its strong market position and exemplary operating and risk management practices, Credit Access Grameen remains one of the must-watch stocks in the Microfinance sector for any interested investor.

Q2FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 471 | 393 | 19.85% | 510 | -7.65% | 981 | 769 | 27.57% |

| PBT | 105 | 127 | -17.32% | 86 | 22.09% | 190 | 275 | -30.91% |

| PAT | 78 | 101 | -22.77% | 64 | 21.88% | 142 | 197 | -27.92% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 577 | 393 | 46.82% | 620 | -6.94% | 1197 | 770 | 55.45% |

| PBT | 107 | 127 | -15.75% | 100 | 7.00% | 207 | 275 | -24.73% |

| PAT | 80 | 101 | -20.79% | 75 | 6.67% | 154 | 197 | -21.83% |

Detailed Results

- The company had a mixed quarter with 20% YoY growth in standalone revenues. The consolidated numbers are not comparable due to the addition of Madura MFI revenues in FY21 which was not present last year.

- The standalone profits for the company fell 23% YoY while PBT declined 17% due to a YoY increase in expenses (impairment of financial instruments) and increased provisions.

- GLP grew 41.5% YoY to Rs 11,183 Cr. Standalone GLP grew 16.5% YoY. MMFL GLP fell 3.6% YoY.

- The customer base expanded 47% YoY to 3.88 million. The standalone customer base grew to 2.802 million which is up 6.1% YoY. MMFL’s customer base grew by 2.6% YoY.

- NII has risen 31.6% YoY to Rs 330.9 Cr. PPOP grew 26.9% YoY at Rs 196.9 Cr.

- Total ECL provisions were 5.35% in CAGL and 4.3% in MMFL.

- Overall RoA and RoE were at 2.4% and 10.7%.

- Overall GNPA was at 1.77% while NNPA was at 0%.

- CRAR: CAGL 26.4% (Tier 1: 25.6%), MMFL 25.0% (Tier 1: 21.0%).

- Collection efficiency at 89% for CAGL in Oct.

- Standalone debt to equity was at 2.8 times. MMFL debt to equity was at 3.8 times.

- Standalone cost to income ratios was at 39.2% and Opex to GLP was at 4.6%.

- The weighted average cost of borrowing was at 11.1% vs 12.3% a year ago.

- Positive ALM mismatch with an average maturity of assets at 15.3 months and average maturity of liabilities at 23.4 months.

- Disbursements in Q2 was at Rs 1420 Cr.

- GL loans accounted for 95.3% of total loans with the rest being retail finance.

- GL loan usage breakup was:

- Animal Husbandry: 45.2%

- Trading: 21.8%

- Partly Agri: 14.7%

- Production: 8.5%

- Housing: 3.8%

- Education: 0.4%

- Others: 5.6%

- Only 1 district now has >4% of the total loan portfolio.

- Karnataka remains the biggest market for the company with 39.6% of GLP. Maharashtra comes in second with 24.8% of GLP and Tamil Nadu is third with 19.8% of GLP.

Investor Conference Call Highlights

- In the case of MMFL, the collection efficiency improved from 54% in June to 83% in September and 85% in October.

- Collections temporarily slowed in the second half of October due to cyclonic floods in certain districts of Maharashtra and Karnataka, intermittent lockdown imposed in Chhattisgarh, and a brief period of festivities in October.

- The standalone liquidity position further improved during the second quarter, with a cash & bank balance of Rs 1,662 Cr as of 30 Sep 2020.

- CAGL successfully completed QIP of Rs 800 Cr in Oct.

- 8% of CAGL customers hadn’t made any payments in Sep and 24% of this set have started repayments in Oct. Similarly, 7% of MMFL customers hadn’t made any payments in Sep and 33% of this set have started repayments in Oct.

- The majority of the non‐paying customer pool was located in Southern Maharashtra.

- Only 2‐3% of customers have not paid anything in the last 4‐5 months.

- Collection efficiencies are expected to normalize and come back to pre-covid levels by December for everywhere except Maharashtra.

- COVID provisions taken in Q2 were at Rs 66 Cr for CAGL and Rs 25 Cr for MMFL.

- The company has undrawn credit lines of Rs 1240 Cr with Rs 980 Cr for CAGL & Rs 260 Cr for MMFL.

