About the Company

Divi’s Laboratories Limited manufactures and sells generic active pharmaceutical ingredients (APIs) and intermediates for in the United States, Asia, Europe, and internationally. The company also undertakes custom synthesis of APIs and intermediates; and supplies a range of carotenoids, as well as markets vitamins to nutritional, pharma, food/beverage, and feed industries. In addition, it exports its products. The company was formerly known as Divi’s Research Center and changed its name to Divi’s Laboratories Limited in 1994. Divi’s Laboratories Limited was founded in 1990 and is headquartered in Hyderabad, India.

Q4 FY23 Updates

Financial Results & Highlights

Detailed Results:

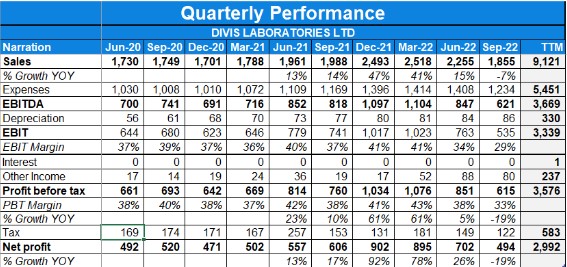

- Consolidated revenues fall by -23% YoY while profit fell by -64% YoY in Q4 FY23.

- EBITDA margins for Q4 FY23 stood at 25%.

Investor Conference Call Highlights

- The management states that despite the market volatility, Divi’s has maintained efficient and sustainable operations.

- The management states that they have capitalized on new opportunities to fuel growth after a return to normalcy in the core API product portfolio and are actively pursuing six point strategic approach to unlock further growth potential.

- The company’s custom synthesis project in collaboration with big pharma’s for contrast media production is progressing well and commercial manufacturing has started.

- FY ’22-’23 has been a year of significant progress for Divi’s with all clearances obtained for Unit 3 facility near Kakinada. Construction activity on the 500 acres of land is progressing well and capex of INR 1,200 crores to INR 1,500 crores for Phase 1 development is in the final stages of strategic refinement.

- The company achieved stability in raw material procurement and availability leading to slight softening in material prices compared to the previous quarter.

- As a conscious continuous effort made by the organization to develop and support domestic supplier base by geographically diversifying the sourcing risk, the dependency on China has been lower as compared to the previous year.

- Exports for the quarter continues to be around 90% and the export to US and Europe is about 68% of the revenue for the quarter and 70% for the year.

- The management states that product mix for generics to custom synthesis is 56:44 for the year and it is 59:41 for the quarter.

- The company has a forex loss of INR 4 crores for the quarter while a gain of INR 130 crores for the year. Due to lower sales revenue during the quarter, constant currency growth for the quarter has been negative at -32%, while it has been negative at -21% for the year.

- The company’s nutraceutical business amounted to INR 150 crores for the quarter and INR 650 crores for the year.

- The company has capitalized assets of INR 480 crores during the quarter and INR 745 crores for the year. The company has capital work in progress of INR 212 crores at end of the quarter.

- As of 31st March, the cash on books is INR 4,136 crores, receivables INR 1,793 crores and inventories INR 3,000 crores.

- The management states that raw material prices are coming down, with the benefit to be seen in the coming quarters.

- The management gives guidance of going back to the 67% to 68% gross margin levels by the end of the financial year.

- The management is very positive on Contrast media in the innovator business segment. The company has increased capacity and has qualifications under completion and growing for the Iopamidol, Iohexol in the regular generic products market.

- The management states that it is building world-class plants to be as a supplier of contrast media active ingredients and expects to become the leader in two, three years just like naproxen and gabapentin.

- The management states that Green Principles chemistry has become a must for the company to be able to do business in the US and Europe.

- The management states that it does not feel any pricing or demand pressure for some of the generic products. For few APIs, the companies are having huge stocks which they are in process of finishing.

- The management states that it expects the company to be growing at a double-digit growth continuing ahead.

- The Unit 3, will begin soon with manufacturing the Nutraceutical APIs and some of advanced intermediates, helping to free up capacity from Unit 1 and Unit 2.

- The freed up GMP, US FDA, European FDA inspected buildings in Unit 1 and Unit 2 will be able to take advantage to produce the required quantities of new opportunities of custom synthesis and other generic products.

- In Unit 3, where the company is investing INR 1,200 crores to INR 1,500 crores; first to begin with, will start manufacturing the starting materials, the intermediates, nutraceutical APIs. In the second phase, it will enter into the APIs that usually take three to four years for the qualifications and US FDA inspection.

- For Kakinada, the board estimates capex to be INR 1,200 crores to INR 1,500 crores for Phase 1; and with discussions in place to plan for the kind of investments in Phase 2. These will come from the INR 4,000-plus crores of reserves that exist.

- The management states that the Kakinada greenfield project started ground clean-up last month and they expect it to commercialize by end of the calendar year ’24.

- The management states that in generic products, the company has mainly two growth engines, firstly being the traditional and the established products like naproxen, dextromethorphan, gabapentin where they have the 60% to 70% market.

- The management states the second growth engine is other generic products where they are in 20%, 30% market and have increased the capacity substantially to become number 2 or number 1 in the market.

- The management states that the overall capacity utilization for the year stands at 77% to 80%.

Analyst’s View:

Divi’s Labs has been a celebrated API manufacturer in India for a long time. The company is doing well and differentiating itself from the rest of the Indian Pharma industry by continuing to hone its efforts in maintaining its dominance in the API industry and Custom Synthesis. The company saw a weak quarter with a sales degrowth of -23% YoY while profits collapsed by -64% YoY. It will be interesting to see whether the company’s six growth engines(Established Generics Portfolio, Generics with growth potential, the contrast media, Sartans, Future Generics & Custom Synthesis) pan out according to management expectations and whether it will face any issues in its planned expansion in Kakinada, which are currently in the execution stage coupled with high pricing pressures & high-cost impact on margins. Nonetheless, given the company’s history of excellent performance and its standing in the global API industry, Divi’s Laboratories remains a pivotal pharma stock in India, especially given the massive China substitution opportunity.

Q3 FY23 Updates

Financial Results & Highlights

Detailed Results:

- Consolidated revenues fall by 32% YoY while profit fell by 66% YoY in Q3 FY23.

- EBITDA margins for Q3 FY23 stood at 23.8%.

Investor Conference Call Highlights

- The company has capitalized INR275 crore for the first nine months of this financial year & has a capital work-in-progress of about INR575 crore as of the end of the quarter.

- The Unit 3 facility near Kakinada has received the necessary clearances from government officials.

- The management states that the Raw material procurement and availability have been stabilized and the material prices have slightly softened compared to the last quarter. However, the prices for some base metals like lithium and iodine have increased over the past quarters and it is expecting this trend to continue.

- Export for the quarter continued to be around 87%, and export to Europe and America is about 69% of revenue for the quarter and 70% for the nine-month period.

