About the Company

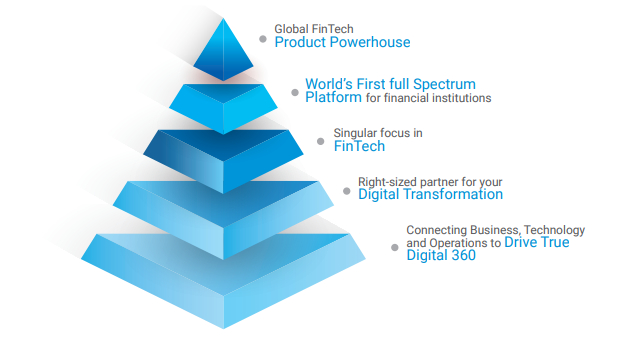

Intellect Design Arena is a global leader in Financial Technology for Banking, Insurance, and other Financial Services. It is positioned at the forefront of the digital transformation that global banks are looking for in a connected world. Intellect’s robust iDigital platform enables products across four distinct lines of businesses: Global Consumer Banking (iGCB), Risk, Treasury & Markets (iRTM), Global Transaction Banking (iGTB), Central Banking, and Insurance (Intellect SEEC). Deep banking domain expertise, coupled with investments of Rs 800 Crores over the last ten years in developing the world’s first full spectrum of banking products has made Intellect the company with one of the most advanced technologies for financial institutions with global businesses.

If you want a quick snapshot of the company’s strengths and weaknesses, click here

Q2 FY23 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 348 | 313 | 11.18% | 362 | -3.87% | 1,255 | 1,003 | 25.11% |

| PBT | 25 | 76 | -67.11% | 61 | -59.02% | 233 | 264 | -11.74% |

| PAT | 17 | 56 | -69.64% | 41 | -58.54% | 207 | 202 | 2.48% |

| Consolidated Financials (in Crs) | ||||||||

| Q2FY23 | Q2FY22 | YoY % | Q1FY23 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 528 | 452 | 16.81% | 541 | -2.40% | 1,878 | 1,497 | 25.75% |

| PBT | 29 | 91 | -68.13% | 93 | 69.82% | 413 | 290 | 51.72% |

| PAT | 46 | 80 | -42.50% | 69 | -33.33% | 350 | 265 | 32.08% |

Detailed Results:

1.The company’s revenue grew by +16.8`% YoY & down -2.40% QoQ on the consolidated basis.

2.Company’s PAT fell -42.50% YoY & -33.33% QoQ

3.EBITDA margins fell from 26% in Q2FY22 to 16% in Q2FY23.

- Gross margin for the quarter was 56%.

- Currency wise revenue mix:

- a) USD:- 36%

- b) INR:- 27%

- c) GBP:- 20%

- d) CAD:- 8%

- e) EURO:- 3%

- f) Others:- 6%

- Segmental growth:

- a) Platform revenue: +33% YoY

- b) icense: -22% YoY

- c) AMC: +10% YoY

- d) Licence linked revenue: +7% YoY

(Licence+Platform+AMC)

- e) ARR: +22% YoY

(On Annualised Basis)

- Days of sales outstanding (DSO) by geography:

- a) Global: 115

- b) India: 164

- Some deal wins in Q2FY23:

1) A leading North America insurance technology company helping commercial insurance brokers and carriers accelerate workflows through its open data platform selects Intellect’s Magic Submission to turn broker submissions into fully structured carrier opportunities.

2) A FinTech company licensed by the Saudi Central Bank as the first company to provide micro-financing services to consumers across the Kingdom has chosen Intellect Debt Management platform (IDM), iTurmeric and ARX.

3) A top 10 Canadian bank signed up for Payments to enable their customers for Payment Tracking & Real Time Rail and PSH-C Release 3.0 Web Logic & Non-Intrusive Ops Release.

4) One of the fastest-growing private wealth management firms in India has chosen Intellect’s digital wealth platform to accelerate business expansion and improve operational efficiencies through STP.

5) One of the largest banks in the Gulf region with over $118 billion in assets and presence in 12 countries has gone live with Intellect Debt Management to optimize their collection process while enhancing customer experience.

6) Fastest go-live at a central bank in Oceania, replacing their legacy system with a fully functional and function-rich treasury system, Capital Cube, in just 11 months.

- Cash & Cash Equivalent for the quarter was 501Cr vs 257Cr in Q2FY22

Investor Conference Call Highlights

1.Mangement acknowledge the disappointment among investors for the Q2FY23 results with that mangement also said that we are a license revenue company.

2.Company guided for above 20% margins for full year.

3.The company stated that $6 million may have flowed into the quarter but could not owing to non-contracting. This is a one-time occurrence in which earnings are on the low side.

4.Due to the shift from product to platform, growth will be slower for the next two to three years.

5.According to the company,the cost structure may increase by 2 million to 3 million every quarter due to the additional personnel requirements and DTM platform.

6.Revenues associated with licences (License+SAAS+AMC). 53% of revenue mix, or 277 crore, recorded YoY growth of 8.1%. The license-related revenues were moderate.

7.The company stated the following factors are affecting its growth:

- i) the demand environment is slowing down ii) customers are taking longer to make decisions.

iii) transaction sizes have either shrunk or customers are requesting stretched transactions to get money on their side save up.

It was mentioned that the customer review process has changed for vendors where decision making used to be fairly quick (through dance and theater sessions), while customers now require on-site validation and go through the product for some time before making the final decision . Intellect also noted that Destiny Deals take even longer to close due to the longer customer selection process, which takes around four to six months. It also notes that the timeframe is longer as it is now targeting big deals and competing with some of the big contenders like Thought Machine & Temenos

8.The company stated that deal conversion is slowing down (44% today vs. 50% a few quarters ago), even while the funnel is consistent at US$818 million, up 1.6% QoQ. Nine platform transactions were among the 14 new contracts company secured during the quarter. Destiny deals for the company climbed by two during the quarter, bringing the total to 66. However, from US$6.2 mn in Q1FY23, the average size of destiny deals shrank to US$5.5 mn.

9.The company stated that they used to spend about 120 crore annually on R&D. However, because to the rupee’s decline versus the dollar, it is now showing | 150 crore. The company invested | 35–40 crore this quarter, which is consistent with their earlier predictions.

10.The company stated that, while the funnel remains stable at US$818 million, up 1.6% year on year, deal conversion is slowing (44% currently vs. 50% a few quarters ago). During the quarter, Intellect won 14 new deals, including nine platform deals. During the quarter, the company’s destiny deals increased by two, bringing the total to 66. However, the average size of destiny deals fell to US$5.5 million in Q1FY23 from US$6.2 million in Q1FY23.

- While licencing revenues (which are lumpy in nature) decreased 21.8% YoY to 68 crore, SAAS revenues (22.6% of the mix) grew 35.4% YoY to 119 crore. AMC revenue increased by 10.6% year over year to $90 crore, while implementation revenue increased by 27.9% year over year to $251 crore.

12.The company stated that, while the funnel remains stable at US$818 million, up 1.6% year on year, deal conversion is slowing (44% currently vs. 50% a few quarters ago). During the quarter, Intellect won 14 new deals, including nine platform deals. During the quarter, the company’s destiny deals increased by two, bringing the total to 66. However, the average size of destiny deals fell to US$5.5 million in Q1FY23 from US$6.2 million in Q1FY23.

Analyst’s View

Intellect Design Arena is a good player in the digital transformation space especially for financial institutions. They have been on a consistent growth path for last several quarters. The revenues of the company have been consistently growing and the high customer retention rate further emphasizes their service and product quality and overall stickiness of their offerings. Considering the current pipeline of orders, their execution capability and reasonable valuation, we believe it seems to be an interesting investible idea.

Q4 FY22 Updates

Financial Results & Highlights

| Standalone Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 360 | 283 | 27.2% | 325 | 10.8% | 1291 | 1019 | 26.7% |

| PBT | 72 | 59 | 22.0% | 50 | 44.0% | 264 | 222 | 18.9% |

| PAT | 51 | 56 | -8.9% | 40 | 27.5% | 202 | 207 | -2.4% |

| Consolidated Financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 523 | 400 | 30.8% | 519 | 0.8% | 1918 | 1510 | 27.0% |

| PBT | 106 | 82 | 29.3% | 118 | -10.2% | 413 | 290 | 42.4% |

| PAT | 95 | 82 | 15.9% | 101 | -5.9% | 350 | 265 | 32.1% |

Detailed Results:

- The company had a great quarter with consolidated revenues rising 30% YoY while PAT grew 16% YoY.

- In $ terms, revenues grew 24% YoY in Q4.

- SaaS revenues rose 84% YoY in Q4.

- License revenues decreased by 6% YoY. AMC revenues were up 14% YoY in Q4.

- The gross margin was at 57.2% which is up 40 Bps YoY.

