About the Company

CCL Products is the largest instant coffee maker and exporter in India. The company was formed set up in 1994 and commenced commercial operations in 1995. It is a profit-making, export-oriented unit (EoU) with the ability to import green coffee into India from any part of the world and export the same to any part of the world, free of all duties. The company has two international subsidiaries in Switzerland and Vietnam. The company has recently ventured into the branded coffee segment through its in-house brand “Continental Coffee”.

If you want a quick snapshot of the company’s strengths and weaknesses, click here

Q4 FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a very good quarter with sales up 38% YoY and PAT up 62% YoY.

- EBITDA margins stood at 18.82% for the quarter ended March’23, showing good recovery.

Investor Conference Call Highlights:

- In the yearly performance on a year-to-year basis, the group has achieved a turnover of Rs.2071.21 Crores, crossing a milestone of 2000 Crores this year as compared to Rs.1462 Crores for the corresponding previous year.

- The management states that remaining free-cash flows that are going to be available will be spent on ongoing projects and building freeze dried capacities.

- The management states that the Russia-Ukraine war has had no impact on Green Coffee prices. The prices are globally moving upward as of now. This is resulting in the company investing more into working capital and inventory.

- 50% – 60% of the company’s volumes come from existing customers and remaining come from either new customers or adding new volumes to existing customers.

- The revenue breakup for the company is as follows; CIS contributes 20-25% of volumes, Europe contributes 12-15%, North America contributes 12-14%, and the remaining bulk comes from domestic.

- The management states that volume growth for the quarter and the year-end stood at a consistent level. It was indicated that they will end the year between 20-25% and they ended little above 20% volume growth and got another 20% value.

- The management states that the annual turnover growth is around 40 to 41% and the guidance for the next year is close to this. They are looking to grow the volumes at around 20% overall.

- The company has already started using the Vietnam capacity of 16000 metric tonne, and 50% of the new capacity is planned to be utilized this year

- The management plans to have one more SD capacity in India of 16,000 tonne by this year end and a freeze dried capacity in Vietnam of 5500 metric by Q2 of next FY.

- The management states that growth in Q4 was mainly driven by additional capacity created due to the Vietnam expansion and robust profit from the NCL unit this quarter.

- The capacity utilization excl. the new added Vietnam capacity stands at 85% to 90%.

- The company’s freeze dried capacity is 100% volume for the next one-and-half years as it is seeing pressure demand from that segment. The board does not see any apparent demand contraction going forward.

- In FY2023 the whole domestic business crossed a turnover of around 250 Crores and the pure brand out of this was between 150 to 160 Crores and the rest 80 Cr was bulk and private label.

- The management gives a guidance of 30% to 40% for the whole domestic business.

- The management explains that despite new coffee crops coming in, Robusta prices are rising due to high demand from Vietnam and Indonesia.

- The management sees the current coffee prices going towards an all-time high, after which they are expected to slowly soften once new crops start coming in from Indonesia and subsequently from India regions.

- Depreciation this quarter was lower at INR 10 crores vs 19 crores the previous quarter, as some of the old capacities have been completely depreciated and the new capacities added have been capitalized in March end.

- EBITDA per kg for the quarter stands in the range of 90 to 100 for spray dried and 130 to 140 in the range of freeze dried, similar to the previous quarters.

- For the branded business, projected sales for this year were around 170, but actual sales were slightly lower at 155-160 due to stock corrections and financial discipline.

- For the branded business, going forward, the company aims for growth projections of 30-35% for the next two to three years.

- The management gives the guidance for effective tax rate for FY24 at 25%.

Analyst’s View:

CCL has already established itself in the wholesale coffee space for many years and its foray into branded sales through the Continental Coffee label has been very encouraging. The company has had a good quarter with 38% growth in revenue and 62% growth in PAT, mainly driven by new addition of capacity in Vietnam. It also saw utilization of above 90% at the plants. Its capacity expansion plans for small packs in India and spray-dried coffee in Vietnam remain on track. It remains to be seen how the company ramps up its utilisations in new capacity coupled with whether the branded business will be able to maintain its growth momentum in other parts of India. Nonetheless, given the enormous market opportunity for the branded business in the domestic market, CCL products may turn out to be a dark horse in the global coffee industry in the years to come.

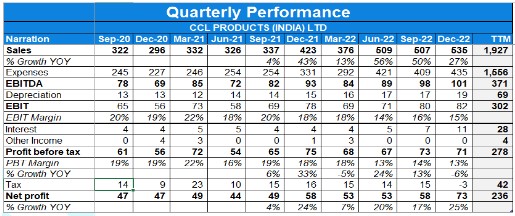

Q3 FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a very good quarter with sales up 27% YoY and PAT up 25% YoY.

- EBITDA margins stood at 15%.

Investor Conference Call Highlights:

- The management explains that the FD per kg EBITDA will be 30% to 40% higher than the spray dried.

- Capex for the FD capacity is somewhere between 4x to 4 5x higher per ton as compared to the spray-dried one.

- The ROCE of the new capacity will be 40% less than the spray-dried one.

- The timeline for the commissioning of new capex is Q3 of 24/25.

- Management is expecting capacity utilization of 50-60% in freeze-dried from the first year itself.

- Topline Volume growth stood at around 6-6.5% due to a shutdown in the India plant for maintenance for 20 days.

- In Vietnam, the company is doing pre-commercial trials & plans to do commercial sales from the Vietnam capacity this quarter itself. And that’s the reason it is staying on its guidance of 20% to 25% volume growth.

- Its new facility is being established in Vietnam vs India as its customer wants territorial de-risking.

- The green coffee prices have come down from 2,300 levels to around 1,900 levels. Going forward in the second half of this year, there are. expectations kf a further drop in raw material prices because of Brazil’s crop.

- Decrease in freight rates & stabilising of supply chain is helping in reducing inventory period.

- Total debt post expansion will stand at 1,085 Crs.

- The management is focused on exporting to new geographies which it was unable to do before owing to peak capacity utilisation levels.

- The management explains that coffee market is expected to grow at 2.5%.where Nestle is the largest player after which, the company is the largest manufacturer.

- The company believes it will be able to grow faster than industry due to addition of value added products coupled with its presence in vietnam & india where they have the freedom to buy raw materials from any country Vs Brazil, which is the largest manufacturer wherein they have the limitation of buying raw material oy from the country & therefore restricting its ability to make different kinds of coffee.

- The company expects its outsourcing to reduce significantly given that Vietnam capacity has started its commercial operations.

- The management claims that all the big producers in the world expect Nestle is a customer of the company.

- The company is focusing on transitioning into a FMCG company.

- The company is supplying in China through Vietnam & expect this region to be the fastest growing.

- The peak utilisations for new capacity will be around 360 Crs.

- The company expects to do approximately INR 250 crores, out of which INR 70 crores is private label and around INR 175-180 crores pure brand business.

- The management states that its EBITDA growth will more or less follow the volume growth.

- The company’s share in global markets stands at 7-8%.

- The management is seeing a trend wherein brands with manufacturing are shutting down because they feel it’s easier, much more economical and safer to just procure from the other existing manufacturers.

- The company states that because of the hikes in rate of interest & increase in the volume of working capital , the finance cost has gone up.

- Depreciation has increased due to capitalization of the packing facility.

- Blended tax rate stood at 12% & is likely to decrease in the coming period owing to larger production in tax free- Vietnam.

- The management is guiding for a 15-20% volume growth in the coming year.

- The company’s margins in Vietnam are higher due to availability of raw materials in the country coupled with less transportation costs.

- Working capital Finance costs stood at 6.5%.

Analyst’s View:

CCL has already established itself in the wholesale coffee space for many years and its foray into branded sales through the Continental Coffee label has been very encouraging. The company has had a decent quarter despite the shutdown of its domestic plant with decent growth in Sales & profit. It also saw utilization of above 80% at the plants. The company has seen a hit in gross margins due to the delays in shipments due to the Russia-Ukraine war. Its capacity expansion plans for small packs in India and spray-dried coffee in Vietnam remain on track. It remains to be seen how the company ramp up its utilisations in new capacity coupled whether the branded business will be able to maintain its growth momentum in other parts of India. Nonetheless, given the enormous market opportunity for the branded business in the domestic market, CCL products may turn out to be a dark horse in the global coffee industry in the years to come.