- The product mix for generics to custom synthesis is 55% and 45% for nine months, and it is 60% to 40% for the quarter.

- The constant currency growth for the quarter has been negative 40%, while it has been negative 17% for a nine-month period.

- The GPM decreased substantially as the raw material prices have gone up and there were pressures from the sales price of the API. However, management expects things to correct in the coming quarters as In several of the generics, it is seeing 50-70% of volumes improving & naturally when volumes improve, prices also improve.

- The company is likely to do investments of 1000 Cr in the Kakinada facility.

- The management states that instead of doing buyouts, it will plan to invest in new technologies in vapor phase chemistry, continuous flow chemistry, photochemistry, and in some of the newer compounds called gadolinium compounds.

- The company sees vast opportunities in the Contrast media segment which is expected to grow globally at a minimum of 10% in the coming years.

- The management is expecting strong Volumes in FY25 for NCE-based molecules which have a market of $20 billion products & patents will be expiring between FY23-25.

- The higher costs of old inventory also led to margin erosion while its old products saw realizations fall by 5-10%.

- PAT has decreased substantially due to a higher increase in other expenses in the form of plant maintenance costs to improve employee safety coupled with a higher tax rate of 29% Vs earlier rates of 15-18%.

- The current capacity utilisations stood at 75%.

- The company is commissioning 2 fast track projects & expects to fully ramp up in Q1Fy24.

- The management explains that although the generics gross margin is more than the custom synthesis gross margin however Raw material price impact in custom synthesis is less as there is no pricing pressure from the customer.

- The company’s contracts don’t have any pricing policy on a quarterly basis as It’s driven by demand and supply from the customers.

Analyst’s View:

Divi’s Labs has been a celebrated API manufacturer in India for a long time. The company is doing well and differentiating itself from the rest of the Indian Pharma industry by continuing to hone its efforts in maintaining its dominance in the API industry and Custom Synthesis. The company saw a weak quarter with a sales degrowth of 32% YoY while profits collapsed by 66%. It will be interesting to see whether the company’s six growth engines(Established Generics Portfolio, Generics with growth potential, the contrast media, Sartans, Future Generics & Custom Synthesis) pan out according to management expectations and whether it will face any issues in its proposed expansion plans in Kakinada, which are currently in the final stage coupled with high pricing pressures & high-cost impact on margins. Nonetheless, given the company’s history of excellent performance and its standing in the global API industry, Divi’s Laboratories remain a pivotal pharma stock in India, especially given the massive China substitution opportunity.

Q2 FY23 Updates

Financial Results & Highlights

Detailed Results:

- Consolidated revenues fall by 3.6% YoY while profit fell by 18.5% YoY in Q2 FY23.

- EBIDTA margins for Q2 FY23 stood at 33.4%.

Investor Conference Call Highlights

- The company experienced minimal to no disruption to customer shipments while some concerns remained regarding labor shortage.

- Raw material procurement and availability issues are slightly stabilized and prices for some raw materials marginally reduced compared to the previous quarter, while for a few like Toluene, Lithium & Iodine, it continues to increase.

- Exports for the quarter accounted for 87% where Exports to the US and Europe accounted for 68% of our revenue for the quarter and 71% for the half-year period.

- Product mix for generics to customs synthesis is 57% and 43% respectively for the quarter and 52% to 48% for half year.

- The company had a Forex gain of Rs. 31 crores for the quarter and Rs. 87 crores for the half year.

- The company’s constant currency growth for the quarter has been negative at 13% for the quarter & 2% for H1.

- The company capitalized assets of Rs. 89 crores during the quarter and Rs. 200 crores for half a year.

- The management is optimistic about the custom synthesis business however the big fast-track project opportunities depend on the rise of Covid. The management further expects the margins to remain at the current levels for the next 2 quarters due to lower revenue & higher raw material costs, however, it expects to tough margins in the range of 30’s once revenue starts rising again.

- The company expects the patents to expire between FY23-25 for new molecules while the company made DMF filing.

- The management is confident of reaching pre-covid levels in its therapeutic segment in the near future.

- The company believes that it has established a new benchmark by delivering hundreds of tons in its fast-track project within a year. Hence it is confident of getting new projects based on its performance during the covid period.

- The current utilization stands at 80-83%.

- The company is still experiencing pricing pressures in its generic API segment. However, it believes that since one of the other 2 big players is leaving the space, the company will benefit from that event in the future.

- The management states “ how big is the dream, I am not dreaming, the dreamer is the big pharma, so we think they are quite big compounds” on being asked about the custom synthesis business’s prospects.

- The management explains that in Sartans, the company is backward integrated (unlike its peers). & make its own Ortho Tolyl Benzonitrile, which is the starting material using a new technology called photochemistry.

- The company developed a cost-effective way of deriving iodine which is the key raw material of custom media & since Iodine prices rose from $15 to $80, this helped company attract two large players in the custom media segment.

- The 2 markets for custom media are CT scan & MRI scan, of which the MRI segment is larger & company is making a new entry in the MRI market (being already present in the CT scan market before).

- The management believes that the long-term trend of the China+1 policy & shift from the US/Europe to India due to lack of capacity will ensure long-term favourable growth for custom synthesis irrespective of the current global tensions.

- The management states that its backward integration efforts ensured that the company could maintain its margins, otherwise dependence on China for materials( whose prices increased by 20-40%) would have troubled the existence of the business.

Analyst’s View:

Divi’s Labs has been a celebrated API manufacturer in India for a long time. The company is doing well and differentiating itself from the rest of the Indian Pharma industry by continuing to hone its efforts in maintaining its dominance in the API industry and Custom Synthesis. The company saw a weak quarter with sales degrowth of 3.6% YoY while profits collapsing by 18%. It will be interesting to see whether the company’s six growth engines(Established Generics Portfolio, Generics with growth potential, the contrast media, Sartans, Future Generics & Custom Synthesis) pan out according to management expectations and whether it will face any issues in its proposed expansion plans in Kakinada, which are currently in the final stage. Nonetheless, given the company’s history of excellent performance and its standing in the global API industry, Divi’s Laboratories remain a pivotal pharma stock in India, especially given the massive China substitution opportunity.

Q1 FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY23 | Q1FY22 | YoY % | Q4FY22 | QoQ % | |

| Sales | 2294 | 1986 | 15.52% | 2545.5 | -9.88% |

| PBT | 844 | 814 | 3.71% | 1065.7 | -20.80% |

| PAT | 691 | 552 | 25.24% | 883 | -21.71% |

| Consolidated Financials (In Crs) | |||||

| Q1FY23 | Q1FY22 | YoY % | Q4FY22 | QoQ % | |

| Sales | 2343 | 1997 | 17.34% | 2570.8 | -8.86% |

| PBT | 851 | 815 | 5% | 1075.7 | -20.86% |

| PAT | 702 | 557 | 26% | 894.6 | -21.53% |

Detailed Results:

- Consolidated revenues rise to 17% YoY while profit saw a rise of 26% YoY in Q1 FY23.