- EBITDA margin decreased by 180 Bps YoY to 23.7% while EBIDTA grew by 19% YoY.

- The Net Days of Sales Outstanding (DSO) is 115 days in Q4.

- The company has zero net debt and cash equivalents of Rs.257 Cr.

- Investment in product development was Rs.29.7 Cr in the current quarter

- The current deal pipeline is sitting at Rs.5455.6 Cr. It accounts for 167 opportunities out of which it has 61 destiny deals having an average deal size of Rs 45.1 Cr which accounts for 64% of total opportunities.

- The company had 6 new deals including 3 in platform businesses.

- The board of directors recommended final dividend of Rs.2.5.

- The large deals in Q4 include

- Strategic deal wins from Reserve Bank of India and a leading private sector multinational bank in India in Q4 FY 22

- iGTB partners with Microsoft to establish Corporate Banking transformation on Cloud

- 35 new Customers have chosen Intellect’s Digital stack for their Digital transformation in FY22 including 13 large transformational deals

Investor Conference Call Highlights:

- The company lost a deal for the Russian bank due to the Russia-Ukraine war which could have led to Rs.4 Cr worth of revenues.

- The talent cost for the quarter increased by Rs.13 Cr due to higher salary, employee base & travel related expenditure.

- The management states that it can deliver the products & services to customers at a faster rate leading to a significant moat in digital transformation where it applies design thinking at the requirement stage, Solution stage & Engineering stage.

- The management states that its budget for FY22 will go up by at least 15% to 20% due to higher travel-related expenses coupled with a higher R&D budget as the company is looking to enter into new countries.

- The management is confident of delivering 20% growth in the coming FY.

- The company is planning to add close to 100-125 people in the current quarter.

- The management states that the company’s PAT margin in the coming FY will be lower due to the higher tax rate.

- The management is confident of touching the $75 million run rate in the coming quarters.

- The company got a contract with Bajaj FinServ and DBS where they came together to launch the first Co-branded credit card & this credit card is being managed by the company from a technology as well as operations perspective.

- The timeline of the company’s deal pipeline of $725 million in 10 years.

- The deal between the company & Microsoft involves exclusive signing for working on all the GTB products suite, cash & cloud payments along with some other products.

- The company is targeting 70-80% of EBIDTA conversion to free cash flows.

Analyst’s View:

Intellect Design Arena is a fast-rising disruptor in the world fintech space. The company’s products are well received all over the world which is evidenced in the diverse set of geographies and financial institutions that they cater to. The company has had an excellent quarter with 30% Yoy revenue growth and 16% Pat growth. The management maintains that the company will reach $75 revenue in the next 3-4 quarters at its current pace and will deliver >20% revenue growth in FY23. Intellect is also looking to set up a Rs 100 Cr AIF to invest in growing fintech businesses that may leverage its platforms It remains to be seen how will the company maintain its growth momentum given the higher employee salaries, attrition rates and more travel-related expense which might hurt its margins. Nonetheless, given the acceptance of the company’s products in all kinds of financial institutions worldwide and its high customer retention rate and accelerated implementation time for its projects, Intellect Design Arena remains a stock to watch out for in the financial software industry.

Q3 FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 325 | 278 | 16.9% | 318 | 2.2% | 931 | 740 | 25.8% |

| PBT | 50 | 70 | -28.6% | 76 | -34.2% | 193 | 163 | 18.4% |

| PAT | 40 | 66 | -39.4% | 56 | -28.6% | 150 | 152 | -1.3% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 519 | 386 | 34.5% | 452 | 14.8% | 1396 | 1111 | 25.7% |

| PBT | 115 | 86 | 33.7% | 90 | 27.8% | 294 | 200 | 47.0% |

| PAT | 101 | 80 | 26.3% | 80 | 26.3% | 255 | 182 | 40.1% |

Detailed Results:

- The company had a great quarter with consolidated revenues rising 34% YoY while PAT grew 26% YoY.

- In $ terms, revenues grew 31% YoY in Q3.

- SaaS revenues rose 113% YoY in Q3.

- License revenues increased by 23% YoY. AMC revenues were up 11% YoY in Q3.

- The gross margin was at 58.6% in Q3 vs 56% last year.

- EBITDA margin was at 26.2% in Q3 and EBITDA for Q3 was up 37% YoY.

- The Net Days of Sales Outstanding (DSO) is 129 days in Q3.

- The company has zero net debt and cash equivalents of Rs.257 Cr.

- Investment in product development was Rs.28.2 Cr in the current quarter

- The current deal pipeline is sitting at Rs 5060.5 Cr. It accounts for 159 opportunities out of which it has 57 destiny deals having an average deal size of Rs 43.5 Cr which accounts for 58% of total opportunities.

- The company had 10 new deals including 4 in platform businesses of which 2 were in USA, 2 in EU, 2 in APAC and 4 in IMEA.

- The company made 10 new implementations in Q2 and 16 implementations of expansions in Q3.

- The large deals in Q3 include

- One of the top 3 bank in France signed up Cash Flow Forecasting and Investment Sweeps from iGTB’s Liquidity Management Platform

- A top 3 Austrian Bank has signed up to extend Trade product capabilities to 2 additional countries

- A top public sector bank in India signed a deal with iRTM for supporting the bank with its LIBOR transition risks

- One of the largest banks in the Oceania region has signed up for Intellect’s Capital Cube

- A destiny deal from Asia’s biggest bank for implementing intellect digital lending platform

Investor Conference Call Highlights:

- Cloud revenues have a lag of 3-4 months in the term of actual realization in P&L A/C.

- The major reason for higher SG&A expenses was activating the partnership network according to the management.

- The company’s ARR today is Rs.684 Cr, and license-linked revenue is 57% of the revenue.

- The company hired 400 new employees to increase the capacity for achieving the $75 million quarterly run rate.

- The 3 levers of operating margins for the company are an increase in destiny deals, better pricing due to branding & shift in revenue mix from implementation-based to license-linked revenue.

- The company’s unbilled revenue is greater than billed revenue due to milestone-based payment terms.

- Due to contractual terms, the actual billing takes place at a later stage leading to a higher Days of Sales Outstanding.

- The management is guiding for 20% growth on the top line and 30% on the EBITDA till 2030.

- The company’s revenue is on a lower scale since 3 of its products are in stage 5 & once they come in, it should boost revenues significantly according to the management.

- The company is creating an AIF as instead of buying out companies at a certain cash outflow to the organization, it can invest for a minority stake at a much lesser amount, but it will be able to influence the ecosystem for the company’s products.

- The management states that the growth of the market is taking place since the buy vs build is growing.

- The promoter shareholding was decreasing at a 1.5-2.5% run rate annually due to ESOPs & RSUs.

- The management believes it is on track for establishing itself in the USA market & once a big order comes, the revenues will start increasing drastically due to increased adoption from other local players.

Analyst’s View:

Intellect Design Arena is a fast-rising disruptor in the world fintech space. The company’s products are well received all over the world which is evidenced in the diverse set of geographies and financial institutions that they cater to. The company has had an excellent quarter with 33% YoY revenue growth and 26% PAT growth. The management maintains that the company will reach $75 revenues in the next 3-4 quarters at its current pace and will deliver >20% revenues growth in FY22. Intellect is also looking to set up a Rs 100 Cr AIF to invest in growing fintech businesses that may leverage its platforms It remains to be seen what challenges the company will be face to maintain its growth momentum as the management has proposed. Nonetheless, given the acceptance of the company’s products in all kinds of financial institutions worldwide and its high customer retention rate and accelerated implementation time for its projects, Intellect Design Arena remains a stock to watch out for in the financial software industry.

Q2 FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 318 | 242 | 31.40% | 295 | 7.80% | 612 | 463 | 32.18% |

| PBT | 76 | 51 | 49.02% | 66 | 15.15% | 143 | 93 | 53.8% |

| PAT | 56 | 46 | 21.74% | 54 | 3.70% | 111 | 85 | 30.59% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 452 | 374 | 20.86% | 425 | 6.35% | 877 | 728 | 20.47% |

| PBT | 91 | 66 | 38% | 88 | 3.41% | 179 | 113 | 58% |

| PAT | 80 | 59 | 36% | 74 | 8.11% | 154 | 102 | 50.98% |

Detailed Results:

- The company had a great quarter with consolidated revenues rising 21% YoY while PAT grew 36% YoY.

- In $ terms, revenues grew 22% YoY in Q2.

- SaaS revenues rose 156% YoY in Q2.

- License revenues declined 12% YoY. AMC revenues were up 9% YoY in Q2.

- The gross margin was at 58% in Q2 vs 56% in Q1.

- EBITDA margin was at 26% in Q2 and EBITDA for Q2 was up 33% YoY.

- The Net Days of Sales Outstanding (DSO) is 141 days in Q2.

