About the Company

ITC Limited is an Indian multinational conglomerate company headquartered in Kolkata, West Bengal. Established in 1910 as the ‘Imperial Tobacco Company of India Limited’, the company was renamed as the ‘India Tobacco Company Limited’ in 1970 and later to ‘I.T.C. Limited’ in 1974. It has a diversified presence in FMCG, Hotels, Packaging, Paperboards & Specialty Papers, and Agri-Business. It has many famous brands like Wills, Classic, Gold Flake, Aashirvaad, Sunfeast, Bingo, Fiama, Vivel, Classmate, and many others.

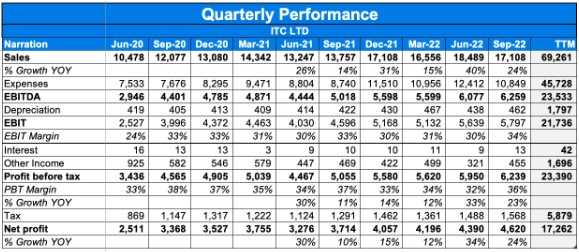

Q2 FY23 Update

Financial Results & Highlights

Detailed Results:

- The company had a very good quarter with a 24% consolidated revenue growth YoY and a rise of

24% YoY in consolidated profits in Q2.

- The Company EBITDA was up 27% YoY.

- Cigarette segment saw revenue growth of 23.3% YoY. Segment EBIT also grew 23.6% YoY.

- Stability in taxes, backed by deterrent actions by enforcement agencies, enabled continued volume recovery from illicit trade.

- FMCG-Others segment grew 21% YoY in Q2. Segment EBITDA grew 15% over Q2FY22. EBITDA margin was at 9.5%.

- Staples & Convenience Foods remained resilient while Hygiene products sales subdued. Out of home consumption saw strong growth. Education & Stationary products bounced back.

- Rapid growth in e-commerce, quick commerce, modern trade and institutional channels.

- ‘Fiama’ and ‘Vivel’ range of Personal Wash products performed well; Hygiene portfolio subdued but remained significantly above pre-pandemic levels.

- Market and outlet coverage is at 2x and 1.3x respectively compared to last year levels. Stockists network in rural markets stands at 2.7x compared to last year.

- ITC e-store now covers 14 cities with over 700 products in 45 categories.

- FMCG Cigarettes saw new varieties of additions to the portfolio.

- The Hotels business saw strong sequential improvement in ARRs with occupancy ahead of pre-pandemic levels. Leisure travel, MICE and Weddings drove entire growth.

- ITC Narmada, a luxurious 291-key property in Ahmedabad launched in Aug’22.

- Two launched during the quarter were Storii Shanti Morada, Goa and Storii Amoha Retreat Dharamshala.

- Recently launched full stack ITC Hotels App with cutting edge user experience.

- More properties to be launched soon under the Welcomhotel brand. Welcomhotel Brand footprint scaled up to 23 properties/2600 keys.

- The company is looking to drive engagement and business through ITC Hotels app which provides food delivery, room reservation, loyalty benefits and offers for customers.

- In the Paper & Paperboard business, the company saw revenues rise 25% YoY & an EBIT rise of 54%. It saw revenue driven by higher volumes and realization.

- A greenfield project for Paper and Paperboard business in Nadiad, Gujarat was commissioned in Q2FY23.

- Agribusiness saw a great revenue increase of 44% YoY & an EBIT growth of 16.6% YoY driven by strong growth in Wheat, Rice & Leaf Tobacco exports.

- ITC MAARS, a crop agnostic ‘physical’ full stack AgriTech platform is scaled up with 460+ FPOs in 9 states encompassing 1.8+ lac farmers.

- World-class manufacturing facility at Mysuru for export of Nicotine and Nicotine derivative products to US/EU is expected to be commission by Q4FY23.

- New Spices factory at Guntur is expected to be commissioned shortly.

- ITC Infotech saw a bad Q2 with revenue of Rs 821 Cr while EBITDA of Rs 211 Cr in the same period.

- ITC Infotech has also signed a ten-year strategic partnership agreement with PTC Inc, deepening its 20 year relationship with the company.

Analyst’s View:

ITC has been one of the biggest conglomerates in the history of modern India. The company has done well to diversify into other FMCG segments and build many leading brands like Aashirvaad, Bingo, etc. The company has seen good performance in Q2FY23 with all segments reporting good growth especially the Paperboard business and the Agribusiness segment. The company is doing well in maintaining a leadership position in many of its brands and always introducing new products under these brands. The company has seen sharp recovery in its out of home consumption products and has seen consistent rise in EBITDA in the FMCG-Others segment. The hotel business is also on its way back with demand coming back and the company is looking to drive this business using digital means through its ITC Hotels app. It remains to be seen how the company will mitigate the effects of the systematic decline of the cigarette industry and how long will it take for the FMCG business to realize its value and start performing like the rest of the industry. Also, ITC Infotech will play a huge role in the upcoming years towards growth of ITC’s bottom line. Nonetheless, given its history of building and maintaining durable brands, its leadership in various operating segments, and its mammoth cash-generating ability, ITC remains a critical stock to watch for any investor interested in the themes of FMCG and consumption, all the while providing a consistently high dividend yield every year.

Q4 FY22 Update

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 17100 | 14928 | 14.5% | 17616 | -2.9% | 62335 | 51775 | 20.3% |

| PBT | 5442 | 4853 | 12.1% | 5492 | -0.9% | 19829 | 17164 | 15.5% |

| PAT | 4190 | 3748 | 11.7% | 4156 | -0.8% | 15057 | 13031 | 15.5% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 18252 | 15983 | 14.1% | 18787 | -2.8% | 67041 | 55787 | 20.1% |

| PBT | 5620 | 5039 | 11.5% | 5580 | 0.7% | 20722 | 17945 | 15.4% |

| PAT | 4259 | 3816 | 11.6% | 4118 | 3.4% | 15485 | 13389 | 15.6% |

Detailed Results:

- The company had a good quarter with a 14% consolidated revenue growth YoY and a rise of 11% YoY in consolidated profits in Q4.

- The Company EBITDA was up 16.8% YoY.

- Cigarette segment saw revenue growth of 10% YoY. Segment EBIT also grew 12.2% YoY with EBIT margins up 130 bps YoY.

- FMCG-Others segment grew 12.3% YoY in Q4. Segment EBITDA grew 22.5% over Q4FY21. EBITDA margin was at 9%.

- Staples & Convenience Foods remained resilient while Hygiene products also moderated. Out of home consumption saw strong growth.

- ITC e-commerce FMCG FY22 Sales are 1.5x of FY21 levels.