- In Annual figures revenue grew by 15.52% YoY and PAT grew by 25.2% YoY.

- EBIDTA margins for Q1 FY23 stood at 40%.

- Cash and bank balance of company stood at Rs 3431 Cr in this quarter

Investor Conference Call Highlights

- The company had a Forex gain of Rs.56 Cr for the quarter and Rs.20 Cr last year.

- The company’s product mix for generics to custom synthesis stood at 47% and 53% respectively for the quarter.

- The company nutraceutical business for this quarter is Rs 186Cr compare Rs 138 Cr last year.

- The company constant currency growth for this quarter has been around 9%.

- The Exports for this quarter accounted 90% of total sales where to regulated market accounted for 74% of total revenue.

- Management states that company continue to face cost pressure and logistical challenges.

- The company has completed the capacity expansion of generic API this quarter.

- Company has filed DMG for 3 new API in multiple countries.

- Company new multipurpose facility for custom synthesis is completed and ready to meet additional capacity for the projects under validation.

- Company continue to experience price increase in raw material and slovents.

- Management states there is no update on KaKinada and still waiting for government clearance.

- After completing KaKinada, company is planning to take up Krishnapatnam project.

- Company is utilizing 80-85% of capacity and still large capacity is available for future demand.

- According to the management, company is expecting Rs 500-600 capex going forward in this year.

- Management gave guideline of maintaining 40% EBITDA margin for FY23.

- Company has completed all order for Molnupiravir and now waiting for fresh orders.

- Management states that 6 drivers (Established Generics Portfolio, Generics with growth potential, the contrast media, Sartans, Future Generics & Custom Synthesis) is going to drive the growth engine over the next years.

Analyst’s View:

Divi’s Labs has been a celebrated API manufacturer in India for a long time. The company is doing well and differentiating itself from the rest of the Indian Pharma industry by continuing to hone its efforts in maintaining its dominance in the API industry and Custom Synthesis. Company saw a healthy sales growth of 17% YoY, despite facing challenges in logistics costs and rises in raw material prices. The product mix remained in favour of customer synthesis which accounted for 53% of revenues in Q1. Company has filed DMG for 3 new API in multiple countries. It will be interesting to see whether the company’s six growth engines pan out according to management expectations and whether it will face any issues in its proposed expansion plans in Kakinada, which are currently in a final stage. Nonetheless, given the company’s history of excellent performance and its standing in the global API industry, Divi’s Laboratories remain a pivotal pharma stock in India, especially given the massive China substitution opportunity.

Q4 FY22 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 2545 | 1741 | 46.2% | 2483 | 2.5% | 8991 | 6861 | 31.0% |

| PBT | 1066 | 652 | 63.5% | 1037 | 2.8% | 3676 | 2628 | 39.9% |

| PAT | 883 | 488 | 80.9% | 907 | -2.6% | 2948 | 1955 | 50.8% |

| Consolidated Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 2571 | 1812 | 41.9% | 2510 | 2.4% | 9074 | 7032 | 29.0% |

| PBT | 1076 | 669 | 60.8% | 1033 | 4.2% | 3683 | 2666 | 38.1% |

| PAT | 895 | 502 | 78.3% | 902 | -0.8% | 2960 | 1984 | 49.2% |

Detailed Results:

- Consolidated revenues were very good rising 41% YoY while profit saw a rise of 78% YoY in Q4.

- Annual figures were similarly good with 29% YoY revenue rise and 49% YoY rise in PAT.

- EBIDTA margins for FY22 stood at 44%.

Investor Conference Call Highlights

- The company’s product mix for generics to custom synthesis stood at 41% and 59% for the full year.

- The company capitalized assets worth Rs.172 Cr during the quarter and Rs.935 Cr during the year. Further, it has capital work in progress of Rs.470 Cr.

- The company had a Forex gain of Rs.29 Cr for the quarter and Rs.38 Cr for FY22.

- The Exports for the year accounted for 90% of total sales where Exports to Europe and Africa accounted for 77% of total revenue.

- The company’s capacity utilisation stood at close to 80%.

- The management sees a good opportunity for growth in the generics segment since close to $40 billion worth of products will be going out of patents between FY23-25.

- The management believes that divis will be the go-to partner for big pharma companies due to its large capacity to produce small molecules.

- The company expects to spend between Rs.2000-3000 Cr in the next 2-3 years for capex.

- The management sees good growth opportunities in generics (due to higher capacity & new contracts signed), Sartan & contrast media.

- The management expects increased demand from lifestyle medicine segments in the coming quarters.

- The management states that since all of its capacities are multi-purpose facilities, they can be used to shift to other products either for the big Pharma companies or its generic division as & when required.

Analyst’s View:

Divi’s Labs has been a celebrated API manufacturer in India for a long time. The company is doing well and differentiating itself from the rest of the Indian Pharma industry by continuing to hone its efforts in maintaining its dominance in the API industry and Custom Synthesis. It had a phenomenal Q4 with 41% sales growth and 78% PAT growth while maintaining its margin profile despite challenges in logistics costs and a rise in input prices. The product mix remained in favour of customer synthesis which accounted for 59% of revenues in Q4. The management has stated that the company can see good opportunity from the evolving demand for new COVID drugs and drug combinations. It remains to be seen whether the company’s identified growth engines pan out according to expectations and whether it will face any issues in its proposed expansion plans in Kakinada where they are finally completing the delayed land acquisition. Nonetheless, given the company’s history of excellent performance and its standing in the global API industry, Divi’s Laboratories remain a pivotal pharma stock in India, especially given the massive China substitution opportunity.

Q3 FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 2483 | 1676 | 48.1% | 1986 | 25% | 6445 | 5123 | 25.8% |

| PBT | 1036 | 629 | 64.7% | 760 | 36.3% | 2610 | 1975 | 32.1% |

| PAT | 907 | 461 | 96.7% | 606 | 49.6% | 2065 | 1466 | 40.8% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 2509 | 1720 | 45.8% | 2006 | 25% | 6502 | 5224 | 24.4% |

| PBT | 1033 | 642 | 60.9% | 759 | 36.1% | 2607 | 1996 | 30.6% |

| PAT | 902 | 470 | 91.9% | 606 | 48.8% | 2065 | 1482 | 39.3% |

Detailed Results:

- Consolidated revenues were very good rising 45% YoY while profit saw a rise of 91% YoY in Q3.

- 9M figures were similarly good with 24% YoY revenue rise and 39% YoY rise in PAT.

- The company saw forex loss of Rs 3.10 Cr in Q3 vs gain of Rs 2.53 Cr YoY & loss of Rs 7.12 Cr last quarter.