- The company has zero net debt and cash equivalents of Rs.257 Cr.

- The revenues have grown 20% YoY & PAT has grown by 51% in H1.

- The current deal pipeline is sitting at Rs 4808.4 Cr. It accounts for 156 opportunities out of which it has 56 destiny deals having an average deal size of Rs 41.4 Cr which accounts for 62% of total opportunities.

- The company had 9 new deals including 6 in platform businesses.

- The company made 10 new implementations in Q2 and 16 implementations of expansions in Q2.

- The average destiny deal size in Q2 FY22 stands at Rs 41.4 Cr against Rs 41.2 Cr in Q1 FY22. Destiny deals contribute to 62% of the total Opportunity funnel in Q2.

- The company launched 2 new platforms in Q2 which are iKredit360 and iGTB Cloud – CashPower.

- The large deals in Q2 were a strategic deal with RESURS Bank in Nordic region, a significant underwriting insurance deal in US, a multimillion destiny deal with a large private sector bank in India, deal wins in Middle East for iGTB’s cashpower platform and a deal with leading South African bank for modernizing their liquidity platform.

Investor Conference Call Highlights:

- Intellect now has over 260 banking clients.

- The company is looking at creating an AIF CAT III fund for investing in companies where the Intellect technology stack can be used.

- The company incurred stabilization expenses of $61 million in this quarter and it is preparing to reach $75 million in sales in the coming 3-4 quarters.

- The GeM platform is growing at 100% YoY and has done close to Rs.40,000 Cr worth of sales in the platform.

- The company’s platform business is maturing leading to the company winning deals in this segment

- The company is getting 8 consecutive deals in every quarter from Europe and the management sees huge potential for growth in that region due to a lot of institutions there running on legacy systems.

- The company has created 3 different packages in cash management for small, midsized, and large corporates which are CashNow, CashXtra & CashPower.

- The management is focused on transitioning Intellect from being a stable product company to an open fintech platform in the next 5 years.

- iGTB Cloud is now live in over 70 countries.

- The management believes that the company has a potential market size of over 1000 commercial banks, SMEs, and Large corporates through the cash management product now.

- The company’s deal win with RESURS bank marks its entry into the Nordic region where this is the first deal of its kind in the region.

- The management hopes that the RESURS deal can help them increase Intellect’s presence in the region given that Resurs has a presence akin to Bajaj Finserv in India and this deal can lead to other deals in the region.

- The company recently came in a partnership for artificial intelligence and trade finance to realize the company’s focus of becoming a fintech, cloud-native, leveraged data, AI and to be able to expand their offerings.

- The management explains that the platform business is an accelerated way of driving the change to subscription-based revenue & it gives the banks the ability to co-create or compose solutions on it.

- The company is investing going to do an investment of close to Rs.100 Cr through the AIF route towards building a platform in a marketplace, where they have a platform that includes a core banking platform, a lending platform & a cash management platform.

- The company cash flow generation was distressed for this quarter due to some payments being stuck from GeM.

- Advances market DSO (day sales outstanding) stand at less than 90 days whereas that for mass market and India stands at 122-132 & 214 days respectively.

- The cash outflow for the proposed AIF will occur in FY22 once it gets approved.

- The management is giving guidance of reaching 30% EBIDTA margin within the next 2-4 quarters and revenue growth of 20% in the next 3 quarters.

- The management states that it has been able to increase its EBIDTA margins by 2% despite the industry seeing a margin contraction of 2% due to operating leverage and increased market share.

- The company’s open API platform is expected to help reduce the costs of banks by 1/10th because of the use of the cloud instead of investing in hardware, middleware & networks for Resurs according to the management.

- The management states that the company can reach an addressable market size of $100 billion in the future through its platform approach.

- The company is opting for AIF to avoid the issue of presenting consolidation accounts.

- The management is focusing on transforming from a product to a platform to an ecosystem.

Analyst’s View:

Intellect Design Arena is a fast-rising disruptor in the world fintech space. The company’s products are well received all over the world which is evidenced in the diverse set of geographies and financial institutions that they cater to. The company has had an excellent quarter with 21% Yoy revenue growth and 36% Pat growth. It also won many big deals including one with Resurs which is a leading financial services giant in the Nordic region. The management expects this deal to help them expand in the region and get more deals from Nordic companies. Intellect also launched its cash management platform in Q2 which helps it expand its client base from banks to include both SMEs and large corporates. The management maintains that the company will reach $75 revenues in the next 3-4 quarters at its current pace and will deliver >20% revenues growth in FY22. Intellect is also looking to set up a Rs 100 Cr AIF to invest in growing fintech businesses that may leverage its platforms It remains to be seen what challenges the company will be face to maintain its growth momentum as the management has proposed and whether the company will be able to capitalize on its deal win with Resurs as the management expects. Nonetheless, given the acceptance of the company’s products in all kinds of financial institutions worldwide and its high customer retention rate and accelerated implementation time for its projects, Intellect Design Arena remains a stock to watch out for in the financial software industry.

Q1 FY22 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 295 | 221 | 33.48% | 283 | 4.24% |

| PBT | 66 | 42 | 57.14% | 59 | 11.86% |

| PAT | 54 | 39 | 38.46% | 56 | -3.57% |

| Consolidated Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 425 | 354 | 20.06% | 400 | 6.25% |

| PBT | 88 | 47 | 87% | 90 | -2.22% |

| PAT | 74 | 43 | 72% | 82 | -9.76% |

Detailed Results:

- The company had a great quarter with consolidated revenues rising 20% YoY while profits grew 72% YoY.

- In $ terms, revenues grew 21% YoY in Q1.

- SaaS revenues rose 101% YoY in Q1.

- License revenues grew 32% YoY. AMC revenues were up 8% YoY in Q1.

- The gross margin was at 56% in Q1 vs 53% last year.

- EBITDA margin was at 24.5% in Q1 and EBITDA for Q1 was up 48% YoY.

- The Net Days of Sales Outstanding (DSO) is 131 days in Q1 as against 126 days a year ago.

- Investment in Product Development (Capitalised)is Rs 28.9 Cr vs Rs 26.92 Cr last year.

- The company has cash & cash equivalents of Rs 255 Cr as of 30th June 2021.

- The company had 10 digital led deal wins in Q1 with 5 of them being large deal wins.

- The company made 8 new implementations in Q1 and 18 implementations of expansions in Q1.

- The current funnel of Intellect is around Rs 4630 Cr out of which Rs 3811.8 Cr is accounted for by 150 Opportunities.

- The average destiny deal size in Q1 FY22 stands at Rs 41.2 Cr against Rs 40.8 Cr in Q4 FY21. Destiny deals contribute to 62% of the total Opportunity funnel in Q1.

- The large deals in Q1 were: 3 from St. James’s Place, 1 from a top 3 GCC Bank in the MENA region, and 1 from the second full-fledged Islamic bank in Malaysia.

Investor Conference Call Highlights:

- The company has 25 clients in USA today.

- It also bagged a major deal in Canada in payment services. It is with a company called PayCorp.

- The St James’s Place deals are part of a 5-year major transformation deal that involves >$10 million.

- The major play for growth in USA is using the CBX layer and helping clients configure unique customer journeys according to their preferences.

- The strategy for Europe is to offer curated solutions using APIs for core banking, lending, and credit card to banks.

- In India, the major focus areas are GeM and the wealth product.

- The company has 2 associates which are NMS Works and Adrenalin. There is a loss in both these associates in Q1 due to seasonal reasons. These companies typically have a slow Q1 and while business rises during Q3 & Q4.

- The management guides for revenue growth of 15-19% in FY22.

- The talent costs across the industry have gone up a lot and it is expected to pressure margins in the near future. Thus, the management is guiding for EBITDA margin to stay in the range of 25-30%.

- The company doesn’t have any plans to get into the cryptocurrency space for the next 12 months at least.

- The company has spent around Rs 1200 Cr in R&D in the last 6 years.

- The company doesn’t have any solutions or businesses related to cryptocurrencies and its products merely register cryptocurrencies as part of the FX space for banks who allow in its transactions.

- Promoter holding is not going down because of promoter stake selling but because of dilution arising from the exercise of employee stock options.

- The company has done pilot partnerships with Ripple in the past, but the adoption is still very slow here in the blockchain space for the company to make a big venture into it.

- The attrition rate has risen in the past 4 months.

- The management has released some pressure in the EBITDA vs growth situation and is looking to maintain optimal growth level at 25% EBITDA margin after it got the feedback to do so from various investor meetings.

- The other income was high in Q1 due to gain from FX and property sales in Mumbai in the quarter.

- SaaS is now at 15-16% of cloud revenues. The management expects it to reach 20-25% of cloud revenues in a few years.

- The company is seeing good interest in Xponent and is already conducting initial trials called Sprint Zero for 2 large insurance carriers. This is expected to be the 2nd major growth driver for the company in USA.

