About the Company

Dixon Technologies (India) Limited is the largest homegrown design-focused and solutions company engaged in manufacturing products in the consumer durables, lighting and mobile phone markets in India. Its diversified product portfolio includes Consumer electronics like LED TVs, Home appliances like washing machines, Lighting products like LED bulbs and tube lights, downlighters and CFL bulbs, Mobile phones like feature phones and smartphones, Security Surveillance Systems like CCTV & DVRs. The company manufactures and supplies these products to well-known companies in India who in turn distribute these products under their own brands.

Q4FY23Updates

Financial Results & Highlights

Detailed Results:

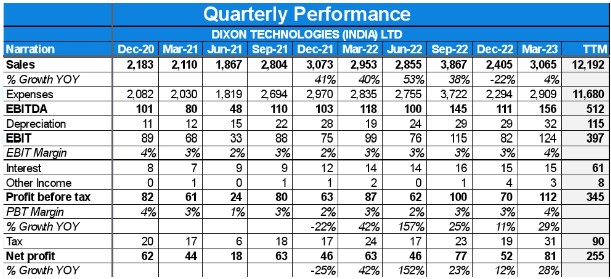

- Consolidated revenues for the quarter ended March 31, 2023, were Rs.3070 Crores, a 4% growth compared to the same period last year.

- Consolidated EBITDA for the quarter was Rs.158 Crores, a growth of 32% compared to the same period last year.

- Consolidated PAT for the quarter was 81 Crores, a growth of 28% compared to the same period last year.

- Margins improved by 110 basis points to 5.2% in the last quarter due to a change in sales mix, operating leverage, cost optimization, and efficiency measures.

- Consolidated revenues for the full year 2022-2023 were 12,198 Crores, a growth of 14% compared to the previous year.

- Consolidated EBITDA for the full year 2022-2023 was 518 Crores, a growth of 35% compared to the previous year.

- Consolidated PAT for the full year 2022-2023 was 256 Crores, a growth of 34% compared to the previous year.

- The company focused on cash conversion cycle and working capital management, resulting in a cash flow of 726 Crores from operations in 2022-2023.

- The company’s balance sheet strengthened with a gross debt to equity ratio of 0.14.

Investor Conference Call Highlights

- The company aims to sustain strong revenue growth by acquiring new customers and targeting large accounts in the mobile business.

- The company highlighted the expansion of facilities, backward integration strategies, partnerships with global brands, and participation in government initiatives such as the PLI scheme.

- The mobile segment is expected to be a significant growth driver, with manufacturing for two large global brands set to start in Q3 or mid-Q3 of the current financiall year.

- The company expects revenues from the mobile segment to exceed the government’s PLI target of 6000 Crores for FY2023-2024.

- The overall revenue growth is expected to be substantial, driven by existing and new client orders across segments.

- Television segment:

- Volume growth for television in 2021-2022 was 2.9 million, and it grew to 3.4 million in the last fiscal year, a 15% growth.

- Budgeted volume growth for the current fiscal year is around 10%, targeting 3.8 million units.

- The share of ODM (Original Design Manufacturer) in the television segment is expected to increase from the current 35% to almost 45-50% in the next 12 to 18 months.

- Roll out of own ODM Google Solutions will further contribute to growth, but ramping up will take time.

- Lighting segment:

- Market has been flattish with competitive intensity.

- Initiatives have been taken to expand the product portfolio, introduce new categories like ropes, and roll out professional lighting solutions.

- Commercial production of new categories and smart lighting from Ibahn acquisition will contribute to revenue growth.

- The company expects growth in the new category of hearables and wearables.

- The company stated that Capex for 2023-2024 is estimated to be around 400 Crores.

- The company aims to double revenue in the next three to four years.

- The company expects growth to be much ahead of industry growth.

- Mobile, washing machines, hearables and wearables, telecom devices, and Rexxam JV are expected to drive double-digit growth.

- Margin expansion is anticipated with operating leverage, ODM focus, and backward integration.

- The company stated that Apple’s presence in mobile manufacturing in India is significant, and Indian manufacturers have an opportunity through partnership routes.

- The company stated that the Chinese brands are looking to outsource base models and deepen manufacturing in India.

- Stabilizing operations and contribution from new customers will take time and specific numbers are difficult to provide.

Analyst’s View:

Dixon Technologies is one of the foremost leaders in the electronics manufacturing and outsourcing industry in India. The company had a poor quarter with sales growing extremely slowly. Capex for 2023-2024 is estimated to be around 4000 Crores. It remains to be seen how the company will reap the benefits of the giant mobile manufacturers coming in India and the tremendous growth of mobile segment, wearables and hearables that it’s expecting in future. Nonetheless, given that the company is focusing on acquiring and retaining new customers and its continuous efforts to expand existing capacities like consumer electronics and add new product lines,, Dixon Technologies is cementing its place as a good growth story in the electronics manufacturing sector in India.

Q3FY23Updates

Financial Results & Highlights

Detailed Results:

- The company had a poor quarter with revenues falling a massive 22% YoY while profit increased by 12%.

- The EBITDA margin for the company has increased by 130 bps YoY to 3.5% in Q1FY23 & EBITDA has risen 108% YoY.

- Segment-wise revenue performance in Q4 was as follows:

- Consumer Electronics: down -39% YoY (33% of Q1 revenues)

- Lighting Products: up 51% YoY (8% of Q1 revenues)

- Home appliances: up 262% YoY (9% of Q1 revenues)

- Mobile Phones: Up 327% YoY (46% of Q1 revenues)

- Security Systems: Up 75% YoY (5% of Q1 revenues)

- The company had a cash conversion cycle of +1 day.

- The company strengthened its balance sheet with a reduction in gross debt by Rs. 223 crores in the same period. The current net debt to equity stands at 0.06 as on 31st December 2022.

- It had a ROCE of 26.3% and an ROE of 22.3%.

Investor Conference Call Highlights

- The company is targeting to reduce debt by another Rs. 50 crores before March 31, ’23 and save almost Rs. 22 crores in interest cost annually.

- In consumer electronics, the company had 17% lower volumes as Diwali was 1 month earlier last year coupled with a significant correction in prices of open cells in the international market.

- The company closed the ODM sublicensing rights with Google related to Android and Google TV, which has opened up a lot of opportunities with 60% to 65% of the Indian market on this platform. It should be able to roll out the same by Q1 of the next financial year.

- The was able to increase operating margins in the lighting division, home appliances through a combination of reduction in input prices, calibrated pricing actions, inventory planning, and value engineering.

- The company’s new product categories in lighting include starting strips and rope lighting, which will be launched in March ’23, In Q3, it completed the technology acquisition of Bluetooth mesh technology and a work-inprogress WiFi solution with smart lightning from Ibahn Illumination.

- The company added new customers like Bosch, TCL, Onida & Chroma in fully & semi- automatic category.

- The new plant for LED lighting components in Dehradun will be operational in March ’23. The capital employed in this business has been reduced by Rs. 161 crores on account of huge focus on current investment.

- The company got some large orders from Nokia for feature phones & working on 2 large customer acquisition in this verticals which can potentially add almost Rs. 6,000 crores in revenues annually.

- For boAt brand,it had a revenue of Rs. 85 crores in Q3 and in 9 months, Rs. 230 crores of the current fiscal. Presently, it is manufacturing TWS and neck bands & will be adding more SKUs like Bluetooth speakers and smart watches which will be operational by March ’23.

- The weighted average selling price in Q3 stood at 11,500 Vs 16,000 YoY.

- THe management expects 20% growth in volumes term in Q4 for television segment despite industry not growing owing to new client acquisition.

- The management expects to clock revenue of 4000 Cr Vs previoud guidance of 5000 Crs for the fiscal year.

- The poor show in lighting & mobile division was owing to – , the demand being slow, unit value has significantly reducing with the migration from driver-based technology to BOB, wherein there is a reduction in unit value of almost 15% to 18% coupled with an internal reason.

- The management states that the key to growth in mobile divison is new customer acquisition & the company will be signing one new customer in Q4.

- In Security surveillance systems, it will have a challenge for a quarter or so because of shifting the campus to a new site. So, there will be some additional costs And the volumes are going to be fairly steady with a single-digit growth.

- The company believes the current order book is very strong across all segments other than lighting & mobile divison where the company is making strong recovery as well.

- The company expects to clock year end revenues of 12,200-12,700 Crs with FY24 guideline of 19000-21000 Crs.

- The volumes of Motorola has been weak despite maintaining market share in India owing to slowdown in exports.