- Market and outlet coverage is at 1.4x and 1.1x respectively compared to last year levels.

- ITC e-store now covers 15 cities with over 700 products in 45 categories.

- No new FMCG product launches done this quarter.

- In the personal care segment, Engage saw good resurgence with rise in mobility.

- FMCG Cigarettes saw new varieties of additions to the portfolio.

- The Hotels business saw strong sequential improvement in ARRs however saw occupancy below pre-pandemic levels. Leisure travel remained strong while business travel is coming back.

- The hotels segment added 9 new properties to the group portfolio including four Welcomhotel properties.

- More properties to be launched soon under the Welcomhotel brand. Welcomhotel Brand footprint scaled up to 23 properties/2600 keys.

- The company is looking to drive engagement and business through ITC Hotels app which provides food delivery, room reservation, loyalty benefits and offers for customers.

- In the Paper & Paperboard business, the company saw revenues rise 31.8% YoY & an EBIT rise of 39.1%. It saw revenue driven by higher volumes and realization.

- A greenfield project for Paper and Paperboard business in Nadiad, Gujarat is expected to be commissioned by Q2 FY23.

- Agribusiness saw a good revenue increase of 29.6% YoY & an EBIT growth of 28.5% YoY driven by strong growth in Wheat, Rice & Leaf Tobacco exports.

- ITC Infotech saw a great FY22 with revenue growth of 13.9% YoY to sales of Rs 2853 Cr while Pat grew 16.6% to Rs 541 Cr in the same period. Margin expansion a/c improved business mix and higher resource productivity.

- EBITDA margin for ITC Infotech decreased 10 bps YoY to 25.1% in FY22. It also saw PAT margin growth of 60 bps to 19%.

- ITC Infotech has also signed a ten-year strategic partnership agreement with PTC Inc. The transaction is expected to be consummated in Q1 FY23.

Analyst’s View:

ITC has been one of the biggest conglomerates in the history of modern India. The company has done well to diversify into other FMCG segments and build many leading brands like Aashirvaad, Bingo, etc. The company has seen good performance in Q4FY22 with all segments reporting good growth especially the Paperboard business growing 31.8% YoY and the Agribusiness segment growing 29.6% YoY. The company is doing well in maintaining a leadership position in many of its brands and always introducing new products under these brands. The company has seen sharp recovery in its out of home consumption products and has seen consistent rise in EBITDA in the FMCG-Others segment with EBITDA margin now at 9%. The hotel business is also on its way back with business travel demand coming back and the company is looking to drive this business using digital means through its ITC Hotels app. ITC Infotech has also turned into a good growth machine for ITC with revenue growth of 13.9% YoY. It remains to be seen how the company will mitigate the effects of the systematic decline of the cigarette industry and how long will it take for the FMCG business to realize its value and start performing like the rest of the industry. Also, ITC Infotech will play a huge role in the upcoming years towards growth of ITC’s bottom line. Nonetheless, given its history of building and maintaining durable brands, its leadership in various operating segments, and its mammoth cash-generating ability, ITC remains a critical stock to watch for any investor interested in the themes of FMCG and consumption, all the while providing a consistently high dividend yield every year.

Q3 FY22 Update

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 17616 | 13733 | 28.2% | 14230 | 23.7% | 45235 | 36846 | 22.7% |

| PBT | 5492 | 4880 | 12.5% | 4880 | 12.5% | 14387 | 12310 | 16.8% |

| PAT | 4156 | 3687 | 12.7% | 3697 | 12.4% | 10866 | 9283 | 17.0% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 18787 | 14670 | 28.0% | 15313 | 22.6% | 48788 | 39803 | 22.5% |

| PBT | 5580 | 4904 | 13.7% | 5054 | 10.4% | 15102 | 12905 | 17.0% |

| PAT | 4118 | 3587 | 14.8% | 3764 | 9.4% | 11225 | 9572 | 17.2% |

Detailed Results:

- The company had a good quarter with a 28% consolidated revenue growth YoY and a rise of 14.8% YoY in consolidated profits in Q3.

- The Company EBITDA was up 18.2% YoY.

- Cigarette segment saw revenue growth of 13.6% YoY and 10.8% QoQ. Segment EBIT also grew 14.4% YoY with EBIT margins up 55 bps YoY.

- FMCG-Others segment grew 9.3% YoY & 1.3% QoQ in Q3. Segment EBITDA grew 46% over Q3FY20 and -7.4% QoQ respectively. EBITDA margin was at 9.1%.

- Staples & Convenience Foods, saw a moderation while Hygiene products also moderated. Out of home consumption saw sharp recovery.

- ITC e-commerce FMCG 9M Sales are 3x of FY20 levels; now accounts for close to 7% of revenue.

- Market and outlet coverage is at 1.5x and 1.1x respectively compared to last year levels.

- ITC e-store now covers 15 cities with over 700 products in 45 categories.

- Sunfeast introduced new Dark Fantasy Deserts collection. Savlon introduced new handwash powder. ITC also acquired minority stake in Mother Sparsh, a premium ayurvedic and natural personal care startup with focus on mother and baby care segments.

- Aashirvaad forayed into the value-added adjacent vermicelli category.

- In the personal care segment, Engage saw good resurgence with rise in mobility.

- FMCG Cigarettes saw new varieties of additions to the portfolio.

- The Hotels business saw occupancy recover to pre-pandemic levels and saw strong sequential improvement in ARRs. Leisure travel remained strong while business travel is coming back.

- The hotels segment launched 2 new Welcomhotel properties which are:

- Welcomhotel Guntur – A first-of-its-kind premium property offering an immersive regional experience. (104 keys)

- Welcomhotel Bhubaneshwar – Draws inspiration from 500 magnificent temples adorning the city. (107 keys)

- 3 more properties to be launched soon under the Welcomhotel brand. Welcomhotel Brand footprint scaled up to 23 properties/2600 keys.

- The company is looking to drive engagement and business through ITC Hotels app which provides food delivery, room reservation, loyalty benefits and offers for customers.

- In the Paper & Paperboard business, the company saw revenues rise 38.5% YoY & an EBIT rise of 57.3%. It also saw paperboard sales volumes at a record high.

- Agribusiness saw a massive revenue increase of 100% YoY & an EBIT growth of 50.6% YoY driven by strong growth in Wheat, Rice & Leaf Tobacco exports.

- ITC Infotech saw a great 9M with revenue growth of 21.3% YoY to sales of Rs 2181 Cr while Pat grew 48.3% to Rs 454 Cr in the same period. Margin expansion a/c improved business mix and higher resource productivity.