- Disbursements in Q2 were made only to existing customers with good repayment history.

- The company is not providing top-up loans for its customers at all.

- New customers accounted for 40% of disbursements in Oct.

- The management expects AUM growth for FY21 to be at around 10-12%.

- The management is expecting an expected credit cost for COVID of a maximum of 3.75-4%.

- H2 growth should be back to normal for both CAGL & MMFL.

- >80% of customers have made full payments in Oct for CAGL.

- The management has admitted that the customer count has indeed fallen QoQ but it has stabilized and should start increasing again now.

- The management has stated that the customer shortfall should be temporary as these customers should be back to take fresh loans.

- Opex is expected to be at 4.8-4.9% an annual basis according to management.

- The company has not restructured any loans and have only extended the tenure of the payment period while keeping EMI the same.

- Long-term credit costs are expected to be at 1.1-1.25% due to a change in customer repayment behaviour.

- The merger process should be completed by Q1FY22 according to management.

Analyst’s View

Credit Access Grameen has emerged as one of the most reliable microlenders in the country. Their revolutionary JLG model has helped bring communities of borrowers together and helped reduce overall risk from their lending to a very large extent as seen in their low NPA numbers. The company has delivered a mixed Q2 performance due to the challenges from state lockdowns and cyclonic floods. The company was able to maintain GLP growth but saw operating expenses rise QoQ while increasing collection efficiency once lockdown ended. The company’s acquisition of Madura Microfinance is expected to be done by Q1FY22. It remains to be seen whether the company will be able to maintain its current revenue growth pace of >30% & AUM growth of 10-12% in FY21 given the integration issues with MMFL and the ongoing COVID-19 pandemic. Nonetheless, given its strong market position and exemplary operating and risk management practices, Credit Access Grameen remains one of the must-watch stocks in the Microfinance sector for any interested investor.

Q1FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 511 | 377 | 35.54% | 461 | 10.85% |

| PBT | 86 | 148 | -41.89% | 30 | 186.67% |

| PAT | 64 | 96 | -33.33% | 23 | 178.26% |

| Consolidated Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 620 | 377 | 64.46% | 482 | 28.63% |

| PBT | 100 | 148 | -32.43% | 41 | 143.90% |

| PAT | 75 | 96 | -21.88% | 31 | 141.94% |

Detailed Results

-

- The company had a good quarter with more than 65% growth in YoY revenues. There was additional growth in revenues due to the addition of Madura MFI revenues in Q1FY21 as well which was not present last year.

- The profits for the company fell 22% YoY while PBT declined 32% due to an increase in expenses (impairment of financial instruments) and increased provisions.

- GLP grew 54% YoY to Rs 11,724 Cr. Standalone GLP grew 27% YoY. MMFL GLP grew 6.5% YoY.

- The customer base expanded to 4.01 million. The standalone customer base grew to 2.876 million which is up 12.2% YoY. MMFL’s customer base grew 15.9% YoY.

- NII has risen 55.2% YoY to Rs 383 Cr. PPOP grew 56% YoY at Rs 255.6 Cr.

- Total ECL provisions were at Rs 476.8 Cr which is at 4.21% of the loan portfolio.

- The total COVID-19 additional provisioning buffer was at Rs 245.6 Cr which is at 2.17% of the portfolio.

- RoA and RoE was at 2.2% and 10.3%.

- GNPA was at 1.62% while NNPA was at 0%.

- The liquidity position was at Rs 1377 Cr as of 30th June 2020. CRAR was at 23.7%.

- On-time centre meetings with >98% customers. CAGL recorded a collection efficiency of 74% in June/ 76% in July. MMFL (Madura Micro Finance Ltd) recorded a collection efficiency of 54% in June/ 64% in July.

- CAGL: Moratorium book down from 100% in April& May to 26% in June and 24% in July.

- MMFL: Moratorium books down from 99% in April to 90% in May, 46% in June, and 36% in July.

- Debt to equity was at 3.3 times. Standalone debt to equity was at 2.9 times.

- Standalone cost to income ratios was at 31% and Opex to GLP was at 4.1%.

- The weighted average cost of borrowing was at 9.4% vs 10.3% a year ago.

- Positive ALM mismatch with an average maturity of assets at 17 months and average maturity of liabilities at 25.2 months.