- For 9M, ODM as % of sales stood at 24% & contributed 48% of profits..

- The guidance for mobile divison for FY24 stands at 8000 Crs.

- The Xiaomi biz didn’t perform as per expectations while growth in Samsung was strong.

- The company expects margins in EMS & mobile biz to increase in the coming year owing to new clients.

- The rate of interest on bills discounting is 7.5-8%.

Analyst’s View:

Dixon Technologies is one of the foremost leaders in the electronics manufacturing and outsourcing industry in India. The company had a poor quarter with sales degrowing owing to slowdown in lighting & mobile division. The company is participating in multiple PLI schemes like mobile phone PLI, IT hardware PLI, AC components PLI, and Telecom products PLI. It has also added refrigerators to its ODM portfolio. The management has high expectations from all its newly formed JV. It remains to be seen how the company will tackle the slowdown the RM price situation pan out, and whether its export ambitions will bear fruit as expected. Nonetheless, given the list of marquee customers that the company has gained and retained over the years and its continuous efforts to expand existing capacities like consumer electronics, add new product lines, and participate in multiple PLI schemes, Dixon Technologies is cementing its place as a good growth story in the electronics manufacturing sector in India.

Q2FY23 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 2,293 | 2,194 | 4.51% | 1,504 | 52.46% | 7,484 | 5,675 | 31.88% |

| PBT | 77 | 80 | -3.75% | 52 | -48.08% | 200 | 206 | -2.91% |

| PAT | 59 | 62 | -4.84% | 39 | 51.28% | 151 | 152 | -0.66% |

| Consolidated Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 3,867 | 2,804 | 37.91% | 2,855 | 34.04% | 10,697 | 6,448 | 65.90% |

| PBT | 100 | 80 | 25% | 62 | 61.29% | 255 | 217 | 17.51% |

| PAT | 77 | 63 | 22.22% | 45 | 71.11% | 190 | 160 | 18.75% |

Detailed Results:

- The company’s revenue grew by +37.91`% YoY & +34.4% QoQ on the consolidated basis.

- Company’s PAT grew +22.22% YoY & 71.11% QoQ

- EBITDA margins fell -0.2% from 4% in Q2FY22 to 3.8% in Q2FY23.

- PAT margin for the quarter was 2.6%.

- Segment wise revenue and operating performance in Q2FY23:

- Consumer Electronics:

- Revenue:- +1% YoY & +61% QoQ

- Operating Profit:- +19% YoY & +72% QoQ

Rev contribution:- 39% in Q2FY23 vs 53% in Q2FY22

OP contribution:- 29% in Q2FY23 vs 33% in Q2FY22

- Lighting Products:

- Revenue:- -27% YoY & +26% QoQ

- Operating Profit:- -25% YoY & +43% QoQ

Rev contribution:- 8% in Q2FY23 vs 14% in Q2FY22

OP contribution:- 16% in Q2FY23 vs 29% in Q2FY22

- Home Appliances:

- Revenue:- +62% YoY & +42% QoQ

- Operating profit:- +72% YoY & +58% QoQ

Rev contribution:- 9% Q2FY23 & 8% Q2FY22

OP contribution:- 22% YoY & 17% QoQ

- Mobile & EMS Division:

- Revenue:- +166% YoY & +22% QoQ

- Operating profit:- +119% YoY & +29% QoQ

Rev contribution:- 41% Q2FY23 & 21% Q2FY22

OP contribution:- 29% Q2FY23 & 18% Q2FY22

- Security Systems:-

- Revenue:- +19% YoY & -10% QoQ

- Operating profit:- -10% YoY & -30% QoQ

Rev contribution:- 3% Q2FY23 & 4% Q2FY22

OP contribution:- 3% Q2FY23 & 4% Q2FY22

- The company have a cash conversion cycle of zero days.

- Company had a ROCE of 27.3% & ROE of 23.9%.

- Company did CFO of 234.3Cr in H1,FY22-23.

- Company have a net debt of 139.9Cr with debt to equity of 0.13.

Investor Conference Call Highlights

- The company reduced its FY23 revenue guidance from 17,000Cr to 15,000Cr.

- The company gave guidance of 3.8%-4% EBITDA margins for FY23.

- In Q2FY23, the company generated FCF of 50.4Cr.

- The company stated that after the headwinds have passed, ROC should rise. In addition, the company anticipates a ROC of more than 40% in the next few years.

- During the first six months of FY23, the company got 4 crore in benefits under the PLI scheme.

- Company will start manufacturing TWS & Smartwatches for samsung in a dedicated plant.

- The inverter controller board for air conditioners of the 40-60 JV with Rexxam is currently operational at Noida’s production facility, with large EBITDA margins for both the domestic and international markets. This JV has a high earning potential. The company has agreed to invest 51 crores over a five-year period.

- According to the company, the lighting segment has a new management team and the business is returning to normal margins of 8%+. The company has gained new customers. The company was able to cut their working capital intensity by 85 crores. In a few more quarters, the category will be back on track for typical growth.

- The company plans to produce 1.7-1.8 billion washing machines, with 1.6-1.5 billion being semi-automatic. In the current fiscal year, 200k will be in the FATL category. The company also believes that the FATL will provide significant growth in the coming year. The company hopes to sell between 450k and 500k FATL units.

- The company expects that growth in the semi-automatic washing machine market would be muted.

- Companies are also chasing large RFQs for anchor clients in the US market for ceiling lighting.

- The company said they have executed first export order in lightning products segment. Company also expects more repeat orders from this business.

- On volumes

Company said:- “Our bulb numbers are around 43 million, baton was around again 4 million, downlighters was 1.4 million and then we had some smaller categories semi automatic washing machine we sold around 4.6 lakhs, a fully automatic washing machine we are now clocking a run rate of almost 20 to 23,000 so it was around 64000-65000 in this quarter, smartphones outside Samsung was around 10,00,000 feature phones outside Samsung was 13,00,000, smartphones for Samsung was around 26,00,000, feature phone for Samsung was around 33,00,000, CCTV was around 14,00,000, DVR was 3,00,000 so this is broadly the quantities that we sold and for both the variables and hearables we did around 2.3 million”

LED TV volume increased by 55% to 11.6 lacs in Q2FY22, compared to 7.5 lacs in Q2FY22. However, revenue did not increase because the portfolio’s selling prices dropped from Rs 18,000 to Rs 11,500.

Volumes for telecom O&D in modems for Airtel have reached a monthly manufacturing level of 100k.

- The company is increasing its capacity for ceiling lights and LED lighting by 30 million, which would result in a revenue of 300 crores. In addition, the company is investing 6Cr in strip lighting, which has the potential to generate revenue of 50Cr.

- When questioned why the revenue projection has been reduced, the company stated that the mobile market is slowing. Also, the price of open cells has corrected, resulting in lesser income for TV even while volumes are increasing.

- In 5G company have two potential opportunities.

1) mobile phone Dixon is among the first few companies to start manufacturing of 5G phones for both domestic and export market.

2) In telecom devices company is already registered UNDER the telecom PLI scheme. Company gotten a new CEO for this business who earlier use to work in tejas Networks - The company anticipates that growth in the semi-automatic washing machine market would be muted.

- Consumer Electronics

- Because of the big ODM/JDMA business, operating margins increased by 50 basis points to 2.9%.

- Volumes increased by 54% in the segment. Revenues are flat as open cell prices fall in the international market.

- The company has the largest capacity in India, including background integration, LCM, and SMT lines, catering to 35%-38% of India’s demand.

- The firm received orders from Dell for monitors, and production has already begun. The company expects volumes of 0.2 million units.

- In the last quarter, the business obtained ODM rights from Google for Android and Google TV. Because 65% of the Indian market is on this platform, there would be several prospects for the company.

- In this area, the company is also establishing an injection moulding facility, which will be operational in Q4.

- Lighting Product

- Operating margins expanded by 1% to 8.2%, in line with the company’s guidance.

- Demand is normalising as a result of channel inventory clearance and cost reductions, which will boost revenue and profitability in the coming quarters.

- With a capacity of 400 million, the company is India’s largest ODM player in lighting. 44% of India’s total requirement.

- The capital employed in this business have been reduced to Rs 85Cr.

- The company is expanding into new product categories such as lighting strips and rope lights, which will be introduced in Q4FY23.

- From Q3FY23 onwards, the company will begin exporting lighting goods to clients in the UAE.

- The company is in the process of acquiring a smart lighting company that is developing wifi-based technologies. This acquisition will be completed by Q1FY23.