- The management states that the business is designed to accommodate for 30% EPS growth and 20% revenue growth each year.

- The company has no impact from the new tech regulations in China as it doesn’t operate in the country and has no clients from there as well.

- The company had launched a new product called iKredit360 in June 2021. It is a purpose-built product for Europe containing credit solutions. The company is already doing Proof of Concept with 2 large European banks for this product.

- The company’s 3 main competitors are Temenos, Oracle Financial, and Mambu. The market leader is Temenos, but the management is confident that Intellect’s technological agility and expertise are better than Temenos.

- The company has 2 major deals of >$50 million in its funnel. The management has stated that it may need to expand the leadership capacity at the company to be able to bid for such large deals.

- The company has a great win rate of over 80% in every POC that it does.

- The company is partnering with other industry players to win deals, but it is not looking to work as implementation partners for these industry players.

- As license-linked revenues grow, gross margin is also expected to expand.

- The GeM project is profitable, but the only issue here is that DSOs are rising here.

- The treasury and wealth products are expected to be monetized next in FY22 and FY23.

Analyst’s View:

Intellect Design Arena is a fast-rising disruptor in the world fintech space. The company’s products are well received all over the world which is evidenced in the diverse set of geographies and financial institutions that they cater to. The company has had an excellent quarter with marquee deal wins including a large 5-year deal with St James’s Place. The company is seeing good interest in its new products including iKredit 360 in Europe and Xponent in USA. It has lowered its target EBITDA from 30% to 25-30% range to be able to maintain the current growth momentum despite rising talent costs putting pressure on margins. It remains to be seen whether the company will be able to maintain its growth momentum as the management has proposed or whether there will be any other headwinds that will put pressure on the company. Nonetheless, given the acceptance of the company’s products in all kinds of financial institutions worldwide and its high customer retention rate and accelerated implementation time for its projects, Intellect Design Arena remains a stock to watch out for in the financial software industry.

Q4 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 283 | 205 | 38.05% | 278 | 1.80% | 1019 | 764 | 33.38% |

| PBT | 59 | 30 | 96.67% | 70 | -15.71% | 223 | -20 | 1215.0% |

| PAT | 56 | 19 | 194.74% | 67 | -16.42% | 207 | -31 | 767.74% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 400 | 361 | 10.80% | 386 | 3.63% | 1510 | 1373 | 9.98% |

| PBT | 90 | 42 | 114% | 86 | 4.65% | 290 | 23 | 1161% |

| PAT | 82 | 41 | 100% | 80 | 2.50% | 264 | 18 | 1366.67% |

Detailed Results

- The company had an excellent quarter with consolidated revenues rising 10% YoY while profits were at Rs 82 Cr vs Rs 41 Cr last year in Q4.

- In $ terms, revenues grew 9% YoY in Q4.

- SaaS revenues rose 68% YoY in Q4 and 47% YoY in FY21.

- The gross margin was at 56.5% in Q4.

- EBITDA margin was at 25% in Q4 vs 18% last year.

- The Net Days of Sales Outstanding (DSO) is 114 days in Q4 FY21 as against 150 days in Q4 FY20.

- Investment in Product Development (Capitalised)is Rs 28.4 Cr vs Rs 23.97 Cr last year.

- The company has cash & cash equivalents of Rs 262 Cr as of 31st Mar 2021.

- The company had 12 digital led deal wins in Q4 with 4 of them being large deal wins. In FY21 period, the company won 32 deals with 15 of them being large ones.

- The current funnel of Intellect is around Rs 4177 Cr out of which Rs 3302 Cr is accounted for by 136 Opportunities.

- The average destiny deal size in Q4 FY21 stands at Rs 40.8 Cr against Rs 38 Cr in Q4 FY20. Destiny deals contribute to 53% of the total Opportunity funnel in Q4 FY21.

- Revenue breakup is 55% Advanced Markets, 29% Rest of the World & 16% India.

- Intellect bagged a large transformational deal with SocieteGenerale, a leading financial institution in France.

- One of the top banks headquartered in Singapore has chosen Intellect Digital Cards.

- Intellect also went live in 13 projects in Q4.

Investor Conference Call Highlights

- The banking industry would run with 100 TPS or 200 TPS at the most according to the management. Thus, Intellect has an edge here by expanding this capacity to 5000 TPS which is the ley to advanced markets in this space.

- The management has likened Intellect’s business to IKEA where it is selling package business components like core banking, lending and credit card, etc, and is delivering new business solutions depending on client requirements. The range here consists of 35 PBCs and 300 APIs.

- The company has 25 customers in the Americas, 23 in Europe, 53 in APAC, 139 customers in India, Middle East, and Africa.

- The main competition in consumer banking are Temenos, Finastra, TCS, Finacle, Mambu, Thought Machine nCinos. The competitors in transaction Banking are Finastra, ACI Worldwide, CGI, bottom line. In core banking, they are Carpe Data, Planck, and Palantir. In Risk and Treasury competition is mainly from Sungard, Finastra, and Calypso.

- The company has added a few leadership profiles in the US.

- The company has become the de facto market standard and won most of its wins in 2 products, digital transaction banking, and corporate liquidity management.

- The company has also added Lloyds Bank as a customer in Q4.

- It now has 40+ customers for liquidity across 56 countries.

- The company has added salespeople in U.K., Spain, Austria, U.S., UAE, Singapore to drive the funnel in these regions.

- All of the company’s products are cloud-native and platform agnostic so they work on all cloud providers including Microsoft and AWS.

- Lending is expected to develop into another growth lever for Intellect. The management has stated that it has no direct competitor for its offering in this space. The offering includes an integrated lending suite across retail, retail customers, SME customers, and corporate customers, and it also got across loan origination, loan management, collateral, limit management, and debt management.

- The company also has 12 modules in quantum banking today.

- All SEEC customers are cloud and subscription-based.

- The company reported license revenue of INR 849 million and AMC revenue of INR 750 million in Q4.

- The management has stated that Intellect now has an assured revenue run rate of revenue of near $76 million per annum. This ARR now forms 38% of total revenues.

- The management maintains its confidence in doubling Intellect’s revenue from $200 million to $400 million in the next 5 years. It has stated that it has designed the business around 20% growth but needs a 14% CAGR for growth to reach $400 million in the given time frame.

- AMC revenues are directly dependent on the closure of the project and thus it has not maintained a stable growth rate as other segments according to the management. AMC is also growing at a slower rate than other businesses at 11-12% CAGR.

- The main idea is to pursue cloud and recurring revenue like nCinos for Intellect according to the management.

- The order backlog is around Rs 1200 Cr at present.

- The company’s TCO offering is expected to be 10-12% cheaper than a comparable price competitor software for the customer bank.

- In the replication of cross streaming tech from Netflix, the company has taken some open-source from Netflix and is looking to offer the synchronization of the entire back end to front-end technologies for corporates with large databases like Reliance or Coca Cola or GE. It has also been able to streamline it for banking specifically in the last 4 years.

- 80% of new deals are in cloud delivery.

- The management is encouraged by the deal wins against industry majors that have provided entry into major economies like Canada, Germany, and France.

- The company is looking to deliver on current deals with big players and use these deals as a springboard to secure the next leads from these marquee customers.

- nCinos is mostly in USA and is built on Salesforce. But Intellect offers distinct advantages due to domain advantages in the case for BFSI industry which has helped it win deals against nCinos, according to the management.

Analyst’s View

Intellect Design Arena is a fast-rising disruptor in the world fintech space. The company’s products are well received all over the world which is evidenced in the diverse set of geographies and financial institutions that they cater to. The company has had an excellent quarter with marquee deal wins with SocGen and Lloyd’s Bank. FY21 was exceptionally good for Intellect with it scoring 32 deals in the year so far with 15 of them being big destiny deals. The company is now targeting to grow organically at a CAGR of near 14% and reach $400 million sales in the next 5 years. It is also looking to use its marquee deal wins to source new leads and establish itself as a serious competitor in all BFSI technology spaces worldwide. It remains to be seen whether the company will be able to maintain its growth momentum as the management has proposed or whether there will be any other headwinds that will put pressure on the company. Nonetheless, given the acceptance of the company’s products in all kinds of financial institutions worldwide and its high customer retention rate and accelerated implementation time for its projects, Intellect Design Arena remains a stock to watch out for in the financial software industry.

Q3 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 278 | 194 | 43.30% | 241 | 15.35% | 740 | 567 | 30.51% |

| PBT | 70 | -36 | 294.44% | 51 | 37.25% | 163 | -55 | 396.36% |

| PAT | 67 | -36 | 286.11% | 46 | 45.65% | 152 | -50 | 404.00% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 386 | 328 | 17.68% | 374 | 3.21% | 1111 | 1019 | 9.03% |

| PBT | 86 | -8 | 1175% | 66 | 30.30% | 200 | -20 | 1100.00% |

| PAT | 80 | -11 | 827% | 59 | 35.59% | 182 | -23 | 891.30% |

Detailed Results

- The company had an excellent quarter with consolidated revenues rising 18% YoY and 3% QoQ while profits were at Rs 80 Cr vs a loss of Rs 11 Cr last year in Q3.

