About the Company

Tata Elxsi provides product design and engineering services to the consumer electronics, communications & transportation industries and systems integration and support services for enterprise customers. It also provides digital content creation for the media and entertainment industry.

If you want a quick snapshot of the company’s strengths and weaknesses, click here

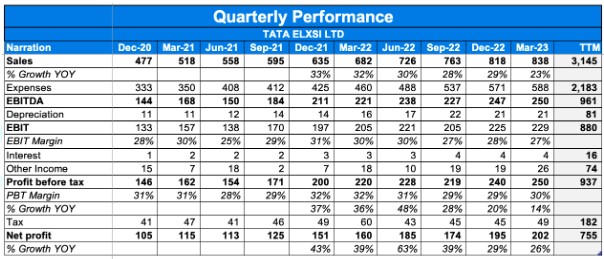

Q4FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company saw its revenue rise by 22.9% YoY.

- PAT increased by 25.9% YoY.

- EBIDTA margins at 29.8%

- EBIDTA grew by 12.8% YoY.

- Constant currency revenue was up 1.6% QoQ.

- Company’s embedded product division (EPD) reported growth of 32.8% YoY while IDV grew by 52.8% YoY in constant currency terms, and SIS grew by 77.6% YoY.

- Performance for the year end involved PAT growth at 37.4% , Revenue growth at 27.3%, EBIDTA margins at 30.6% & PBT margin at 29.1%

- The revenue rise in different segments in the EPD business was–

- Automotive business: Up 27.4% YoY

- Media & communication business: 9.2% YoY

- Healthcare business: Up 20.5% YoY

- Revenue distribution across different geographies is as follows:

- EU: 35.5%

- Americas: 41.4%

- India: 17.3%

- RoW: 5.8%

- The top 5 client & top 10 accounted for 39.8% and 49.4% of sales respectively.

- Attrition among employees was at 17.3%

- The offshore mix was at 74.5% in Q4 vs 75.2% YoY.

- Tata Elxsi has been chosen by Alps Alpine to establish a Global Engineering Centre (GEC) in Thiruvananthapuram. The GEC will focus on software-led innovation and engineering to support Alps Alpine’s vision for future mobility.

- Tata Elxsi has been chosen as the Strategic Partner for ‘Left-Shift’ SDV product development strategy by a leading European OEM representing a multi-year multi-million USD long-term engagement.

- Tata Elxsi has been selected by a leading Middle East telecom operator as a Design-Led consultancy and development partner for next-gen applications around 5G including Healthcare, IoT, and connected Digital Services.

- Tata Elxsi was selected by a world-leading telecommunications products company for 5G broadband software and solution development that will power next-gen consumer devices.

- Tata Elxsi has won a multi-million USD Design Digital deal to deliver consumer research and insights for the next generation of consumer devices and applications, by a world leading technology company.

Investor Conference Call Highlights

- The management is proud of the company crossing the 3000 crore revenue milestone on a yearly basis.

- The board of directors have recommended a final dividend of 606% for the financial year ending 31st March 2023. This represents a 42.6% increase over the previous year and corresponds to a payout ratio of 50% of PAT.

- The company has made a strategic long-term deal with Alps Alpine in Japan to establish a global engineering center for developing next-gen mobility solutions in India and a multiyear SDV deal with a European OEM.

- The management recognizes that an offshore centric and ownership driven delivery model is not only harder to execute but also requires almost three times the number of resources to deploy as compared to onsite deployment for the same impact on top line.

- However, the management strongly believes that this is the only way to create long-term and sustainable value and the company is best positioned to deliver on this.

- The company’s Healthcare and Life Sciences business was impacted by the extension of regulatory deadlines, which cut into existing work and revenues but the business recovered from the setback within a quarter and is building a strong pipeline of deals with penetration into new marquee customers.

- The company is seeing the success of key strategies deployed over the last two years with strong synergies between the EPD, IDV and SI divisions playing out well, seeing an increase in duration and size of deals leading from this up selling and cross selling.

- The management is positive on the 5G opportunities and deals that are coming back.

- The company is going to have a 4.5 crores of ESOP expense for the year.

- The management explains that operating cash has been slightly muted this year mainly due to an impact on trade receivable. This is expected to be normalized by the next quarter.

- Tata Elxsi has set up a global delivery center as part of a multi-year commitment. Tata Elxsi’s prior relationship and successful project delivery have given Alps Alpine the confidence to trust them with this crucial offshore engagement.

- The management states that despite expected impact from ESOPs, the company is targeting to operate in a PBT band of 28 to 29% using different levers including utilization.

- The growth of Tata Elxsi has seen divergence between the top ten client bucket and those outside it, with growth outside the top ten being softer.

- The growth discrepancy is attributed to some clients pausing or putting on hold their R&D initiatives due to a difficult macroeconomic situation. Despite these challenges, the company plans to continue growing its top ten accounts, which includes their top 20 clients, in the next financial year.

- The management assures that the company is working to grow their top accounts, increase offshore work, and focus on select customers to strengthen their position in the market.

- Regarding the Tata Technology IPO, the management states that the businesses are orthogonal, and the company does not see any impact on its business.

- The management gives guidance that the current EBITDA margins are sustainable upto the next financial year.

- The management does not see AI as a problem to the company as it is addressing very deep domain problems like recommendation engines that go into OTT products.

- Employee costs for the company are up 4.5% QoQ, mainly due to increase in headcounts by the company.

- The management guides an addition of 2200 headcount to the company from a hiring perspective.

- The management states that apart from main verticals, it has been focusing on design business and within that on the course consumer electronics.

- The management states that manufacturing is an area that the company is investing as in India there are lot of opportunities especially Industry4.0 and IOT solutions that exist.

- The management states that the company has also been involved in the Gaganyaan project of ISRO and the company done some very fantastic work there.

Analyst’s View:

Tata Elxsi had another good quarter with revenue growth of 22.9% YoY and profit growth of 25.9% YoY in Q4FY23. The company continues to see good growth in all segments and recovery in the transport segment. The deal wins in the media and comms space have been very encouraging. The auto segment continues to recover and the opportunities for Tata Elxsi in this space are getting better with more and more auto players coming onto the EV and connected vehicles bandwagon. It has been hiring aggressively and is not expected to slowdown in its hiring trend according to the management. The company has also seen good growth in the auto sector for Tata Elxsi and it is looking to target 2 and 3-wheeler EVs in India with its service offerings. It remains to be seen how the company will be able to retain its top talent given the high attrition in the industry and what opportunities will the company explore to grow its new verticals. Nonetheless, given the company’s strong technological capabilities and its resilient performance in the last year, Tata Elxsi remains a good technology stock to watch out for, particularly given the rising demand for its services in the media & communications spaces.

Q4FY22 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 700 | 525 | 33.3% | 642 | 9.0% | 2515 | 1866 | 34.8% |

| PBT | 220 | 162 | 35.8% | 200 | 10.0% | 745 | 512 | 45.5% |

| PAT | 160 | 115 | 39.1% | 151 | 6.0% | 550 | 368 | 49.5% |

Detailed Results:

- The company saw its revenue rise by 33% YoY.

- PAT increased by 39% YoY.

- EBIDTA margins at 32.5%

- EBIDTA grew by 31.7% YoY.

- Constant currency revenue was up 31.5% YoY.

- The company reported EBIDTA margins at 33.2% and PAT margins at 23.5%.

- Company’s embedded product division (EPD) reported growth of 7.5% QoQ while IDV grew by 8% QoQ.

- Performance for the year end involved PAT @21.9% , Revenue growth at 35.3%, EBIDTA margins at 31% & PBT margin at 29.6%

- The revenue rise in different segments in the EPD business was–

- Automotive business: Up 38.6% YoY

- Media & communication business: 31.6% YoY

- Healthcare business: Up 62.4% YoY

- Revenue distribution across different geographies is as follows:

- EU: 34.2%

- Americas: 40.1%

- India: 14.5%

- RoW: 11.2%

- The top client accounted for 11.4% of sales while the top 5 & top 10 accounted for 36.1% and 48.3% of sales respectively.