- EBITDA margin for ITC Infotech improved 400 bps YoY to 27.5%. It also saw PAT margin growth of 380 bps.

Analyst’s View:

ITC has been one of the biggest conglomerates in the history of modern India. The company has done well to diversify into other FMCG segments and build many leading brands like Aashirvaad, Bingo, etc. The company has seen good performance in Q3FY22 with all segments reporting good growth especially the Paperboard business growing 38.5% YoY and the Agribusiness segment growing 100% YoY. The company is doing well in maintaining a leadership position in many of its brands and always introducing new products under these brands. The company has seen sharp recovery in its out of home consumption products and has seen consistent rise in EBITDA in the FMCG-Others segment with EBITDA margin now at 9.1%. The hotel business is also on its way back with business travel demand coming back and the company is looking to drive this business using digital means through its ITC Hotels app. ITC Infotech has also turned into a good growth machine for ITC with revenue growth of 21.3% YoY for 9M. It remains to be seen how the company will mitigate the effects of the systematic decline of the cigarette industry and how long will it take for the FMCG business to realize its value and start performing like the rest of the industry. Nonetheless, given its history of building and maintaining durable brands, its leadership in various operating segments, and its mammoth cash-generating ability, ITC remains a critical stock to watch for any investor interested in the themes of FMCG and consumption, all the while providing a consistent 5% dividend with a strong runway for business for many years to come.

Q2 FY22 Update

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 14230 | 12714 | 11.9% | 13388 | 6.3% | 27619 | 23113 | 19.5% |

| PBT | 4880 | 4301 | 13.5% | 4015 | 21.5% | 8895 | 7430 | 19.7% |

| PAT | 3697 | 3253 | 13.6% | 3013 | 22.7% | 6711 | 5595 | 19.9% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY22 | Q2FY21 | YoY % | Q1FY22 | QoQ % | H1FY22 | H1FY21 | YoY% | |

| Sales | 15313 | 13730 | 11.5% | 14688 | 4.3% | 30001 | 25134 | 19.4% |

| PBT | 5055 | 4565 | 10.7% | 4467 | 13.2% | 9522 | 8001 | 19.0% |

| PAT | 3764 | 3343 | 12.6% | 3419 | 10.1% | 7107 | 5986 | 18.7% |

Detailed Results:

- The company had a decent quarter with a 11.5% consolidated revenue growth YoY and a rise of 12.6% YoY in consolidated profits in Q2.

- Company EBITDA was up 16% QoQ.

- Cigarette segment saw revenue growth of 10.3% YoY and 10.5% QoQ. Segment EBIT also grew 10.4% YoY and 11.2% QoQ.

- FMCG-Others segment grew 23% YoY & 8% QoQ in Q2. Segment EBITDA grew 82% over Q2FY20 and 35% QoQ respectively. EBITDA margin improved to 10%. Segment EBIT fell 2.7% YoY.

- Staples & Convenience Foods, saw a moderation while Hygiene products also moderated. Out of home consumption saw sharp recovery.

- ITC e-commerce FMCG Sales tripled YoY in H1: now accounts for close to 7% of revenue.

- Market and outlet coverage is at 1.4x and 1.1x respectively compared to pre‐Covid levels.

- ITC e-store now covers 15 cities.

- Aashirvaad forayed into the value-added adjacent vermicelli category.

- ‘B Natural’ Beverages launched ‘B Natural-Nutrilite’ co-created with Amway.

- In the personal care segment, Engage saw good resurgence with rise in mobility.

- In the cigarette segment, the company increased its stockist network 2.1x YoY and rural servicing infrastructure 1.1x YoY.

- The Hotels business saw revenues come back to Q4FY21 level with EBITDA of Rs 17 Cr. Occupancy and ARR continue to rise. Leisure travel remained strong while business travel is coming back.

- The hotels segment launched 2 new brands which are:

- Storii by ITC Hotels: A collection of handpicked properties offering unique bespoke

experience-led stays. - Mementos by ITC Hotels: A collection of unique hotels ranging from modern marvels, hidden retreats to historic treasures.

- Storii by ITC Hotels: A collection of handpicked properties offering unique bespoke

- The company also launched Welcomhotel Katra which is located in the foothills of the holy Vaishno Devi Shrine in Aug 2021. It also launched Welcomhotel Bhubaneshwar in Oct 2021.

- 4 more properties to be launched soon under the Welcomhotel brand.

- The company also reduced fixed costs by 31% YoY in Q2 in the hotels business.

- In the Paper & Paperboard business, the company saw revenues rise 25% YoY & an EBIT rise of 24%. It also saw paperboard sales volumes at a record high.

- Agribusiness saw a decent revenue decline of 7% YoY & an EBIT growth of 15.7% YoY driven by strong growth in Wheat, Rice & Leaf Tobacco exports. Value added portfolio grew 16% YoY.

- ITC Infotech saw a great H1 with revenue growth of 24% YoY to sales of Rs 1445 Cr/

- EBITDA margin improved 680 bps YoY to 28.2%. It also saw PAT growth of 69% YoY

Analyst’s View:

ITC has been one of the biggest conglomerates in the history of modern India. The company has done well to diversify into other FMCG segments and build many leading brands like Aashirvaad, Bingo, etc. The company has seen decent performance in Q2FY22 with the Paperboard business growing 25% YoY and the FMCG-Cigarette segment also showing revenue growth of 10% YoY. The company is doing well in maintaining a leadership position in many of its brands and always introducing new products under these brands. The company has seen sharp recovery in its out of home consumption products and has seen consistent rise in EBITDA in the FMCG-Others segment with EBITDA margin now at 10%. The hotel business is also on its way back with business travel demand coming back and the company launching 2 new brands of “Storii” and “Mementos” in this business. ITC Infotech has also turned into a good growth machine for ITC with revenue growth of 24% YoY and PAT growth of 69% YoY in H1. It remains to be seen how the company will mitigate the effects of the systematic decline of the cigarette industry and how long will it take for the FMCG business to realize its value and start performing like the rest of the industry. Nonetheless, given its history of building and maintaining durable brands, its leadership in various operating segments, and its mammoth cash-generating ability, ITC remains a critical stock to watch for any investor interested in the themes of FMCG and consumption, all the while providing a consistent 5% dividend with a strong runway for business for many years to come.