- In $ terms, revenues grew 15% YoY.

- License revenues rose 85% YoY. AMC revenues grew 18% YoY and Cloud/SaaS revenue grew 28% YoY. License linked revenue was at 53% of total revenue vs 42% last year.

- The gross margin was at 56% against 47% last year.

- EBITDA margin was at 26%.

- Order backlog as of 31st Dec 2020 was at Rs 1203 Cr.

- The Net Days of Sales Outstanding (DSO) is 124 days in Q3 FY21 as against 132 days in Q3 FY20.

- Investment in Product Development (Capitalised)is Rs 28.3 Cr vs Rs 28.7 Cr last year.

- The company has cash balance of Rs 124 Cr as of 31st Dec 2020.

- The company had 10 digital led deal wins in Q3 with 6 of them being large deal wins. In 9M period, the company won 20 deals with 11 of them being large ones.

- Repeat revenue from existing customers stood at 85%.

- The current funnel of Intellect is around Rs 4162 Cr out of which Rs 3200 Cr is accounted for by 132 Opportunities.

- The average destiny deal size in Q3 FY21 stands at Rs 45 Cr against Rs 39 Cr in Q3 FY20. Destiny deals contribute to 53% of the total Opportunity funnel in Q3 FY21.

- Revenue breakup is 58% Advanced Markets, 28% Rest of the World & 15% India.

- iGCB enters North America by winning its first IDC cloud subscription deal.

- 9 projects went live in Q3.

- The company won destiny deals in North America, Germany, CEE, Australia, Indonesia, and Jordan.

Investor Conference Call Highlights

- Intellect Design Arena has the world’s largest cloud-native API led microservices based multiproduct fintech platform powered by AI/ML for global leaders in banking, insurance, and capital markets.

- It is also the only company on the same architecture, which offers a full spectrum of banking and insurance technology product through its 4 lines of business, which are Global Consumer Banking (GCB), Global Transaction Banking (GTB), Risk, Treasury, and Markets (RTM) & Insurance.

- The growth in the product business is moving from almost $20 billion to the $30 billion market size in the fintech space.

- Intellect’s competition in Consumer Banking is Temenos, Finastra, TCS, Finacle, and Oracle. In Transaction Banking, Finastra is the key competition along with ACI Worldwide, CGI, and Bottomline. In Treasury, competition is from Sungard, Finastra, and Calypso. And competition in Insurance is from Carpe Data and Planck.

- Cash and cash equivalents for Intellect are at Rs 183.7 Cr.

- The company also won a supply chain deal in Vietnam.

- The management has stated that whenever Intellect enters a new geography, it approaches the largest bank for a deal and subsequently other banks come in with time. This is going on with Jordan right now.

- Intellect has launched 3 new products in the quarter including DTB M 21 which already has 53 customers.

- The destiny deal in Germany is with OTTO which is one of the largest European e-commerce players and the second largest e-commerce player in Germany after Amazon.

- The North American deal is its first cloud subscription deal for a mid-tier bank in Canada.

- Intellect also won a multimillion-dollar upgrade deal with an innovative digital bank in Africa. The deal is a 4 country rollout which includes core banking as well as core lending.

- The big deal from Australia is for Intellect SEEC in the insurance space.

- Intellect SEEC also went live in Q3 with Ameritrust which is a commercial insurance underwriter in USA.

- Another client from USA, Amerisure has extended its contract instead of 3 years to a fresh contract for 5 years. Amerisure is one of the leading commercial insurance companies in USA focusing on construction, manufacturing, and health care.

- Liberty, which is one of the largest insurance companies worldwide with revenues well over $43 billion, has gone live on IDX platform for 3 of its business lines.

- The company has indeed seen a rise in win rate as compared to last year according to management.

- The management has stated that revenues have stabilized at $40 million per quarter and even 10% revenue growth may result in 30% EPS growth in coming years.

- The management has stated that it is indeed aiming for 20%+ rupee revenue growth going forward.

- There are significant tailwinds for the move to cloud subscription model in the fintech space according to the management. There isn’t any degradation in lifetime value from migration to subscription model according to the management.

- The management has stated that as the global presence of Intellect rises and it goes to new markets like Thailand and Vietnam, its share of advanced markets will naturally go down.

- The company is targeting business share from emerging markets to be near 33%.

- The deal funnel contains both license and subscription deals and in subscription deals, it has only 2 years of deal value linked even if the deal is for more than 2 years.

- The management has admitted that USA is the toughest market to crack for fintech companies and AI/ML is key to succeeding in this region. The management is optimistic about the company’s prospects based on the good acceptance of the Intellect SEEC platform in the Insurance sector in USA and its data platform which is similar to Palantir. The company has also recently won 2 big deals in Liquidity space in USA.

- The management is confident that as growth levers for the company mature, the EBITDA margin will slowly come to 40% and will ensure bottom-line growth even when the top line is stagnant.

- The company still has Rs 450 Cr in tax losses.

- The company is also working on some deals with Jio, AWS, and IBM.

Analyst’s View

Intellect Design Arena is a fast-rising disruptor in the world fintech space. The company’s products are well received all over the world which is evidenced in the diverse set of geographies and financial institutions that they cater to. The company has had an excellent quarter with its first ever German deal and a first ever cloud subscription deal in USA. 9MFY20 was very good for Intellect with it scoring 20 deals in the year so far with 11 of them being big destiny deals. The company is now targeting to grow organically in the USA market with its SEEC platform and its data platform which is reportedly similar to Palantir. It remains to be seen whether the company will be able to maintain its growth momentum as the management has proposed or whether there will be any other headwinds that will put pressure on the company. Nonetheless, given the acceptance of the company’s products in all kinds of financial institutions worldwide and its high customer retention rate and accelerated implementation time for its projects, Intellect Design Arena remains a stock to watch out for in the financial software industry.

Q2 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 242 | 189 | 28.04% | 221 | 9.50% | 463 | 373 | 24.13% |

| PBT | 51 | -13 | 492.31% | 42 | 21.43% | 93 | -19 | 589.47% |

| PAT | 46 | -13 | 453.85% | 39 | 17.95% | 85 | -14 | 707.14% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 374 | 338 | 10.65% | 354 | 5.65% | 728 | 691 | 5.35% |

| PBT | 67 | -15 | 546.67% | 53 | 26.42% | 120 | -14 | 957.14% |

| PAT | 59 | -16 | 468.75% | 43 | 37.21% | 102 | -13 | 884.62% |

Detailed Results

- The company had a very good quarter with revenues rising 11% YoY and 5% QoQ while profits rising 37% QoQ.

- License revenues rose 131% YoY. AMC revenues grew 19% YoY and Cloud/SaaS revenue grew 25% YoY. License linked revenue was at 56% of total revenue vs 46% last year.

- The gross margin was at 56% against 45% last year.

- EBITDA margins expanded 400 bps QoQ to 24%.

- Order backlog as of 30th Sep 2020 was at Rs 1194 Cr.

- The Net Days of Sales Outstanding (DSO) is 127 days in Q2 FY21 as against 126 days in Q2 FY20.

- Investment in Product Development (Capitalised)is INR 28.4 Cr, the same as in Q2 FY20.

- The company had 6 deal wins in Q1 with 4 of them being large deal wins.

- Repeat revenue from existing customers stood at 93%.

- The current funnel of Intellect is around Rs 4018.1 Cr ($ 540 Mn) out of which Rs 3028.5 Cr ($ 407 mn) is accounted for by 117 Opportunities.

- The average deal size in Q2 FY21 stands at Rs 14.9 Cr ($ 2 Mn) against Rs 16.8 Cr ($ 2.4 mn) in Q2 FY20.

- The average deal size of destiny deals stands at Rs 44.6 Cr ($ 6 Mn) in Q2 FY21. Destiny deals contribute to 53% of the total Opportunity funnel in Q2 FY21.

- Revenue breakup is 57% Advanced Markets, 28% Rest of the World & 15% India.

- Digital Transaction Banking (DTB) has won its 57th customer during Q2FY21 for the largest bank in Southeast Asia.

- 19 projects went live in Q2.

- Closed a multi-million-dollar upgrade deal with an Apex National Financial Institution in India for their core banking and lending transformation.

Investor Conference Call Highlights

- The company now boasts of 900 APIs in 12 product lines.

- The company is able to do POCs or proof-of-concept of its solutions in 2 to 6 weeks’ time.

- The company’s focus is to increase our license revenue as it is recurring and provides good certain revenues.