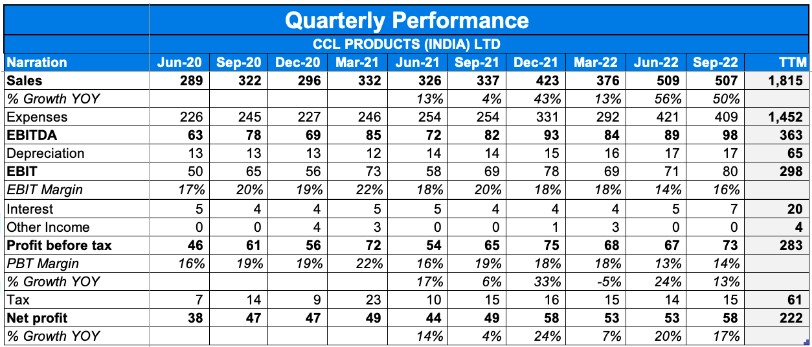

Q2 FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a very good quarter with sales up 50% YoY and PAT up 17% YoY.

- While sales grew in a healthy manner, EBITDA margin recovered from its hit at 19%.

Investor Conference Call Highlights:

- The company plans to add another 16000 tonnes of capacity to its already existing 37500 tonnes.

- The management looks to maintain a healthy volume growth of 20%-25%, and to maintain this growth, the management is running up capacities in a fast and phased manner.

- For the last three to four quarters, the company has also been outsourcing some quantities to fulfil its commitments.

- The company is getting good growth with its bulk customers and is adding a lot of departmental stores.

- The company is currently supplying to the top cold coffee and confectionary brands and is seeing fast growth in that area.

- In the next quarter, the company will start doing trials for some near-term capacities coming into operation. The management expects to get some commercial volumes too.

- The management gives a guidance of a similar margin profile in the coming quarters. They also stated that the margin profile will be exactly in line with volume growth.

- Working capital requirements have largely gone up due to increase in volume, value of raw materials and value of business.

- The management expects inventory days to go down towards the end of the year from 120 to 90.

- The management is very confident on coffee as a product considering that it has seen recessions, pandemics, war and has survived during all these periods with volume increases.

- In terms of product innovation, the company has developed capabilities to such an extent that it can offer the entire range of potential products like expresso coffee, instant format, cold brews, functional coffees, flavoured coffees etc.

- The management states that no manufacturer can get this capability overnight and they had bought equipments from 30 different countries.

- The company’s current inventory is 100% against back-to-back contracts that the company has in place.

- Overall consumption of instant coffee has largely been stable and is growing due to office demand.

- The company has grown in the domestic markets by 30% to 40% and the management expects the momentum to continue for some period.

- The quarter the company is selectively expanding into other zones like the North-east and West, which are smaller markets than the South but growing markets.

- For the plant protein product, the company is now expanding into Chennai and Mumbai.

- The management maintains the guidance of 200 crore plus top-line for the domestic business in FY23 out of which 70% will be branded and 30% will be non-branded.

- In domestic, Q1 was 50 odd crore while Q2 was 60 odd crore. The management is very positive about the upcoming quarters with the season approaching.

- In terms of retail touch points, the company is directly servicing 1,20,000 outlets out of which 80% are in the South. The company is looking to end the year with 1,40,000 direct outlets.

- After the expansion in India and Vietnam, it would take the company 2 to 3 year to reach 85% capacity utilization.

- Currently, the capacity utilization is at 100% of both freeze dried and spray dried in India. Outsourcing stands currently at 5% of quantity at 1500 to 2000 tonnes.

Analyst’s View:

CCL has already established itself in the wholesale coffee space for many years and their foray into branded sales through the Continental Coffee label has been very encouraging. The company has had a decent quarter with growth in Sales & growth in profit despite inflation pressures. It also saw complete utilization and outsourcing at the plants. The company has seen a hit in gross margins due to the delays in shipments due to the Russia Ukraine war. Its capacity expansion plans for small packs in India and spray dried coffee in Vietnam remain on track. It remains to be seen whether the rising green coffee prices will result in any drop in order placement for CCL and whether the branded business will be able to maintain its growth momentum in other parts of India. Nonetheless, given the enormous market opportunity for the branded business in the domestic market, CCL products may turn out to be a dark horse in the global coffee industry in the years to come.

Q4 FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 251 | 290 | -13.4% | 261 | -3.8% | 954 | 861 | 10.8% |

| PBT | 80 | 122 | -34.4% | 32 | 150% | 183 | 210 | -12.8% |

| PAT | 65 | 100 | -35% | 16 | 306% | 127 | 158 | -19.6% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 379 | 334 | 13.4% | 423 | -10.4% | 1466 | 1245 | 17.7% |

| PBT | 68 | 71 | -4.2% | 74 | -8.1% | 261 | 234 | 11.5% |

| PAT | 52 | 49 | 6.1% | 58 | -10.3% | 204 | 182 | 12% |

Detailed Results:

- The company had a good quarter with consolidated sales up 13.4% YoY and PAT up 6.1% YoY.

- FY22 numbers were good with 17.7% YoY revenue growth and 12% YoY PAT growth.

Investor Conference Call Highlights:

- The company witnessed a hit in gross margins due to delay in FD supplies because of the Ukraine-Russia War.

- The company also faced input cost pressures and logistics cost pressures during the quarter.

- The percentages of costs that got impacted in Q4 due to various reasons was 2%. And 500-700 tons of FD got deferred.

- The new small pack capacity of 12000 ton has been commissioned this quarter.

- Freeze Dried coffee contributed to 25% volumes this year.

- The company has achieved 200 crores in domestic revenues this year out of which 70% is branded sales.

- The company launched protein based snacks recently in Pune, Hyderabad and Chandigarh.

- The management has given guidance of 15%-17% volume growth for the coming year.

- The company is on track to commission 16500 tons of capacity in Vietnam in the second half of the year.

- Currently at group level the capacity utilisation stands at 85%, which is almost maximum kind of utilisation.

- The company’s inventory days have mainly gone up as the company has taken a call to store more green coffee and the company plans to keep supplies of four months currently as compared to previous two and half to three months.

- Volume growth for the year was 10% in Russian markets, 20% in USA and Europe was around 15%.

- About 20% of the company’s revenues are from Russia and are currently at 75% of normalized levels.

- The management does not see the Brazil issue ease-up for another year.

- Capex planned by the company stands at 30 to 40 crore on Indian Operations and 30 million USD on Vietnam operations to increase capacity from 15000 tons to 30000 tons.

- Out of the 30 million USD capex for Vietnam operations, the company is going to contribute 7 million and is going to borrow 20 million.

- The company is in plans to decide a location for adding another 16000 tons capacity in a greenfield capex apart from Vietnam expansion.

- The management does not expect green coffee prices falling below 100 USD, which will keep the spray dried coffee demand intact.

- The income tax on the new capex in Vietnam will be zero.

- The company has 10000-ton small pack capacity in India which can be increased to 25000 ton anytime with minimum expenditure as per the demand.

- For the upcoming FY, FD volume is expected to be flattish due to the current capacity constraints.

- The company’s aim for creating the domestic entity was to shift from being a B2B player to being a B2C player.

- Coffee prices have increased from 1300 USD per ton in Jan to 2100 USD per ton currently for Robusta. The company uses 90% Robusta.

- The company has booked 16.5 cr of export incentives received during FY22 and has 7 cr as the balance left to be received.

- The company reported 230 crores revenue in the Switzerland operations with a PAT of 7.5 crores.