Q1 FY22 Update

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 13388 | 10399 | 28.74% | 14929 | -10.32% |

| PBT | 4015 | 3128 | 28.36% | 4854 | -17.28% |

| PAT | 3013 | 2343 | 28.60% | 3748 | -19.61% |

| Consolidated Financials (In Crs) | |||||

| Q1FY22 | Q1FY21 | YoY % | Q4FY21 | QoQ % | |

| Sales | 14688 | 11404 | 28.80% | 15984 | -8.11% |

| PBT | 4467 | 3436 | 30% | 5039 | -11.35% |

| PAT | 3343 | 2567 | 30% | 3817 | -12.42% |

Detailed Results:

- The company had a decent quarter with a 29% consolidated revenue growth YoY and a rise of 30% YoY in consolidated profits in Q1.

- Company EBITDA was up 50% YoY.

- FMCG-Others segment grew almost 10% YoY in Q1. Segment EBITDA & EBIT grew 16% YoY and38% YoY respectively. EBITDA margin improved 40 bps YoY to 8%. Staples & Convenience Foods,saw a mild uptick while Hygiene products bounced back well after a normalized H2.

- ITC e-commerce FMCG Sales doubled: now accounts for close to 8% of revenue.

- Market and outlet coverage is at 1.4x and 1.1x respectively compared to pre‐Covid levels.

- ITC e-store now covers 11 cities.

- Bingo saw good YoY growth while Yippee saw good QoQ growth.

- Aashirvaad Svasti’ entered the Bengali desserts space with the launch of Aashirvaad Svasti Mishti Doi in select markets of West Bengal.

- The demand from rural markets remained resilient but was slowing down.

- Input costs in FMCG-Others have risen sharply.

- The cigarette segment saw good revenue and EBIT growth of 33% and 37% YoY respectively. It also saw a margin expansion of 210 bps YoY.

- The Hotels business remained down due to restrictions in place for the 2nd wave of COVID-19 but the domestic leisure segment saw a good uptick in tourist destinations in June when the restrictions were lifted.

- ITC Windsor, Bengaluru, became the first hotel in the world to receive the prestigious LEED Zero Carbon Certification.

- Aggressive cost-cutting led to a YoY rise of 50% or Rs 87 Cr in Q1.

- In the Paper & Paperboard business, the company saw revenues rise 54% YoY & an EBIT rise of 145%. Growth during the quarter was driven by Value Added Paperboards, Décor paper, and carton packaging.

- Agribusiness saw a decent revenue growth of 9.2% YoY & an EBIT growth of 9.5% YoY driven by strong growth in Wheat, Rice & Leaf Tobacco exports, and Soya in the domestic market.

Analyst’s View:

ITC has been one of the biggest conglomerates in the history of modern India. The company has done well to diversify into other FMCG segments and build many leading brands like Aashirvaad, Bingo, etc. The company has seen good performance in Q1FY22 with the Paperboard business growing 54% YoY and the FMCG-Cigarette segment doing very well with revenue growth of >30% YoY. The company is doing well in maintaining a leadership position in many of its brands and always introducing new products under these brands. The company has shown resilient growth in its FMCG segment in the health & hygiene space and has seen good growth in the e-commerce space with channel sales account for 8% of total sales now. It has also done well to keep expanding the Hygiene range. The hotel business is also on its way back with demand rising sharply when restrictions went down in June. It remains to be seen how the company will mitigate the effects of the systematic decline of the cigarette industry and how long will it take for the FMCG business to realize its value and start performing like the rest of the industry. Nonetheless, given its history of building and maintaining durable brands, its leadership in various operating segments, and its mammoth cash-generating ability, ITC remains a critical stock to watch for any investor interested in the themes of FMCG and consumption, all the while providing a consistent 5% dividend with a strong runway for business for many years to come.

Q4 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 14929 | 13734 | 8.70% | 12176 | 22.61% | 51776 | 49821 | 3.92% |

| PBT | 4854 | 4880 | -0.53% | 4512 | 7.58% | 17164 | 19167 | -10.5% |

| PAT | 3748 | 3688 | 1.63% | 3797 | -1.29% | 13032 | 15136 | -13.90% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 15984 | 14670 | 8.96% | 13228 | 20.83% | 55788 | 53991 | 3.33% |

| PBT | 5039 | 4905 | 3% | 4743 | 6.24% | 17945 | 20026 | -10% |

| PAT | 3817 | 3587 | 6% | 3926 | -2.78% | 13390 | 15585 | -14.08% |

Detailed Results

- The company had a decent quarter with a 9% consolidated revenue growth YoY and a rise of 6% YoY in consolidated profits in Q4. Pat grew 8.4% YoY

- FMCG-Others segment grew almost 16% YoY in Q4 and 16% YoY in FY21. Segment EBITDA grew 19% YoY and EBITDA margin improved 115 bps YoY to 8.9% in FY21 and 8.3% in Q4. Staples, Convenience Foods, and Health & Hygiene products record growth of 13% YoY in Q4 & 20% YoY in FY21. Discretionary/’out-of-home’ categories grew 23% YoY in Q4 & 2% YoY in FY21. Savlon saw consumer spend of Rs 1200 Cr in FY21.

- ITC e-commerce FMCG Sales doubled: now accounts for close to 5% of revenue.

- In Staples, Snacks, and Meals category, ‘Aashirvaad’ atta fortified its leadership position in the branded packaged atta industry during the year while Aashirvad Svasti range of dairy products saw a good response.

- Sunrise Foods process integration completed.

- Personal Care products saw capacity expansion across categories like Handwash 4.5x, Sanitizers 100x, Floor Cleaner 2.3x, Soaps & Antiseptic Liquids 6x during FY21.

- The hotel business earned an EBITDA of Rs 25 Cr in Q4. Construction of 3 new properties -ITC Narmada, a Luxury Collection hotel in Ahmedabad, and Welcomhotels at Bhubaneswar and Guntur -with around 500 rooms are nearing completion.

- In the Cigarette segment, Revenues grew 14.2% YoY while EBIT rose 7.7% YoY.

- In the Hotels business, leisure destinations turned in a strong performance in the wedding business and staycations leading the charge. The company reduced fixed costs by 41% in FY21. ITC also commissioned Welcomhotel Shimla& Welcomhotel Ahmedabad.

- In the Paper & Paperboard business, the company saw revenues rise 13.5% YoY & an EBIT rise of 13.1%. It saw strong growth in Specialty papers –Pharma & Décor segments.

- Paper Machine Rebuild Project at Bhadrachalam successfully commissioned in March’21.

- Agribusiness saw a robust revenue growth of 78.5% YoY & an EBIT growth of 54.2% YoY driven by wheat exports to Bangladesh, Malaysia, Sri Lanka & UAE. It also saw strong growth in value-added spices in food-safe markets.

- ITC launched a total of 120+ products in FY21.

- The company also announced a final dividend of Rs 5.75 per share bringing the total dividend for FY21 to Rs 10.75 per share.