- Disbursements were minimal in Q1 with only Rs 46 Cr done.

- GL loans accounted for 94.9% of total loans with the rest being retail finance.

- GL loan usage breakup was:

- Animal Husbandry: 45%

- Trading: 21%

- Partly Agri: 14%

- Production: 8%

- Housing: 4%

- Education: 1%

- Others: 7%

- Only 1 district now has >4% of the total loan portfolio.

- Karnataka remains the biggest market for the company with 40% of GLP. Maharashtra comes in second with 24.2% of GLP and Tamil Nadu is third with 19.9% of GLP.

Investor Conference Call Highlights

- The company is focussing on making its on-ground network and sales and customer-facing organization as agile as possible.

- The moratorium was only provided to those who needed it.

- Excluding Maharashtra, collection efficiency in July shall exceed 80%.

- The company has also kept on the annual increment and bonus plans to maintain employee morale.

- All the disbursal was done in cashless mode only.

- Only 17% of customers have not made any payments and are under full moratorium. The management expects less than 4-5% of these customers to not be able to pay up once the moratorium ends.

- The management has stated that if how the COVID-19 situation pans out will determine whether the company will be able to maintain its annual growth momentum.

- The company has sufficient capital, branches, and employees to grow 10-15% in FY21.

- The company aims to maintain growth in step with industry growth in the medium term and demand for the industry remains intact with good room for growth.

- The models of MMFL and CAGL are different in terms of their repayment times as MMFL has monthly repayment while CAGL has weekly payments. The management expects MMFL performance should be better than other competitors with the same monthly model.

- MMFL performed better than CAGL in Karnataka.

- The company has started providing repeat loans to groups who have made full repayments.

- Collections were mainly hampered due to local lockdowns in states and districts.

- Disbursements are expected to grow as new customer acquisition shall start once COVID-19 comes down and growth comes back as it does seasonally in H2 each year.

- The management expects a 4-5% increase in collections in Karnataka as local lockdowns ease going forward.

- The company’s decision to issue CP of Rs 200 Cr is mainly to diversify funding sources and not due to any liquidity overhang.

- The company has also taken approval for Rs 1000 Cr of NCDs to stay ready in case it needs to raise additional funds.

- The company has already 65% of accrued interest for moratorium 1 in June.

- The company restricts weekly meetings to 4-6 participants so that it can meet all customers within a month.

- New groups are formed of max 5 members to ensure adequate social distancing norms.

- There aren’t any specific fault lines exposed in the MFI business.

- The change in operations is happening towards digital processes which have been hastened due to the pandemic.

- There aren’t any inconsistencies in customers who have already started their repayment behaviour.

- The company has appointed PWC for integration efforts with MMFL. Technical integration should be completed by end of FY21.

- The company will be applying a singular operation process once the integration is completed. Even if a monthly collection policy is put in place, weekly meetings will continue to take place.

- Customer retention remains a top priority for the company.

- Repayment behaviour is very subjective and it is not appropriate to compare different regions as there may be different issues in different places.

- The growth is being driven by new customer acquisition in new states and the company remains focused on expansion in these states thus reducing the contribution of the top 3 states.

- The procedural approvals will take some time for the merger and it is expected to be completed in due course.

- The availing moratorium is not applied at the group level and is only put up at an individual level.

- The management expects normalcy in businesses to come back in 5-6 months.

- Initial installments that were paid after the moratorium will be used to pay off the accrued interest portion and the loan period will get extended.

Analyst’s View

Credit Access Grameen has emerged as one of the most reliable microlenders in the country. Their revolutionary JLG model has helped bring communities of borrowers together and helped reduce overall risk from their lending to a very large extent as seen in their low NPA numbers. The company has delivered a stellar Q1 performance despite the challenges from lockdown and COVID-19. The company was able to maintain GLP growth and keep operating expenses down while increasing collection efficiency once lockdown ended. The company’s acquisition of Madura Microfinance which should help the company gain a ready and set customer base with good data and history of repayment as well as continue its pace of expansion. It remains to be seen whether the company will be able to maintain its current growth pace of >30% in FY21 given the integration issues with MMFL and the ongoing COVID-19 pandemic. Nonetheless, given its strong market position and exemplary operating and risk management practices, Credit Access Grameen remains one of the must-watch stocks in the Microfinance sector for any interested investor.