- The company’s data superiority is over 94% in the USA which is the best in class.

- The total collection for H1 was at Rs 771 Cr.

- The company closed another large deal on liquidity in the USA. The company is now cementing its market leadership in this space with 23% of global cross-border cash concentration going through its platforms. This new customer was the 11th in USA and 25th in North America.

- The company has 5 platforms that are set to go live in H2.

- The company will be launching Intellect Payments Hub ’21, which is completely cloud-native in the next quarter.

- In the company’s central banking proposition, Intellect is in last-stage talks with 2 large central banks for digital transformation. The company is chasing a destiny deal in this vertical in the EU which is expected to be closed in H2.

- The management has stated that the increased deal run rate is mainly due to the superiority of the company’s architecture over competitors like Finastra and Temenos.

- The management is expecting this momentum in signing deals to continue as deal signing has been impacted in H1 from COVID and these deals will come back to the table now.

- According to management, 30% EBITDA will come with a 60% gross margin.

- The company is targeting to reach 30% margins in the next 4 quarters.

- The management has stated that advanced market share in revenues will be close to 60% going forward and can rise to 62-63% if these markets grow more than expected.

- The Intellect SEEC platform is a partner of Snowflake and uses it for faster processing of the data layer. The management states that the entire platform is comparable to Palantir which is an AI platform-based company in the USA.

- Palantir does data consolidation for a variety of agencies including the US govt. Intellect SEEC does the same thing but for financial services only.

- There isn’t any non-compete clause between Intellect & Polaris.

- The management hopes to achieve 20% sales growth & 40% EBITDA growth for the company. It also hopes to reach $400 million in sales in the next 5 years.

- Demand scenario in many spaces has come back to pre-covid levels mainly due to digital acceleration.

- The company is net debt negative with cash of Rs 94 Cr and a low-cost term loan of Rs 60 Cr.

- The company has 3 clients in the APAC region, which are about to go live in the next 2 quarters.

Analyst’s View

Intellect Design Arena is a fast-rising disruptor in the world fintech space. The company’s products are well received all over the world which is evidenced in the diverse set of geographies and financial institutions that they cater to. The company has done well to garner good deal-wins in Q2 especially its 11th deal in the USA in the Liquidity space where it is fast establishing its dominance. The current quarter was good for the company with the EBITDA margin appreciation of 400 bps to 24%. The company is also seeing good traction and demand for its Intellect SEEC platform and is set to launch 5 new platforms in H2. It has also done well in the last year to migrate all of its APIs and make them all cloud compliant. It remains to be seen whether the company will be able to reach its revenue target and maintain its growth momentum as the management has proposed or whether there will be any other headwinds that will put pressure on the company. Nonetheless, given the acceptance of the company’s products in all kinds of financial institutions worldwide and its high customer retention rate and accelerated implementation time for its projects, Intellect Design Arena remains a stock to watch out for in the financial software industry.

Q3 FY20 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 193.6 | 238.9 | -18.96% | 188.76 | 2.56% | 566.55 | 738.6 | -23.29% |

| PBT | -36.36 | 22.53 | -261.38% | -13.32 | -172.97% | -50.19 | 12.93 | -488.17% |

| PAT | -36.36 | 22.53 | -261.38% | -13.32 | -172.97% | -50.19 | 131.5 | -138.17% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 327.92 | 379.61 | -13.62% | 338.09 | -3.01% | 1018.56 | 1110.98 | -8.32% |

| PBT | -7.83 | 15.49 | -150.55% | -15.44 | 49.29% | -19.6 | 96.9 | -120.23% |

| PAT | -10.67 | 13.54 | -178.80% | -16.13 | 33.85% | -23.4 | 89.7 | -126.09% |

Detailed Results

- Consolidated revenue from operations fell 13.6% YoY while the same figure fell 14.17% YoY in $ terms.

- License revenue for the quarter fell 44% YoY while AMC revenue for the quarter grew 8% YoY.

- Cloud Revenues for the company grew 50% YoY.

- Gross margins were at 46.58% which is down 190 bps YoY.

- In Q3, deals worth $5 million were received but were not added to revenues due to pending documentation. This is expected to be recognized in Q4.

- Net days of sales outstanding came at 132 days in the current quarter. The investment into product development for Q3 stands at Rs 28.72 Cr.

- Collections for Q3 rose by Rs 22 Cr QoQ to Rs 334 Cr.

- The company had 6 wins in Q3 with one large digital transformation deal. It also did 17 implementations in the quarter.

- The current funnel for the company is at $536 million which come to roughly Rs 3817 Cr.

- Average deal size in Q3FY20 was $2.3 million or Rs 16 Cr vs $1.9 million or Rs 13 Cr last year.

- The company has 41 destiny deals in Q3FY20 vs 36 last year. These deals have an average size of $5.6 million or Rs 39 Cr.

- License based order backlog is Rs 1125 Cr. SaaS and Subscription-based order backlog is Rs 825 Cr including the GeM project.

- Repeat revenue from existing customers stood at 92% in the current quarter.

- Cash and cash equivalents were at Rs 121 Cr while net debt for the company was reduced by Rs 9 Cr in Q3.

Investor Conference Call Highlights

- The research and engineering costs have gone up from an annual run rate of Rs 90 Cr to Rs 132 Cr in Q1. This figure has been going down and in Q3 it was at an annualized rate of Rs 124 CR.

- The management has stated that the credit card platform is ready to be deployed on cloud in India and Chile on a subscription basis.

- The company also has its cloud-based lending platform ready to be deployed in India and the Middle East.

- The company has seen that IDC and GTB have crossed revenues of more than Rs 1000 Cr since 2015. Payments and liquidity have reached more than Rs 500 Cr and Lending and Treasury have generated more than Rs 300 Cr since 2015.

- The company has close to 240 customers currently.

- The company also completed a 3-day event with bankers from the industry in Cambridge University.

- The management is seeing an acceleration of deals moving towards the SaaS model. In IDC, open banking and open architecture are features being demanded which is well suited to this platform.

- The company is also seeing the rise of digital banks.

- Deal closure is taking almost 8-9 months as compared to 6 months earlier.

- The company is chasing 7 deals in IDC in Q4.

- In IDC Central Banking, the company is closing on 2 deals which are expected to be big-ticket items.

- In the lending platform, the company is seeing good traction in EU, Middle East and Asia Pacific. This is especially true for loan origination product in this segment.

- The management has stated that increased M&A activities in US banking space have been a major cause of delay in deal completion for the company in FY20.

- The management believes that the current deal structures shall result in at least 19% growth in AMC in the coming year.

- The management expects the new platforms should have good sales reception in the near future with more cross-sell opportunities rising with existing customers.

- The management has mentioned that margins have suffered a bit as the majority of the costs for the SaaS model are front-loaded. But these margins are expected to normalize in the near future.

- The company has also seen 100% customer retention for its AI ML products.

- The margin profile for GCB is set to improve as traction rises. GTB and GCB margin profiles are expected to be equal in the next year.

- The margins for the SaaS products will stay low until September ’21.

- The management saw the rate of rising in SaaS deal values was slow and customers are asking for cloud services but are not necessarily ready to pay or accept the charges. Thus the management decided to not ignore small deals and pivot from its earlier guidance of chasing big deals only.

- The company is expecting 20% EBITDA margin levels in FY21.

- The management has mentioned that the company will see more cost reductions in the future.

- The management sees the core businesses of the company to be in the performance stage. The cash flows for the company will turn positive if the company has sales of $ 50-55 million.

- The total receivables have come down to Rs 592 Cr from Rs 614 Cr in the last quarter.

- The GeM business is expected to do better in the coming year. The company expects this business to grow by 50%+ in the next year.

- The company is planning on 6 more products in the next 5 years and it will keep on its product portfolio of 12 products in total.

Analyst’s View

Intellect Design Arena is a fast-rising disruptor in the digital transformation space for financial institutions. The company’s products are well received all over the world which is evidenced in the diverse set of geographies and financial institutions that they cater to. The current quarter was not good for the company with the company incurring losses at the PBT level. The company was again unable to recognize revenues of $5 million that it has received because of pending documentation. This is a result of the expansion of the contract completion cycle for the company. The company has seen good growth in some of its newer segments like SaaS. It remains to be seen whether the company will get back to the growth path as fast as the management has proposed or whether there will be any other headwinds that will put pressure on the company. Nonetheless, given the acceptance of the company’s products in all kinds of financial institutions worldwide and its high customer retention rate and accelerated implementation time for its projects, Intellect Design Arena remains a stock to watch out for in the financial software industry.