Investor Conference Call Highlights

- The company has done capex of Rs 196 Cr in Q3 and expects to do Rs 100 Cr more in Q4.

- The company is now operating at 80-85% capacity according to the current safety standards.

- Divi’s saw a rise in input prices due to the energy crisis in China. Logistics remained a challenge in both procurement and dispatch of raw materials and finished products.

- Exports accounted for 92% of sales in Q3 and 90% in 9M. EU and USA accounted for 79% of revenues in Q3 and 77% in 9M.

- Product mix for generics and custom synthesis was at 43:57 in the 9M period. The ratio for Q3 was at 40:60.

- Constant currency growth for the quarter was 59% YoY, while for the nine-month period it was 32% YoY.

- The Nutraceutical business saw sales of Rs 166 Cr in Q3 and Rs 471 Cr in 9M.

- As of 31st December receivables amounted to INR2,209 crores and inventories INR2830 crores. The cash on books was INR 2,323 crores.

- The management states that the demand for COVID drugs is constantly evolving and Divis is capable of making the new drugs whenever required as it has done in the past with hydrochloroquine, molnupiravir and others.

- The management states that the company will continue to invest in increasing capacity ahead of time and it is always looking to build multi-product, multi-purpose blocks to not stay dependent on any specific products.

- The company will be receiving 500acres of land for the Kakinada project soon according to the management.

- The management states that it is not tied to any particular company for making and selling COVID drugs and it can meet the requirements of any other buyer in the market.

- The management is not worried for the lower mix of generics as it expects generics to rise up in the future as $20 billion of APIs will go off-patent between 2023 to 2025.

- The management states that the recent crackdown of the FDA on Chinese sourced APIs is indeed an opportunity for the Indian Pharma industry and for DIVI’s.

- The custom synthesis business is also expected to stay strong mainly due to the demand for nw COVID drugs and combinations.

- The management states that most generic contracts are multi-year and they have provisions for input price volatility.

- The company is looking to invest Rs 1000-2000 Cr into greenfield project in Kakinada and brownfield projects at its existing sites.

- The management expects to maintain the current revenue run rate and growth given all the different avenues of growth like generic opportunity, contrast media, sartans and custom synthesis.

Analyst’s View:

Divi’s Labs has been a celebrated API manufacturer in India for a long time. The company is doing well and differentiating itself from the rest of the Indian Pharma industry by continuing to hone its efforts in maintaining its dominance in the API industry and Custom Synthesis. It had a phenomenal Q3 with 43% sales growth and 92% PAT growth while maintaining its margin profile despite challenges in logistics costs and a rise in input prices. The product mix remained in favour of customer synthesis which accounted for 60% of revenues in Q3. The management has stated that the company can see good opportunity from the evolving demand for new COVID drugs and drug combinations. It remains to be seen whether the company’s identified growth engines pan out according to expectations and whether it will face any issues in its proposed expansion plans in Kakinada where they are finally completing the delayed land acquisition. Nonetheless, given the company’s history of excellent performance and its standing in the global API industry, Divi’s Laboratories remain a pivotal pharma stock in India, especially given the massive China substitution opportunity.

Q2 FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 1987 | 1727 | 15.1% | 1986 | 0.1% | 3966 | 3450 | 15.0% |

| PBT | 760 | 685 | 10.9% | 814 | -6.6% | 1574 | 1346 | 16.9% |

| PAT | 606 | 513 | 18.1% | 552 | 9.8% | 1158 | 1006 | 15.1% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 2007 | 1763 | 13.8% | 1997 | 0.5% | 3996 | 3506 | 14.0% |

| PBT | 760 | 693 | 9.7% | 814 | -6.6% | 1574 | 1354 | 16.2% |

| PAT | 606 | 520 | 16.5% | 557 | 8.8% | 1164 | 1012 | 15.0% |

Detailed Results:

- Consolidated revenues were up 14% YoY while profit saw a rise of 17% YoY in Q2.

- H1 figures were similarly good with 14% YoY revenue rise and 15% YoY rise in PAT.

- The company saw forex loss of Rs 7.12 Cr in Q1 vs gain of Rs 19.64 Cr in Q1 & loss of Rs 15.63 Cr last year.

Investor Conference Call Highlights

- In Q2, the company capitalized Rs 296 Cr and it now has CWIP at Rs 440 Cr.

- The company expects to spend Rs 300 Cr in capex in H2.

- The capex program done in the last 2 years for debottlenecking, backward integration, and upgrading of utilities has resulted in minimizing supply risk and production disruptions according to the management.

- The company saw an EBITDA margin of 43% in H1.

- Exports accounted for 88% of revenues in H1. EU and USA accounted for 72% of company revenues.

- The product mix in H1 was at 46:54 for generics to custom synthesis.

- Constant currency growth was 15% YoY in Q2 and 18% YoY in H1.

- The cash on books was at Rs 1763 Cr. Receivables were at Rs 1852 Cr and inventories were at Rs 2676 Cr.

- The company has started seeing sales of molnupiravir in Q2. The company won’t be doing any capex for this product for the next 2 quarters at least.

- The management is not concerned about the shift in product mix as it states that custom synthesis has gone above generics due to a few projects getting fast-tracked.

- The management believes that the oral antiviral market can grow to be as big as $30-70 billion a year and Pfizer with PAXLOVID and Merck with Molnupiravir should be the frontrunners here.

- The management states that the rise in inventories is mainly due to sourcing and stocking higher than normal raw materials to prevent any supply chain disruptions.

- The company is protected from any cost rises due to its long-term contracts with customers that have provisions for price rises.

- The capex for FY23 will depend on how soon the company gets the land for the Kakinada expansion. Capex is generally expected to be at Rs 1000 Cr to Rs 2000 Cr for the next 2 years.

- In new generic products, the company now has a 20% market share, and it will go for backward integration once it reaches 70% market share. This will be done in the same way as the company has done in the past with naproxen, dextromethorphan, gabapentin, and other products.

- Roughly solvent cost for the company is at 5-10% of revenues.

- The company will aim to manufacture most of its key raw materials but it will not go into making solvents and methanol and ethanol as the overall consumption of these solvents is much lower for the company vs the other uses in the market.

- The management maintains that the key to the growth of its API business has been quality of products, assurance of supply, and non-competing complementary role for formulation making customers for Divi’s. Customers are also more focused on ensuring consistent supply rather than the best price in the current uncertain times.

- The company has 2 international and 1 domestic stream for molnupiravir and the management states that Divi’s is ready to ramp up capacity whenever required.

- The company is still validating its contrast media developments and it will start commercial production once the validations are complete.