- Attrition among employees was at 20.8%

- The offshore mix was at 70.1% vs 75.1% in Q4.

- The company won many new deals including

- Design Digital deal win leveraging Tata Elxsi video platform and IP for a Middle East broadcasting leader

- A North American Healthcare platform provider selected Tata Elxsi for providing cloud engineering services

- selected by a leading German Tier 1 supplier for establishing an Offshore Development Center for Autonomous Driving and ADAS technologies

- multi-year multi-million USD deal for EV system development from a global automotive leader

- selected to establish and set up a Virtual Reality Innovation Center by a leading European commercial vehicle manufacturer

Investor Conference Call highlights:

- The company added 2000 employees on net basis in FY22.

- The management states that its attrition rate is better than overall industry.

- Company takes 6-9 months to train freshers.

- Company is planning to add 2500-3000 freshers in this year.

- On site: off shore effort mix is 90:10.

- The company did a wage hike in January to junior employees which constitute 55-70% of total employee base & expects to give wage hike to senior employees from may onwards.

- The quarterly wage hike had an impact of 150 Bps on margins which was offset by operating leverage, better utilisations & better utilisation from fix price contracts.

- The company is confident about maintaining margins despite inflation due to revenue expanding while cost remaining nonlinear along with expansion in places where tax rates are lesser.

- The company expects to maintain fixed price contracts ratio to 50% of total contracts.

- The company doesn’t see any slowdown in OTT market according to the management.

- The company has hired more freshers in Q2 & Q3 and lower fresher hiring in Q4 should not indicate slowdown according to the management.

- The company’s EV centre is expected to bridge gap for traditional & modern OEM to adopt software & technology.

- The company is targeting Indian market for EV service offerings & is looking to target 2 & 3-wheeler segments first.

- The management states last 3 quarter’s performance of automotive business is a good indication of strong potential of this segment.

- The company doesn’t have any customers in Ukraine-Russian Geography & doesn’t expect to be affected by the war.

- The company has expanded its media business segment in Middle East & Latin America as well.

- The company has been investing aggressively in sales & tools in last 4 Quarters.

- The consistency in the revenue has been largely due to pivot from project-based contracts to annuity based long term contract.

- The company is targeting a 40:40:20 revenue mix for automotive, media and healthcare businesses.

- The company isn’t focusing on M&A unless a great opportunity presents in its valuation range since it is comfortably doing organic growth of 30%.

- The management sees market expanding as well as the market share of customers is expanding, leading to a higher share of wallet from existing customers.

- The company’s ability to get new customers through a long multi-year deal is aiding it to growth QoQ without getting affected by any seasonality.

Analyst’s View:

Tata Elxsi had another good quarter with revenue growth of 30% YoY and profit growth of close to 40% YoY in Q4. The company continues to see good growth in all segments and recovery in the transport segment. The deal wins in the media and comms space have been very encouraging. The auto segment continues to recover and the opportunities for Tata Elxsi in this space are getting better with more and more auto players coming onto the EV and connected vehicles bandwagon. It has been hiring aggressively and is not expected to slowdown in its hiring trend according to the management. The company has also seen good growth in the auto sector for Tata Elxsi and it is looking to target 2 and 3-wheeler EVs in India with its service offerings. It remains to be seen how the company will be able to retain its top talent given the high attrition in the industry and what opportunities will the company explore to grow its new verticals. Nonetheless, given the company’s strong technological capabilities and its resilient performance in the last year, Tata Elxsi remains a good technology stock to watch out for, particularly given the rising demand for its services in the media & communications spaces.

Q3FY22 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 642 | 492 | 30.5% | 598 | 7.4% | 1815 | 1341 | 35.3% |

| PBT | 200 | 146 | 37.0% | 171 | 17.0% | 525 | 350 | 50.0% |

| PAT | 151 | 104 | 45.2% | 125 | 20.8% | 390 | 253 | 54.2% |

Detailed Results:

- The company saw its revenue rise by 30% YoY.

- PAT increased by 45% YoY.

- EBIDTA grew by 46.8% YoY.

- Constant currency revenue was up 33.2% YoY.

- The company reported EBIDTA margins at 33.2% and PAT margins at 23.5%.

- Company’s embedded product division (EPD) reported growth of 35.4% YoY.

- The revenue rise in different segments in the EPD business was

- Automotive business: Up 31.2% YoY

- Media & communication business: 30.2% YoY

- Healthcare business: Up 71.5% YoY

- The design business (IDV) saw rise in revenue of 12% YoY in Q3 while SIS business grew 22.8% YoY.

- Revenue distribution across different geographies is as follows:

- EU: 8%

- Americas: 3%

- India: 7%

- RoW: 2%

- The top client accounted for 14.4% of sales while the top 5 & top 10 accounted for 38% and 46.7% of sales respectively.

- Attrition among employees has risen to 18.2% from 13.9% in Q2.

- The offshore mix was at 75.1% vs 74.7% in Q2.

- The company won many new deals including

- Selection by a world-leading systems supplier for the development of an autonomous driving platform for commercial vehicles.

- a 3-year 20M US$ deal by a leading global MSO to support and manage its network operations across data, mobile and video service delivery.

- Design Digital deal from a leading Japanese OEM for the development of a next-gen HMI for infotainment and incockpit interface for their range of vehicles.

- selected by a North American new-age EV OEM for a strategic software development program.

- A US headquartered Healthcare technology leader awarded Tata Elxsi a long-term multi-million US$ deal for its Digital Transformation & Cloud Migration Program.

Investor Conference Call highlights:

- The company has added 414 new employees in Q3 while the attrition rate stood at 18.2%.

- The company won ‘The Videotech Award’ for the ‘Most Innovative OTT Technology of The Year’.

- The margin expansion is taking place due to economies of scale, higher offshore mix, and lower costs due to improved utilization rates of 83% & suppressed SG&A expenses according to the management.

- The management is focused on ensuring that 20% of transportation revenues come from commercial vehicles as well as off‐road farm equipment and the rail segment in the next 3 years besides the already strong contribution from passenger car vehicles.

- The company has a three‐year roadmap about the 40:40:20 ratio between automotive, media and communication, and the healthcare business that it wants to maintain.

- The increase in top client concentration is due to the deeper mining & ramp-up of deals that the company has won in the past 2-3 quarters according to the management.

- JLR, one of its top clients was affected in the current quarter due to the semiconductor crisis. However, the management expects it to perform profitably in the coming quarters.

- IDV revenues are relatively down due to delay in a project of one large customer & thus is a temporary issue according to the management.

- The management states that from an organization’s perspective, the capability in IDV has helped in winning larger deals in EPD and getting better margins and better pricing because of the capability that IDV brings in.

- The management believes the ER&D segment to be the fastest-growing.

- The management states that even though the rise in fix-price contracts has aided margins in the last few quarters, it is a double-edged sword since it requires taking complete ownership and one needs to have very strong internal capabilities to focus on product management & delivery excellence.

- The management is planning to do further salary hikes in January to control the attrition rate.

- The company is focused on growing all three verticals to de-risk itself from industry cycles.

- The company will have to keep adding new employees to ensure growth rather than deriving operating leverage where revenues will increase despite no employee growth.

- The average length of deals for EV, connected & autonomous vehicles ranges from 12-18 months to 24 months and so on.

- The margins in the medical segment are highest followed by media & communication & automotive.

- The rise in demand for engineers due to the foray of several industry participants into digital play is leading to a higher attrition rate.