- Through the PLI scheme, the company has began investing in LED lighting components. The capacity is expected to be operational by Q4FY23.

- Home appliances

- The revenue for the quarter was Rs 363 crore, with an EBITDA of Rs 33 crore. Margins increased YoY and QoQ as a result of passing on commodity costs to customers.

- According to the company, they presently have 160 semi-automatic models ranging from 6 kgs to 14 kgs with an annual capacity of 2.4 million and recorded the greatest ever output of about 1.6 lakhs in the month of. Aside from Bosch, the firm also produces equipment for Lloyd and Croma. In this area, it has begun to reach volumes of 22,000-25,000 per month.

- The company is nearing the end of a contract with a major Japanese brand in the FATL category for both domestic and global markets.

- Mobile phone and EMS division

- The quarterly EBITDA was 42Cr, with a 2.7% operating margin.

- In Q2, the company produced 1 million units for Motorola.

- The company manufactures smart and feature phones for NOKIA as well as feature phones for ITEL.Company is also expecting of getting more business from NOKIA in coming months for domestic and global markets.

- As previously stated, the company is on the verge of finalising a large order with a couple of brands for mobile phones for the domestic and export markets. Production for these brands is expected to begin in Q4FY23.

- For the R&D head position for mobile devices, the company have hired a highly senior talent, and a new team and lab will be established in Hyderabad.

- In Q2FY23, the company manufactured 3.3 million 2G phones and 2.6 million 4G phones for Samsung.

- Security surveillance

- The revenue for the quarter was 118Cr, with an EBITDA of 3.6Cr and an operating margin of 3.1%.

- The company stated that the segment’s order book is healthy.

- Company is doing capacity expansion by increasing its capacity from 10 mil per annum to 14 mil per annum. And relocating its base from Tirupathi to Kopparthi in Andhra Pradesh.

- The company has begun manufacturing in the O&D category. Airtel had placed big orders for the company’s for HD Zapper set-top boxes. Production will begin in the Q2FY24.

- As the government has extended the PLI scheme by a year, the company has opened a new facility for hybrid set-top boxes and other telecom products. The facility is scheduled to open in December 2022.

- The company is also in talks with large global brands regarding manufacturing in this category.

- Wearables & Hearables

- India is the 3rd largest market globally and also one of the fastest growing.

- Dixon & Boat JV have achieved a milestone of manufacturing 1 million devices per month. (of TWS).

- The company is building a plant in nodia to produce neck bands and smartwatches. The factory will be operational in December.

- In the first six months of FY23, the company spent 185 crores on capital expenditures, with a total capex of 330 crores planned.

Analyst’s View

Dixon Technologies is one of the foremost leaders in the electronics manufacturing and outsourcing industry in India. The company has done well to scale up its different diverse divisions: lights, consumer appliances, mobiles, etc. It has also acquired many marquee customers along the way. The company has also managed to acquire global electronics conglomerates like Samsung as a customer in different business segments. The company is also looking to capitalize its expertise and market reach to expand into export markets where there is a lot of potential for growth, especially for an electronics ODM. It remains to be seen whether the way forward for the company in the export market will be as smooth as the domestic one. The company also imports a visible majority of its raw materials for its many divisions from China and the effects of the recent coronavirus scare will only be reflected if the trade shutdown persists for more than a quarter. Nonetheless, given the list of marquee customers that the company has gained and retained over the years and its outstanding cash-generating ability, Dixon Technologies is a thus a good growth-story in the outsourced manufacturing market of India.

Q1FY23 Updates

Financial Results & Highlights

Detailed Results:

- The company had a great quarter with Q1 revenues rising a massive 53% YoY while profit increased by 152%. This was mainly due to a low base the previous year.

- The EBITDA margin for the company has increased by 90 bps YoY to 3.5% in Q1FY23 & EBITDA has risen 108% YoY.

- Segment-wise revenue performance in Q4 was as follows:

- Consumer Electronics: down -26% YoY (33% of Q1 revenues)

- Lighting Products: up 51% YoY (8% of Q1 revenues)

- Home appliances: up 262% YoY (9% of Q1 revenues)

- Mobile Phones: Up 327% YoY (46% of Q1 revenues)

- Security Systems: Up 75% YoY (5% of Q1 revenues)

- The company had a cash conversion cycle of -3 days.

- It had a ROCE of 26.5% and ROE of 24.2%.

Investor Conference Call Highlights

- Consolidated EBITDA for the quarter was at INR 101 crore vs 48 crore the previous year.

- The company reported a foreign exchange loss of 12 crore during the quarter.

- In LED televisions, Dixon has the largest capacity in India. They have a capacity of 6 million sets, which includes the backward integration in both LCM and SMT lines, and they service more than 35% of the India’s requirement.

- The management states that LED televisions has a strong order book in Q2. The company is also looking at exports to Southeast Asian markets.

- The company is in active discussions with a large brand for ODM solutions.

- As a backward integration plan, the company is also going to start indexation modelling for the mechanical televisions this year.

- The company has got large orders from large global brands for manufacturing LED monitors and production commenced in April ’22 for Dell. For Samsung, the discussions are on.

- In LED, bulb growth capacity of 300 million, which is 50% of the Indian requirement. have already expanded the annual capacity in battens to 64 million, against total annual requirement of 110 million and downlighters they have expanded to 24 million out of total Indian requirement of around 45 million.

- The company has received the first export order from the UAE market, and is working for a large RFQ for an anchor customer from US market.

- The company is in advanced plans for acquiring a smart lighting company which has cutting edge Bluetooth mesh technology and is in process for developing Wifi-based technology for smart LED lighting solutions.

- The company has started investing under the PLI scheme for LED lighting components, which is primarily in the backward integration space and lighting.

- In addition to Bosch, the company has also started manufacturing washing machines for Lloyd and Croma.

- For Motorola, the company is also getting into backward integration and is setting up an LDS line in other strategy for deepening of manufacturing.

- The company has started manufacturing Nokia’s feature phone business in addition to smartphones, and discussions are underway for ore business for smartphone for domestic and global markets.

- In Security surveillance system, the order book for the segment looks very healthy and the company is going into further capacity expansion from 10 million per annum to 14 million per annum in next three months.

- For this, the company is relocating its existing setup in Tirupati to Kopparthi electronic manufacturing cluster, where the company has taken 2 lac square feet constructed facility.

- In telecom and networking equipments, the company has started manufacturing ONTs for Airtel and JV with Bharti’s Group. Current commercial production is 70k per month.

- In addition to manufacturing laptops pre-sale, the company is also in final stages to close an agreement for manufacturing of tablets for a large global bank with production commencing in Q4.

- The company’s JV with Rexxam to manufacture inverter controller board for air controllers is now operational in new manufacturing facility in Noida.

- The company has formed a 50/50 JV with Boat for wearables and hearables by the name Imagine Marketing. Current production is 0.5 million devices per month which will be ramped up to 1.5 million devices in the next two months.

- For refrigerators, the company has started construction on a 28 acre land in Greater Noida. Capacity is being created for 1.2 million DC refrigerators in 190 to 235 litres category.

- The management states that in the lighting segment, even though input prices have softened, the effect will start reflecting from Q3 due to the previous inventory.

- The management is confident of concluding export orders from UAE and EU in the current quarter for the lighting segment.

Analyst’s View:

Dixon Technologies is one of the foremost leaders in the electronics manufacturing and outsourcing industry in India. The company had another great quarter despite challenges and margin contraction due to RM price increases and high shipping costs. The company is participating in multiple PLI schemes like mobile phone PLI, IT hardware PLI, AC components PLI, and Telecom products PLI. It has also added refrigerators to its ODM portfolio. The management has high expectations from all its newly formed JV. It has also seen the Samsung smartphones order rise to 1.5 million per month, highly increasing its chances of fulfilling the PLI scheme obligations. The company has also started passing the RM price increases to its customers and it expects margins to come back soon. It remains to be seen what obstacles it will face that may threaten to halt its growth momentum, how will the RM price situation pan out, and whether its export ambitions of Dixon will bear fruit as expected. Nonetheless, given the list of marquee customers that the company has gained and retained over the years and its continuous efforts to expand existing capacities like consumer electronics, add new product lines, and participate in multiple PLI schemes, Dixon Technologies is cementing its place as a good growth story in the electronics manufacturing sector in India.