Analyst’s View

ITC has been one of the biggest conglomerates in the history of modern India. The company has done well to diversify into other FMCG segments and build many leading brands like Aashirvaad, Bingo, etc. The company has seen good performance in the current quarter with the Agribusiness growing 78% YoY on the back of wheat exports and the FMCG-Others doing very well and rising steadily. The company is doing well in maintaining a leadership position in many of its brands and always introducing new products under these brands. The company has shown resilient growth in its FMCG segment in the health & hygiene space which was witnessed by the more than Rs 1200 Cr consumer spend on Savlon alone in FY21. It has also done well to keep expanding the Aashirwad range and maintain market share in strong areas like atta while expanding into pulses, breakfast meals, and most recently dairy products. The Hotel business is also on its way back with demand coming in from weddings and staycations and has earned Rs 25 Cr EBITDA in Q4. It remains to be seen how the company will mitigate the effects of the systematic decline of the cigarette industry and how long will it take for the Hotel business to get back to pre-covid level of operations. Nonetheless, given its history of building and maintaining durable brands, its leadership in various operating segments, and its mammoth cash-generating ability & the 5%, ITC remains a critical stock to watch for any investor interested in the themes of FMCG and consumption, all the while providing a consistent 5% dividend with a strong runway for business for many years to come.

Q3 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 13551 | 12997 | 4.26% | 12587 | 7.66% | 36537 | 37645 | -2.94% |

| PBT | 4848 | 5036 | -3.73% | 4274 | 13.43% | 12250 | 14655 | -16.41% |

| PAT | 3663 | 4142 | -11.56% | 3232 | 13.34% | 9238 | 11339 | -18.53% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 14670 | 13960 | 5.09% | 13730 | 6.85% | 39804 | 40763 | -2.35% |

| PBT | 4805 | 5049 | -5% | 4565 | 5.26% | 12906 | 15283 | -15.55% |

| PAT | 3587 | 4048 | -11% | 3419 | 4.91% | 9573 | 11658 | -17.88% |

Detailed Results

- The company had a mixed quarter with a 5% consolidated revenue growth YoY and a fall of 11% YoY in consolidated profits in Q3.

- FMCG-Others segment grew almost 11% YoY in Q3 and 16% YoY in 9M. Segment EBITDA grew 28% YoY and EBITDA margin improved 150 bps YoY to 9.2%. Staples, Convenience Foods, and Health & Hygiene products record growth of 11% YoY. Discretionary/’out-of-home’ categories grew 11% YoY. Savlon saw consumer spend of Rs 1000 Cr in 9M period.

- The hotel business turned EBITDA positive and was break-even in Q3.

- Ecommerce now accounts for 5% of revenues from the FMCG-Others segment.

- In Staples, Snacks and Meals category, ‘Aashirvaad’ atta fortified its leadership position in the branded packaged atta industry during the quarter while Aashirvad Salt saw strong growth.

- The company also added new products like ‘YiPPee!’ Saucy Masala Noodles, ‘Sunfeast Dark Fantasy’ ChocoChip and ChocoNut Fills biscuits, ‘B Natural’ Pom+immunity juice, and ready-to-drink immunity soups in two variants -Red Veggie and Tomato; Khatta Meetha Poha, Veggie Upma, Mini Idli Sambar, Suji Halwa with Jaggery under Aashirvaad range of breakfast and snacking meals; ‘Sunfeast Caker’, Range of organic dals and pulses under ‘Aashirvaad Nature’s Super Foods’, and many others.

- In the Cigarette segment, Revenues grew 5% QoQ but declined 7.6% YoY while PBT rose 13% QoQ. The company introduced new variants like Gold Flake Neo, Classic Connect, American Club Clove Mint, Gold Flake Indie Mint, Capstan Fresh Flavour, Gold Flake Luxury Filter, Gold Flake Neo SMART Filter, Navy Cut Deluxe Filter, Player’s Gold Leaf Chase, and Gold Flake Star.

- In the Hotels business, leisure destinations turned in a strong performance with Rajasthan, Goa, and hill stations leading the charge. The company reduced fixed costs by 44% in Q3. ITC also added Welcomhotel Shimla and relaunched Welcomhotel Port Blair in Q3.

- In the Paper & Paperboard business, the company saw revenues decline 5% YoY & EBIT decline of 14.6%. It saw subdued domestic demand which was partly offset by export growth.

- Agribusiness saw a robust growth of 18.5% YoY driven by trading opportunities in rice, soya, and wheat supplies for Aashirvaad atta. Value-added portfolio (ex. aqua) comprising spices for ‘food-safe’ markets, processed fruits, frozen snacks, etc. posted 25% growth in revenue.

- The company also announced an interim dividend of Rs 5 per share.

Analyst’s View

ITC has been one of the biggest conglomerates in the history of modern India. The company has done well to diversify into other FMCG segments and build many leading brands like Aashirvaad, Bingo, etc. The company has seen another mixed performance in the current quarter with its FMCG-Cigarettes still not recovered to pre-covid levels and the FMCG-Others doing very well and rising steadily. The company is doing well in maintaining a leadership position in many of its brands and always introducing new products under these brands. The company has shown resilient growth in its FMCG segment in the health & hygiene space which was witnessed by the more than Rs 1000 Cr consumer spend on Savlon alone in 9MFY21. It has also done well to keep expanding the Aashirwad range and maintain market share in strong areas like atta while expanding into pulses and breakfast meals. The Hotels business is also on its way back and was EBITDA positive and breakeven in Q3. It remains to be seen how the company will mitigate the effects of the systematic decline of the cigarette industry and how long will it take for the Hotels business to get back to pre-covid level of operations. Nonetheless, given its history of building and maintaining durable brands, its leadership in various operating segments, and its mammoth cash-generating ability, ITC remains a critical stock to watch for any investor interested in the themes of FMCG and consumption.

Q2 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 12587 | 12526 | 0.49% | 10399 | 21.04% | 22985 | 24649 | -6.75% |

| PBT | 4274 | 4808 | -11.11% | 3128 | 36.64% | 7403 | 9619 | -23.04% |

| PAT | 3232 | 4023 | -19.66% | 2343 | 37.94% | 5575 | 7197 | -22.54% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 13730 | 13497 | 1.73% | 11404 | 20.40% | 25134 | 26802 | -6.22% |

| PBT | 4565 | 5042 | -9.46% | 3436 | 32.86% | 8001 | 10234 | -21.82% |

| PAT | 3419 | 4173 | -18.07% | 2567 | 33.19% | 5986 | 7610 | -21.34% |

Detailed Results

- The company had a mixed quarter with a 1.7% consolidated revenue growth YoY and a fall of 18% YoY in consolidated profits in Q2.