- The management states that high growth is expected in the automotive business in the future due to

- contribution of software and technology to the total value of the car is increasing,

- the level of sophistication is increasing in each of these technology trends,

- a larger percolation is downwards from premium to mid and lower segments

- all the latest innovations & developments are being increasingly being driven by software

Analyst’s View:

Tata Elxsi had another good quarter with revenue growth of 30% YoY and profit growth of 45% YoY in Q3. The company continues to see good growth in all segments and recovery in the transport segment. The deal wins in the media and comms space have been very encouraging. The auto segment continues to recover and the opportunities for Tata Elxsi in this space are getting better with more and more auto players coming onto the EV and connected vehicles bandwagon. The company has done well to achieve multiple deals wins in Q3 including deals for EV and OTT platforms development. It has been hiring aggressively and is expected to continue this hiring trend for the rest of FY22. It remains to be seen how the company will be able to retain its top talent as attrition in the industry & the company is rising and what opportunities will the company explore to grow its new verticals. Nonetheless, given the company’s strong technological capabilities and its resilient performance in the last year, Tata Elxsi remains a good technology stock to watch out for, particularly given the rising demand for its services in the media & communications spaces.

Q2FY22 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 598 | 435 | 37.47% | 576 | 3.82% | 1174 | 849 | 38.28% |

| PBT | 171 | 110 | 55% | 154 | 11.04% | 325 | 204 | 59% |

| PAT | 125 | 79 | 58% | 113 | 10.62% | 239 | 148 | 61.49% |

Detailed Results:

- The company saw its revenue rise by 37% YoY.

- PAT increased by 58% YoY.

- EBIDTA grew by 22.4% QoQ & 55.6% YoY. EBITDA margin was at 30.8% while NPM was at 21%.

- Constant currency revenue was up 37.2% YoY.

- The company reported EBIDTA margins at 30.8% and Net Margins at 21.0%

- Company’s embedded product division (EPD) reported growth of 34.4% YOY.

- Contribution from EPD business includes –

- Automotive business: Up 29% YoY

- Media & communication business: 32.9% YoY

- Healthcare business: Up 72.3% YoY

- The design business (IDV) saw decline of 14.2% QoQ due to shift in program timelines, but it was up by 64.5% YoY.

- SIS segment was up 46.1% YoY.

- The company’s headcount increased 9% QoQ.

- Revenue distribution across different geographies is as follows:

- EU: 4%

- Americas: 6%

- India: 4%

- RoW: 7%

- The top client accounted for 13.1% of sales while the top 5 & top 10 accounted for 36.6% and 48% of sales respectively.

- Attrition among employees has risen to 13.9% from 10.2% in Q1 and 6% last year.

- The offshore mix was at 74.7%.

- The company won many new deals including

- A multimillion US dollar electric vehicle software development program for a new-age EV OEM in the APAC geography.

- A software platform development deal for Level 3 autonomy and beyond from a North American system supplier.

- An EV system software development deal from a leading Japanese Tier-1 supplier.

- Selected as platform provider and system integrator for a multi-region Android TV launch for a leading America-based operator.

- Selected to deploy iCX for a leading global telecom operator across multiple countries.

Investor Conference Call highlights:

- Tata Elxsi saw a volumes-led constant currency growth of 37.2% YoY in consolidated terms.

- The company has added 700 new employees in Q2.

- The company did a full salary hike this quarter leading to the wage bill rising Rs 13 to 15 Cr.

- The management expects to reach the peak performance that it achieved in FY17 & FY18 by FY24. Currently, JLR’s business is much smaller than its peak but it should rise again due to the OEM’s pivoting into EVs according to the management.

- The management states that the semiconductor shortage issue is limited to only the next quarter and long-term outsourcing contracts are not yet affected.

- The management is seeing an increase in utilization rates and very high demand in the markets place for its services because of which the company has added more than 1800 engineers this quarter and 1000 engineers in the last quarter. It is looking to maintain the same hiring rate for the next 2 quarters as well. Employee costs will be maintained near 25% of total revenues.

- The company can outsource more work offshore, leading to a better margin profile and enhancing the company’s ability to invest in new avenues for growth.

- The company has built new platforms like FalconEye and ICX Quotient because of which it can attract and win new customers. By licensing these products, the company can build its service revenue around these platforms which helps it to differentiate from its competitors.

- The company currently doesn’t have any acquisition plans in its pipeline, but it won’t shy away from them according to the management.

- The IPR revenue is currently below 5% of total revenue however the company gets good traction around the services related to IPR.

- The company will continue investing in Edtech and the manufacturing businesses which are in the incubation stage.

- The management states that it will maintain a hiring rate of 1200-1500 in the next 2 quarters.

- The management expects the entire industry to benefit from the boom in ER&D, digital space & digital manufacturing. Further, it expects good demand for its media business due to the emergence of OTT and sustained growth in the medical devices and healthcare segment in the coming years.

- The utilization rate excluding fresh campus hires is 80%.

- The management states that most of the recent growth has come from offshore led revenues and this is also the reason behind aggressively increasing headcount for the company.

- Japan, China, and Korea account for around 20% of the transportation vertical’s revenues. The company is seeing good wins in China & Korea while Japan is muted.

- The company currently has only 6-7% of its employees working from the office. However, it is working towards bringing more people to the office by January and creating a hybrid working model.

- The company has been able to achieve growth of 8% QoQ for the last 8 quarters and the management is expecting it to increase due to the right internal investments, hiring focus on customers, and better mining of clients.

- The management expects a good run rate in its designing business in the next 3 to 4 quarters.

- Normally it takes around 9-12 months for a fresh hire to start working but the company will be looking to reduce this time to 3-6 months according to the management.

- The management expects to maintain offshore ERD business clients’ offshore mix at 55-70%.

- The management expects the rail and off-road segments to come up to 20% of revenues in the next 3-5 years.

- The company is working on increasing its offshore business as even though the margin profile is on the lower side, it will help the company improve its strategic placement in terms of its competitors and increase the scale of the overall business.

Analyst’s View:

Tata Elxsi had another good quarter with revenue growth of 37% YoY and profit growth of 58% YoY in Q2. The company continues to see good growth in all segments and recovery in the transport segment. The deal wins in the media and comms space have been encouraging. The IDV segment has also seen phenomenal growth of 64% YoY and is instrumental in sourcing new service deals. The auto segment continues to recover and the opportunities for Tata Elxsi in this space are getting better with more and more auto players coming onto the EV bandwagon. The company has done well to achieve multiple deal wins in Q2 including deals for EV and OTT platforms development. It has been hiring aggressively and is expected to continue this hiring trend for the rest of FY22. It remains to be seen how the company will be able to retain its top talent as attrition in the industry & the company is rising and what opportunities will the company explore to grow its new verticals. Nonetheless, given the company’s strong technological capabilities and its resilient performance in the last year, Tata Elxsi remains a good technology stock to watch out for, particularly given the rising demand for its services in the media & communications spaces.

Q1FY22 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 576 | 414 | 39.13% | 525 | 9.71% |

| PBT | 154 | 94 | 64% | 162 | -4.94% |

| PAT | 113 | 69 | 64% | 115 | -1.74% |

Detailed Results:

- The company saw revenues rise 39% YoY in Q1.

- The PAT for the company rose 64% YoY in Q1.

- The PBT was down QoQ due to an additional Rs 33 Cr of employee expenses due to a special one-time bonus to employees.

- The EBITDA margin was at 26.9% in Q1 vs 23.1% a year ago.

- EPD division grew 29.5% YoY and 6.3% QoQ in Q1.

- Transportation division fell 17.8% YoY & 2.2% QoQ in Q1.

- Media & Communications vertical grew 29% YoY & 6.7% QoQ in Q1.

- Healthcare division grew 83.1% YoY & 18.5% in Q1.

- IDV grew 128% YoY & 11.8% QoQ in Q1.

- SIS (System Integration & Support) grew 13% YoY and fell 15.7% QoQ in Q1.

- Revenue distribution by geography for Q1 was as follows:

- EU: 33.4%

- Americas: 43.7%

- India: 13.9%

- Rest of the World: 9%

- The top 10 customers now account for 50.9% of the total sales while top customer accounted for 12% of sales.