Q2 2020 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY20 | Q2FY19 | YoY % | Q1FY20 | QoQ % | H1FY20 | H1FY19 | YoY% | |

| Sales | 188.76 | 263.64 | -28.40% | 184.18 | 2.49% | 372.94 | 499.7 | -25.37% |

| PBT | -13.32 | 50.53 | -126.36% | -0.5 | -2564.00% | -13.82 | 106.79 | -112.94% |

| PAT | -13.32 | 50.53 | -126.36% | -0.5 | -2564.00% | -13.82 | 109 | -112.68% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY20 | Q2FY19 | YoY % | Q1FY20 | QoQ % | H1FY20 | H1FY19 | YoY% | |

| Sales | 338.09 | 395.92 | -14.61% | 352.55 | -4.10% | 690.64 | 737.37 | -6.34% |

| PBT | -15.45 | 38 | -140.66% | 3.67 | -520.98% | -11.77 | 81.43 | -114.45% |

| PAT | -16.14 | 32.24 | -150.06% | 3.4 | -574.71% | -12.74 | 76.17 | -116.73% |

Detailed Results

- Consolidated revenue from operations fell 14.6% YoY while the same figure fell 14.8% YoY in $ terms.

- License revenue for the quarter fell 54.3% YoY while AMC revenue for the quarter grew 16.6% YoY.

- The company recorded 9 digital wins with 4 large transformation deals in the quarter.

- Net days of sales outstanding after taking customer advances came at 126 days in the current quarter. The investment into product development for Q2 stands at Rs 28.36 Cr.

- The current order backlog in GeM is at Rs 400 Cr while order backlog in other cloud deals is at Rs 375 Cr.

- The current funnel for the company is at $524 million which come to roughly Rs 3685 Cr.

- Average deal size in Q1FY20 was $2.4 million or Rs 16.88 Cr vs $1.8 million or Rs 12.66 Cr last year.

- The company has 41 destiny deals in Q2FY20 vs 35 last year. These deals have an average size of $6.2 million or Rs 44 Cr.

- License based order backlog is Rs 1100 Cr. GeM project order backlog is Rs 400 Cr while other cloud deals backlog is Rs 300 Cr.

- Repeat revenue from existing customers stood at 98% in the current quarter.

- A total of 14 implementations were completed in the quarter including Abu Dhabi Islamic Bank and Raiffeisenlandesbanks.

- The company has also won a big deal with an Indian market leader for iGCB. Overall iGCB has a pipeline in excess of $45 million for H2FY20.

- iGTB has a funnel over $90 million for H2FY20. Intellect SEEC has registered a pipeline of over $ 20 Mn for Xponent, Digital Underwriting platform powered by AI & ML.

Investor Conference Call Highlights

- The management has conceded that they will have to face volatile fluctuations in revenues due to the erratic nature of a software products business.

- The management has identified two major risk factors: predicting the closure of the last deal and the adoption of current revenue.

- The management has stated that one large deal got deferred so it impacted revenues significantly.

- Three deals converted to cloud deals but were not recognized yet because there isn’t any precedent on how to record it in accounting standards. If these deals were recognized as legacy deals, then revenues would have risen significantly.

- The company’s rationalization efforts have borne fruit and costs have gone down by Rs 10 Cr as compared to costs last year (excluding ESOPs of Rs 4 Cr).

- The management expects cost savings of Rs 18 Cr in the next quarter.

- The company was able to complete a large deal delivery in around 6 months almost 6 weeks ahead of schedule which signified the company’s efficiency in delivering implementations.

- The management has maintained that the deferred revenues are still in the pipeline.

- The company expects the Intellect SEEC pipeline to grow in the near future and some of the deals for these products may come in in Q4FY20.

- The management maintains that their key investments into product development have helped them establish 3 major accomplishments:

- The products are 86%-92% RFP compliant so implementation costs are very competitive among similar market participants

- All products are cloud-ready and are using cloud-native technologies.

- The company has built FABRIC data services that use AI/ML for sophisticated data analytics and other services.

- The focus for the next 6 quarters will be to use tier 1 customer solutions for tier 2 and tier 3 customers.

- The license fee that got deferred in this quarter is > $10 million.

- The management has acknowledged that the migration of iGCB to the cloud may keep revenues from this segment muted till FY21.

- The management has stated that they don’t need to go ahead with a capital raise at this time.

- The company has closed on update on one large iGTB deal and the other update will take place in Q3.

- The cycle time for most deals in the UK is getting extended due to Brexit and general uncertainties.

- The company is deploying 50% of current deals on the cloud.

- The management has clarified that their main products of iGTB and IDC are already cloud-native so they are not facing any problems for configuring for the cloud specifically.

- The expenses recognition for both license based and cloud-based models is the same. Only the revenue recognition is different.

- In the contextual banking platform, the company has 4 companies who should come live in the next 2 quarters.

- The management is defining their focus for the rest of the year to be maintaining margins and achieving EBITDA growth of 35% in FY20.

- Q3 is widely expected to be more cost-efficient than in previous quarters.

- The management has guided that Q4 should be cash flow positive.

Analyst’s View

Intellect Design Arena is a fast-rising disruptor in the digital transformation space for financial institutions. The company’s products are well received all over the world which is evidenced in the diverse set of geographies and financial institutions that they cater to. The current quarter was not good for the company with the company incurring losses at the PBT level. The main concern here is the volatility of the product revenues and deferment of deals that have caught the company off guard. The company has an impressive pipeline of deals and have also initiated a good amount of deals in the quarter but their actual cycle time for these deals to get approved and generating revenues is getting longer and this poses a risk to the company which is still not cash flow positive on a yearly basis yet. However, the technological expertise of the company and the wide acceptance of their diverse range of products across all segments of the finance industry is what makes Intellect Design Arena an undervalued stock with good potential, despite the variability in revenues and profit booking.

Notes from Annual Report 2018-19

Management Discussion Analysis

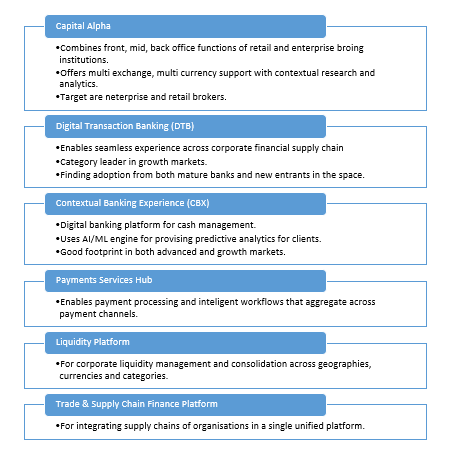

- The company is operating a suite of products in three main verticals in the finance industry which are Retail & Corporate Banking, Treasury & Capital Markets, and Insurance Industry. They are:

- The company’s transaction banking business has over 80 clients with 90 installations predominantly in growth markets.

- The company has another product called WealthQube which is targeted at wealth managers, private bankers, advisory firms and IFAs. The company promises a 20% rise in productivity and revenues from their product and have established a good foothold in growth markets.

- Intellect SEEC is another product addressing the digital and data needs of insurance carriers both through products and offering data as a service model. The product also has an AI-powered underwriting platform. The product has been adopted by leading insurers in the USA.

- Lastly, the company also operates a government e-marketplace portal (GeM) as a managed service along with a consortium of partners where they get fees based on transaction value. The portal has crossed Rs 20,000 Cr in GMV and is expected to rise even further as more state govt, departments and public sector enterprises come on board in the future.

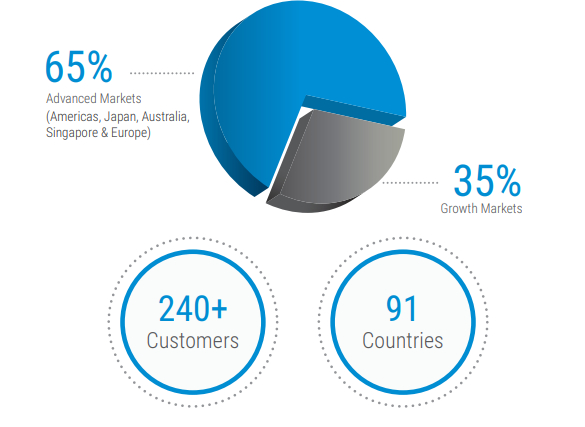

- All in all, the company has 240 active customers across 70 countries. In the transaction banking space, the company has 80 clients which is just about 25% of the 300+ players in this space worldwide highlighting good foothold and acceptance in this sector.

- The company attributes the following factors for their phenomenal growth in the last 4 years:

- Increasing win-rate

- A higher share of wins in advanced markets

- Increased license realization

- In the last 6 quarters, the company has amassed an overall deal pipeline of over $ 500 million with order backlog from license and subscription deals coming in at Rs 1800 Cr. 85% of total revenues were derived from repeat customers, highlighting the strength of the company’s business.

- The company is looking to institute cost moderation measures which have seen sales, marketing, and admin costs go down to 31% of revenues from 43% two years ago. They also want to keep research & engineering costs under 15% of revenues.