Q4FY22 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 1670 | 1840 | -9.2% | 2090 | -20.1% | 7487 | 5677 | 31.9% |

| PBT | 48 | 62 | -22.6% | 48 | 0.0% | 200 | 206 | -2.9% |

| PAT | 35 | 44 | -20.5% | 35 | 0.0% | 151 | 152 | -0.7% |

| Consolidated Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 2954 | 2110 | 40.0% | 3074 | -3.9% | 10700 | 6450 | 65.9% |

| PBT | 87 | 61 | 42.6% | 63 | 38.1% | 255 | 217 | 17.5% |

| PAT | 63 | 44 | 43.2% | 46 | 37.0% | 190 | 160 | 18.8% |

Detailed Results:

-

- The company had a great quarter with Q4 revenues rising 40% YoY while profit increased by 43%.

- The EBITDA margin for the company has increased by 30 bps YoY to 4.1% in Q4FY22 & EBITDA has risen 49% YoY.

- FY22 figures saw revenues rising 66% YoY while EBITDA margin fell 90 bps YoY to 3.6% and PAT saw growth of 19% YoY.

- Segment-wise revenue performance in Q4 was as follows:

- Consumer Electronics: down 15% YoY (34% of Q4 revenues)

- Lighting Products: down 20% YoY (10% of Q4 revenues)

- Home appliances: up 60% YoY (8% of Q4 revenues)

- Mobile Phones: Up 348% YoY (44% of Q4 revenues)

- Security Systems: Up 0.3% YoY (4% of Q4 revenues)

- The company had a cash conversion cycle of 0 days.

- It had a ROCE of 24.9% and ROE of 21.9%.

- As of 31st March 2022, Dixon has a cash balance of Rs.176.46 Cr.

- Total cash flow from operations in Q4FY22 was at Rs.272.76 Cr.

- The company’s net debt was at Rs.140.63 Cr in March.

Investor Conference Call Highlights

- The company expanded its annual capacity of the AC PCB division to 6 million leading to the ability to cater to almost 35% of India’s market requirements.

- The management expects LD volumes to grow by 40% in the coming FY on account of a big order win while margins will remain stable or increase due to operating leverage.

- The management states that the LED bulb segment has a capacity of 300 million, which is 50% of India’s requirement.

- The company made a subsidiary- Dixon Technologies Solutions Private Limited in line with its backward integration strategy and it will be making investments of INR 20 crore this year and overall investment to the tune of INR 100-odd crore in 5 years.

- The management is expecting a 30% growth in the washing machine segment.

- The company is making an entry in the refrigerators segment where it will be creating a capacity of almost 1.2 million direct cool categories, which will be ultimately expanded to the frost-free category as well. Its product portfolio will be from 190 to 235 litres with multiple features and different star ratings.

- The company entered in 51:49 JV made with Betel for telecom and networking products.

- The company entered into a 60:40 JV with Rexxam to manufacture inverter controller boards for air conditioners.

- A 50:50 JV has been formed with Imagine Marketing for its flagship brand, Boat for manufacturing variables in wearables where currently the company is manufacturing TWS and has an estimated yearly volume order of around 7 million units. The company will soon start the production of the neckband with an estimated yearly order of around 4.44 million units at our Noida manufacturing facility.

- The management expects growth of close to 1.5X in its mobile division with expected revenue of close to Rs.7000-7500 Cr in FY23.

- The management is seeing inflationary pressures in the biz & is unable to pass price hikes in its lighting division. It expects the margin to reach back to the original after 2 quarters.

- The management is guiding for revenue growth of 55-60% for FY23 & margin profile of 4-4.25%.

- The company is planning a Capex of Rs.340 Cr in FY23.

- The management states that out of Rs.7000 Cr of potential revenues from mobile biz in FY23, Rs.6000 Cr will be contributed by Motorola.

- The management states that it is comfortable with the existing level of debt & doesn’t plan to raise any equity.

- The company is not planning to enter into the AC business as it wants to consolidate in its existing verticals.

- The company is not facing any chip shortage currently.

Analyst’s View:

Dixon Technologies is one of the foremost leaders in the electronics manufacturing and outsourcing industry in India. The company had another great quarter despite challenges and margin contraction due to RM price increases and high shipping costs. The company is participating in multiple PLI schemes like mobile phone PLI, IT hardware PLI, AC components PLI, and Telecom products PLI. It has also added refrigerators to its ODM portfolio. The management has high expectations from all its newly formed JV. It has also seen the Samsung smartphones order rise to 1.5 million per month, highly increasing its chances of fulfilling the PLI scheme obligations. The company has also started passing the RM price increases to its customers and it expects margins to come back to 4% and above soon. It remains to be seen what obstacles it will face that may threaten to halt its growth momentum, how will the RM price situation pan out, and whether its export ambitions of Dixon will bear fruit as expected. Nonetheless, given the list of marquee customers that the company has gained and retained over the years and its continuous efforts to expand existing capacities like consumer electronics, add new product lines, and participate in multiple PLI schemes, Dixon Technologies is cementing its place as a good growth story in the electronics manufacturing sector in India.

Q3FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 2090 | 1897 | 10.2% | 2195 | -4.8% | 5817 | 3836 | 51.6% |

| PBT | 48 | 76 | -36.8% | 80 | -40.0% | 152 | 144 | 5.6% |

| PAT | 35 | 57 | -38.6% | 62 | -43.5% | 116 | 107 | 8.4% |

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 3073 | 2182 | 40.8% | 2804 | 9.6% | 7746 | 4339 | 78.5% |

| PBT | 63 | 81 | -22.2% | 80 | -21.3% | 168 | 155 | 8.4% |

| PAT | 46 | 61 | -24.6% | 62 | -25.8% | 127 | 115 | 10.4% |

Detailed Results:

- The company had a weak quarter with Q3 revenues rising 40% YoY while profit dropping by 25%.

- The EBITDA margin for the company has fallen by 120 bps YoY to 3.4% in Q3FY22 & EBITDA has risen 3% YoY.

- 9M figures saw revenues rising 79% YoY while EBITDA margin fell 140 bps YoY to 3.4% and PAT saw growth of 10% YoY.

- Segment-wise revenue performance in Q3 was as follows:

- Consumer Electronics: down 5% YoY (46% of Q3 revenues)

- Lighting Products: Up 9% YoY (14% of Q3 revenues)

- Home appliances: down 20% YoY (6% of Q3 revenues)

- Mobile Phones: Up 57% YoY (31% of Q3 revenues)

- Security Systems: Up 14% YoY (4% of Q3 revenues)

- The company had a cash conversion cycle of 0 day.

- It had a ROCE of 24.1% and ROE of 21.2%.

- As of 30th Sep 2021, Dixon has a cash balance of Rs 266.23 Cr.

- Total cash flow from operations in Q2FY22 was at Rs 126.74 Cr.

- The company’s net debt was at Rs 40.5 Cr in Sep from a negative net debt of Rs 8.04 Cr in March.

Investor Conference Call Highlights

- The major reason for the margin contraction is an increase in commodity & freight prices and a rise in revenue mix from mobile business.

- The company has an annual capacity of 5.5 million after backward integration exercise which serves 35% of India’s market.

- The company is making investments in injection molding units in the integrated Tirupati campus, which will be operational by the Q1 end of this fiscal.

- The company has received a huge order for LED TVs from a large global brand for which commercial production is expected to start from May of the forthcoming year meanwhile commercial production of another order which was received in the previous quarter for LED TVs is expected to start by April of next fiscal with expected volumes in year 1 of around 0.5 million.

- In LED bulb, the company has a capacity of 300 million, which is almost 50% of the Indian requirement & it has already expanded the capacity in battens to 5 million per month and in downlighters to 1.5 million per month.

- The company is in the final stage of approvals for both technical and commercial from its global customers and the export will be starting from the forthcoming quarters.

- The company received approval under the PLI scheme of the government of India for manufacturing LED lighting components through its wholly owned subsidiary Dixon Technologies Solutions Private Limited & as a part of backward integration strategy, the company will be committing 100 crores for this project which will also help in margin expansions.

- In the home appliances segment, the company has 160-odd models in the semi-automatic category with the largest portfolio ranging from 6 kgs to 14 kgs. It now also possesses the largest capacity of semi-automatic washing machines, which is almost 2.4 million annually.

- Additional industrial footprint in Dehradun will be operational by Q1 of next fiscal which will help in meeting the festive demand.

- Motorola mobile business has now ramped up and stabilized with monthly volumes touching at 215K and the company has a strong order book for around 1.2 million in Q4 and 1.6 million to 1.7 million starting to Q1 next fiscal.