- The company had offshore % at 72.6% in Q1.

- The company is giving out a final dividend of Rs 24 & a special dividend of Rs 24 in Q4 totalling the dividend at Rs 48 per share in the quarter.

- The company won many key deals from:

- A leading global healthcare provider for strategic digital and development of their next-generation digital health platform

- A leading global automotive OEM for strategic development of their next

generation EV system development - A world-renowned institution for arts and music for he

development of their OTT platform using TEPLAY - A leading US based broadcaster for their global OTT platform development

- A leading European headquartered innovator and systems supplier for their EV platform

development program - A leading appliances company to set up a Digital Center of Excellence (DCoE) to develop their portfolio of next generation of connected and smart appliances

Investor Conference Call highlights:

- US operations for Tata Elxsi grew 69.3% YoY and 17.5% QoQ. EU operations grew 5.4% QoQ & 30.1% YoY. India Operations grew 2.8% QoQ and 47.6% YoY.

- Although margins have remained high, the management believes that it will come down slightly when due to the comeback of travel and other expenses when normal business activity resumes.

- The management states that the increasing headcounts and hiring done by Tata Elxsi should be seen as an indicator of the company’s confidence in its future growth and demand rise. The company is building capacity to be able to service its strong order book.

- The company sees good opportunities in the auto sector coming from the EV theme.

- The major reason for the growth in the USA is the growth in the media & comms and healthcare segments which are US-centric. Most of the growth in the EU is led by the auto segment and thus it has lagged USA growth.

- Licensing revenues are still below 5% of total revenues for Tata Elxsi.

- The commitment with the Govt of Kerala for Kinfra has not been confirmed yet and it will be done by Dec or Jan. Right now, only an MoU has been signed.

- On the competitive side, the company’s main rival in the media & comms segment is Accenture. In the auto segment, it faces competition from specialized players like ALTEN or Bertrandt in Germany. In India, its main rivals are KPIT & LTTS.

- The utilization level in Q1 was at 79%.

- Only 10% of company employee strength is onsite. The rest 90% is offshore.

- Although the company has announced a bonus, the management admits that attrition is rising but it is an issue occurring in the entire IT sector in India.

- The management admits that onsite % will increase as normalcy in business comes back but it will not go up to pre-COVID levels.

- Although R&D is a discretionary spending item, the management believes that no big company will be willing to scrimp on it as the threat of technological obsolescence is very high in today’s fast-paced world.

- The management has stated that Tata Elxsi stands to gain from not only Tata Motors but also from many other industry players who looking to play on the EV theme.

- The main scope of work with Indian Railways is in station infrastructure improvement and modernization. This is a slow process but has good potential for the company given the sheer size of the opportunity.

- 8 out of the top 20 auto OEMs are clients of Tata Elxsi.

- JLR is not the biggest client for Tata Elxsi. The biggest client currently is from the Media & Comms space.

- Tata Elxsi is not aiming to become a product company but is aiming to use its products to act as enablers to build services around them for clients.

Analyst Views:

Tata Elxsi had another good quarter with its highest ever quarterly revenues in Q1. The company continues to see good growth in all segments and recovery in the transport segment. The deal wins in the media and comms space have been encouraging. This has also led to good QoQ growth of over 15% in US business which is mostly media sector driven. The auto segment continues to recover slowly and the opportunities for Tata Elxsi in this space are getting better with more and more auto players come onto the EV bandwagon. The company has done well to achieve multiple deal wins in Q1 including deals for EV and OTT platforms development. It remains to be seen how the company will be able to retain its top talent as attrition in the industry rises and what opportunities will the company explore in its quest to achieve $1 billion sales. Nonetheless, given the company’s strong technological capabilities and its resilient performance in the last year, Tata Elxsi remains a good technology stock to watch out for, particularly given the rising demand for its services in the media & communications spaces.

Q4FY21 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 525 | 452 | 16.15% | 492 | 6.71% | 1866 | 1668 | 11.87% |

| PBT | 162 | 110 | 47% | 146 | 10.96% | 512 | 352 | 45.45% |

| PAT | 115 | 82 | 40% | 105 | 9.52% | 368 | 256 | 43.75% |

Detailed Results

- The company saw revenues rise 16% YoY in Q4.

- FY21 revenues were also up 12% YoY. Revenues from operations in the same period rose 13.4% YoY.

- The PAT for the company rose 40% YoY in Q4 & 43.7% YoY in the FY21 period.

- The EBITDA margin was at 32.4% in Q4 and 28.6% in FY21.

- The company recorded its highest ever yearly PBT of Rs 511.9 Cr.

- EPD division grew 14.6% YoY in FY21 and 15.5% YoY in Q4.

- Transportation division fell 4.1% YoY in Q4 & 6.2% YoY in FY21.

- Media & Communications vertical grew 22.4% YoY in Q4 & 20.5% YoY in FY21.

- Healthcare division grew 65.4% YoY in Q4 & 41.8% in FY21.

- IDV grew 9.1% YoY in FY21 & 39.2% YoY in Q4.

- Revenue distribution by geography for FY21 was as follows:

- EU: 36.1%

- Americas: 36.8%

- India: 13.3%

- Rest of the World: 13.9%

- The top 10 customers now account for 46.8% of the total sales while top customer accounted for 11.8% of sales.

- The company had offshore % at 70.4% in Q4 & 66.9% in FY21.

- The company is giving out a final dividend of Rs 24 & a special dividend of Rs 24 in Q4 totalling the dividend at Rs 48 per share in the quarter.

- The company won many key deals from:

- A leading global automotive OEM with a multi-year and multi-million USD connected vehicle program leveraging IoT.

- A leading European Tier 1 automotive supplier for cybersecurity.

- A leading US headquartered medical devices company with a multimillion USD deal for development and regulatory services.

- A leading US video provider selected Tata Elxsi’s FalconEye test automation solution for their next generation of video products and applications.

Investor Conference Call Highlights

- The management states that the reason for margin appreciation in Q4 was the higher proportion of services projects.

- The management maintains that sensors remain integral to the company’s service offerings for more than 15-20 years and will continue to do so.

- The company is approaching the VR tech space in multiple ways. In the system integration business, it is looking to integrate and sell VR gear for corporates where they’re setting up large enterprise visualization setups. On the development and design side, it is working on VR for education, training, and to help customers market new services through VR technology.

- The margins in VR remain low until it gains mass adoption and large-scale use.

- The management states that although margin profile may come down once economic recovery happens as normal expenses shall resume, margins should remain on the high side given the trend of increased offshoring is here to stay.

- The management insists that the turnaround to growth for the EPD division is sustainable and should continue for the coming financial years.

- The management admits that the company is facing some supply-side issues especially in senior management roles given the rapid expansion in the last 3 quarters. The company is indeed adding as it goes and expects the brand of the company to help attract top talent.

- The company will undertake the next salary hike in July 2021.

- The management remains optimistic about the auto segment given emerging themes in this sector like electrification and autonomous vehicles.

- The management is confident of sustaining the growth in the medical devices business as the company has built its IP and frameworks which help differentiate it from the rest of the industry.

- The company is indeed pursuing both organic and inorganic opportunities for expanding into a $1 billion company. The organic growth is to be pursued by developing new segments which are adjacent to existing ones while the inorganic growth will be led by strategic acquisitions.

- The management states that there are both positives and negatives of engaging with new-age EV players. The positives include the exposure to cutting-edge tech and innovations while the negatives include the enormous risks involved with such ventures as they are mostly in the R&D stage.

- The management has identified many key subsegments in its operating divisions which are:

- Auto: Connected, autonomous, shared and electric mobility.

- Media & Comms: Media devices, operators & new media companies.

- Healthcare: Medical devices, pharma & digital health

- The utilization rate was very high at 97% in Q4.