Analyst’s View:

Divi’s Labs has been a celebrated API manufacturer in India for a long time. The company is doing well and differentiating itself from the rest of the Indian Pharma industry by continuing to hone its efforts in maintaining its dominance in the API industry and Custom Synthesis. It had a great quarter in Q2 and was able to maintain its margin profile despite challenges in logistics costs and a rise in solvent prices. The product mix remained in favour of customer synthesis which accounted for 54% of revenues. The management has stated that the market for oral antivirals is expected to be at $30-70 billion per year and Molnupiravir which the company is contracted to make by Merck is one of the 2 frontrunners in this upcoming market. It remains to be seen whether the company’s identified growth engines pan out according to expectations and whether it will face any issues in its proposed expansion plans in Kakinada which have stalled so far due to delay in land acquisition. Nonetheless, given the company’s history of excellent performance and its standing in the global API industry, Divi’s Laboratories remain a pivotal pharma stock in India, especially given the massive China substitution opportunity.

Q1 FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 1986 | 1728 | 14.93% | 1741 | 14.07% |

| PBT | 814 | 661 | 23.15% | 652 | 24.85% |

| PAT | 552 | 492 | 12.20% | 488 | 13.11% |

| Consolidated Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 1997 | 1748 | 14.24% | 1812 | 10.21% |

| PBT | 814 | 661 | 23% | 669 | 21.67% |

| PAT | 557 | 492 | 13% | 502 | 10.96% |

Detailed Results:

- Consolidated revenues were up 14% YoY while profit saw a rise of 13% YoY in Q1.

- The company saw forex gain of Rs 19.64 Cr in Q1 vs a gain of Rs 4.81 Cr last year.

Investor Conference Call Highlights

- Divi’s capitalized Rs 268 Cr in Q1. CWIP was at Rs 579 Cr. This includes new capacities for new generic molecules.

- The 2nd stream for the new fast-track project in DCV-SEZ has been validated and is now in commercial production. The third stream for the new fast-track project is completed at Unit 1, validated, and ready to supply API to partners.

- The company was operating at full capacity in Q1. Backward integration to basic chemicals for most of its products helped minimize the supply risk and avoid production disruption according to the management.

- A rise in crude oil prices has resulted in an increase in solvent prices for the company.

- The main concerns right now are regarding logistics, freight costs, and unavailability of containers.

- Exports accounted for 89% of sales in Q1. USA & EU accounted for 70-71% of total revenues. The product mix in Q1 was 50:50 for generics and custom synthesis.

- Constant currency growth in Q1 was 21% YoY. The nutraceutical business saw sales of Rs 138 Cr in Q1.

- The company has cash on books of Rs 2060 Cr with receivables at Rs 1897 Cr and inventory at Rs 2383 Cr.

- The management states that the investment into green chemistry, backward integration, and the modernization & upgradation of plants has led to margin strengthening in the past few years for Divi’s.

- The management states that the company gets good margins on both generics and custom synthesis. Thus, margins will remain steady no matter where the product mix shifts towards.

- The management states that Divi’s has developed 6 distinct growth engines which are:

- Generics where Divis has 60-70% market share, and which is growing with 10% CAGR

- Other generics where Divis has 20-30% market share, and it is looking to rise to 60-70% market share in the next few years

- Sartans with control over nitrosamine impurity and azido impurity

- Contrast media where Divis is signing up with big players

- The 2 fast track custom synthesis projects

- New generic products whose patents will expire from 2023 to 2025

- The recent backward integration has enabled Divis to be able to control the impurities in making raw materials for Sartans and it is one of the few companies in the world with the ability to do so.

- The management states that Divis is one of the large makers of molnupiravir for Merck and the drug is still undergoing Phase III trials currently.

- The management maintains that demand for generic APIs remains strong and has not dropped down anywhere in the world.

- The growth opportunity in contrast media is expected to come from both the generic and custom synthesis business lines.

- The nutraceutical business is expected to grow 10-15% in FY22.

- The cases regarding the Kakinada plant have been dismissed in court and the company expects the AP govt to hand over the land in a month or so.

- The management maintains that opportunities like molnupiravir are going to stay strong and will not slow down in the future as many major pharma companies like Roche, Sanofi, Pfizer are pursuing these molecules.

- The management maintains that technological superiority is going to be the differentiator for Indian Pharma companies.

- The 6th growth engine mentioned above of products going off-patent from 2023 to 2025 has a market opportunity of $20-23 billion.

- The tax rate in Q1 seems to be high as the company has not seen any benefits coming from the SEZ. They should start coming in later in the year and the management expects the year-end tax rate to be below 25%.

- The capex in the next 2-3 years accounting for the new Kakinada and Krishnapatnam projects is expected to be at Rs 1000-2000 Cr.

- The management clarifies that the upcoming capex for the new Kakinada plant is for products other than the 6 identified growth engines.

- In filing for products with expiring patents, the company follows the rule that it will only file for those products where it has identified and developed an edge in terms of atom-to-atom efficiency, green chemistry, or an overall most competitive process.

- The opportunity arose when the FDA came out strong on nitrosamine impurity in sartans around 2-3 years ago. Divi’s was also audited by the FDA for the same but was found to have no impurities due to its unique making process. Thus arose the opportunity to be able to supply RM for Sartans which is free from these impurities which big pharma companies had no control over since they were sourcing these materials from the players where the impurities were found.

Analyst’s View:

Divi’s Labs has been a celebrated API manufacturer in India for a long time. The company is doing well and differentiating itself from the rest of the Indian Pharma industry by continuing to hone its efforts in maintaining its dominance in the API industry and Custom Synthesis. It had a decent quarter in Q1 and was able to maintain its margin profile despite challenges in logistics costs and a rise in solvent prices. The management identified 6 growth engines for Divi’s which should drive the growth in the future. It has seen the resolution court dispute over the Kakinada land and has plans to make Rs 1000-2000 Cr of capex to make new plants in Kakinada and Krishnapatnam. It remains to be seen whether the company’s identified growth engines pan out according to expectations and how the company will reduce its dependence on China for raw materials which is a prevalent issue with the entire industry. Nonetheless, given the company’s history of excellent performance and its standing in the global API industry, Divi’s Laboratories remain a pivotal pharma stock in India, especially given the massive China substitution opportunity.

Q4 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 1741 | 1453 | 19.82% | 1676 | 3.88% | 6861 | 5500 | 24.75% |

| PBT | 652 | 475 | 37.26% | 630 | 3.49% | 2628 | 1813 | 45.0% |

| PAT | 488 | 392 | 24.49% | 461 | 5.86% | 1955 | 1373 | 42.39% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 1812 | 1466 | 23.60% | 1721 | 5.29% | 7032 | 5584 | 25.93% |

| PBT | 669 | 471 | 42% | 642 | 4.21% | 2666 | 1819 | 47% |

| PAT | 502 | 388 | 29% | 471 | 6.58% | 1984 | 1377 | 44.08% |

Detailed Results

- Consolidated revenues were up an impressive 23.6% YoY while profit saw a rise of 29% YoY in Q4.

- The company saw forex gain of Rs 3.9 Cr in Q4 vs a gain of Rs 57.1 Cr last year.