- FMCG-Others segment grew almost 18.4% YoY and segment EBITDA grew 66% YoY. The revenues excluding education and stationery products have grown 25% YoY. Segment EBITDA margins expanded 300 bps YoY to 9.7%.

- The hotel business was similarly severely impacted in Q2 due to restrictions on travel and hotel operations.

- In Staples, Snacks and Meals category, ‘Aashirvaad’ atta fortified its leadership position in the branded packaged atta industry during the quarter and added new products like organic atta & pulses and low sodium salt variants.

- The company also added new products like ‘Sunfeast Farmlite’ Veda Marie Digestive, Nuts Digestive & Seed Digestive biscuits; ‘Sunfeast Caker’ Trinity and Swiss Roll cakes; Tedhe Medhe ‘Bingo!’ Namkeen Aloo Bhujia, Pulse Mix, Nut Cracker & Nut Mix; ‘Candyman Jelimals’ Immunoz; ‘Aashirvaad Svasti’ Lassi; ‘B Natural’ Nagpuri Santra & immunity range of juices and ‘Aashirvaad’ Organic atta, Organic Dais, Salt Proactive (low sodium salt) & Iodised Crystal Salt in Q2.

- In Personal Care Products Business, Savlon recorded significant market share gains across sub-segments and is on course to become a 1000 crore brand in terms of annual consumer spend in FY21.

- Under the Savlon brand, the company added many new products in Q2 like Savlon Surface Disinfectant Spray, Savlon Clothes Disinfectant Spray, Savlon Spray and Wipe, Savlon Germ protection Wipes, Savlon Hexa Hand Sanitizer, Savlon Hexa Advanced Bodywash, etc.

- With growing preference for natural products, Nimyle, a 100% natural floor cleaner grew rapidly strengthening its market standing in the East. Nimwash, a 100% natural action product for cleaning fruits and vegetables, is also gaining consumer franchise.

- In the Cigarettes segment, Revenues declined 14.4% YoY. The company introduced new variants like Classic Connect, Gold Flake Indie Mint, Capstan Fresh, Gold Flake Luxury Filter, Navy Cut Deluxe Filter, Gold Flake Star, Gold Flake Regal Special, Gold Flake Super Star (Super Mint), and Player’s Gold Leaf Rush in Q1.

- In the Hotels business, the company reduced its fixed costs by close to 50%. It launched ‘Flavours’ and ‘Gourmet Couch’ menus as home delivery and takeaway offerings which received an encouraging response.

- In the Paper & Paperboard business, the company saw revenues decline 6.8% YoY. It maintained segment margins at last year’s levels despite volume and pricing pressure through product mix enrichment, sharp focus on operational efficiency, and structural cost-saving interventions. ITC also strengthened the market standing in Value Added Products by 500 bps.

- Agribusiness saw a robust growth of 12.8% YoY driven by trading opportunities in rice, mustard, coffee, and higher wheat supplies for Aashirvaad atta. Value-added portfolio (ex. aqua) comprising spices for ‘food-safe’ markets, processed fruits, frozen snacks etc. posted 25% growth in revenue.

Analyst’s View

ITC has been one of the biggest conglomerates in the history of modern India. The company has done well to diversify into other FMCG segments and build many leading brands like Aashirvaad, Bingo, etc. The company has seen a mixed performance in the current quarter with its FMCG-Cigarettes still not recovered to pre-covid levels and the FMCG-Others doing very good and rising steadily. The company is doing well in maintaining a leadership position in many of its brands and always introducing new products under these brands. The company has shown resilient growth in its FMCG segment due to the increase in at-home consumption and the migration towards trusted brands in the food space. It has also done well to expand the manufacturing capability of Savlon Brand and to capitalize on the demand surge for Health & Hygiene products by introducing many new products under the Savlon brand. It remains to be seen whether there are any more disruptions in the future from COVID-19 and how long will it take for the Hotels business to get back to its feet. Nonetheless, given its history of building and maintaining durable brands, its leadership in various operating segments, and its mammoth cash-generating ability, ITC remains a critical stock to watch for any investor interested in the themes of FMCG and consumption.

Q1 FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 10399 | 12123 | -14.22% | 12175 | -14.59% |

| PBT | 3128 | 4812 | -35.00% | 4512 | -30.67% |

| PAT | 2343 | 3174 | -26.18% | 3797 | -38.29% |

| Consolidated Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 11404 | 13305 | -14.29% | 13228 | -13.79% |

| PBT | 3436 | 5192 | -33.82% | 4743 | -27.56% |

| PAT | 2567 | 3437 | -25.31% | 3926 | -34.62% |

Detailed Results

-

- The company had a dismal quarter with a 14% consolidated revenue decline YoY and a fall of 25% YoY in consolidated profits.

- FMCG-Others segment grew almost 12.2% YoY and segment EBITDA grew 42.4% YoY. The revenues excluding education and stationery products have grown 34% YoY.

- The hotel business was similarly severely impacted in Q1 due to restrictions on travel and hotel operations. Q1 revenues fell 94% YoY. Aggressive reduction in controllable fixed costs partly mitigated the impact.

- The Agribusiness revenues were up 4% YoY on the back of trading opportunities in oilseeds and rice.

- The paper & packaging segment saw its performance impacted by lower offtake from end-user industries. Here export growth helped mitigate weak domestic demand. segment revenues declined by 32.8% YoY.

- In Staples, Snacks and Meals category, ‘Aashirvaad’ atta posted strong growth across markets. The brand further fortified its leadership position in the branded packaged atta industry during the quarter with significant value and volume growth.

- Sunfeast’ Biscuits and Cakes recorded robust growth driven mainly by a surge in ‘at home’ consumption and the consumers’ preference for trusted brands.

- In the Dairy & Beverages category, ‘Aashirvaad Svasti’ range of fresh dairy products and ghee recorded strong growth.

- The Chocolates and Confectionery categories were severely impacted reflecting the subdued demand for discretionary products.

- The Personal Care Products Business recorded substantial growth in revenue driven by heightened awareness and demand for hygiene products such as hand sanitizers, hand wash, antiseptic liquids, and floor cleaners in the wake of COVID-19 pandemic.

- The newly set-up perfume manufacturing plant at Manipura, Himachal Pradesh was re-purposed to manufacture hand sanitizers and service increased demand.

- The portfolio was augmented with the launch of several products like ‘Savlon Surface Disinfectant Spray’, ‘Savlon Hexa’ hand sanitizing liquid, ‘Savlon Germ Protection Wipes’, Savlon Hand Sanitizer Sachet, ‘Savlon Hexa advanced’ Soap.