- The company also finalized the Nokia feature phone business with a monthly volume of 0.5 million units in addition to smartphones that they are currently manufacturing, and production is likely to commence from Q1 next fiscal. In addition, it has acquired a new customer-Itel in the feature phone category. A 2 lakh square feet facility in Noida has been purchased to meet the demand from these customers.

- The order books on Samsung smartphones have also significantly increased from 1 million to almost 1.5 million a month which makes the company one of the only players to achieve the thresholds for revenue & investments as prescribed under the PLI scheme.

- In the set-top box business – the company has manufactured 6.5 lakh set-top boxes for Jio, DISH TV, SITI cable, SUN TV, and reported revenues of INR 70 crores with 2.3% operating margin, and order book in this vertical is also stable.

- Given the robust order book in the camera & DVR segment, the company is going into further capacity expansion from 10 million per annum to 14 million per annum by Q1 next fiscal. For this, they are relocating their existing set-top box factory in Tirupathi to Kopparthi Electronic Manufacturing Cluster where they have taken a 2 lakh square feet constructed facility.

- The company is pursuing new opportunities in the refrigerator segment for which initially they will be creating a capacity of 0.6 million direct cool refrigerators, which will be further ramped up to 1 million.

- The management states that they have started manufacturing laptops for Acer from December 21, and volumes are expected to increase significantly from next fiscal.

- Partnerships for this quarter include 51-49 JV with VT for telecom and networks, 40-60 JV with Rexxam, Japan for inverter controller board for air conditioners, 50-50 JV with BoAt for manufacturing of wearables & wearables.

- The company has started passing price hikes to the customers of the ODM business and expects margins to increase from the next quarter itself.

- Profitability has been lower due to a high mix of low margin businesses like mobile & television coupled with high fixed costs due to new factory set up & raw material & freight inflation.

- The management expects the margins to compress during the coming years due to a switch in prescriptive business, however due to higher asset turnover because of higher turnover – the return ratios on capital will improve from 30% to close to 40%.

- The volume from the consumer electronics segment has fallen by 8% YoY however pricing increase led to 3% revenue growth.

- Capex for the current year will stand close to Rs.370-380 Cr meanwhile net debt stands at Rs.100 Cr

- The management believes that the current run rate for the automatic washing machines is 10K per month & expects to ramp it up to 300K per month from next fiscal.

- Open sell prices for LED TVs have softened significantly & management expects it to stabilize.

- Management is confident of doing Rs.2500 revenue for PLI this year and touching Rs.4000 Cr ceiling in the next fiscal.

- Due to the conversion cost being on an absolute side rather than the percentage of the price at which sales are made, the margins for the consumer electronics business looks optically lower whenever the price of the goods increase, thus one must look at absolute growth in EBIDTA & the ROC profile.

- Due to backward integration, margins in ODM business are expected to increase by 0.7-1%.

- Debtor days have improved due to factoring done by the management along with favorable collection terms in the new mobile business with Motorola.

- Margins in the JV with Rexxam will be 7-8% & the JV is expected to generate revenues of close to Rs.300 Cr from the next couple of years.

- Investment in the LED segment will be Rs.100 Cr with revenues of close to Rs.130-140 Cr & PLI incentive of 6% in the first year leading to EBIDTA margins of 9-10%.

- The margins are expected to rationalize back to 4-4.2% from the current levels of 3.5%

- The company passes on price increases in its prescriptive business (which involves mobiles, set-top box, security service & consumer electronics business) immediately and is not affected by commodity inflation. However, it passes on price hikes in the ODM business (which involves washing machines & lighting) with a lag of 1-3 months leading to margin compression due to raw material inflation.

Analyst’s View:

Dixon Technologies is one of the foremost leaders in the electronics manufacturing and outsourcing industry in India. The company had another great quarter despite challenges and margin contraction due to RM price increases and high shipping costs. The company is participating in multiple PLI schemes like mobile phone PLI, IT hardware PLI, AC components PLI, and Telecom products PLI. It has also added refrigerators to its ODM portfolio. The management has high expectations from all its newly formed JVs. It has also seen the Samsung smartphones order rise to 1.5 million per month, highly increasing its chances of fulfilling the PLI scheme obligations. The company has also started passing the RM price increases to its customers and it expects margins to come back to 4% and above soon. It remains to be seen what obstacles it will face that may threaten to halt its growth momentum, how will the RM price situation pan out, and whether the export ambitions of Dixon bear fruit as expected. Nonetheless, given the list of marquee customers that the company has gained and retained over the years and its continuous efforts to expand existing capacities like consumer electronics, adding new product lines, and participating in multiple PLI schemes, Dixon Technologies is cementing its place as a good growth story in the electronics manufacturing sector in India.

Q2FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 2196 | 1473 | 49.1% | 1531 | 43.4% | 3727 | 1939 | 92.2% |

| PBT | 80 | 66 | 21.2% | 24 | 233.3% | 104 | 69 | 50.7% |

| PAT | 62 | 48 | 29.2% | 18 | 244.4% | 81 | 50 | 62.0% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 2805 | 1639 | 71.1% | 1868 | 50.2% | 4672 | 2156 | 116.7% |

| PBT | 80 | 72 | 11.1% | 24 | 233.3% | 104 | 74 | 40.5% |

| PAT | 63 | 52 | 21.2% | 18 | 250.0% | 81 | 54 | 50.0% |

Detailed Results:

- The company had a phenomenal quarter with Q2 revenues rising 71% YoY and profit rising 21%.

- The EBITDA margin for the company has fallen by 150 bps YoY to 4% in Q2FY22 & EBITDA has risen 24% YoY.

- H1 figures followed a similar trend with revenues rising 117% YoY while EBITDA margin fell 160 bps YoY to 3.4% and PAT saw growth of 50% YoY.

- Segment-wise revenue performance in Q2 was as follows:

- Consumer Electronics: Up 55% YoY (53% of Q2 revenues)

- Lighting Products: Up 34% YoY (14% of Q2 revenues)

- Home appliances: Up 54% YoY (8% of Q2 revenues)

- Mobile Phones: Up 203% YoY (21% of Q2 revenues)

- Security Systems: Up 149% YoY (4% of Q2 revenues)

- The company had a cash conversion cycle of -1 day.

- It had a ROCE of 30% and ROE of 26.1%.

- As of 30th Sep 2021, Dixon has a cash balance of Rs 266.23 Cr.

- Total cash flow from operations in Q2FY22 was at Rs 126.74 Cr.

- The company’s net debt was at Rs 40.5 Cr in Sep from a negative net debt of Rs 8.04 Cr in March.

Investor Conference Call Highlights

- The major reason for the margin contraction is an increase in commodity prices and a rise in the ODM mix for TVs.

- The commercial operations in the new TV expansion should start in Q4 and it has an annual capacity of 1 million units.

- After the capacity enhancement in downlighters, the company now has a total capacity of 1.5 million vs an industry requirement of 3 million.

- The company has gotten technical approval for exporting lighting products to Europe.

- The company has filed for PLI application for the lighting products space. The total investment in the PLI project for lighting is expected to be at Rs 100 Cr over the next 5 years.

- The company’s new plant in Dehra Dun is expected to bring up the total capacity for semi-automatic washing machines to 2.4 million units by May 2022.

- The company has added 3 new customers in washing machines and its fully automatic top loading machine making plant is now operational and it has already gotten an order for 15000 units from an anchor customer.

- The Motorola mobile business is now at volumes of 2000-3000 units per month. The company has also finalized the order to make feature phones for Nokia along with smartphones and it expects quarterly volumes of 5 Lac units from this association from Q4 onwards.

- On the Samsung side, the company is now making 6-10 lac units per month and it has received requests to increase capacity to 15-16 lac units per month. The company has acquired land in Gurgaon and is planning on building an integrated mobile phone campus there next year.

- The company has kicked off the refrigerator project. It will have an initial capacity of 6 lac DC units which will be ramped up to 10 lac units by FY24. This should enable the company to service 11-12% of India’s requirements.

- The company has formed the JV with Bharti Group with Dixon having a 51% stake in it. The JV has already gotten PLI approval.

- Dixon has entered an MoU with Rexxam whom Dixon currently outsources the assembly of PCB assemblies for Daikin India. The JV will be owned 40% by Dixon and it has already applied for the PLI scheme for AC components.

- The management acknowledges that the feature phone demand will come under pressure in the future, but this will only lead to customers leaning for 4G and 5G smartphones from Dixon.

- The management admits that the margin profile for Dixon will remain under pressure due to commodity price volatility and sustained rise in shipping costs.