Analyst’s View:

CCL has already established itself in the wholesale coffee space for many years and their foray into branded sales through the Continental Coffee label has been very encouraging. The company has had a decent quarter with growth in Sales & growth in profit despite inflation pressures. It also saw utilization of above 85% at the plants. The company has seen a hit in gross margins due to the delays in shipments due to the Russia Ukraine war. Its capacity expansion plans for small packs in India and spray dried coffee in Vietnam remain on track. It remains to be seen whether the rising green coffee prices will result in any drop in order placement for CCL and whether the branded business will be able to maintain its growth momentum in other parts of India. Nonetheless, given the enormous market opportunity for the branded business in the domestic market, CCL products may turn out to be a dark horse in the global coffee industry in the years to come.

Q3 FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 261 | 189 | 38% | 218 | 19.7% | 702 | 570 | 23.1% |

| PBT | 32 | 30 | 6.6% | 36 | -11.1% | 103 | 88 | 17% |

| PAT | 16 | 21 | -23.8% | 21 | -23.8% | 61 | 58 | 5.1% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 423 | 300 | 41% | 337 | 25.5% | 1086 | 911 | 19.2% |

| PBT | 74 | 56 | 32.1% | 65 | 13.8% | 193 | 162 | 19.1% |

| PAT | 58 | 47 | 23.4% | 49 | 18.3% | 151 | 133 | 13.5% |

Detailed Results:

- The company had a great quarter with consolidated sales up 41% YoY and PAT up 23.4% YoY.

- 9M numbers were good with 19.2% YoY revenue growth and 13.5% YoY PAT growth.

Investor Conference Call Highlights:

- The management maintains the growth guidance for FY22 at more than 15% and believes that it is on track for the same.

- The expansion plans in Vietnam were completed last quarter. It is one of the reasons for the enhanced capacity utilization also.

- The doubling of capacity plans has already started and by Q3FY23 it should be up and running.

- The expanded capacities were running at optimum levels. The company’s plants are running at almost full capacity.

- It will take more than 1-2 months to get a higher volume out of the plants because of the pending approval from customers for revised blends submitted to them.

- The company will be increasing the small pack capacity to 20,000 tonnes. The 12,000-tonne expansion which is a part of this will be completed this quarter.

- The domestic market branded business continues to do well. On both the total level and on the branded side, the company has grown by 40% in the 9M duration of this FY.

- The management’s outlook for the branded and non-branded segments in the domestic markets is around 200+ crore. The branded category is expected to be around 70% – 75% of this.

- As per Nielson, the company’s market share is 3.1% in the south region of the country, being the number three brand there. The south region accounts for 70% of the coffee consumption of the country.

- The management states that it works on a costless basis and basis on the extent of the change in raw material prices, it passes it on to the customers. This ensures that the per kg base realization is always the same.

- Volume growth on a percentage basis was 17%. The EBITDA per unit remained the same from the normal level for this quarter.

- The company has 13,500 tonne capacity in Vietnam currently after completing the previous round of expansion. The company is now in the process of doubling this capacity by Q3 of next FY.

- The management intends to wait for the domestic sales to reach a minimum threshold level before setting up a separate new factory for the domestic business. The process will be initiated at the end of the year.

- The company is not looking for any expansion in the freeze-dried coffee business due to the pressure from competitors who are setting up new plants in Brazil and Vietnam.

- The management observes that the gap between spray-dried and freeze-dried coffee has come down drastically. People are going for cheaper options with the spray-dried category which also has very good quality blends of coffee.

- The management foresees the green coffee prices to remain high for another two years at least. This is one of the reasons for the management’s confidence in spray-dried expansion rather than freeze-dried expansion.

- The company is at around 6% to 7% market share in the states of Andhra Pradesh and Telangana.

- The management is highly optimistic about the future of the coffee vending machine business in India

- The problem of shipping containers and freight costs has improved but is yet causing minor hindrance to the company.

- The company’s market share in the US will be at 7%. In Russia, it will be at 15%.

- In Most cases the freight costs are borne by the customer only.

- From a total capacity of 38,500 tonnes; 5000 tonnes are sold in India annually and the rest is exported.

- The capacity utilization of the company currently stands at 80% – 85%.

- There is not much impact of inflation or currency fluctuation on the business as the entire purchasing of raw materials and selling of goods by the company is done in dollars internationally.

- The distribution of the products is taken care of by the customer in exports. The company supplies the goods directly to the warehouses where the customer has asked them to deliver. For the domestic market, the company has a distribution network of 1lac retail outlets and 350 distributors.

- The total domestic market for branded coffee is 2300 crore. 70% of this comes from the south.

- The company’s annual advertising spends are around 13-15 crore which is spent on south regional channels and non-south news channels.

- Out of 38,500 tonnes total capacity, 11000 tonnes is currently freeze-dried which is going to remain constant and all of the remaining is for spray-dried coffee. An additional 15000-tonne capacity will add in Vietnam which will be in spray-dried coffee.

- The topline of the Vietnam operations was 322 crores and EBITDA was at 87 crores.

- The company plans to have specialized and premium packaged product offerings ahead and is not focusing on any small packs manufacturing in Vietnam currently due to the bulk coffee demand that the company is already catering to from the Vietnam plant.

- The e-commerce business is currently 10% of the total retail business.

- 75% of the company’s customers do long-term contracts of more than one year.

- Under a government incentive, the company received 7.57 crores this quarter.

Analyst’s View:

CCL has already established itself in the wholesale coffee space for many years and their foray into branded sales through the Continental Coffee label has been very encouraging. The company has had a great quarter with 41% YoY growth in Sales & 23.4% growth in profit. It also saw utilization of above 80% at the plants. CCL is planning to achieve Rs 200 Cr of sales from the domestic branded business. The company has seen a good response to its cold brew product and has also received inquiries for this product from European, Chinese and Russian supermarket chains. CCL also expects Q4 revenues to rise disproportionately as it expects the rise in green coffee prices to start reflecting in sales from Q4 onwards. It is also undertaking capacity expansion for small packs in India and spray dried coffee in Vietnam to keep up with the rising demand. It remains to be seen whether the rising green coffee prices will result in any drop in order placement for CCL and whether the branded business will be able to maintain its growth momentum in other parts of India. Nonetheless, given the enormous market opportunity for the branded business in the domestic market, CCL products may turn out to be a dark horse in the global coffee industry in the years to come.

Q2 FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 218 | 205 | 6.34% | 222 | -1.80% | 441 | 382 | 15.45% |

| PBT | 36 | 33 | 9.09% | 35 | 2.86% | 71 | 57 | 24.6% |

| PAT | 21 | 20 | 5.00% | 24 | -12.50% | 45 | 36 | 25.00% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 337 | 322 | 4.66% | 326 | 3.37% | 663 | 611 | 8.51% |

| PBT | 65 | 61 | 7% | 54 | 20.37% | 119 | 107 | 11% |

| PAT | 49 | 47 | 4% | 44 | 11.36% | 93 | 86 | 8.14% |

Detailed Results:

- The company had a flat quarter with consolidated sales up 5% YoY and PAT up 4% YoY.

- H1 numbers were better with 8.5% YoY revenue growth and 8% YoY PAT growth.

Investor Conference Call Highlights:

- The equipment installation and the commissioning of the expansion in Vietnam have been completed. By Q3 this line is expected to be fully operational.

- Praveen Jaipuriar has been appointed as CEO of CCL Products.

- The management has raised the growth guidance for FY22 to more than 15% from the earlier guidance of 10-15%.

- The management states that it has a stronger order book than before and Q3 & Q4 are typically peak quarters for CCL so it is confident of achieving >15% growth in FY22.

- Due to the rise in green coffee prices, the revenues for CCL may appear inflated from Q4 onwards according to the management.

- The company has been able to achieve margin growth alongside volume growth in Q2 despite the absence of MEIS which was present in Q2 last year.

- The company is expecting to get Rs 15 Cr in MEIS in H2FY22.

- The utilization level in the India plant was at 90% for freeze-dried coffee.

- The management expects the company to continue to operate in peak capacity and thus it has been pushing for capacity expansion.