- FY21 numbers were very good with consolidated revenues up 26% YoY and profits up 50% YoY.

- The company announced a dividend of Rs 20 per share in Q4.

Investor Conference Call Highlights

- During FY21, assets worth 1,179 crores have been capitalized.

- Capacity increases were completed in levodopa, pregabalin, mesalamine, & carbidopa.

- The debottlenecking and backward integration programs taken up during the last 2 years have also become fully operational.

- Divi’s is now working at 86% capacity utilization currently.

- As of 31st March 2021, Divi’s has cash on the book of Rs 2156 Cr, receivables of Rs 1677 Cr, and inventory of Rs 2145 Cr.

- Exports for the quarter accounted for 90% of sales, and for the year, it is 88% of sales.

- The nutraceutical business for the quarter amounted to INR 156 Cr & Rs 595 Cr for FY21.

- Currently, the ratio of API to custom synthesis is at 60-40. The company aims to bring it up to 50-50. The ratio is flexible and will be moving depending on the demand for custom synthesis and commitments towards it.

- The management claims that Divi’s has become one of the leaders in the world producing anywhere from 60% to 90% of the demand of the world for several generics. It believes that its strong suit is that it is a pure API maker which is not competing with its generic customers, unlike other Indian players. This has enabled Divi’s to command premium prices for playing complementary roles to its customers.

- The Kakinada is the main capex remaining in the company’s plans and it is waiting on the court judgment to proceed here. The supply from the added capacities is expected to start in a few months and only requires some approval which doesn’t include any inspections.

- Divi’s is MSD’s authorized manufacturer for molnupiravir API and is allowed to supply APIs to MSD’s VL partners in India.

- MSD has retained its rights for supply into the Americas, the EU, and other regulated markets. The VL is for the rest of the world. The company has 3 streams for this API currently where 2 are to be used for exports only while the 3rd is to be used for Indian makers.

- The huge cash chest is maintained to be on the lookout for acquiring newer APIs and will not be used for expansion in traditional APIs.

- The traditional generics market for naproxen, gabapentin & dextromethorphan is growing 5-15% per year. The demand for these products is steadily rising with the global aging population. In newer APIs, like levodopa, pregabalin, mesalamine, carbidopa, especially pregabalin and mesalamine, Divi’s has a market share of 20-30% and is looking to increase it to 60-70%.

- Contrast media is growing at the rate of 15% to 25%. Although the company is meeting less than 10% of market demand here, there remains a big scope for expansion here according to the management.

- There is good demand coming in from custom synthesis as most big pharma companies have sold off their API units. Thus for new compounds, they will have to turn to custom synthesis majors with big capacities like Divi’s.

- The main challenges for Divi’s remain logistics and RM sourcing. To prevent any circumstantial delays and disruptions, the company is always looking to source and keep stock of 3-6 months in advance.

- Although utilization is at 86%, the management is confident that Divi’s can introduce 10 new products and operate them at different volumes from the spare capacity.

- The management maintains that the drivers of margin expansion remain reducing RM costs and applying the tools of green chemistry that give the highest yields, highest recoveries, least waste; and consuming less raw materials while increasing atom efficiency.

- The custom synthesis will indeed yield higher margins for smaller volume products but as they transition to generic products, the margin profile gets moderated which can be enhanced with cost-cutting and operational efficiency according to the management.

- Despite the recent COVID pushed boom in global pharma, the fact remains that setting up manufacturing plants in this space requires a lot of clearances and time while the cost of running them in western economies is also high which ultimately defeats the purpose if it becomes economically unfeasible. Thus the threat from newly sanctioned and financed API makers in these markets is small for established players like Divi’s.

Analyst’s View

Divi’s Labs has been a celebrated API manufacturer in India for a long time. The company is doing well and differentiating itself from the rest of the Indian Pharma industry by continuing to hone its efforts in maintaining its dominance in the API industry and Custom Synthesis. It had another good quarter in Q4 and maintained its growth momentum in FY21 with 26% revenue growth and 44% PAT growth. The management is doing well to develop new avenues like contrast media APIs and overall efficiency through initiatives like green chemistry. It has also completed the majority of its expansion in capacities for generic APIs and nutra segment which should start contributing to sales in a few months. It remains to be seen how the company will be able to chart its path in the future by solely relying on its core areas of API and Custom Synthesis while everyone else is diversifying into as many emerging segments as they can and whether the rise in margins in FY21 can be sustained going forward. Nonetheless, given the company’s history of excellent performance and its standing in the global API industry, Divi’s Laboratories remain a pivotal pharma stock in India, especially given the massive China substitution opportunity.

Q3 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 1676 | 1431 | 17.12% | 1727 | -2.95% | 5123 | 4048 | 26.56% |

| PBT | 630 | 489 | 28.83% | 685 | -8.03% | 1976 | 1338 | 47.68% |

| PAT | 461 | 361 | 27.70% | 513 | -10.14% | 1467 | 981 | 49.54% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 1721 | 1438 | 19.68% | 1763 | -2.38% | 5224 | 4118 | 26.86% |

| PBT | 642 | 487 | 32% | 693 | -7.36% | 1997 | 1349 | 48.04% |

| PAT | 471 | 359 | 31% | 520 | -9.42% | 1482 | 988 | 50.00% |

Detailed Results

- Consolidated revenues were up an impressive 20% YoY while profit saw a rise of 31% YoY in Q3.

- The company saw forex gain of Rs 2.53 Cr in Q3 vs a gain of Rs 17.96 Cr last year.

- 9M numbers were very good with consolidated revenues up 27% YoY and profits up 50% YoY. This good 9M performance was mainly due to the stellar H1 performance and the continued growth momentum in Q3.

Investor Conference Call Highlights

- In the last few months, Divi’s has completed validations of several APIs in both the generic and custom synthesis side of the business.

- It has also started many initiatives on research, one of which is green chemistry where Divi’s is revisiting the chemistry of existing products to see possibilities of process efficiency and improve the and lowering the costs.

- The cash on books is at Rs 2064 Cr. Inventories are at Rs 9915 Cr and receivables are at Rs 1499 Cr.

- Exports for the quarter accounted for 85% of sales. EU and USA accounted for 68% of sales.

- Domestic sales accounted for 15% of total sales.

- Product mix for generics to custom synthesis is at 60%:40%.

- The company is currently offering contrast media API for iopamidol which it has been producing for many years. The management has stated that the majority of the cost in the API was in Iodine which can now be fully recycled which can lead to significant savings and minimal costs on recalling and recycling iodine from waste streams. Divi’s is also looking to start implementing in other contrast media compounds.

- The management has stated that there a reasonably good size of the market for it and Divi’s is one of very few players in the world with the capability to do so.

- The company has already gotten all the required approvals for the new unit on Kakinada. The AP govt has also set up a committee to address all the concerns raised on the unit and the company is hopeful of resolution on this issue soon.