- The management is fairly confident that the company’s deal pipeline is good enough to help avoid a soft Q1.

- Around 700 or more employees are currently on-site.

- The semiconductor shortage represents a very small risk for Tata Elxsi mainly from the auto sector.

- The number of multi-year deals that Tata Elxsi has won in FY21 is greater than in FY20. The company also is not operating under a standard IT pricing mechanism which is based on the number of hours. This is because the company is often operating in niche segments and thus can avoid pricing competition.

- The management has stated that the transportation segment is going through a transformative phase with innovations like electrification and autonomous vehicle tech is widely seen as inevitable evolutions and thus there is some uncertainty in the industry. But there is no denying the rising importance of technology in the auto sector especially considering these new industry innovations.

- 8-9% of revenues for Tata Elxsi come from Japan. The company has been associated with the region since 1996. Because of its long association, it sees the opportunity here as there is marginally less competition due to the language barrier and slow adoption of outsourcing.

- The company is planning to make at least 700 lateral hires in FY22.

- The onsite-offshore mix is expected to stay at current levels for the next 3 quarters at least.

- The effective tax rate is around 25-26% and is expected to reduce as the company expands its business in the SEZ.

- The management clarifies that cybersecurity is not for enterprise security like McAfee but for cybersecurity for the devices that the company is working on only.

Analyst’s View

Tata Elxsi had a good quarter with its highest ever quarterly revenues and capped off a remarkable performance in FY21. The company continues to see good growth in in all segments and recovery in transport segment. It has also managed to maintain its offshore ratio and high levels of utilization which has helped boost PBT growth. The company is also identifying both organic and inorganic opportunities for its expansion to achieve its goal of $1 billion revenues. The auto segment continues to be subdued due to the COVID-19 situation. The company has done well to achieve multiple deal wins in Q4 including a multiyear deal for its connected mobility IoT platform. It remains to be seen how the company’s major clients adapt to the new world after COVID-19 and what opportunities will the company explore in its quest to achieve $1 billion sales. Nonetheless, given the company’s strong technological capabilities and its resilient performance in the last year, Tata Elxsi remains a good technology stock to watch out for, particularly given the rising demand for its services in the broadband and media & communications spaces.

Q3FY21 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 492 | 444 | 10.81% | 435 | 13.10% | 1341 | 1216 | 10.28% |

| PBT | 146 | 102 | 43.14% | 110 | 32.73% | 350 | 243 | 44.03% |

| PAT | 105 | 75 | 40.00% | 79 | 32.91% | 253 | 174 | 45.40% |

Detailed Results

- The company saw revenues rise 10.8% YoY in Q3. Revenues from operations rose 12.7% YoY.

- 9M revenues were also up 10% YoY.

- The PAT for the company rose 40% YoY in Q3 & 45% YoY in the 9M period.

- The operating margin was at 30.1% in Q3.

- The company gained Rs 4.55 Cr from foreign exchange gains.

- EPD division grew 14.5% YoY and 9.3% QoQ.

- Transportation division declined 8.4% YoY & grew 6.9% QoQ.

- Media & Communications vertical grew 7.3% QoQ & 24.3% YoY.

- Healthcare division grew 23.5% QoQ & 34% YoY. Others in EPD grew 4.3% QoQ & 20.1% YoY.

- IDV grew 27.5% QoQ & 7.1% YoY.

- Revenue distribution by geography is as follows:

- EU: 36.5%

- Americas: 36%

- India: 13%

- Rest of the World: 14.4%

- The top 10 customers now account for 47.2% of the total sales while top customer accounted for 11.7% of sales.

- The company had offshore % at 67.8% in Q3.

Investor Conference Call Highlights

- The constant currency growth in Q3 was 10% QoQ and 7.5% YoY.

- The management has clarified that the revenues are volume driven and IP revenues have not shown major growth yet. The major cause for higher revenue productivity is utilization levels which have gone up for the company.

- Another reason for increased margins was the growth in the high margin healthcare business.

- The management expects the onsite ratio to remain at current levels of near 30% and it is not expected to go back to pre-covid levels of near 50%.

- The company is not pushing on the semiconductor industry for business and all ongoing work from this vertical is from legacy customers.

- The management has admitted that although Japan is an important region for the company, the decision-making process is very slow there and they tend to insource as much as possible. Nonetheless, the company is focusing on the medical business in the region.

- The management views the consolidation of Tata Elxsi as a subsidiary of Tata Sons very favourably as it will open up new opportunities for the company within the group.

- The company has started working with a leading EV player in North America in the connectivity and infotainment domain.

- The management has clarified that Autoscape launched by TCS is not a competitor for Tata Elxsi as it is more of a service framework and is a collection of services, capabilities, and some IP that they have which is applicable to the entire auto industry.

- While auto-recovery is still underway, the main drivers of growth for the company have been media & comms and the healthcare verticals.

- The company has the policy to cover through both options and forward cover for forex hedges.

- Customer concentration will reduce slowly as the company is onboarding many new customers who may in the future contribute higher and enter the top 10.

- As mentioned before, the company will continue to look to expand into adjacent verticals to its existing verticals to reduce dependence on these verticals and to expand avenues of growth for the company.

- The management has mentioned that currently a few of the company’s platforms are firing and once all of them are up, it will reflect in growth and profitability for the company.

- According to management, the main differentiator for Tata Elxsi is that it is a very focused engineering player and is mainly looking to build its edge on design-led initiatives instead of competitive pricing.

- The current utilization rate was at 75-76% vs 70% last quarter. The management has stated that there are still avenues for margin expansion in the future for Tata Elxsi.

- The management confirms that the company is indeed ingrained in the EV initiatives for both Tata Motors & JLR.

- The management is not worried about attrition as it is confident in the company’s sourcing of talent and market reputation.

- Revenue per engineer has gone up due to higher utilization and the company being able to charge based on the value that it provides to the customers.

- The company is actively focussing on sourcing customers and deals with multi-year engagement rather than one-time projects. Thus most of its recently added customers are in on multi-year deals.

- The management is confident that the healthcare business will yield higher margins than other segments as the company is confident of being able to offer end to end solutions for the industry while maintaining required levels of compliance to the rigorous regulatory standards for the industry.

- The company has around Rs 900 Cr as cash in its books.

- The management admits that it indeed had to make concessions on pricing due to COVID-19 but it is not expected to face much pricing pressure as it is not competing on pricing in most of its projects and is mostly working on the upper end of the industry spectrum.

Analyst’s View

Tata Elxsi had a good quarter with its highest ever quarterly revenues and robust PBT & PAT growth. The company continues to see good growth in the emerging medical space and the media & communications space which have been the primary driver of growth in Q3. It has also managed to improve its offshore ratio and maintain high levels of utilization which has helped boost PBT growth. The auto segment continues to be subdued due to the COVID-19 situation but is recovering well. The company has done well to bring in a North American EV player as a customer in Q3. It remains to be seen how the company’s major clients adapt to the new world transformed after COVID-19 and what impact it shall have on the company’s performance going forward. Nonetheless, given the company’s strong technological capabilities and its resilient performance in the last year, Tata Elxsi remains a good technology stock to watch out for, particularly given the rising demand for its services in the broadband and media & communications spaces.

Q2FY21 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 435 | 398 | 9.30% | 414 | 5.07% | 849 | 772 | 9.97% |

| PBT | 110 | 70 | 57.14% | 94 | 17.02% | 204 | 141 | 44.68% |

| PAT | 79 | 50 | 58.00% | 69 | 14.49% | 148 | 99 | 49.49% |

Detailed Results

- The company saw revenues rise 9.3% YoY in Q2. Revenue from operations rose 11.5% YoY

- The PAT for the company rose 58% YoY in Q2.

- H1 performance was very good with 10% YoY revenue growth and Pat growth of 49.5% YoY.

- The company gained Rs 4.55 Cr from foreign exchange gains.