- The operations in Vietnam have not been affected much by the rise of COVID cases there as the Vietnam plant is a fully automated plant for bulk production and it requires minimal manpower.

- The domestic branded business has grown 40-45% in Q2 and has seen H1 revenues of Rs 85 Cr.

- The management is targeting to reach Rs 200 Cr of sales in the domestic branded business in FY22.

- All the profits made by the branded business will be invested in distribution expansion and brand-building activities.

- The new capex for Vietnam has been started and it is expected to be completed by Q2FY23.

- The company has already presold all the coffee it can make this year and it will be selling for delivery in the next financial year from now on.

- As the branded business expands to the rest of India, the company will be looking to free up capacity to cover this rise in demand and it will shift the shortfall in bulk production to Vietnam.

- The company has been supplying to repackers and supermarket chains in the EU for a while now and the management expects that now CCL has a big enough track record to compete for the priority supplier position with these customers.

- Following the success in US supermarkets, European, Chinese, and Russian supermarket chains have also approached the company to get cold brew products.

- The next capex will effectively double the capacity from the current 13,500 tons to 27,000 tons. This capex will be $20 million.

- The new packing facility in India has also been completed and it is expected to start working in Q3.

- The initial capacity in this packing unit will be around 10,000 to 12,000 tons and this can be expanded by adding machinery to 20,000 tons.

- Continental has established itself as the number 3 player in the South Zone and it will now expand to other zones in India according to the management.

- The container shortage is still going on and the management does not expect this to improve in the next few months at least.

- The company imports green beans from multiple countries including Ivory Coast, Uganda, Indonesia, Vietnam, and many others.

- The management doesn’t expect global coffee prices to come down and it even expects global coffee prices to rise a little from the current level.

- The management expects volume growth in FY22 to be near 15% while revenue growth will exceed 15% due to a rise in green coffee prices.

- Growth is coming from various places for CCL including old customers seeing a rise in volumes, to new retail chains and private labels.

- The management is confident of fully utilizing the new capacity to be added within 2 years of completion.

- The company will focus on spray-dried sales for the next 1 year before planning to expand the freeze-dried business.

- 20-30% of spray-dried production is used to make value-added products like cold brew and ready mix packs.

- Despite the rise in cases in Russia, the company has not seen any drop in orders.

Analyst’s View:

CCL has already established itself in the wholesale coffee space for many years and their foray into branded sales through the Continental Coffee label has been very encouraging. The company has had a moderate quarter with 5% YoY growth in Sales & 4% growth in profit. It also saw utilization of above 90% at the domestic facilities. The company’s branded business is growing well, with sales rising 40-45% YoY in Q2 and reaching the Rs 85 Cr mark in H1. CCL is planning to achieve Rs 200 Cr of sales from the domestic branded business. The company has seen a good response to its cold brew product and has also received inquiries for this product from European, Chinese and Russian supermarket chains. CCL also expects Q4 revenues to rise disproportionately as it expects the rise in green coffee prices to start reflecting in sales from Q4 onwards. It remains to be seen whether the rising green coffee prices will result in any drop in order placement for CCL and whether the branded business will be able to maintain its growth momentum in other parts of India. Nonetheless, given the enormous market opportunity for the branded business in the domestic market, CCL products may turn out to be a dark horse in the global coffee industry in the years to come.

Q1 FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 222 | 176 | 26.14% | 291 | -23.71% |

| PBT | 35 | 24 | 45.83% | 122 | -71.31% |

| PAT | 24 | 17 | 41.18% | 100 | -76.00% |

| Consolidated Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 326 | 289 | 12.80% | 335 | -2.69% |

| PBT | 54 | 46 | 17% | 72 | -25.00% |

| PAT | 44 | 38 | 16% | 49 | -10.20% |

Detailed Results:

- The company had an encouraging quarter with consolidated sales up 13% YoY and PAT up 16% YoY.

- The major difference in standalone sales and profits QoQ is due to the high other income of Rs 65 Cr in Q4FY21 which includes dividend from the Vietnam subsidiary Ngon.

Investor Conference Call Highlights:

- The freeze-dried capacity utilization in India was at 70% in Q1 and the total Vietnam utilization was at 80% in the quarter. The utilization of spray-dried in India was 65-70% in Q1.

- The new small-pack capacity will come online in Q2. The capacity expansion in Vietnam is underway with machine purchases and implementation to start by next month.

- The main areas plagued by frost in Brazil are growing Arabica and thus the prices of Arabica have risen much higher as compared to the price rise in Robusta.

- The company is not much concerned with it since 90% of its consumption is from Robusta.

- Freight rates continue to remain high as the global container shortage issue has not been fully resolved.

- RoE was at 15.12% as of the end of June 2021 and it is expected to improve slightly for the rest of FY22 according to the management.

- Despite the rise in spot coffee prices, the company will be executing its contracts at the agreed prices only.

- The management expects the inflationary trend to continue in FY22 and it may put pressure on orders or volumes sought by customers.

- The management reassures that the rise in industry prices shouldn’t have any major impact on its profitability and margins.

- The gross margin shift QoQ is mainly due to the changes in the product mix.

- The major change from Q4 in Q1 was the reduction in sales of small packs which resulted in the top line coming lower proportionally but gross earnings remaining high.

- The India branded segment continued its good momentum and has shown almost 48-50% YoY growth.

- On the MEIS issue, CCL received around Rs 6 Cr in Q1 from its accumulated figure of Rs 28 Cr.

- The new product introductions in the USA are doing well and are providing the company with opportunities to do the same in other countries once the new product sees a good response in the USA.

- The management has stated that 80-85% utilization is the ideal range for the Vietnam plant. IN India operations, the overall utilization depends on the product mix as there are some products which are low volume and high margin and vice versa and thus reductions in utilization may not always be bad.

- Because of the widening gap in Arabica and Robusta prices, the company can expect to see a 20-25% increase in volumes sold in the USA in FY22 according to the management.

- 95% of sales in the USA are in bulk while 5% are in small packs.

- The capacity expansion in Vietnam is expected to start in Sept or Oct this year and it will take at least 1 year to complete.

- Although Vietnam is facing a major impact from COVID-19 spread currently, CCL is operating its plant with special permissions and by following the govt guidelines.

- The govt in Vietnam is keen to keep the factories in the country running and thus the company has not faced any issues with factories running there.

- There hasn’t been any major rise in realization in Q1 vs Q4FY21.

- Advanced orders make up 65% of the business mix while 35% are from spot orders. Most of these advanced orders are confirmed at the end of each financial year.

- The company is targeting to reach a margin of Rs 130-135 per kg in the next 3-3.5 years. It earned around Rs 112 per kg in FY21.

- Coffee process and industry has been deemed as essential in most countries and thus the impact of lockdown disruptions is less severe for the industry.

- The company is looking to keep the pace for the distribution expansion for the branded business. The company is not expecting any significant profit from this business as it is concentrating on expanding this business using the profits earned.

- The capex for FY22 is expected to be around Rs 15-20 Cr and there are no new projects planned other than the small-pack and Vietnam expansions.

- Consolidated net debt for CCL is at Rs 250 Cr with long-term debt at Rs 178 Cr.

- Effective tax rate is expected to come down to 15% as Vietnam operations are tax-free.

- The USA instant coffee market is expected to be at 80,000 tons per year with India expected to account for 10% of this number. CCL is targeting to supply 5,000-6,000 tons per year in the USA.

Analyst’s View:

CCL has already established itself in the wholesale coffee space for many years and their foray into branded sales through the Continental Coffee label has been very encouraging. The company has had a decent quarter with 13% YoY growth in Sales & 16% growth in profit despite the rise in coffee beans. It also saw good utilization of 80% at the Vietnam facility despite the severe impact from COVID-19. The company’s branded business is growing well, and the company is looking to consolidate its expansion in the West and Northeast zones. The company is doing well to capitalize on its unique offerings and push for new product introduction in the USA market which can be later supplied to other countries when it gets good approval in USA. It remains to be seen whether the rising green coffee prices will result in any drop in order placement for CCL and whether the branded business will be able to maintain its growth momentum. Nonetheless, given the enormous market opportunity for the branded business in the domestic market, CCL products may turn out to be a dark horse in the global coffee industry in the years to come.