- The Agarbatti industry was confronted with significant operational challenges, especially in the initial lockdown phase, mainly due to the higher focus of consumers and trade channels on essential products.

- The significant surge in demand across categories in the portfolio was met through technology-enabled solutions leveraging predictive analytics tools, shortened demand planning cycles, focus on fewer SKUs, and higher-value packs, backed by flexible manufacturing plans and responsive supply chain operations to cater to variability in demand.

- During the lockdown phase, nearly two-thirds of the throughput was delivered direct-to-customer/market from factories leading to a reduction in time-to-market.

- The company was the first in the industry to launch an online ordering system for retailers. It also facilitated swift scaling up of cold-calling and Whatsapp based order taking from retailers and deployed mechanized and non-mechanized delivery modes.

- The company also enhanced the presence of its product portfolio in alternative channels and entered into a collaboration with several companies such as Dominos, Swiggy, Zomato, Dunzo.

- The company expanded its presence in the emerging channels of Modern Trade and e-Commerce during the quarter, growing at over 20% and 90% respectively.

- In the Cigarettes segment, manufacturing operations were resumed in mid-May and thereafter rapidly scaled up. Currently, all factories are operational and production has been scaled up to pre-COVID levels.

- The company has launched many new cigarette variants like Gold Flake Luxury filter in the Longs segment, and Navy Cut Deluxe Filter, Gold Flake Indie Mint and Capstan Fresh in the regular size filter segment. The Flake brand was launched in an innovative 5s pack in target markets.

- In the Hotels business, the company is progressing towards accreditation by the National Accreditation Board for Hospitals & Healthcare Providers (NABH) for its operating procedures.

- In Agribusiness, the company ramped up the direct milk sourcing network in West Bengal to cater to the increasing requirements on the back of the growing franchise of the Aashirvaad Svasti range of dairy products.

- While demand for packaging in Pharma has remained stable, there has been a significant adverse impact in categories like publications, décor, wedding cards.

- Swift resumption of business ahead of the competition, strong dealer network, and agility in servicing customer needs to be aided in further strengthening market share in the Value Added Paperboards segment. Strategic cost management and import substitution continue to aid margin expansion and strengthen competitive advantage in this space.

Analyst’s View

ITC has been one of the biggest conglomerates in the history of modern India. The company has done well to diversify into other FMCG segments and build many leading brands like Aashirvaad, Bingo, etc. The company has seen a modest performance in the current quarter with severe disruption in its FMCG-Cigarettes and the Hotels business due to the lockdown. The company is doing well in maintaining a leadership position in many of its brands. The company has shown resilient growth in its FMCG segment due to the increase in at-home consumption and the migration towards trusted brands in the food space. It has also done well to expand the manufacturing capability of Savlon Brand and to capitalize on the demand surge for Health & Hygiene products by introducing many new products under the Savlon brand. It remains to be seen whether there are any more disruptions in the future from COVID-19 and how long will it take for the Hotels business to get back to its feet. Nonetheless, given its history of building and maintaining durable brands, its leadership in various operating segments, and its mammoth cash-generating ability, ITC remains a critical stock to watch for any investor interested in the themes of FMCG and consumption.

Q4 FY20 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 12176 | 12946 | -5.95% | 12997 | -6.32% | 49821 | 48269 | 3.22% |

| PBT | 4512 | 4954 | -8.92% | 5036* | -10.41% | 19167* | 18444 | 3.92% |

| PAT | 3797 | 3482 | 9.05% | 4142 | -8.33% | 15136 | 12464 | 21.44% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 13228 | 13902 | -4.85% | 13960 | -5.24% | 53991 | 52036 | 3.76% |

| PBT | 4743 | 5142 | -7.76% | 5049* | -6.06% | 20026* | 19138 | 4.64% |

| PAT | 3926 | 3593 | 9.27% | 4048 | -3.01% | 15585 | 12824 | 21.53% |

*Includes an exceptional item of Rs 132.11 Cr which represents the loss of tobacco leaf stocks destroyed in a fire at a third party owned warehouse. The insurance claim for this is under process.

Detailed Results

-

- The company had a modest quarter with a 5% consolidated revenue decline YoY and a rise of 9% YoY in consolidated profits.

- FY20 performance was decent with 4% consolidated revenue growth and 21.5% profit growth. The growth in profits was mainly due to fall in corporate tax rate which was instituted earlier this year.

- Free cash flow in FY20 was up 30% YoY.

- The Board recommended a dividend of Rs 10.15 for FY20.

- FMCG-Others segment grew almost 5% YoY and segment EBITDA grew 32.8% YoY.

- The Education and Stationery Products segment was doing well until February but was severely impacted in the peak month of March due to the closure of educational institutions from the COVID-19 lockdown. This segment grew 5% YoY in Q4.

- The hotel business was similarly severely impacted in March due to the closure of the company’s facilities. FY20 revenues grew 10% YoY while segment EBITDA grew 12 % YoY in the same period.

- The Agribusiness was also impacted in March from the supply chain disruptions from COVID-19.

- The paper & packaging segment saw modest revenue growth of 5.3% YoY in Q4 driven by higher in-house pulp production, enhanced operating efficiencies, and benign input costs.

- The Company entered into a Share Purchase Agreement (‘SPA’) to acquire 100% of Sunrise Foods Private Limited (SFPL), an Indian company primarily engaged in the business of spices under the trademark ‘Sunrise’.

- ITC has been ranked #1 globally amongst peers (comprising companies with a market capitalization between USD 38 Bln. and USD 51 Bln.) and overall #3 globally on ESG performance in the Food Products industry by Sustainalytics — a renowned global ESG ratings company. ITC has been rated ‘AA’ by MSCI-ESG – the highest among global tobacco companies.

- The cigarette business was the most impacted in Q4 due to the steep increase in taxes since Feb 2020 and the operational disruptions from the lockdown.

- The FMCG-Others EBITDA margins rose 160 bps to 7.1% in Q4 despite the heightened competitive intensity, early closure of educational institutions that impacted the Education & Stationery Products Business, elevated input costs, gestation costs of new products/categories and manufacturing facilities and impact due to disruptions following the outbreak of the pandemic.

- Earnings per share for FY20 was at Rs 12.33 vs Rs 10.19 a year ago.

- In Q4 the company launched Aashirvaad Nature’s Super Foods, a differentiated range of products comprising Gluten-Free Flour, Ragi Flour, and Multi-Millet Mix which are naturally gluten-free, rich in dietary fiber and a source of protein.