- EPD division grew 15.1% YoY and 7.1% QoQ.

- Media & Communications vertical grew 6.7% QoQ & 19.2% YoY.

- Healthcare division grew 14.1% QoQ & 50% YoY.

- IDV grew 15.1% QoQ with key international design project wins.

- Revenue distribution by geography is as follows:

- EU: 39.8%

- USA: 35%

- India: 12.5%

- Rest of the World: 12.6%

- The top 10 customers now account for 50.7% of the total sales.

Investor Conference Call Highlights

- The company saw constant currency growth of 6.9% QoQ and 4.4% YoY.

- The company signed a multiyear deal with a European Tier 1 supplier for our vehicle electronics and software. It also added a new automotive OEM as a customer.

- The management stresses that it will continue to focus on maintaining margins and it will indeed be giving out salary hikes this year due to the stellar performance. The hike is expected to be around 6-8%.

- Offshore % has increased to 65.3% in Q2 from 57.4% in Q1.

- The other expenses have been down mainly due to the fact that around 95% of the workforce is working from home for the company.

- The management believes that the company is back at pre-covid momentum in terms of both pipeline and emerging opportunities.

- The partnership announced with Schaeffler is like an offshore development center for a customer. In the case of other announced partnerships like INVIDI or Google, the company is providing a joint go-to-market with somebody else to provide larger or more complete solutions to its customers. For example, in OTT, the solution in partnership with Google and Widevine is used for content protection. With INVIDI, the company is offering its OTT customers a platform for addressable ads.

- The management is optimistic about the business with the company’s top client and is confident that it will continue on a positive outlook.

- The company continues to maintain its offices and will take a permanent decision once the pandemic goes out.

- The management has stated that it has initiatives going on in both new product development and possible acquisitions for nonlinear growth options for the company.

- IPR based revenue remains low at less than 5%. The company is looking to move more towards a solutions model where it can offer both products and services depending on client needs rather than remain firmly in a segregated product vs service model.

- The company is maintaining cash reserves at Rs 900 Cr which it will be using for possible inorganic growth options if they come up.

- The management hopes to add on 2-3% in service revenues in the future and for services to continue beyond a 1-year period which will provide a longer tail of revenues.

- The company currently has 1-2 platforms in its major verticals. It has TE PLAY and FalconEye in media, Autonomai, and AutomaTE in auto sector and is looking to develop more platforms in these spaces.

- Although the company has worked in the space side in the Mangalyaan mission and a few others, it is not expecting big growth in this segment as most of the projects here are govt driven which are hard to deliver.

- The company does see the application of Autonomai in auto parking but the management acknowledges that many of the emerging markets can never achieve full autonomy because the roads and infrastructure don’t suit it. So rather than full autonomy, there is a good opportunity for individual features like auto parking valet systems, traffic jam assist, etc. The company will look to remaster Autonomai to suit features that it thinks have more applications than full autonomy at the moment.

- The company is seeing good traction for the network operations automation solution where the client can automate some of the monitoring and control of the network to make sure that subscribers don’t have any disruption to the services. The company is also looking to adapt this to other industries under the concept of remote monitoring and remote management which can apply to any enterprise.

- The company has made 300 fresh grad hires and 100-150 lateral hires in Q2.

- The management aims to maintain constant currency annual growth at 10-12% for the next few years.

- The company is indeed looking towards IDV opportunities and is looking for cross-selling with EPD customers for IDV. In the next 2-3 years, the IDV growth rate is expected to be higher than the EPD growth rate.

- The 14% QoQ growth in other expenses is mainly due to one-time increase in H-1B visa fees.

- The company saw a forex loss of Rs 1.9 Cr in Q2.

- Currently, 9% of revenues is coming from the medical business.

- The company is also expecting to generate Rs 4 Cr of export incentive per quarter. But it has no clarification on the matter yet from the govt.

- The management has stated that COVID-19 has indeed accelerated transformation towards automation and ensuring continuous operation without disruption in many industries.

- The management maintains that H2FY21 will be better than H1FY21 for the company.

- The management has observed that sales and marketing are continually shifting towards digital and it is expected to be a permanent change.

- The company is indeed seeing demand coming back in the auto sector but it will still a few more quarters for the industry to reach pre-covid activity levels.

- The management has clarified that the company is not working on the anticipated Tata super app currently.

- In the auto sector, connected and infotainment continues to lead and accelerate while electric comes after that and ADAS comes last. In Media, OTT & broadband and data-led services are leading for the company.

Analyst’s View

Tata Elxsi had a good quarter with stable revenue growth and robust PBT & PAT growth. The company continues to see good growth in the emerging medical space and the media & communications space. It has also managed to improve its offshore ratio and keep other expenses minimal which has helped boost PBT growth. The IDV segment also seems to have been revived with a continued focus on cross-selling this segment services to EPD customers. The auto segment continues to be subdued due to the COVID-19 situation. It remains to be seen how the company’s major clients cope with the disruption caused by the pandemic and what impact it shall have on the company’s performance going forward. Nonetheless, given the company’s strong technological capabilities and its resilient performance in the last year, Tata Elxsi remains a good technology stock to watch out for, particularly given the rising demand for its services in the broadband and media & communications spaces.

Q1FY21 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 414 | 374 | 10.70% | 452 | -8.41% |

| PBT | 94 | 70 | 34.29% | 110 | -14.55% |

| PAT | 69 | 49 | 40.82% | 82 | -15.85% |

Detailed Results

- The company saw revenues rise 10.7% YoY in Q1.

- The PAT for the company rose 41% YoY in Q1.

- The company gained Rs 4.55 Cr from foreign exchange gains.

- EPD division grew 13.2% YoY.

- Media & Communications vertical grew 3.3% QoQ & 23.3% YoY.

- Healthcare division grew 5.3% QoQ & 26.5% YoY.

- Revenue distribution by geography is as follows:

- EU: 35.8%

- USA: 36%

- India: 13.1%

- Rest of the World: 15.1%

- The top 10 customers now account for 48.6% of the total sales.

- Transportation vertical earnings remain under pressure due to muted sales from the auto industry worldwide.

Investor Conference Call Highlights

- The management has stated that additional expenses are still high since a number of the company’s employees are stuck in overseas locations.

- The company will not be making any new hires or office expansions in FY21.

- The management has guided that discretionary expenses like travel should stay low going forward as the industry and company adjust and adapts to the new normal of remote working.

- The auto sector demand is expected to stay muted. Although the company is winning large deals in this space, most of these are getting pushed back by a quarter or so.

- The company is looking at the Middle East as the new frontier for deals in the media and broadcasting segment.

- The utilization rate in QA1 was at 75%.

- The company has not moved forward with its plans for acquisition but it remains on the lookout for any potential opportunities.

- The management has assured that the company will continue to derisk and remove dependence on a single customer and the transportation vertical.

- The company has not undertaken any salary hikes and will not do so for the rest of the year.

- The management has stated that in the long run, the company will rethink overall infrastructure requirements and office space requirements which will lead to further cost savings.

- The company had 2 deal wins in Q1, one in the transportation sector and the other in the medical sector.

- In the long term, the management envisions revenue distributions as 40% from the transportation sector, 40% from media and communications & 20% from medical devices space.

- The company indeed has some platforms under development for remote management of assets in the studio and telecom industry. These platforms are seeing good traction and interest due to COVID-19.

- The company has gone forward with the model of more offshoring due to reduced budgets of its existing customers due to COVID-19. The company is also looking to enhance security measures when working from home as much as possible and are evaluating best-in-class security architectures available for data security at homes.

- The management has stated that as long as the customer is satisfied that the company can work remotely, it may take up offshoring all the way up to 100%.

- The company has around Rs 250 Cr of reserves and it will not be distributing this through dividends as it needs these funds to finance any possible acquisitions in the near future.

- The management maintains PBT guidance of 22-24% and states that there may be further improvement in margins due to a big reduction of travel expenses.