Q4 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 291 | 245 | 18.78% | 189 | 53.97% | 862 | 957 | -9.93% |

| PBT | 122 | 111 | 9.91% | 31 | 293.55% | 210 | 298 | -29.5% |

| PAT | 100 | 96 | 4.17% | 22 | 354.55% | 159 | 239 | -33.47% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 335 | 267 | 25.47% | 300 | 11.67% | 1246 | 1144 | 8.92% |

| PBT | 72 | 58 | 24% | 56 | 28.57% | 235 | 225 | 4% |

| PAT | 49 | 42 | 17% | 47 | 4.26% | 182 | 166 | 9.64% |

Detailed Results

- The company had an encouraging quarter with consolidated sales up 25% YoY and PAT up 17% YoY.

- FY21 figures were good with consolidated revenues rising 9% YoY and PAT rising 10% YoY due to steady operations throughout the year from Vietnam facility.

Investor Conference Call Highlights

- The EBITDA for FY21 was at Rs 310 Cr vs Rs 290 Cr last year.

- The management maintains volume growth guidance of 10-15% in FY22.

- The company has not faced any inventory accumulation in Q4 due to delays in shipments from the container shortage that it faced in Q3.

- The management states that there is scope for margin expansion in the Vietnam plant due to lower depreciation schedule for the old plant, expansion of capacity, and better working capital management.

- Although freeze-dried proportion has risen in Q4, the main reason for gross margins rising is the heightened demand for small packs before the summer.

- Freeze-dried capacity was working at 62% utilization in FY21.

- The management has clarified that the volume growth guidance is not including the normalization of freight prices and if this happens, the guidance can be expanded further.

- The company has not seen any drop or degradation in customer relationships due to the delays in shipping as the immediate requirements of customers were met from the warehouses in USA and Switzerland that the company owns.

- The expanded capacity in the Vietnam plant should be operational from the 1st of July.

- Vietnam capacity utilization was close to 95% in FY21. The Duggirala plant saw utilization at 65-70% in FY21.

- There was indeed some margin loss in India operations in Q4 due to higher input costs.

- The company was anticipating 30-40% growth in the India business, but it has revised its expectations down to 25-30% in FY21 due to the 2nd wave of COVID-19 if things normalize from July onwards.

- The higher input costs are due to drought conditions in Brazil which led to a rise in arabica prices. Thus correspondingly, robusta prices also went up somewhat to match it.

- But the management assures that this input price volatility will have minimal effects as most of the contracted sales of the company are on a cost-plus basis.

- The expansion in the Vietnam plant is 3500 MTPA.

- The India business sales were at Rs 150 Cr (vs Rs 95 Cr last year) of which branded sales were Rs 100 Cr while the rest was for institutions and private labels.

- The management indeed has plans to double capacity in Vietnam and will look into it in 6-9 months after the current expansion is complete.

- The management expects the company to hit peak utilization in small packs by October this year.

- Vietnam sales for FY21 were Rs 375 Cr and profits were at Rs 85 Cr.

- Switzerland sales were at Rs 180 Cr (net consolidated value addition of Rs 25 Cr) for FY21 and Profits were at Rs 6-7 Cr.

- Short-term debt has risen for CCL as these funds were raised to buy inventory of green coffee when its prices rose.

- The management has plans to reduce net debt by Rs 84 Lacs in FY22.

- The company is also installing pending small pack capacity to 12000 MT which should be available for full-scale production by Q3FY22.

- USA now accounts for 15% of sales. The management has stated that it expects better realizations going forward due to the rise in small pack sales.

- The entire small pack capacity is in India currently. The management is thinking of establishing another such facility in Vietnam in the future.

- There isn’t much clarity on the replacement of the MEIS for CCL but the management expects the pending dues of Rs 27-28 Cr to be realized in FY22.

- EU accounts for 22-25% of exports.

- The total instant coffee market in India is around Rs 2000 Cr. Going by this, the company has a market share of close to 5%.

- The company has a total reach of 95,000 outlets. It expects to reach 1.5 Lac outlets by the end of FY22. The 2 main rivals in India, Nescafe, and Bru both have total reach of 10 Lac+.

- The expected capex in FY22 is around Rs 50-60 Cr. The CWIP currently is at Rs 148 Cr.

- Volume growth in FY21 was at 10% YoY.

- The company is looking to hit sales of 50,000 MT by 2024. To do this it is looking to increase capacity to 55,000-65,000 in the same period.

- It is also targeting sales of Rs 250 Cr for the India business in the next 2 years. As branded sales rises, margins are also expected to rise to 25-30% for CCL.

- The company is already getting inquiries for 1000 MT of cold brew mix and it is very optimistic about the prospects for this product.

- Around 8-10% of retail sales are coming from e-commerce.

Analyst’s View

CCL has already established itself in the wholesale coffee space for many years and their foray into branded sales through the Continental Coffee label has been very encouraging. The company has had a good quarter with 25% YoY growth in Sales despite the rise in coffee beans. It also saw continued high utilization at the Vietnam facility. The company’s branded business is growing well and has already reached Rs 100 Cr in sales in FY21. The company is doing well to capitalize on its unique offerings and is working hard on expanding its influence. This is evident from the response seen from customers for its new cold brew product and the inquiries it is getting from export destinations. It remains to be seen how fast the capacity expansion will be done for CCL and whether the branded business will be able to maintain its growth momentum. Nonetheless, given the enormous market opportunity for the branded business in the domestic market, CCL products may turn out to be a dark horse in the global coffee industry in the years to come.

Q3 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 189 | 224 | -15.63% | 205 | -7.80% | 571 | 711 | -19.69% |

| PBT | 31 | 58 | -46.55% | 33 | -6.06% | 88 | 187 | -52.94% |

| PAT | 22 | 36 | -38.89% | 20 | 10.00% | 58 | 142 | -59.15% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 300 | 303 | -0.99% | 322 | -6.83% | 911 | 876 | 4.00% |

| PBT | 56 | 69 | -19% | 61 | -8.20% | 163 | 168 | -2.98% |

| PAT | 47 | 47 | 0% | 47 | 0.00% | 133 | 124 | 7.26% |

Detailed Results

- The company had an encouraging quarter with consolidated sales flat YoY and PAT flat YoY.

- Consolidated figures were boosted due to the low impact of COVID-19 on Vietnam operations as compared to its impact on Indian operations.

- 9M figures were good with consolidated revenues rising 4% YoY and PAT rising 7% YoY.

Investor Conference Call Highlights

- The company saw substantial stock build-up due to logistics issues and the inability to get dispatches on time.

- This problem was not unique to the company and was present for all major exporters and shippers in India like Bajaj Auto.

- Another big omission this year was the absence of MEIS which was Rs 11 Cr last year in Q3.

- During the quarter, the company suffered from a scarcity of food-grade containers and suffered a delay of 15-20 days on average.

- According to management around Rs 50-60 Cr of sales couldn’t be recognized in time in Q3 due to these delays. The majority of this was in freeze dried product.

- The company has not seen any loss in orders due to this delay because coffee has a shelf life of 2 years or more & the onus is on the customer to arrange for containers and lift them. The company also saw in many cases that customers were paying extra to procure containers and get shipments in time.

- Also there isn’t any chance of replacing any order from another vendor as any customer will need a minimum of 3 months lead time for them to procure from anybody else, according to the management.

- The company had increased manufacturing of small packs as freeze dried product was not being shipped and thus other expenses climbed up due to packing material costs going up.

- The Russia business order has been pushed to Q4 due to the shipping delay and similarly, other postponed orders have also spilled over to Q4 and Q1FY22.

- The management is unclear on what is going to happen on the MEIS replacement incentive scheme.

- Pricing is not affected by the MEIS situation and it will be affected only by the supply and demand situation in the market at the time of the order.