Q4FY20 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 461 | 336 | 37.20% | 454 | 1.54% | 1684 | 1283 | 31.25% |

| PBT | 30 | 118 | -74.58% | 146 | -79.45% | 451 | 498 | -9.44% |

| PAT | 23 | 76 | -69.74% | 108 | -78.70% | 328 | 322 | 1.86% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 482 | 336 | 43.45% | 454 | 6.17% | 1705 | 1283 | 32.89% |

| PBT | 41 | 118 | -65.25% | 146 | -71.92% | 462 | 498 | -7.23% |

| PAT | 31 | 76 | -59.21% | 108 | -71.30% | 335 | 322 | 4.04% |

Detailed Results

-

- The company had a good quarter with more than 43% growth in YoY revenues.

- The profits for the company fell 60% YoY while PBT declined 65% due to an increase in expenses (impairment of financial instruments).

- The company made disbursements of Rs 10,389 Cr in FY20 which was up 26.4% YoY.

- The standalone gross loan portfolio has risen to Rs 9896 Cr registering a YoY growth of 38.2%. the consolidated GLP rose 67.4% YoY after the addition of MMFL.

- The number of branches also expanded substantially to 1393 growing 107.8% YoY.

- The company now boasts of an active borrower base of 4.06 million which is also up 64.2% YoY.

- The standalone net interest income for the company rose 28.1% YoY showing strong growth.

- The company now has a presence in 248 districts across 14 states and 1 union territory.

- Operating expenses to gross loan portfolio rose to 4.9% for CGL in FY20..

- ROE was at 12.9% for CGL while ROA was at 3.6% in FY20.

- GNPAs were at 1.57% with a provisioning of 2.86% thus ensuring NNPA of 0%.

- The weighted average cost of borrowing for the company remained stable at 9.6% in Q4.

- The company maintains a comfortable liquidity position by maintaining a positive static liquidity gap every month.

- The company has a positive ALM mismatch with an average maturity of assets at 18.4 months and an average maturity of liabilities at 27.3 months.

- The debt to equity ratio for CGL was at 2.9 times.

- The company boasts of collection efficiency of 98%.

- The geographic distribution of portfolio exposure is well distributed across 156 districts with only no district having more than 4% exposure and top 5 districts only having 15% exposure of the consolidated entity.

- The company had a CAR of 23.6% in FY20.

- The company has taken additional provisions of Rs 82.9 Cr for COVID-19.

- The company maintained the cash of Rs 408 Cr in June 2020.

- 70% of combined GLP is in orange or green zones. >80% of customers are engaged in essential activities thus ensuring small or no income disruption from COVID-19.

Investor Conference Call Highlights

- The share of Karnataka has been reduced from 53% to 40% in terms of the loan portfolio.

- 97% of districts have <2% portfolio.

- The share of rural customers has risen to 86%.

- Excluding the transaction costs for the MMFL transaction and COVID provisioning, the consolidated PAT would have been Rs 490.6 Cr vs current PAT of Rs 335 Cr.

- The company has provided 100% moratorium to all of its customers till 31st The management has stated that only around 10% of customers had expressed interest in applying for additional moratorium till August.

- The company’s near term focus will be on maintaining stable and healthy liquidity so that it is able to lend to any customers that need funds.

- The company will ensure that EMIs remain the same for the customers and the company will not be capitalizing the interest to prevent the customers to pay out interest on the accrued interest.

- The company will evaluate the requirement for raising additional capital after Q2 in FY21.

- The company has relaxed the norm of providing additional loans after 6 months of borrowing. This has been done to help customers who may require additional funds.

- The company does not have any direct impact on the migrant crisis. This is because the company does not lend to anyone who has proof of residence of fewer than 2 years.

- The company is reducing the meeting size by having customers represent other customers to maintain COVID-19 prevention guidelines.

- GNPA increase has been mostly from stage 2 to stage 3. There has not been any movement of people moving into delinquency.

- The management has stated that most of the customers who the company thinks will opt for the second moratorium are in urban areas and in Tamil Nadu who has a lot of districts with more than 100 cases.

- 60% of the company’s lenders have provided them moratorium. The company has repaid the rest of the lenders.

- The company is also looking into diversifying into international funding and reduce dependence on banks to less than 50%.