- Overall revenues in USD is $55 million in Q1.

- The management expects a 5-10% growth in the transportation vertical. The transport adjacent verticals account for 4-5% of revenues and the management expects it to become 15-20% of revenues in the next 3 years.

- The company is building T-Play, which is a new platform that enables the rapid launch of new OTT services. All in all the company has filed 8-9 patents in the last 1-2 years.

- The management has stated that the company can reach 70% offshore by the end of FY21.

Analyst’s View

The company had a good quarter with stable revenue growth and robust PBT growth. The company continues to see good growth in the emerging medical space and the media & communications space. It has also managed to improve its offshore ratio and keep travel expenses minimal which has helped boost PBT growth. The auto segment continues to be subdued due to the COVID-19 situation. It remains to be seen how the company’s major clients cope with the disruption caused by the pandemic and what impact it shall have on the company’s performance going forward. Nonetheless, given the company’s strong technological capabilities and its resilient performance in the last year, Tata Elxsi remains a good technology stock to watch out for, particularly given the rising demand for its services in the broadband and media & communications spaces.

Q4 2020 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 452 | 420 | 7.62% | 444 | 1.80% | 1668 | 1640 | 1.71% |

| PBT | 110 | 107 | 2.80% | 102 | 7.84% | 352 | 433 | -18.71% |

| PAT | 82 | 71 | 15.49% | 75 | 9.33% | 256 | 290 | -11.72% |

Detailed Results

-

-

- The company saw revenues rise 7.6% YoY in Q4.

- The PAT for the company rose 15.5% YoY in Q4 and declined 11.7% YoY in FY20.

- Revenue from operations grew 3.6% QoQ & 8.3% YoY.

- EPD division grew 4.1% QoQ & 10.6% YoY while IDV grew by 7.6% QoQ & 5.4% YoY.

- Media & Communications vertical grew 8.6% QoQ & 25.5% YoY.

- Revenue distribution by geography is as follows:

-

- EU: 39.9%

- USA: 35.5%

- India: 11.4%

- Rest of the World: 13.2%

- The top 10 customers now account for 50.6% of total sales.

- The management commented that Q4 saw key wins for the company in the OTT space, broadband technology, and digital transformation in media & communications space.

- The company also added new customers in rail and off-road segments thus adding to diversification into adjacent segments.

-

Investor Conference Call Highlights

- The shipping of hardware was impacted due to the recent lockdown which has had an impact on revenue recognition.

- The medical business grew 60% YoY and was flat QoQ.

- The company is expecting softness and deferment of deals from auto clients mainly due to the softness in the industry being extended due to the COVID-19 phenomenon.

- The company saw a good turnaround in H2Fy20 after a muted performance in Q1 & Q2 with the emergence of new verticals like medical business and entry into new adjacent verticals like rail.

- The management has refrained from giving any definite estimation for the auto industry recovery as major auto markets in the world have all been hit by the COVID-19 and it is difficult to gauge how long it will stay in these places.

- The company is not withdrawing any offers for employment made so far and will only make hiring slow in the future to cope with the impact and wait for the broader market to recover to resume normal hiring again.

- The company expects less impact from COVID-19 in the media & comms business and the medical business. These are the verticals that are pushing the company up and compensating for the drop in business from the auto segment.

- The company has gotten inquiries for designing ventilators for Indian companies but it has not expected to have a significant impact on the company’s business.

- The management is seeing a relaxed stance from western countries on regulation and compliance on medical devices mainly due to the COVID-19 impact but this is not expected to last for long.

- The company is seeing major auto customers renegotiating contracts with them and it is not opposed to this given that the industry is going through troubled times. The management has stated that the company is ready to take a minor setback in order to maintain its current business relations and provide some leeway to its customers.

- The focus for the company is to maintain incremental growth and highlight YoY growth given the current market scenario.

- The management does not want to provide hard guidance for EBITDA margins given that it will work to preserve the workforce but it is still confident of delivering margins of 20-24%.

- The company is working to maintain the highest levels of IT security given the recent attack of Cognizant and the change in working culture to working from home.

- The company is working to show that its onsite employees have been able to provide similar levels of performance working from home and thus it can provide similar work within a budget without the constraints of sending and keeping people onsite.

- The company saw broad-based growth in the USA and the media & communications business grew a lot in India especially in the OTT space.

- The company has not seen any cancellations yet and it does not expect any cancellations. At most, there would be renegotiations and deferments.

- The management has stated that its target is to reach at least last year’s figures for each quarter.

- The company is working on many aspects in the rail segment like propulsion systems, entertainment systems, AC regulating systems, etc.

- The off-road customers for the company are OEMs from abroad.

- The first roll off of extra capability in the auto segment will be easily redeployed into adjacent systems. Similarly, the infotainment systems in the rail segment can be done by the media & comms employees.

- The utilization rate for the company is 74% which is around the highest levels seen by the company.

- Other expenses for Q4 were less than usual mainly due to a reduction in travel expenses.

- The management expects the media & communications business to grow at a steady pace in Fy21 going forward.

- In the 5G space, the company is actively involved in industry gatherings and it will continue to invest in capabilities into this space. The management has accepted that the rollout may be slow in some countries but it will come out sooner or later.

Analyst’s View

The company had a good quarter with good sequential growth and expansion in all operating sectors. The growth momentum in H2FY20 has helped cover for the decline in the H1 and maintain flat revenue growth for FY20. The company has seen good growth in the emerging medical space and the media & communications space. It has also expanded into adjacent segments of rail and off-road. The auto segment continues to be subdued due to the COVID-19 situation. It remains to be seen how the company’s major clients cope with the disruption caused by the pandemic and what impact it shall have on the company’s performance going forward. Nonetheless, given the company’s strong technological capabilities and its resilient performance in the last year, Tata Elxsi remains a good technology stock to watch out for, particularly given the rising demand for its services in the broadband and media & communications spaces.

Q3 2020 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 443.96 | 404.32 | 9.80% | 398.21 | 11.49% | 1215.99 | 1220.3 | -0.35% |

| PBT | 102.05 | 94.41 | 8.09% | 70.43 | 44.90% | 242.68 | 326.63 | -25.70% |

| PAT | 75.42 | 65.99 | 14.29% | 49.8 | 51.45% | 174.02 | 218.67 | -20.42% |

Detailed Results

-

- The company saw revenues rise 9.8% YoY and 11.5% QoQ.

- The PAT for the company rose 14.3% YoY and 51.45% QoQ respectively.

- 9M revenues saw a minor decline of 0.35% while 9M PAT declined 20% YoY mainly due to a decline in performance in the past 2 quarters.

- Revenue from operations was at its highest level ever at Rs 423.4 Cr.

- EPD division grew 9.8% QoQ while IDV grew by 9.9% QoQ.

- Transportation vertical grew 10.4% QoQ while Healthcare vertical grew 40.6% QoQ.

- The management mentioned that this growth in QoQ performance is mainly due to ramp up in large deals won earlier this year and the addition of new customers in electric vehicles, medical devices, and OTT segments.

Investor Conference Call Highlights

- Offshore salary hikes offered in the quarter were around 8% with onsite hikes ranging from 1%-2%.

- The company has seen revenues from JLR bottom out and show modest growth in the quarter as compared to the previous 2 quarters.

- The company has also started servicing many deals that it has won in the last quarter which has resulted in the >10% QoQ growth in transportation division revenues.

- The management maintains that the company will continue to look to expand its healthcare division aggressively and it sees some large opportunities in this space coming its way in the near future.

- The current utilization rate is estimated to be close to 70% and the management has mentioned that close to 75% is the sweet spot for the company in terms of utilization rate.

- Margins are largely expected to stay within the band of 22-24%.

- The big deal wins for the company so far have been 2 tier-1 customers from the USA and 2 OEMs in the APAC region.