- For both the new installations in India and Vietnam, they are expected to be completed in Q4 and commissioned in Q1.

- The container scarcity is expected to continue for the next 1-1.5 months.

- The company is also looking to time its exports more precisely and to use its import containers for export to partially mitigate the container shortage.

- Volumes sold in 9MFY21 were similar to those in 9MFY20.

- Small packs now account for 15-20% of sales and the company has also increased small packs capacity by 40% QoQ.

- The total incentives from MEIS was Rs 33 Cr for FY20.

- Once the container issue is resolved, the management is confident of adding Rs 50 Cr to the top line from current sales figures for India operations.

- Given the dispatches go in a timely manner, the management is confident of hitting 10% volumes growth for FY21.

- The management is estimating MEIS backlog to be at Rs 28 Cr currently.

- Capacity utilization in Vietnam was at 90% while in India, FDC plant was at 80-85% and Duggirala plant was at 60-65%.

- EBITDA margins are expected to rise back to 25% from current level of 21% once the FDC dispatches are completed in time.

- The management is aiming for 80-85% capacity utilization in FY22 which brings the volumes guidance to around 33,000 tons. The volume growth is expected to be driven primarily by the increase in capacity in Vietnam which has been running at 90%+ utilization levels throughout FY21 so far.

- The volumes spill over into Q4 should yield higher margins and PBT as the expenses have already been recognized in Q3.

- The India sales for 9M were at Rs 105 Cr where Rs 70 Cr was in branded sales.

- The Swiss office should be able to add supermarket chains from FY22 onwards as the minimum of 2 years supply experience will be covered by the end of FY21.

- The management is confident of maintaining margins of 25% even without MEIS.

- The company has seen good response on the cold brew product from USA and has started getting inquiries for it from EU, Russia and others.

- Volume growth from USA has doubled YoY.

- The management has stated that it doesn’t expect any import restrictions on coffee in USA as all coffee consumed there is imported.

Analyst’s View

CCL has already established itself in the wholesale coffee space for many years and their foray into branded sales through the Continental Coffee label has been very encouraging. The company has had a modest quarter due to the container shortage which has forced many orders to be postponed to Q4. It also saw continued high utilization at the Vietnam facility. The company’s branded business is growing well and has already reached Rs 70 Cr in sales in 9MFY21. The company is doing well to capitalize on its unique offerings and is working hard on expanding its influence. This is evident from the response seen from customers for its new cold brew product and the inquiries it is getting from export destinations. It remains to be seen how long the container shortage will last and whether the branded business will be able to maintain its growth momentum. Nonetheless, given the enormous market opportunity for the branded business in the domestic market, CCL products may turn out to be a dark horse in the global coffee industry in the years to come.

Q2 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 205 | 222 | -7.66% | 176 | 16.48% | 382 | 487 | -21.56% |

| PBT | 33 | 27 | 22.22% | 24 | 37.50% | 57 | 129 | -55.81% |

| PAT | 20 | 24 | -16.67% | 17 | 17.65% | 36 | 106 | -66.04% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 322 | 299 | 7.69% | 289 | 11.42% | 611 | 573 | 6.63% |

| PBT | 61 | 44 | 38.64% | 46 | 32.61% | 107 | 99 | 8.08% |

| PAT | 47 | 42 | 11.90% | 38 | 23.68% | 86 | 77 | 11.69% |

Detailed Results

-

- The company had an encouraging quarter with consolidated sales growth of 8% YoY and PAT growth of 12% YoY.

- Consolidated figures were boosted due to the low impact of COVID-19 on Vietnam operations as compared to its impact in Indian operations.

- The company has announced an interim dividend of Rs 2 per share.

Investor Conference Call Highlights

- Capacity utilization in the Vietnam unit was near 100% in the quarter.

- The margin profile has improved for the company due to the company selling more freeze-dried products from the SEZ plant which yields gross margins of around 48%.

- The management expects the Vietnam plant to be running at nearly full capacity for the rest of the year due to the good order backlog (the large order from the USA) and expects sales volumes of at least 9000 tons from this plant in FY21. At the same time, they will also be working on increasing the capacity at this unit to 13,500 tons.

- The management guides that optimum utilization for the new FDC unit is at 80-85%. There will be a reduction in the utilization at the old facility on yearly basis due to loss of operations for 2.5 months plus the 1 month of lockdown.

- The management has assured that postponed orders from Russian customers from Q1 will be completed with the rest of FY21.

- The domestic business revenues in H1 were at Rs 60 Cr which is a growth of almost 70% YoY. This includes branded and institutional business.

- The company has already spent around Rs 5 Cr in A&P spend on branding in H1 so far.

- The company has started supplying its first private-label small pack business to the U.S. to a large retailer.

- The company has also renewed its existing supermarket business in the EU for the next year.

- The growth in the branded business in H1 was almost 100% YoY.

- The company is looking to supply several high-end products like flavoured coffees, micro-zone coffees, cold brews, and instant cold brews to its customers. The management feels there is good potential from these products due to the changing consumption pattern on the introduction of these products.

- The management is citing an example of how the company’s R&D has helped bring down the cost of cold brew products from $150/kg to $30/kg which the company sells on to a customer for $50/kg which is very attractive to the customer.

- The management expects the value proposition of these new products to sustain for at least a couple of years due to the company’s first-mover advantage.

- The new labeling and packaging plant for small packs has gotten delayed due to COVID and is expected to be fully operational by Q1FY22.

- The company is operating at peak capacity for small packs and is even exploring third-party packing for some products as demand is outstripping capacity for them.

- Value-added products account for less than 5% of total sales for the company.

- The management has stated that the scope for the single-serve pods is limited in India as there is very little usage here and it is very easy to make for every small roaster so it does not have any sustainable export advantage. The company can get into this market for India sales whenever it wants to as the market is very small.

- The management is expecting capacity utilization of 70% or more in Freeze-dried coffee in the SEZ plant.

- The Continental brand business accounts for almost 70% of domestic business. Institutional businesses have been slow in FY21 so far due to COVID but this segment is expected to improve going forward.

- The volume growth for the company has been 7% YoY.

- Spillover sales from Q1 into Q2 are expected to be around Rs 15-16 Cr.

- The management expects to maintain flat volume growth for freeze-dried coffee in FY21 and any growth in overall volumes will be driven by growth in spray-dried coffee.

- The management has maintained that Brazilian coffee exporters are not in competition with the company as 90% of their coffee is from Arabica while 95% of the company’s coffee is from Robusta.

- The company is targeting 10% volume growth in H2.

- The company’s distribution reach stands at 75,000 units currently and it is expected to reach 1,00,000 units by end of the year. The company wants to reach all of the 10 Lakh plus population towns and cities in India by the end of the year.

- The management has stated that there are clear signs of in-home consumption going up for coffee in H1 so far. It remains to be seen whether this trend is temporary or permanent.

- The company is hoping to achieve around 4-5% on average of coffee sales from all of its distribution outlets.

- The management has stated that a large part of branded sales growth has come from existing outlets as the number of news outlets to be added has been lower than before due to COVID.

- The management has maintained that demand for coffee remains resilient throughout the world and there has been no real reduction in consumption of coffee due to COVID.

- The export incentive for H1 was at Rs 18 Cr vs Rs 15 Cr last year.

Analyst’s View

CCL has already established itself in the wholesale coffee space for many years and their foray into branded sales through the Continental Coffee label has been very encouraging. The company has had a good quarter on the back of almost 100% utilization at the Vietnam facility. The company’s branded business is growing well and the management has reassured that growing the top line is the primary concern for this division. The company is doing well to capitalize on its unique offerings and is working hard on expanding its influence. This is evident from the response seen from customers for its new cold brew product and its other niche products. It remains to be seen how the coffee industry will come out from COVID-19 and whether the branded business will be able to maintain its growth momentum. Nonetheless, given the enormous market opportunity for the branded business in the domestic market, CCL products may turn out to be a dark horse in the global coffee industry in the years to come.