- The management expects activity to resume in normalcy in the next few months since the impact on the MFI industry has not been as bad as anticipated. Since the majority of customers of CGL are in essential activities and are rural-based, the impact has been muted.

- Around 55% of borrowers pay weekly, 38% pay fortnightly while 8% pay monthly.

Analyst’s View

Credit Access Grameen has emerged as one of the most reliable microlenders in the country. Their revolutionary JLG model has helped bring communities of borrowers together and helped reduce overall risk from their lending to a very large extent as seen in their low NPA numbers. The company has delivered a stellar FY20 performance with more than 38% standalone loan book growth. The company’s acquisition of Madura Microfinance which should help the company gain a ready and set customer base with good data and history of repayment as well as continue its pace of expansion. It remains to be seen whether the company will be able to maintain its current growth pace of >30% in FY20 given the integration issues with MMFL and the ongoing COVID-19 pandemic. Nonetheless, given its strong market position and exemplary operating and risk management practices, Credit Access Grameen remains one of the must-watch stocks in the Microfinance sector for any interested investor.

Q3 2020 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 453.56 | 350.76 | 29.31% | 392.97 | 15.42% | 1223.33 | 946.88 | 29.20% |

| PBT | 145.92 | 153.71 | -5.07% | 127.01 | 14.89% | 421.07 | 380.12 | 10.77% |

| PAT | 107.99 | 99.74 | 8.27% | 100.88 | 7.05% | 304.72 | 245.43 | 24.16% |

Detailed Results

-

- The company had a good quarter with more than 29% growth in YoY revenues.

- The profits for the company rose 8.3% YoY while PBT declined 5% due to an increase in expenses (impairment of financial instruments).

- The company made disbursements of Rs 2977 Cr in the current quarter which was up 68.9% YoY.

- The gross loan portfolio has risen to Rs 8872 Cr registering a YoY growth of 45.8%.

- The number of branches also expanded substantially to 928 growing 40.8% YoY.

- The company now boasts of an active borrower base of 2.77 million which is also up 22.5% YoY.

- The company announced the acquisition of Madura Microfinance which was the 11th largest MFI in India.

- The net interest income for the company rose 28.1% YoY showing strong growth.

- Operating expenses to gross loan portfolio rose to 5.1% which is a fall of 40 bps QoQ.

- ROE was at 16.5% from 17.7% last year.

- GNPAs was at 0.85% from 1.01% last year.

- The company maintains a provisioning of 1.61% thus ensuring NNPA of 0%.

- The weighted average cost of borrowing for the company remained stable at 10% in Q3.

- The company maintains a comfortable liquidity position by maintaining a positive static liquidity gap every month.

- The company has a positive ALM mismatch with an average maturity of assets at 15.5 months and an average maturity of liabilities at 26.6 months.

- The company boasts of collection efficiency of 98.3%.

- The geographic distribution of portfolio exposure is well distributed across 156 districts with only 1 district having more than 5% exposure and top 5 districts only having 21% exposure.

- The loan book consists of 78% income generation loans or IGL which yield 19% to 21% thus ensuring a high overall portfolio yield of 19.7% in the current quarter.

- The company continues to provide PAT guidance for FY20 of Rs 425 to 450 Cr.

Investor Conference Call Highlights

- The management has stated that the situation in Karnataka has been solved and the on-time collections in the affected districts were more than 70% and thus the provisioning for the quarter was higher as compared to Q2. The company’s exposure in these 2 districts is less than 1%.

- The management does not expect any big changes in the provision going forward and the company should be able to achieve its target PAT guidance by the end of the year.

- The management has mentioned that overall credit cost should not exceed by more than 1%.

- The management has stated that the infrastructure growth next year will not as high as it has been in FY20. The company will be focussing on stabilizing and consolidating at the new locations in most of next year.

- The company can see an increase in ticket size mainly on the back of repeat customers who come back for bigger loans. Another factor here is that the regulator has increased the limit for GLP to Rs 1.25 Lac. Thus management expects an annual increase of almost 10%.

- The management has stated that the company’s efforts to control risk exposure from geographical concentration has helped the company avoid major loss of operations like in the case of the recent Karnataka districts.

- The management has stated that Madura will continue to do business according to its established mandate and only after the acquisition is over will the management look for how to complete the merger and integrate the whole entity.