- The company has partnered with Siemens for its factory automation initiative which is expected to be completed in 8-12 months. This initiative will be first applied in the TV and lighting plants.

- The current volumes of the PLI revenue stream for smartphones are around 3-3.25 lac per month and are expected to grow to 4.15 lacs in the next quarter.

- The feature phone volumes under the PLI scheme are expected to be at 1 million a month.

- The Samsung business of over 1 million units per month is not covered under the PLI.

- The approvals for the US market are still pending approval.

- LED monitor capacity will be at 5 lac units initially and will be scaled up to 1 million units in the 2nd year of operations. The management expects this business to generate Rs 400-450 Cr of sales in its 1st year.

- The IT products production will start from Dec and the management remains confident that it will be able to reach the performance ceilings prescribed under the PLI scheme.

- The company is planning to do a capex of Rs 320 Cr in the next 6 months.

- In the semi-automatic washing machine category, the company has added new customers in Tier 2 and Tier 3 categories.

- The company is expecting sales of Rs 1400-1600 Cr in the next year for the JV with Bharti. Which should rise to Rs 8000-9000 Cr of annual sales in the next 5 years.

- The management has guided for margins to remain in the range of 4-5% in the next 5 years.

- The company expects to see margin expansion in the mobile business as operating leverage kicks in with volume growth.

Analyst’s View:

Dixon Technologies is one of the foremost leaders in the electronics manufacturing and outsourcing industry in India. The company had another great quarter despite challenges and margin contraction due to RM price increases and high shipping costs. The company is participating in multiple PLI schemes like mobile phone PLI, IT hardware PLI, AC components PLI, and Telecom products PLI. It has also added refrigerators to its ODM portfolio. The management has high expectations from all its newly formed JVs. It is also looking to start the LED monitor business which is expected to generate Rs 400-450 Cr of sales in its 1st year. It remains to be seen what obstacles it will face that may threaten to halt its growth momentum, how will the RM price situation pan out, and whether the export ambitions of Dixon bear fruit as expected. Nonetheless, given the list of marquee customers that the company has gained and retained over the years and its continuous efforts to expand existing capacities like consumer electronics, adding new product lines, and participating in multiple PLI schemes, Dixon Technologies is cementing its place as a good growth story in the electronics manufacturing sector in India.

Q1FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 1531 | 466 | 228.59% | 1841 | -16.82% |

| PBT | 24 | 2 | 905.42% | 62 | -61.08% |

| PAT | 18 | 2 | 901.10% | 45 | -59.51% |

| Consolidated Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 1867 | 516 | 261.82% | 2111 | -11.56% |

| PBT | 24 | 2 | 1011% | 61 | -60.66% |

| PAT | 18 | 2 | 1035% | 44 | -58.73% |

Detailed Results:

- The company had a decent quarter with Q1 revenues rising 261% YoY and profit rising 1035%. This was mainly due to the low base in Q1FY21.

- The EBITDA margin for the company has fallen by 70 bps YoY to 2.6% in Q1FY22 & EBITDA has risen 182% YoY due to the low base last year.

- Segment-wise revenue performance in Q1 was as follows:

- Consumer Electronics: Up 262% YoY (68% of Q1 revenues)

- Lighting Products: Up 98% YoY (8% of Q1 revenues)

- Home appliances: Up 193% YoY (4% of Q1 revenues)

- Mobile Phones: Up 476% YoY (16% of Q1 revenues)

- Security Systems: Up 462% YoY (4% of Q1 revenues)

- The company had a cash conversion cycle of 0 day.

- It had a ROCE of 31.5% and ROE of 27.1%.

- As of 30th June 2021, Dixon has a cash balance of Rs 174 Cr.

- Total cash flow from operations in Q1FY22 was at Rs 37.52 Cr.

- The company’s net debt has risen to Rs 54.35 Cr in June from a negative net debt of Rs 8.04 Cr in March.

Investor Conference Call Highlights:

- The utilization of lighting products is expected to come back to 85-90% in August.

- Gross & EBITDA margin contraction YoY was driven by changes in the segment mix with a higher increase in the share of low margin LED TVs during the quarter. The company also faced negative operating leverage which also put pressure on margins.

- Rising commodity costs since November last year continued in Q1 and hampered the operating margin of the ODM business.

- Inventory levels have risen due to weak demand and securing raw materials and components in advance due to the ongoing supply chain and logistics issues in the world.

- Dixon currently has a capacity of 4.4 million TV sets including backward integration in LCM and SMT lines. It has started production of large screen sizes like 70, 75, and 85 inches in the current quarter for anchor customers.

- Its capacity expansion to 5.5 million will be executed by August, adding new automated 65 inches integrated lines with LCM and FA and 1 more high-speed SMT line. The increased capacity of 5.5 million is expected to account for 35% of domestic demand.

- The capacity of the SMT line has also been increased to 2.7 million per year from 1.8 million previously.

- Dixon is aiming to set up a capacity of 1 million LED monitors and the production will be commencing by Q3. The margins here are expected to be similar to LED TV. The initial volume for this product is expected to be at 0.5 million which is expected to increase to 1 million per year in the next 2 years.

- Margins in the lighting business were negatively affected by reverse operating leverage due to a drop in volumes, a rise in input costs, and a lag in passing on price increases.

- In the LED bulb segment, Dixon has a capacity of 300 million which is almost 50% of the Indian requirement.

- Dixon is in the process of developing outdoor lighting solutions, and its first project will be launched by September ‘21 which also includes streetlights.

- The company has 160-odd models in washing machines and the largest product portfolio ranging from 6 to 12 kgs across the semi-automatic category. It is also increasing its capacity from 1.2 million to 1.5 million units in August.

- The facility for top-loading fully automatic washing machines in Tirupati is ready and the mass production will start from September ’21 with a product portfolio of 96 variants across 6 to 10 kg categories.

- Dixon has begun exporting mobile phones for Motorola to Southeast Asia and North America.

- Around 65-70% of revenues in the mobile phone PLI scheme are expected to come from Motorola.

- Dixon is in talks with another big mobile phone player in North America.

- Production has started for Samsung 4G phones and Dixon has an order book of almost 1 million 4G phones per month in Q2.

- Dixon has manufactured almost 6 lakh set-top boxes for Jio, Dish TV, Siti Cable, and others for Q1. The order book in this vertical is at 0.5 million set-top boxes per month but there are supply challenges due to the unavailability of semiconductors.

- In Medical electronics, Dixon sold 145 units of the RT-PCR machines in Q1.

- The company is planning to create a capacity of 0.6 million DC category initially in the refrigerator category which will be ramped up to 1 million.

- Dixon is also eligible for the IT hardware PLI scheme and has partnered with a large brand to move forward in this business opportunity.

- Dixon has entered into a JV with Bharti Enterprises to make telecom and network application products. The JV will have 74% ownership by Dixon and 26% by Bharti Enterprises. The operations will be managed by Dixon.

- On Wearables and hearables, Dixon has started manufacturing TWS for boAt.

- The company is also looking to apply for the AC components PLI scheme for PCB assembly.

- The telecom JV is expected to reach revenues of almost Rs 2000 Cr in the next 2 years.

- In the PLI for AC-PCB, revenues are expected to reach Rs 400-450 Cr in the next 2 years. In the PLI for IT products, the revenues are expected to reach Rs 800-1000 Cr and in the refrigerator business, revenues are expected to reach around Rs 500-600 Cr, given sales volumes of 0.5 to 0.6 million.

- In the new businesses (telecom, laptops, etc.) the operating margins are expected to be at 2.8% to 3.5%, including the benefits from the PLI schemes. In the refrigerator ODM business, the operating margin is expected to be at 8% to 10%.

- The management expects the margins in the lighting business to come back to 8-9%.

- The management expects Motorola to source 8-10% of its global requirement from Dixon.

- Although there are significant challenges in sourcing raw materials and components in almost all businesses, Dixon has enough stock in inventory to ride out the situation according to the management.

- The company is waiting to get safety approvals for its lighting products from various countries after which it can start exports of its lighting products. It will be exporting primarily to USA and Western Europe initially.

- The order book for both lighting products and washing machines had fallen in Q1 due to local lockdowns and both have risen back to previous levels now. The washing machine order book has even risen to 150k in Aug & Sep from the normal level of 100k-110k per month.

- The management expects a normalized margin profile of 3.5-3.75% as most of the incremental growth will be driven by the new business lines.