Q1 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 176 | 265* | -33.58% | 245 | -28.16% |

| PBT | 24 | 102 | -76.47% | 111 | -78.38% |

| PAT | 17 | 82 | -79.27% | 96 | -82.29% |

| Consolidated Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 289 | 274 | 5.47% | 267 | 8.24% |

| PBT | 46 | 54 | -14.81% | 58 | -20.69% |

| PAT | 38 | 35 | 8.57% | 42 | -9.52% |

Detailed Results

-

- The company had a modest quarter with sales growth of 5.5% YoY and PAT growth of 8.6% YoY.

- Consolidated figures were boosted due to the low impact of COVID-19 on Vietnam operations as compared to its impact in Indian operations.

Investor Conference Call Highlights

- The standalone EBITDA margins declined drastically mainly due to loss of operations from lockdown in Q1. The freeze-dried portion also declined almost 50% which led to further margin decline.

- In major markets like Russia, the majority of shipments have been postponed and thus the company was mainly planning for maintenance in Q1 and to gear up continuous production for the rest of the year.

- The SEZ plant is up and running and the EOU plant will start running after maintenance is completed in a few days.

- There has been a slight decline in roasted ground coffee consumption because of the coffee shops being shut across the world during the lockdown period.

- On the other hand, the in-home segment of instant coffee seems to be increasing across the world.

- 90% of the consumption of instant coffee is in the in-home segment.

- The company has only 10-15% of its total capacity in small packs. There is a value addition of $2 per small pack and there is also 15-20% incremental EBITDA.

- The company did have many postponements but it didn’t lose any orders or customers.

- The company’s sales of single-serve packs have increased a lot. It is also looking to get into the single-serve capsule or pod business whose global patent has run out.

- The company has added 1 new USA customer for its Vietnam facility in Q1.

- The company will be doing its best to reach 75% utilization in Freeze-Dried in FY21.

- The company is also seeing an increase in spray-dried demand as it is a value segment for most customers.

- Capacity utilization in India is expected to be between 65-75% in Fy21. The Vietnam utilization rate in Q1 was almost 100% on current capacity. The proposed capacity expansion here is expected to be done by Q3.

- Around Rs 30 Cr of inventory had to be postponed and will be dispatched in August or September.

- The management has clarified that there is no demand destruction in freeze-dried and there have only been postponements going on here.

- Continental brand has grown 40% YoY in Q1 with sales of Rs 22 Cr.

- Capex for FY21 is going to be Rs 120 Cr for the packing and agglomeration facility and $8 million in Vietnam for capacity expansion of 3500 tons.

- Green coffee prices have risen 10-15% but this rise is not sustainable according to the management as overall demand for coffee has gone down due to closure of coffee shops.

- The management has stated that none of the company’s large customers has gotten into any problems due to a drop in demand. Instead, these customers have seen good demand from panic buying.

- The revenues from Vietnam in Q1 were at Rs 107 Cr and EBITDA was at Rs 30 Cr.

- The management has stated that the primary objective of the branded business is to drive revenues so it is not guaranteed that it may turn PAT positive in FY21.

- The current sales levels in Switzerland subsidiary is expected to continue as the company has renewed contracts with customers of this subsidiary already.

- The management has stated that it doesn’t find the roasting and grinding segment as attractive as the instant coffee segment because the barriers to entry here are very low and the competition is very high. There are also other issues here including shelf-life.

- The management has stated that wherever it has built plants it has done so with the option of doubling capacity. Thus it can easily add 15000 tons to Vietnam and 5000 tons to freeze-dried plant in India any time its wants with just the installation of required machinery.

- The management has reaffirmed that the company will be both value and volume-driven. It shall be value-driven in its branded segments and volumes driven in its large supply areas.

- Q1 volumes were a little higher as compared to last year despite the lockdown.

- Revenue contribution geographically was at USA:20%, EU:20%, Russia & CIS: 25%, ROW: 35%.

- Once the planned packing facility comes online, the company can increase small packs by up to 60% in the first year of operations.

- The market size for the single-use capsule is at$ 35 billion today and it is expected to grow to $ 51 billion by 2027.

- The export incentive book in Q1 was around Rs 7 Cr.

- The company is seeing a huge demand for cold brew in the USA. It has already developed spray-dried and freeze-dried versions for it. The company has already received orders for it from some customers and in small packs. The management estimate that the company can sustain its first-mover advantage in this space for 2-3 years.

- The company is looking to do 100 tons of sales for cold brew in the first year before rising to 500-600 tons in the next year. A major customer of the company has estimated that if it uses the company’s product to sell in its 3000 stores, it will save 60% in product costs. Thus the company is also looking to target coffee chains with this product.

- The capacity enhancement in the freeze-dried line will require a plant shutdown of 2 months next year. It was to be done this year but the engineers required couldn’t come due to COVID-19.

- The company has had no impact from the depreciation of Russian ruble as all export transactions take place in dollars

Analyst’s View

CCL has already established itself in the wholesale coffee space for many years and their foray into branded sales through Continental Coffee label has been very encouraging. The company has had a modest quarter on the back of almost 100% utilization at the Vietnam facility. The company’s branded business is growing well and the management has reassured that growing the top line is the primary concern for this division. The company is doing well to capitalize on its unique offerings and is working hard on expanding its influence. This is evident from the response seen from customers for its new cold brew product. The company also has a good opportunity in the coffee capsule business whose patent has expired recently. It remains to be seen how the coffee industry will come out from COVID-19 and whether the branded business will be able to maintain its growth momentum. Nonetheless, given the enormous market opportunity for the branded business in the domestic market, CCL products may turn out to be a dark horse in the global coffee industry in the years to come.

Q4 FY20 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 245 | 225 | 8.89% | 224 | 9.38% | 957 | 839 | 14.06% |

| PBT | 111 | 61 | 81.97% | 58 | 91.38% | 298 | 179 | 66.48% |

| PAT | 96 | 49 | 95.92% | 36 | 166.67% | 239 | 125 | 91.20% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 267 | 263 | 1.52% | 303 | -11.88% | 1144 | 1085 | 5.44% |

| PBT | 58 | 47 | 23.40% | 69 | -15.94% | 225 | 209 | 7.66% |

| PAT | 42 | 35 | 20.00% | 47 | -10.64% | 166 | 155 | 7.10% |

Detailed Results

-

- The company had a modest quarter with sales growth of 1.5% YoY and PAT growth of 20% YoY.

- The FY20 figures show modest growth for the company so far this year with only 5.4% YoY revenue growth and 7.1% YoY profit growth.

- The standalone performance was phenomenal with PAT growth in excess of 90% in both Q4 and FY20 despite only having 9% and 14% YoY revenue growth in Q4 & FY20 respectively.

Investor Conference Call Highlights

- The capacity utilization at Chitoor plant has been 50-53% of which major portion came in Q3 & Q4.

- Management has stated that there wasn’t any significant revenue loss due to the lockdown in March since most of the required volumes had already been made and were just stuck due to a lack of shipping. These orders were shipped later.

- The management has stated that the main reason for the rise in margins is the improvement in product mix.

- The company did have production outage in April but it should be able to make up for it. But the management has refrained from providing any specific guidance for demand in FY21.

- The India business did around Rs 90 Cr of sales and a loss of Rs 3 Cr in FY21.

- The branded sales of the company did suffer from lockdown.

- The management has stated that the manufacturing has resumed at normal levels and the company has had zero material impact from COVID in Vietnam. Indian operations did suffer initially but it has since normalized.

- The management has observed that indeed retail demand for instant coffee has gone up while wholesale demand for coffee which is mainly in offices has gone down due to COVID. But irrespective of COVID, the overall demand for instant coffee is widely expected to go up this year.

- The company has not had any order cancellations due to COVID yet but it has indeed received some requests for postponement of shipments due to disruptions in certain markets.