- The management expects deal volumes to rise as the global auto industry recovers in the near future.

- The company now has a total of more than 160 active customers.

- The management has guided that it expects the QoQ growth rate for the auto division to stay at 5-6% while it expects the growth rate of healthcare division to be much higher owing to the small base and aggressive expansion it sees in this segment.

- The management has further declared that it expects the healthcare division to rise and form around 20-25% of revenues in the next 3 years from the current contribution level of 8%.

- The management has also mentioned that the margins earned in the healthcare business are higher than other businesses.

- The top customers for the company account for 15.7% while the top 5 accounts for 37.8% and the top 10 account for 50.8% of total revenues.

- The management has explained that since the company specializes in product engineering rather than standard IT projects, the team requirements are much smaller and the command pyramid structure is much steeper with greater emphasis on product development and R&D. This helps differentiate the company from standard IT companies out there.

- The company currently has a 40% onsite and 60% offshore mix.

- The management has mentioned that despite gaining growth momentum now, it largely expects the total performance for FY20 to be flat overall.

- Broadly, the work done by the company for the auto industry is in infotainment, autonomous driving and driver assistance.

- The company is yet to decide on whether to switch to the new tax regime and the management has said that it will wait for the upcoming budget to decide on this.

- The management has mentioned that there is only one healthcare client within the top 10 customers of the company.

- The cash and cash equivalents for the company at the end of Q3 stood at Rs 600 Cr.

- The company is looking for verticals adjacent to its three main ones of auto, media, and healthcare for expansion. For example, the company is looking for opportunities in the rail and off-road transport segments as these segments may have opportunities similar to the auto segment for the company.

- The company is currently investing heavily in developing sales verticals in the medical space in the USA and EU and it will only add to other divisional sales teams on a need basis whenever required.

- The management believes that the growth in the auto division for the company can rise again to double digits given the potential of autonomous car technology and the increasing use of electronics and software in cars everywhere.

- The management has mentioned that forex gain has contributed to around 2% of revenue growth in the current quarter.

- The company has also been heavily involved in the Nexon EV project for Tata Motors in recent times.

- The company has plans to add 700 to 800 engineers in the next year, net of attrition.

Analyst’s View

The company had a good quarter with good sequential growth and expansion in all operating sectors. The management expects the current growth momentum to persist and cover for the decline in the past 2 quarters and maintain flat growth for FY20. The company has seen good growth in the emerging medical space and is seeing good signs of growth revival from the auto sector. It remains to be seen whether this expected auto sector revival remains sustained and whether the company will be able to grow its medical space business at the pace that it is expecting. But given the company’s expertise in disruptive technologies like autonomous cars and product engineering in diverse sectors like OTT and medical devices, Tata Elxsi remains a potentially good stock to watch out for.

Q2 2020 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY20 | Q2FY19 | YoY % | Q1FY20 | QoQ % | H1FY20 | H1FY19 | YoY% | |

| Sales | 398.21 | 426.1 | -6.55% | 373.81 | 6.53% | 772.03 | 815.98 | -5.39% |

| PBT | 70.43 | 123.95 | -43.18% | 70.18 | 0.36% | 140.62 | 232.21 | -39.44% |

| PAT | 49.8 | 82.18 | -39.40% | 48.79 | 2.07% | 98.59 | 152.65 | -35.41% |

Detailed Results

-

- The company saw revenues drop 6.55% YoY and grew 6.5% QoQ.

- The PBT and PAT for the company fell by larger quantum with falls of 43% and 39% YoY respectively.

- The QoQ performance was encouraging with EPD business growing 5.3% QoQ, Design business growing 12.9% QoQ and System Integration Business growing 27% QoQ.

- In the EPD segment, transportation vertical has grown 9% QoQ. Media and Communications also grew 5% QoQ.

- The medical business is expected to grow as the company has won deals in this business and its revenues will be added in the next quarter.

- In terms of geographies, the US market grew 9%, India grew 18% and the rest of the world grew 15% for the company.

- Europe was flat with negligible forex gains.

- The company has won a couple of deals in the Electric Vehicle space in Europe, one of which is with a tier 1 OEM.

- The company has also won one large deal in the OTT space.

Investor Conference Call Highlights

- 98% of revenues are expected to be driven by deals with existing customers for the company.

- The management has guided that they will keep margins between 22% and 24% for H2FY20.

- The salary hike that the company was going to take in Q2 has been postponed to Q3 and will reflect in the salary expenses next quarter.

- From a cost perspective, a 7-8% impact is expected from the upcoming salary hike.

- The company is still operating at the original tax rate of 32% and is yet to decide on the alternate tax route that they will be taking.

- The management expects significant growth in Q3 and Q4 as they expect some big contracts to get finalized in the coming quarters.

- The revenue mix from on-site and offshore is 42.6:57.4 currently.

- The utilization rate for the quarter was 71%.

- The revenue contribution from JLR is around 16.3% in the quarter. The revenues from JLR were largely flat while the transport segment revenue grew 9% highlighting the company’s efforts in diversifying and reducing dependence on JLR.

- The total number of active customers that the company has currently is 161.

- The management maintains that they have not defocussed from AUTONOMAI but are looking into adding additional capabilities and subcomponents as the inquiries are coming in for specific parts rather than for the whole package.

- The management has confirmed that they have not lost wallet share and are working towards increasing it.

- The company has made good progress in the engineering division where they are now looking to score deals worth more than $10 million as compared to 2 years ago where they were scoring deals of $ 100,000.

- The management claim that there are significant opportunities in media and telecommunications as a lot of media channels are looking to integrate into Android TV and RDK with Tata Elxsi being the best engineering partners for these platforms.

- The company is also planning to expand its medical business aggressively in the US and EU in the next 2-3 years and bring this segment as the third great pillar for the company alongside transportation and telecommunications.

- The company is not directly vulnerable to Brexit but has a lot of customers in the UK like JLR, various media houses, etc which are vulnerable and thus the company can have some indirect impact on business from the event.

- The company plans to push utilization levels up to 75% and keep it near that figure for optimal performance.

- The management has guided that they are on the lookout for possible M&A opportunities but there probably won’t be any in the rest of FY20.

- The area where the company faces competition the most is the automotive sector. The media and medical sectors are not as competitive as the automotive sector for the company.

Analyst’s View

Tata Elxsi has been one of the few Indian companies that have focused exclusively on advanced technologies and integrated product design. The company had a modest quarter with signs of revival and good growth in its other sectors. The company saw almost flat growth in its automotive business but was able to grow other businesses well sequentially (like system integration). The company still faces an uphill task of maintaining its revenue growth despite challenges in its dominant automotive sector and the challenge of bringing up and developing nascent sectors like medical space. Nonetheless, given their technological reputation and focus on growing other key verticals like telecommunications and medical, Tata Elxsi remains a good investment prospect in the information technology and industrial design segment.

Q1 2020 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY20 | Q1FY19 | YoY % | Q4FY19 | QoQ % | |

| Sales | 373.81 | 389.88 | -4.12% | 420.1 | -11.02% |

| PBT | 70.19 | 108.26 | -35.17% | 106.76 | -34.25% |

| PAT | 48.79 | 70.49 | -30.78% | 71.29 | -31.56% |

Detailed Results

-

- The company saw revenues drop 4% YoY and 11% QoQ.

- The PBT and PAT for the company fell by larger quantum with falls of 35% and 31% YoY respectively.

- The depreciation expenses for the company has shot up from Rs 6.1 Cr to Rs 10.44 Cr due to the re-categorisation of leases expenses from other expenses to depreciation.

Investor Conference Call Highlights

- The new order bookings for current quarter were higher than Q4FY19.

- The broadcast and communications unit and medical services unit have grown faster than the last 2 quarters.

- The company has been reeling from the sudden pace of revenues loss from Jaguar Land Rover.

- The company is expecting this development to reverse once Jaguar Land Rover recovers and normalises.