- The management expects to achieve 3x revenue growth from FY21 to FY24 with revenues for FY22 expected to be at 11,500-12,000 Cr.

Analyst’s View:

Dixon Technologies is one of the foremost leaders in the electronics manufacturing and outsourcing industry in India. The company had a decent quarter despite challenges and margin contraction due to RM price increases and local COVID lockdowns. The company is participating in multiple PLI schemes like mobile phone PLI, IT hardware PLI, AC components PLI, and Telecom products PLI. It is looking to expand aggressively in these new business lines and is also looking to add refrigerators to its ODM portfolio. The management has set an ambitious target of achieving 3x revenue growth from FY21 to FY24. It remains to be seen what obstacles it will face that may threaten to halt its growth momentum, how will the RM price situation pan out, and whether the export ambitions of Dixon bear fruit as expected. Nonetheless, given the list of marquee customers that the company has gained and retained over the years and its continuous efforts to expand existing capacities like consumer electronics, adding new product lines, and participating in multiple PLI schemes, Dixon Technologies is cementing its place as a good growth story in the electronics manufacturing sector in India.

Q4FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 1841 | 768 | 139.71% | 1897 | -2.95% | 5677 | 3681 | 54.22% |

| PBT | 62 | 40 | 55.00% | 76 | -18.42% | 206 | 142 | 45.1% |

| PAT | 45 | 30 | 50.00% | 57 | -21.05% | 152 | 111 | 36.94% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 2111 | 857 | 146.32% | 2183 | -3.30% | 6450 | 4405 | 46.42% |

| PBT | 61 | 37.0 | 65% | 82 | -26% | 217 | 157 | 38% |

| PAT | 44 | 28 | 57% | 62 | -29.03% | 160 | 121 | 32.23% |

Detailed Results

- The company had a phenomenal quarter with Q4 revenues rising 146% YoY and profits rising 57% YoY.

- The EBITDA margin for the company has fallen by 270 bps YoY to 3.8% in Q4FY21 & EBITDA has risen 45% YoY.

- Segment-wise Q4 & FY21 Revenue performance is as follows:

- Consumer Electronics: Up 200% YoY in Q4 & 83% YoY in FY21 (60% of FY21 revenues)

- Lighting Products: Up 50% YoY in Q4 & down 3% YoY in FY21 (17% of FY21 revenues)

- Home appliances: Up 63% YoY in Q4 & 9% YoY in FY21 (7% of FY21 revenues)

- Mobile Phones: Up 381% YoY in Q4 & 56% YoY in FY21 (13% of FY21 revenues)

- Security Systems: Up 100% YoY in Q4 & 1% YoY in FY21 (3% of FY21 revenues)

- Reverse Logistics: Down 18% YoY in Q4 & 14% YoY in FY21 (0.2% of FY21 revenues)

- The company had a cash conversion cycle of 0 day.

- It had a ROCE of 31.4% and ROE of 25%.

- Total cash as of 31st March 2021 was at Rs 63.94 Cr.

- Total cash flow from operations in FY21 was at Rs 170.11 Cr.

- The company has negative net debt of Rs 8.05 Cr.

- The company announced a final dividend of Rs 1 per share for FY21.

Investor Conference Call Highlights

- Gross & EBITDA margin contraction was primarily driven by an increase in the share of business during the quarter from LED TVs, which is an OEM business with a lower margin, and from steep price increases on the commodity side.

- In the ODM business also, there was a negative impact from commodity price increases as there is a lag in passing on the price increases to the customer.

- Dixon currently has a capacity of 4.4 million TV sets, including backward integration in both LCM and SMT, which is the largest capacity in India. It has already started production of large-screen TVs like 70, 75 inches, and 85 inches for its anchor customers.

- Dixon is adding a new automated 65-inch integrated line with LCM and FA and increasing the total capacity to 5.5 million units.

- Dixon’s PCB capacity with the new line of SMT is going to further increase from 1.8 million to 2.8 million.

- It has also tied up with 2 large global brands for manufacturing LED monitors. And the production will commence from Q3 of FY22. Dixon is aiming to set up a capacity of 1 million LED monitors by the start of Q3. The operating margin in this space is expected to be at 2.7-2.9%.

- Dixon is in the process of developing outdoor lighting solutions, namely street lights, and commercial lights, and these will be launched in Q2FY22.

- The company has 140-odd models and the largest product portfolio ranging from 6 to 12 kgs across the semi-automatic category. It is also increasing its capacity from 1.2 million to 1.5 million units.

- The new facility for fully automatic top loading in Tirupati has been set up already. Commercial production should start here by the start of Sep with nearly 40 models in the range of 6-10 kgs. Samples have been submitted to the anchor customer Bosch for approval already.

- Dixon commenced production for Motorola in mid-March and for Nokia in Feb. It has a strong order book from Motorola with 60-65% of these orders for exports.

- Dixon is the first Indian mobile manufacturing company, which has an Indian infrastructure and is capable of building the 5G phone as per any global requirement according to the management.

- Dixon made 6 lakhs set-top boxes in the last quarter and 21 lakhs in the whole year. The order book in this vertical looks very healthy with almost 0.5 million set-top boxes per month. But due to a shortage of components, Dixon will only be able to deliver around 0.35 million per month starting Q2.

- In Medical and electronics, Dixon made almost 550-odd units of RT-PCR machines.

- The company has decided to go ahead with the refrigerator product in the direct cool categories. It will initially be creating a capacity of 0.6 million which will be ramped up to 1 million. The category will be 170-220L. the target for production commencement in Q3FY23.

- Dixon has entered into a JV with Bharti Enterprises to make telecom and network application products. The JV will be owned 74% by Dixon and 26% by Bharti.

- The company is targeting to start exporting the 5G phone to the U.S. for Motorola from August or September.

- The revenue potential of the set-top box business is around Rs 450-500 Cr with a reduced delivery capacity of 0.35 million units per month. The company is supplying to Jio, Den, hatchway, SITI & DishTV in this space.

- The medical devices revenue potential should be around Rs 12-13 Cr per year according to the management.

- The company is looking to participate in the PLI schemes for lighting, IT hardware, network products & AC components.

- The total capex for FY21 was at Rs 167 Cr. The capex for FY22 will be much higher than FY21 as the company will be looking to participate in different PLI schemes.

- The total capex for refrigerators is expected to be at Rs 100 Cr in the next 1.5 years.

- The mobile sales in Q4 were marginally lower due to the shortage of chipsets and displays and other supply chain issues.

- The management expects the deliveries to Bosch to start around Oct and the formal launch of the products by Bosch by Dec or Jan. the initial deliveries will be in the 6-8 kgs category.

- The total capacity for fully automatic washing machines is around 6 lacs and the company will be targeting to reach sales of Rs 550-600 Cr in the next 2-2.5 years considering 80% capacity utilization. Operating margins in this segment will be in the low double digits.

- The company is going to look into backward integration for lighting products in the direction of plastics. It will require a capex of Rs 50-60 Cr across 4-5 years and should help in margin appreciation of 2-6%. By this time, the batten capacity is expected to rise to 5 million units.

- The company has a tie-up with boAt for wearables and it will be pursuing this segment aggressively as this is a high growth space in India.

- The market opportunity for Dixon in the telecom and network products space is around Rs 1600-1800 Cr per year.

- The current business in AC PCBs is around Rs 110-120 Cr.

- The management expects the overall margin profile to be in the range of 4-4.5%.

Analyst’s View

Dixon Technologies is one of the foremost leaders in the electronics manufacturing and outsourcing industry in India. The company had a phenomenal quarter with revenues rising 146% YoY and profits rising 57% YoY from last year. The company is looking to start exporting 5G smartphones for Motorola from Sep this year already. It is also looking to apply for 4 PLI schemes which are Mobile Phones, AC components, Lighting, and Telecom & Network Products. Despite the issues of components shortage for the TV industry, Dixon is confident of being able to complete its commitments without many hiccups. It remains to be seen whether the company will be able to expand aggressively as it has done in the recent past and what obstacles it will face that may threaten to halt its growth momentum in its emerging segments like refrigerators & street lighting. Nonetheless, given the list of marquee customers that the company has gained and retained over the years and its continuous efforts to expand existing capacities like consumer electronics and adding new product lines like disruptive medical devices, Dixon Technologies is cementing its place as a good growth story in the outsourced manufacturing sector in India.