- In India, the company has a combined capacity of 25,000 tons while in Vietnam, it has a capacity of 10,000 tons. The company is adding an additional capacity of 3,500 tons to the Vietnam plant. This addition was to commence from Q1 but has since been delayed to Q3 due to COVID.

- The company is not expanding its manufacturing capacity in India. It is only increasing agglomeration and packing capacity.

- The management is confident of margin expansion as the company has delivered its highest ever margins despite seeing only 50% utilization in the year.

- The branded business in India has grown 40% YoY. The company is focussing on sales and distribution in the South currently due to higher demand there. Once it establishes itself there it will expand to the rest of the country.

- According to Nielsen, the company has a market share of 2%. The management feels that according to internal sales, their market share should be around 4-5%.

- The management is confident of maintaining this growth rate for branded products as the company is seeing a good conversion from its wet sampling exercises where they do 1 lac free samples each month. Another source of confidence for the company is the fact that the company is operating in the different segments using different blends, unlike existing players who have few blends which are mostly segmented by price and overall quality.

- Currently, branded margins are depressed mainly due to incremental expenses for gaining market share and promotion. The management expects these margins to rise above bulk business margins in the long run.

- The plants were running at 33% capacity in May. This is mainly due to the presence of carryover stocks from March due to delay in shipments and orders.

- Cash conversion has been generally better in FY20 as compared to FY19 according to the management.

- The Capex planned for FY21 is Rs 120 Cr in India and Rs 80 Cr in Vietnam.

- The management expects the current product mix to continue and the margins to sustain at current levels in FY21.

- The capacity utilization for the Vietnam plant has been 65-70% in FY21 so far.

- The management expects to be spending around Rs 11-12 Cr on retail coffee business in FY21 which was the same as in FY20.

- Switzerland’s unit revenue was Rs 135 Cr and PAT was at Rs 3.73 Cr for the year.

- Vietnam unit revenue was at Rs 268 Cr and PAT was at Rs 56 Cr for the year

- Around 50% of the sales volumes are going to branded players where the company supplies them coffee in bulk.

- The aforementioned Capex of Rs 120 Cr in India was mainly towards a new packing facility for making small packs for the company.

- The opportunity size of branded coffee in India was Rs 2000 Cr in FY20. Around 60% of the instant coffee market is in South India.

- The management has stated that none of its international customers want to launch in India since the market size is still too small for them as compared to other geographies and the fact that India is predominantly a tea-drinking nation.

- The management guides for improvement of 10-15% in EBITDA in FY21 despite 1-1.5 months of the plant shutdown.

- The company did have a negative impact of Rs 3-4 Cr in Q4 due to a reduction in the export incentive from 7% to 5%. The incentive booked in Q4 was Rs 7 Cr.

- The in-house branded sales were around Rs 55 Cr in FY21.

- Currently, only 6-7% of sales are from online channels. The company is offering discounts to expand this channel and will scale back on discounting as this channel expands.

- Pre-COVID, the no of direct distribution outlets for the company were around 55,000-60,000. The company is aiming to expand this to 75,000-80,000 outlets by the end of FY21.

- The total number of distribution outlets is around 6 lakh for the major rival brands. Similarly, the total number of potential outlets in South India is around 8-9 Lakh.

- The market share for Nestle & HUL in coffee is almost 50-50.

- The stock buildup right now is Rs 33 Cr and the EBITDA margin at cost price is 25%.

- The management does not expect any significant change in raw material prices in FY21.

- The company expects orders in the USA to almost double to 4,500 to 5,000 tons in FY21 from 2,000 tons in FY20. These orders will be serviced from both India and Vietnam.

- The company is also getting into the small packs business in the USA from next month onwards.

- Currently, the debt for the company is at Rs 296 Cr. The company is aiming to pay up the debt by FY24. Roughly around Rs 76 Cr of debt repayment is to be made each year.

- The management is aiming for normal operations with a 10-15% growth in FY21.

Analyst’s View

CCL has already established itself in the wholesale coffee space for many years and their foray into branded sales through Continental Coffee label has been very encouraging. The company has had a decent quarter on the back of the improved product mix and improvement in margins and PAT. The company’s branded business is growing well and has already captured a 5% market share in South India according to internal estimates. The company is doing well to capitalize on its unique offerings and is working hard on expanding its influence. The company has had minimal impact from COVID in its Vietnam facility and has not been hit as hard from COVID-19 as other industries. It remains to be seen how the export business will pan out in the year given the logistical disruptions from COVID-19 and whether the branded business will be able to maintain its growth momentum. Nonetheless, given the enormous market opportunity for the branded business in the domestic market, CCL products may turn out to be a dark horse in the global coffee industry in the years to come.

Q3 2020 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 224.05 | 181.12 | 23.70% | 222.34 | 0.77% | 711.24 | 614 | 15.84% |

| PBT | 57.96 | 34.59 | 67.56% | 26.58 | 118.06% | 186.85 | 118.02 | 58.32% |

| PAT | 36.08 | 23.83 | 51.41% | 24.16 | 49.34% | 142.48 | 76.12 | 87.18% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 303.36 | 234.99 | 29.09% | 299.1 | 1.42% | 876.19 | 821.88 | 6.61% |

| PBT | 68.71 | 43.37 | 58.43% | 44.44 | 54.61% | 167.64 | 161.16 | 4.02% |

| PAT | 46.99 | 32.6 | 44.14% | 42.07 | 11.69% | 123.74 | 119.25 | 3.77% |

Detailed Results

-

- The company had a good quarter with sales growth of 29% YoY and PAT growth of 44% YoY. But these figures were high mainly due to the low base of Q3FY19 last year.

- The 9M figures show modest growth for the company so far this year with only 6.7% YoY revenue growth and 3.8% YoY profit growth.

- Other income was also low in Q3 coming in at Rs 6.47 Cr vs Rs 9.1 Cr last year.

- Another change as compared to last year was in 9M cost of raw materials which fell 6.4% YoY. However, 9M revenues rose 6.75% YoY.

Investor Conference Call Highlights

- The margins for the company are expected to stay stable at current levels mainly due to the shift of the product mix towards freeze-dried coffee.

- The management has mentioned that the company is operating at optimal capacity in the Vietnam facility and the company is looking to expand capacity in this unit. This is because the current product mix has caused output volumes from this unit to decline and thus the company feels the need to expand capacity to address growing demand in a timely manner.

- The volumes for the quarter were according to the company’s estimates.

- The company is going to invest $8 million for expansion in the Vietnam plant to increase capacity by 3500 tons. This expansion is expected to be done by Q1FY21. The company expects the capacity utilization in the expanded capacity in FY21 to be around 75%.

- In the domestic business, the company expects sales of Rs 100 Cr in FY20 and more than half of this is expected from the branded business. Last year the branded sales were only Rs 30 Cr vs Rs 50 Cr expected this year.

- The company spent around Rs 14-15 Cr for business expansion and marketing and the company expects to maintain this proportion going forward.

- The management has stated that the company is expecting to earn around $14 million in revenues from the proposed expansion as full capacity.

- The management admits that the YoY growth in Q3 was mainly due to lower base in Q3FY19 and QoQ growth has been normal. The realization has been higher mainly due to freeze-dried capacity working at optimal utilization.

- The Vietnam business has become EBITDA breakeven in Q3 and is expected to turn profitable in Q4.

- The company has realized the Merchandise Export from India Scheme (MEIS) of Rs 30 Cr in the year so far.

- In India operations, the company expects capacity utilization of around 80-85% in the next year. The company is also planning an activity which can increase capacity by 500 tons.

- Gross margins are expected to stay stable at current elevated levels as it has been achieved as a result of the company’s upgradation efforts and other initiatives like the improved product mix.

- The CAPEX for this year and next year in total is around $23 million which includes the $8 million expansion in Vietnam.

- The rise of coffee prices does not affect the company’s sales immediately and since the company uses 6 months or one-year contracts, the impact appears sometime in the future.

- The working capital cycle for the company has increased mainly because of enhanced operations in Switzerland unit.

- The inventory days is at 60 days and receivables are at 75 days with no change in payables.