- The company identifies these companies as major competitors:

- GTB (Global Transaction Banking): Finastra, Infosys.

- Consumer Banking: Temenos (T24), Infosys (Finacle), Oracle Financial (Flex Cube), Finastra

- Treasury & Capital Markets:

- Capital Cube: Calypso, Murex, Finastra, FIS

- Capital Alpha: Fidessa, Flextrade

- Capital Sigma: Calypso, Vermeg, Temenos, TCS

- Insurance: Guidewire, Fineos, iPipeline

- Wealth & Asset Management: Temenos, Avaloq, Misys, Additiv, Edgeverve, Sage

Financial Performance in FY18-19

- Consolidated revenues for the year grew 36% YoY bringing up revenue growth over the last 4 years to a CAGR of 24.62%.

- The consolidated revenues grew 25.5% in dollar terms.

- The license revenue grew 67% YoY while the AMC revenue grew 17.55% YoY.

- 65% of all revenues originated from advanced markets.

- The company has also reduced SG&A costs to 31.21% of revenue from 35.22% in FY18 and 43.62% in FY17.

- Research, engineering and development costs are now at 14.91% of revenues as compared to 17.18% last year.

- The company achieved $ 947,000 per deal this as compared to $ 579,000 per deal last year.

- The gross margin was sustained at 49.46% for the previous year.

- The company also won 47 deals including 13 large digital transformation deals in FY19.

- The previous quarter also has good YoY revenues growth of 31.26% in rupee terms and 19.83% in dollar terms.

- The average from the top 20 accounts grew to Rs 42 Cr this year from Rs 18 Cr last year.

- The company’s research and development costs have also gone down to 14.9% from 17% last year showing better throughput from lower investments. R&D costs have gone up in absolute terms to Rs 30 Cr this year from Rs 23 Cr last year.

- The company has also signed 4 ‘destiny’ deals with large American insurers based on machine learning and big data. The company claims to have established itself as a clear leader in the domain of AI and machine learning for commercial insurance.

- The company maintains that they have increased pricing power due to their brand and their previous performance which is evident from the increased average that they have pulled from the top 20 customers mentioned in the first point in this segment.

Current Deals

The current funnel is around Rs 3580 Cr where Rs 3275 Cr is accounted by 133 opportunities. Average deal size in these opportunities is Rs 16 Cr ($2.3 million).

The company currently has 41 destiny deals in Q1FY20 with average destiny deal size at Rs 41 Cr ($5.9million).

Exhibits

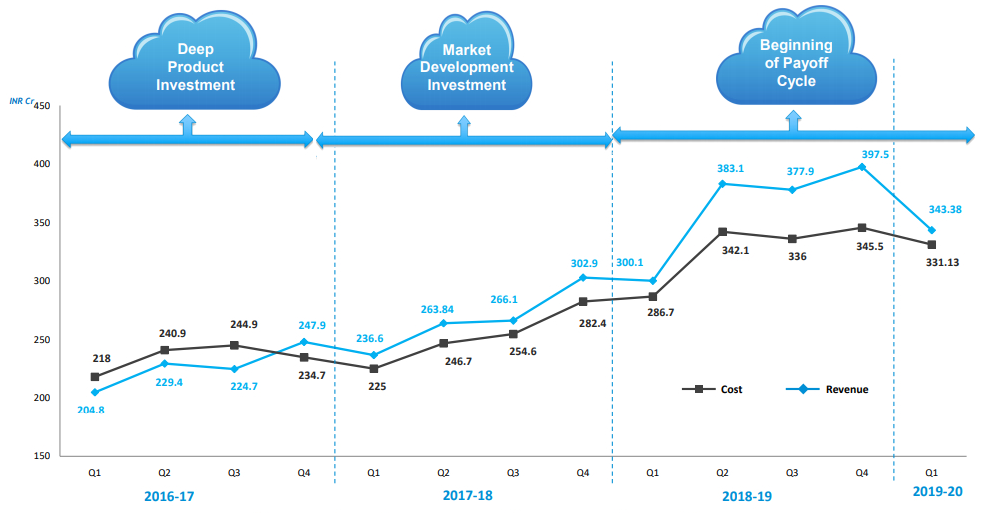

Analyst’s View

Intellect Design Arena is an emerging player in the financial technology space. They have successfully built a robust suite of products helping them cater to any and every financial institution no matter the function or sector. The company’s products have found acceptance across a wide variety of geographies from the advanced markets of US, UK, Japan to growth markets in India and Latin America. This highlights the versatility of their product customizations and their expertise in handling the various compliance requirements and regulations in diverse geographies. The company has now entered the product payoff phase and is expected to generate long term value in the years to come.

Q1 2020 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY20 | Q1FY19 | YoY % | Q4FY19 | QoQ % | |

| Sales | 184.1 | 236* | -21.99% | 254.1 | -27.55% |

| PBT | -0.5 | 56.25 | -100.89% | 13.47 | -103.71% |

| PAT | -0.5 | 58.4 | -100.86% | 5.5 | -109.09% |

| Consolidated Financials (In Crs) | |||||

| Q1FY20 | Q1FY19 | YoY % | Q4FY19 | QoQ % | |

| Sales | 352.5 | 341.4** | 3.25% | 401.2 | -12.14% |

| PBT | 3.6 | 43.4 | -91.71% | 43.2 | -91.67% |

| PAT | 3.4 | 43.9 | -92.26% | 41.5 | -91.81% |

*Contains other income of Rs 41 Cr

**Contains other income of Rs 42 Cr

Detailed Results

- Consolidated revenue from operations grew 14.4% YoY while the same figure grew 10.3% YoY in $ terms.

- License revenue for the quarter grew 41% YoY while AMC revenue for the quarter fell 8% YoY.

- The company recorded 5 digital wins with 2 large transformation deals with iGTB in Vietnam and the Bank of Mongolia.

- Net days of sales outstanding after taking customer advances came at 119 days in the current quarter. The investment into product development for Q1 stands at Rs 29.45 Cr.

- The current order backlog in GeM is at Rs 400 Cr while order backlog in other cloud deals is at Rs 300 Cr.

- The current funnel for the company is at $515 million which come to roughly Rs 3580 Cr.

- Average deal size in Q1FY20 was $2.3 million or Rs 16 Cr vs $1.8 million or Rs 12.5 Cr last year.

- The company has 41 destiny deals in Q1FY20 vs 34 last year. These deals have an average size of $5.9 million or Rs 41 Cr.

- License based order backlog is Rs 1128 Cr. Repeat revenue from existing customers stood at 88% in the current quarter.

Investor Conference Call Highlights

- There were 3 deals whose license revenues were not recognized in this quarter due to incomplete paperwork within the quarter deadlines. Thus these deal revenues will be recognized in the next quarter.

- The company is winning good deals against major competitors and the opportunities in digital transformation are increasing.

- Out of their 4 core business, 3 are already on the growth track.

- The company has also started to promote operational excellence by shifting down responsibilities one level down. For example, the duties and responsibilities of a VP are being shifted to the people below him in order to contain costs for growth.

- The company is also shifting the design and packaging of the product from the USA to India as it is feasible now due to the maturity of the product. Doing this helps the company moderate salary costs while ensuring sufficient quality of their product.

- The company is focusing on reducing the number of opportunities while increasing delivery efficiency of these opportunities. Thus the company is comfortable at the current funnel and will not be pursuing other opportunities desperately to ensure proper attention and service quality to existing customers.

- The realization of AMC contracts is 24-30 months and so the realization of revenues is expected to come after a few quarters at least.

- The services revenue is expected to come up in Q3 and Q4 onwards.

- In other income, the company got around Rs 13 Cr for sales of land.

- The management advises that QoQ changes in revenue do not properly reflect the performance as the recognition of revenue from projects is not uniform.

- The company is confident of achieving their revenue growth target as most of their deals are originating from North America and Asia and they are less vulnerable to immediate macro events like Brexit.

- The company’s accounts in the UK are from deep clients like Lloyds and HSBC and they do not expect any decline from this geography. The company is not very concerned about new businesses as most of its revenues are derived from repeat customers who have stayed loyal.

- The company expects to maintain its R&D expenditure for the year at the current pace.

- The company is comfortable at the current levels of cash generation and cash burn and is not going to raise additional cash unless there is any big deviation from current projections.

- The company has maintained that its data set quality is higher than its competitors.

- The company had achieved 24% growth last year despite the IDC business not contributing. Now that this business line has started delivering, the company is confident of achieving its proposed guidance targets.

- The traction for IDC is mainly in Africa and the Middle East. One of the IDC deals is also in the UK and this expected to go live in 2-3 months and push this business line in the UK and EU.

- The management sees that there will be more cloud migration for corporate banking and the company’s products are cloud ready and they are prepared for the trend to follow.

Analyst’s View