Q3FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 1897 | 810 | 134.20% | 1473 | 28.78% | 3836 | 2913 | 31.69% |

| PBT | 76 | 30 | 153.33% | 66 | 15.15% | 145 | 103 | 40.78% |

| PAT | 57 | 22 | 159.09% | 48 | 18.75% | 107 | 80 | 33.75% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 2183 | 996 | 119.18% | 1639 | 33.19% | 4339 | 3548 | 22.29% |

| PBT | 82 | 35 | 134% | 72 | 13.89% | 156 | 120 | 30.00% |

| PAT | 62 | 26 | 138% | 52 | 19.23% | 116 | 93 | 24.73% |

Detailed Results

- The company had a phenomenal quarter with Q3 revenues rising 119% YoY and profits rising 138% YoY.

- The EBITDA margin for the company has fallen by 80 bps to 4.6% in Q3FY21 & EBITDA has risen 89% YoY.

- Segment-wise Q3 Revenue performance is as follows:

- Consumer Electronics: Up 199% YoY (62% of current revenues)

- Lighting Products: Up 26% YoY (16% of current revenues)

- Home appliances: Up 68% YoY (5% of current revenues)

- Mobile Phones: Up 114% YoY (14% of current revenues)

- Security Systems: Up 10% YoY (3% of current revenues)

- Reverse Logistics: Down 3% YoY (0.2% of current revenues)

- The company had a cash conversion cycle of 1 day.

- It had a ROCE of 31.7% and ROE of 23.8%.

Investor Conference Call Highlights

- The EBITDA margin contraction in Q3 was primarily driven by a substantial change in the segment mix with a higher increase in the share of business during the quarter from LED TVs and due to certain input price increases.

- The management expects the cost pressure to continue in the near to medium term.

- The company has completed the automation of 1/3 of its capacity for LED bulbs.

- It has also decided to expand capacity at a new site in Dehradun in an adjacent plot of land for semi-automatic washing machines from 1.2 million to almost 1.6 million.

- The plant in the Tirupati campus for fully automatic top loading is almost complete. The lines are being laid, and the trials will begin in February and early March. It will have a capacity of 600,000 units.

- Dixon has closed agreements with new global customers Motorola and Nokia. The commercial production for Nokia has already started.

- The capacity for smartphones is expected to be at 20 million units per year for the next 2 years which should yield sales of Rs 25000-28,000 Cr in the next 5 years.

- In set-top boxes, Dixon manufactured 9 lakhs set-top boxes for Jio, DISH, and SITI Cable in Q3. It has an order book for 3-4 lac units per month for the next few quarters.

- The order book and the forecast given by Motorola is consuming almost all of the ceiling that the government offers in the mobile phone PLI scheme.

- The management has stated that the business should become sustainable by the time the PLI scheme is over in 2025 as the goal of the scheme is to create a stable environment for local companies to be able to compete globally.

- The management expects TV volumes sold to be at least 20-25% up from last year.

- The main issue in the TV business is not the demand but it is the supply chain challenges like the availability of open cell in glass.

- The company is already near full utilization in the new capacity in battens and downlighters.

- The LED TV market in India has shifted from 32 inches to 43 inches. Thus unit sale value has gone up by 14-15k in last 2 quarters.

- The wearables market in India is expected to be at Rs 5000 Cr. Dixon has tied up with boAt to create a new brand in this space.

- In Q3, in the mobile business, 75% of revenues have come from Xiaomi and Samsung. Rest 25% came from all other brands.

- The management expects sales volumes for Samsung to reach 0.7 million in the next fiscal year.

- The set top box market opportunity is expected to be around Rs 350-400 Cr for Dixon. This is mainly from domestic sales and the company is not looking at export options for it at the moment.

- The management shouldn’t have any problems sourcing the components for the mobile phones as they are sourced and procured by the brand owner.

- The company is not expected to be affected by the rise in duty for some input materials for PCBs as the rise in duty is for a small part of the overall PCB and this minor cost increase will anyway be passed on to the customer.

- The company has done capex of Rs 104 Cr in 9M, most of which was for the full auto washing machine plant and the mobile PLI project. The overall capex for Fy21 is expected to be around Rs 145-155 Cr.

- In terms of sales volumes, the company sold 6 Cr light bulbs, 45 lac battens, 14 lac downlighters, 46-47 lac of other lighting products. It also sold 2.4 lac washing machines and 75 lac phones of which 72 lac were feature phones and 3 lac were smartphones. It also sold 9 lac CCTVs and 9 lac set top boxes.

- Given the company’s capabilities in the lighting business, the management feels that it can venture into export markets. The company already has a full portfolio of lighting options and is already #3 or #4 in terms of LED bulb volumes in the world.

- The global lighting market is around $8 billion and the company will be aiming for a $500 million slice of this pie in the next 4-5 years.

- The management has guided that EBITDA margins should be at 4.5% at least in FY22.

- The main international competition other than China for contract manufacturing for India are Vietnam, Thailand, and Philippines according to the management.

Analyst’s View

Dixon Technologies is one of the foremost leaders in the electronics manufacturing and outsourcing industry in India. The company had a phenomenal quarter with revenues and profits doubling from last year. Demand has come back fast in all of its segments and the company has already acquired Motorola and Nokia as customers for mobile phones whose volumes should help Dixon reach the volume ceiling for the PLI scheme easily. Despite the issues of components shortage for the TV industry, Dixon is confident of being able to complete its commitments without many hiccups. It remains to be seen whether the company will be able to expand aggressively as it has done in the recent past and what obstacles it will face that may threaten to halt its growth momentum in its emerging segments. Nonetheless, given the list of marquee customers that the company has gained and retained over the years and its continuous efforts to expand existing capacities like consumer electronics and adding new product lines like disruptive medical devices, Dixon Technologies is cementing its place as a good growth-story in the outsourced manufacturing sector in India.

Q2FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 1473 | 1167 | 26.22% | 466 | 216.09% | 1939 | 2103 | -7.80% |

| PBT | 66 | 42 | 57.14% | 2 | 3200.00% | 69 | 73 | -5.48% |

| PAT | 48 | 38 | 26.32% | 2 | 2300.00% | 50 | 58 | -13.79% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 1639 | 1405 | 16.65% | 517 | 217.02% | 2156 | 2552 | -15.52% |

| PBT | 72 | 48 | 50.00% | 2 | 3500.00% | 74 | 84 | -11.90% |

| PAT | 52 | 43 | 20.93% | 2 | 2500.00% | 54 | 67 | -19.40% |

Detailed Results

- The company had a great quarter so far with Q2 revenues rising 17% YoY and profits rising 21% YoY.

- The EBITDA margin for the company has fallen by 80 bps to 5.5% in Q2FY21 & EBITDA has risen 36% YoY.

- Segment-wise Q2 Revenue performance is as follows:

- Consumer Electronics: Up 30% YoY (59% of current revenues)

- Lighting Products: Up 4% YoY (18% of current revenues)

- Home appliances: Up 4% YoY (9% of current revenues)

- Mobile Phones: Up 2% YoY (12% of current revenues)

- Security Systems: Down 9% YoY (2% of current revenues)

- Reverse Logistics: Down 5% YoY (0.2% of current revenues)

- The company had a cash conversion cycle of 0 days.

- Net Debt was at Rs 17.13 Cr with net debt to equity at 0.03 times.

- It had a ROCE of 26.9% and ROE of 20.7%.

Investor Conference Call Highlights

- Dixon hopes to achieve an ROCE of 30%+ and an ROE of 25%+ in forthcoming quarters and years.

- LED TV revenues were at Rs 957 Cr vs Rs 738 Cr last year, strong growth of 30% YoY. Operating profit margins also expanded from 2.4% to 2.8% YoY on the back of the scale, a higher level of backward integration, the expansion of PCB capacity, and improved sales mix towards larger sizes of above 43 inches.

- Dixon completed the capacity expansion to 4.4 million TVs including backward integration and LCM which is around 30% of the Indian LED TV market. This capacity is expected to be increased to 5.5 million units by the end of FY21.

- The decision to increase LED TV capacity was taken due to the imports on complete LED televisions being shifted to the prohibited category.

- The latest customer addition in the customer portfolio of LED television is Vu, which is a significant domestic player in LED television. The production for Vu is going to start in November.

- Another new customer in the LED TV category is OnePlus. Production for OnePlus will start from Q4.

- Dixon already has a capacity of almost 200 million to 250 million LED bulbs, which is more than 40% of the Indian requirement.

- Dixon has expanded its capacity of battens from 250,000 in Phase 1 to 1.5 million. In downlighters, capacity has expanded from 150,000 per month to 600,000 per month and will go up to 1.2 million per month by Q1FY22.