- The management has clarified that the company is not losing any business due to the delay as Unit I & II are already done and ready for operation.

- The gross margin improvement has been a result of the introduction of new technologies, new designs of equipment by the engineering department & backward integrations with process improvement according to the management.

- The management expects growth to accelerate from Q4 or Q1FY22 onwards as 10 big molecules become generic and Divi’s has completed qualification to make them.

- The management is confident of sustaining margins at current levels.

- The capex of Rs 400 Cr announced in Q2 is ongoing and 1 stream is completed while 2 others are yet to be commissioned. Production from these new lines should start in H1FY22.

- Over 95% of the carotenoids business is from USA and EU. The revenue potential of the business at its current full capacity is Rs 600 Cr. The company has also doubled the capacity for this business after undertaking the expansion a year ago.

- The world market size for contrast media API is expected to be around $4-6 billion. The consumption of contrast media has risen a lot in the past 2-3 years. Divi’s hopes to be a major player in this field going forward.

- Green chemistry mentioned above is mostly about conservation and recycling of materials to reduce end wastage. This also leads to lower RM consumption and emissions at plants.

- The management has acknowledged that the competition from China on the API front is indeed rising but the company has been able to maintain its leadership position in many of its captive segments.

- The management has stated that the arrival of the 10 big molecules shouldn’t cause mature molecules to slow down as the demand for these old molecules remains resilient. A good example of this is ibuprofen where the company has increased capacities but demand has remained stable. In the case of the new molecules, they may cannibalize a few of the old ones but this will happen only in those used for the same kind of treatments.

- The management has stated that all of Divi’s prices are fixed beforehand in long term contracts and thus it is not concerned with spot price volatility.

- The management has stated that large volumes have declined for the industry in general as many end manufacturers already have their own API setup for large volume drugs set up and the industry is moving towards sourcing small volume and more complex products for API makers. But Divi’s has an advantage in that it can also supply large volumes of quality products whenever required.

- Although the company has visited gadolinium-based APIs in the past, it has no plans currently to get into it.

- The investments for the 10 new generic molecules are already planned and allocated. In some products, the company has already completed the submission of applications.

- The management has stated that there is no immediate big impact on the profitability of any drug when it goes off patent as there is strict resistance in the market to maintain the previous quality standards. This may go down in the case of normal drugs but in the case of critical drugs like neurological drugs, this resistance is very strong as a little variation in the impurities can cause enough disturbance in the brain in this case. Nonetheless, Divi’s is confident of maintaining margins in custom synthesis even when products are going off patent by mitigating the fall with initiatives like green chemistry according to the management.

Analyst’s View

Divi’s Labs has been a celebrated API manufacturer in India for a long time. The company is doing well and differentiating itself from the rest of the Indian Pharma industry by continuing to hone its efforts in maintaining its dominance in the API industry and Custom Synthesis. It had another good quarter in Q3 and maintained its growth momentum in 9M with 27% revenue growth and 50% PAT growth. The management is doing well to explore and develop new avenues like contrast media APIs and in overall efficiency through initiatives like green chemistry. It remains to be seen how the company will be able to chart its path in the future by solely relying on its core areas of API and Custom Synthesis while everyone else is diversifying into as many emerging segments as they can and whether the rise in gross margins in last 9 months can be sustained going forward. Nonetheless, given the company’s history of excellent performance and its standing in the global API industry, Divi’s Laboratories remain a pivotal pharma stock in India, especially given the massive China substitution opportunity.

Q2 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 1727 | 1451 | 19.02% | 1728 | -0.06% | 3450 | 2617 | 31.83% |

| PBT | 685 | 483 | 41.82% | 661 | 3.63% | 1346 | 849 | 58.54% |

| PAT | 513 | 353 | 45.33% | 492 | 4.27% | 1006 | 620 | 62.26% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 1763 | 1493 | 18.08% | 1748 | 0.86% | 3506 | 2608 | 34.43% |

| PBT | 694 | 488 | 42.21% | 661 | 4.99% | 1354 | 861 | 57.26% |

| PAT | 520 | 357 | 45.66% | 492 | 5.69% | 1012 | 629 | 60.89% |

Detailed Results

- Consolidated revenues were up an impressive 18% YoY while profit saw a rise of 46% YoY in Q2.

- The company saw forex losses of Rs 15.6 Cr in Q2.

- H1 numbers were very good with consolidated revenues up 34% YoY and profits up 61% YoY. This good H1 performance was mainly due to the stellar Q1 performance and the continued growth momentum in Q2.

Investor Conference Call Highlights

- The company has capitalized Rs 614 Cr in Q2 for the Capex program which has gotten delayed due to COVID-19. The remaining projects are expected to be completed before the end of the financial year.

- The company is planning a new Capex of Rs 400 in addition to the planned Rs 1800 Cr.

- Exports accounted for 87% of sales.

- The product mix for generics to custom synthesis is at 60% : 40%.

- Constant currency growth for the quarter has been 18% YoY.

- Nutraceuticals business amounted to Rs 167 crores for Q2 and Rs 294 crores for H1.

- The company has received some very fast-tracked projects with a lot of incentivization and high returns due to which they are planning for the new Capex of Rs 400 Cr for the custom synthesis business.

- The management has refrained from providing any comment on the concerns regarding the case against company officials brought up by SEBI.

- The company has increased its capacity dramatically from debottlenecking. Its capacity for naproxen has increased by 5000 tons and gabapentin has increased by 2500 tons.

- The management aims to sell these new incremental volumes without compromising on price.

- The new projects coming in for custom synthesis are for an organic synthesis reaction and it cannot be confirmed whether it is for COVID or any other therapy.

- The management has stated that UNIT 1 & 2 have already received USFDA clearance and thus adding additional units to these spaces will not require any more approval as it is to be used for the same product. Thus the company can immediately expand manufacturing in this UNIT and start selling higher volumes out of it.

- In the medium term, the management expects custom synthesis to lead over generic products but in the long term these divisions should be at 50-50.

- Some of the Rs 1800 Cr Capex is for debottlenecking which has been completed. Some of it is for backward integration, upgrading utility infrastructure, and the modern wastewater treatment plants at both sites. All of these are keeping in mind the next 10-15 years and preparing for new regulations to come.

- The Capex of Rs 400 Cr for the custom synthesis projects is expected to be completed in the next 6-9 months and is expected to start production immediately upon completion.

- The company is waiting on final clearance on the Kakinada site and is expected to start construction on the site in Dec or Jan. The Capex for this site is around Rs 600 Cr.

- The management is not concerned with the fact that top customers account for 35-36% of sales as they believe that as the company keeps on adding more products and capacity, new customers will come in automatically and the customer concentration will normalize naturally.

- Sales are expected to start in 203 years for the Kakinada unit with construction expected to be completed in 1-1.5 years.