- In the Spices segment, the company expanded its geographical footprint to 17 states and recorded healthy volume growth in FY20.

- In the Instant Noodles category, YiPPee! noodles sustained its growth momentum and overall market standing as a strong, competitive #2 brand in the noodles space.

- Due to the demand surge for Health & Hygiene products from COVID-19, the company rapidly expanded manufacturing capacity manifold and enhanced availability of the ‘Savlon’ antiseptic liquid, soap, handwash, hand sanitizer, and ‘Fiama’ handwash products in the market. The newly setup perfume manufacturing plant at Manpura, Himachal Pradesh was re-purposed in quick time to manufacture hand sanitizers and service increased demand.

- The company also launched ‘Savlon Surface Disinfectant Spray’ and ‘Savlon Hexa’ hand sanitizing liquid for quick and persistent action.

- The manufacturing facilities in staples category (atta, biscuits, and noodles) has returned back to 100 % utilization.

- Other FMCG categories and Paperboards and Packaging are operating at 80-85% of normal levels.

- The company developed and launched many products during the lockdown such as the Savlon Disinfectant Spray, Savlon Hexa with added protection, Savlon Wipes, Nimwash, B-natural Plus range of Immunity beverages, Home and Family Packs of some of the company’s trusted brands, etc.

- The company has also tied up with various companies like Dominos, Swiggy, Zomato, Dunzo, Amway, etc for the last-mile delivery of its products.

- The company is also introducing innovations like ‘ITC Store on Wheels’ to ensure direct reach to consumers in residential agglomerations. It is also increasing availability in e-commerce platforms including the ITC eStore.

Analyst’s View

ITC has been one of the biggest conglomerates in the history of modern India. The company has done well to diversify into other FMCG segments and build many leading brands like Aashirvaad, Bingo, etc. The company has seen a modest performance in the current quarter with severe disruption in its FMCG-Cigarettes and the Hotels business due to the lockdown. The company is doing well in maintaining a leadership position in many of its brands. The company has shown resilient growth in its FMCG segment despite the supply chain constraints brought on by COVID-19. IT has also done well to expand the manufacturing capability of Savlon Brand and to capitalize on the demand surge for Health & Hygiene products by introducing two new products under the Savlon brand. It remains to be seen how the company will restructure its vast supply chain structure to function efficiently in the post COVID world and whether there are any more disruptions in the future from COVID-19. Nonetheless, given its history of building and maintaining durable brands, its leadership in various operating segments, and its mammoth cash-generating ability, ITC remains a critical stock to watch for any investor interested in the themes of FMCG and consumption.

Q3 FY20 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 12996.63 | 12267.65 | 5.94% | 12525.8 | 3.76% | 37645.42 | 35322.72 | 6.58% |

| PBT | 5035.53* | 4821.19 | 4.45% | 4807.7 | 4.74% | 14654.97* | 13490.25 | 8.63% |

| PAT | 4141.93 | 3209.07 | 29.07% | 4023.1 | 2.95% | 11338.97 | 8982.42 | 26.24% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY20 | Q3FY19 | YoY % | Q2FY20 | QoQ % | 9MFY20 | 9MFY19 | YoY% | |

| Sales | 13960.5 | 13168.8 | 6.01% | 13497.27 | 3.43% | 40762.96 | 38133.6 | 6.90% |

| PBT | 5049.25* | 4828.19 | 4.58% | 5042.11 | 0.14% | 15282.88* | 13996.18 | 9.19% |

| PAT | 4047.87 | 3136.96 | 29.04% | 4173.72 | -3.02% | 11658.1 | 9231.4 | 26.29% |

*Includes an exceptional item of Rs 132.11 Cr which represents the loss of tobacco leaf stocks destroyed in a fire at a third party owned warehouse. The insurance claim for this is under process.

Detailed Results

-

- The company had a modest quarter with 3.43% revenue growth YoY and a decline of 3% YoY in profits.

- 9M performance was good with 6.9% revenue growth and 26% profit growth. The growth in profits was mainly due to fall in corporate tax rate which was instituted earlier this year.

- The FMCG-Cigarettes segment saw revenues rise 5.3% YoY while profits from the segment rose 6.4% YoY.

- The FMCG-Others segment revenue was up 6.1% YoY. Segment EBITDA grew 48% YoY. The margins for the segment rose 230 bps YoY.

- Hotels segment also showed good performance with segment revenues up 22.2% YoY and EBITDA up 40.1% YoY.

- The company commissioned Welcomhotel Amritsar on 1st November 2019. ITC Royal Bengal has received a good response and is setting new benchmarks since its inception a short while ago.

- Paper division saw almost flat revenues and profits due to slowdown in the FMCG and liquor industry and depressed realizations on the softening of global pulp prices.

- Agribusiness revenue grew 10.4% and saw profits of 16.7% YoY. This was mainly driven by trading opportunities in oilseeds, pulses & coffee and scaling up of value-added segments (spices and frozen snacks).

- Aashirvaad continues to maintain a leadership position in its segment.

- Shortage of potato due to extensive crop damage in parts of Karnataka and Maharashtra caused by excessive rainfall adversely impacted Bingo! potato chips sales.

- The company added two new variants ‘Herby Spin’ and ‘Chatpata Swing to its Tedhe Medhe range.

- The company also launched `Sunfeast’ Bounce Loops in vanilla, chocolate and jam flavours in the quarter.

- The company also launched ‘Candyman’ Fantastik, a crispy wafer roll filled with chocolate cream in the quarter.

- In personal care, the company saw a consolidation of Savlon handwash and the introduction of two new deodorants for women under the Engage brand.

- In the stationary products business, the company continues to occupy a leadership position in this segment.

- The company also launched `Mangaldeep Lo Smoke Agarbatti’ with 80% less smoke.

- The company sustained its leadership position in the legal cigarette market.

Analyst’s View

ITC has been one of the biggest conglomerates in the history of modern India. The company has done well to diversify into other FMCG segments and build many leading brands like Aashirvaad, Bingo, etc The company has seen good performance in the current quarter with good revenue and EBITDA growth in its FMCG-Others and the Hotels business. The company is doing well in maintaining a leadership position in many of its brands. The company has shown resilient growth in its FMCG segment despite the current industry slowdown. It remains to be seen how long will it take for the company to bring up the earning power of its new segments and how will the future of the cigarette industry pan out in the country. Nonetheless, given its history of building and maintaining durable brands, its leadership in various operating segments and its mammoth cash-generating ability, ITC remains a critical stock to watch for any investor interested in the themes of FMCG and consumption.

Disclaimer

This is not a piece of investment advice. Please read our terms and conditions.