- Of the new brownfield expansion for backward integration, the company can use only 25% of the new capacity. The rest is pending approval from regulatory authorities.

- The company expects sales of Rs 600 Cr in FY21 in the Nutraceutical business. It is expected to maintain a growth rate of 15-18% as the company expands to new markets.

- The management has stated that in the custom synthesis business, most of the customers are big pharma companies and many are indeed repeat customers.

- The company has not had to turn down any big orders due to a capacity shortfall so far.

- The management has admitted that gross margins near 60% are sustainable going forward.

- There are no instances of customers stocking up in APIs and most of them want delivery to be just in time. Instead many orders in December are getting postponed to January as it is the end of the year for most customers.

Analyst’s View

Divi’s Labs has been a celebrated API manufacturer in India for a long time. The company is doing well and differentiating itself from the rest of the Indian Pharma industry by continuing to hone its efforts in maintaining its dominance in the API industry and Custom Synthesis. It had a phenomenal performance in H1 with 34% revenue growth and 61% PAT growth. The management has done well to gain big and high yielding projects in the custom synthesis business which has spurred the company to do additional Capex to expand custom synthesis capacity. It remains to be seen how the company will be able to chart its path in the future by solely relying on its core areas of API and Custom Synthesis while everyone else is diversifying into as many emerging segments as they can and whether the rise in gross margins in last 6 months is sustainable as the management has stated. Nonetheless, given the company’s history of excellent performance and its standing in the global API industry, Divi’s Laboratories remain a pivotal pharma stock in India, especially given the massive China substitution opportunity.

Q1 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 1728 | 1172 | 47.44% | 1453 | 18.93% |

| PBT | 661 | 366 | 80.60% | 475 | 39.16% |

| PAT | 492 | 267 | 84.27% | 392 | 25.51% |

| Consolidated Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 1748 | 1193 | 46.52% | 1466 | 19.24% |

| PBT | 661 | 373 | 77.21% | 471 | 40.34% |

| PAT | 492 | 272 | 80.88% | 388 | 26.80% |

Detailed Results

-

- Consolidated revenues were up an impressive 47% YoY while profit saw a rise of 81% YoY in Q1.

- The company received forex gains of Rs 5 Cr in Q1.

- Most of the capex programs for FY21 have been delayed due to the non-availability of workmen of some contractors implementing the projects. The company expects these projects to be completed by H2FY21.

Investor Conference Call Highlights

- Divi’s developed a process from indigenous raw material, for hydroxychloroquine in response to COVID-19.

- It also developed a process for 4 intermediates of Remdesivir which were used to prevent shortages for the drug.

- The company has invested in debottlenecking backward integration to minimize dependency on the supply of raw materials from China. It has also invested in upgrading its existing digital and quality control infrastructure, set up the most modern water treatment facility, and built future community blocks with automation with maximum mechanization.

- The main threats posed by the pandemic to the API industry were fluctuations in the cost and availability of raw material and supply chain costs and management.

- The company has put in place several measures in order to fortify business continuity by ensuring timely procurement of raw materials, strategic implementation of production schedules, and swiftly organizing the shipment of finished products to customers.

- The company has a cash reserve of Rs 1343 Cr with receivables of Rs 1550 Cr and an inventory of Rs 1742 Cr.

- EU & Americas accounted for 74% of revenues.

- The product mix for generics to custom synthesis is at 59:41 in revenue terms.

- Constant currency growth for the quarter was 39% YoY.

- The company is looking to expand volume production capacity and producing intermediates for gabapentin to maintain its leadership in the drug. Once the dependence on imports for intermediates is eliminated, margins will rise for this product.

- Out of the proposed Rs 1800 Cr of capex, Rs 1000 Cr has already been implemented last year while the rest is under implementation.

- The company also expects around 25-30% production jump after the implementation of the debottlenecking backward integration. The main aims of the capex plan are:

- Debottlenecking backward integration.

- Introduction of new generic products.

- Custom Synthesis.

- Expanding the company’s manufacturing for the key building blocks for key generic APIs for which the company is currently dependent on China.

- The completion of the capex is also dependent on certain regulatory submissions and clearances.

- The main reason for all API companies in India doing well is the rise in volumes to replace Chinese supplies.

- Carotenoids sales have improved to Rs 127 Cr in Q1. This mainly driven by the rise in COVID-19 as Carotenoids are a natural immune booster.

- The units completed in Feb and March 2020 have only completed their validations and have yet to be commercialized.

- The prices for products like dextromethorphan has remained stable in Q1 and may have increased slightly due to additional logistical costs.

- The company is waiting for a legal resolution with the Govt for the Kakinada plant before forming any capex plans for the site.

- The management remains confident that the company will be able to meet any surge in demand given the planned capacity.

- As with the API industry benefiting from the China replacement phenomenon, the custom synthesis industry in India is also expected to benefit similarly.

- The gross block addition in Q1 was at around Rs 215 Cr.

- The management has stated that the company is operating at peak utilization levels.

- The management has stated that the company may not be eligible for the PLI scheme in APIs by the Govt of India as most of the company’s sales are in exports.

- The management mentions that there were indeed some one-offs and lumpy revenues in Q1 due to COVID-19.

- The management has stated that the company remains focused on its main strength of inventing new technologies to improve yield conversions on in-demand molecules and this provides the company with more opportunities with big pharma companies.

- In terms of margins, custom synthesis can go up to 55% or as low as 40% while generics can go anywhere between 45% to 60%. Thus overall margins can vary between 40-60% depending on the mix.

- The company is not concerned too much with the announcements by big innovator pharma companies to set up API production as it would not yield any sustainable cost advantages as compared to outsourcing to companies like Divi’s. Also getting regulatory clearance is a time-consuming process which is another roadblock in this path.

- The company has no plans to get into the biologics space at the moment.

- The management has stated that the opportunity size for APIs remains the same despite COVID-19. Only the nature of this opportunity may have changed.

- The company stands ready to make any required capex if needed in case of a surge in demand for custom synthesis.

Analyst’s View

Divi’s Labs has been a celebrated API manufacturer in India for a long time. The company is doing well and differentiating itself from the rest of the Indian Pharma industry by continuing to hone its efforts in maintaining its dominance in the API industry and Custom Synthesis. It had a phenomenal performance in Q1 with 47% revenue growth and 81% PAT growth. Though the management has admitted that Q1 had some one-off and lumpy sales, there is no denying the fact that the company is set to benefit immensely from the general industry shift away from Chinese API makers. It remains to be seen how the company will be able to chart its path in the future by solely relying on its core areas of API and Custom Synthesis while everyone else in diversifying into as many emerging segments as they can. Nonetheless, given the company’s history of excellent performance and its standing in the global API industry, Divi’s Laboratories remain a pivotal pharma stock in India, especially given the massive China substitution opportunity.

Disclaimer

This is not a piece of investment advice. Please read our terms and conditions.