About the Company

Kotak Mahindra Bank is an Indian private sector bank headquartered in Mumbai, Maharashtra, India. It offers banking products and financial services for corporate and retail customers in the areas of personal finance, investment banking, life insurance, and wealth management. As of April 2019, it is the second-largest Indian private sector bank by market capitalization.

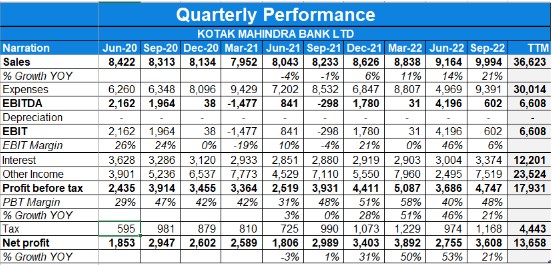

Q2FY23 Updates

Financial Results & Highlights

Detailed Results :-

- The company had a great quarter with revenues rising at 14% YoY while PAT rose 53% YoY mainly due to the low base last year from high provisioning.

- Consolidated CAR was at 23.9% with tier 1 capital at 23%.

- Consolidated assets grew 27.7% YoY to Rs 3.37 Lac Cr in Q1 vs Rs 2.63 Lac Cr last year.

- RoA was at 2.61% vs 2.36% last year.

- ROE stood at 14.09% Vs 13.47

- Consolidated Book value per share was at Rs 519 per share.

- 72% of the total PAT came from the bank, 7% from Insurance and 7% from Capital markets.

- Standalone CASA was at 56.2% vs 60.6% a year ago.

- Standalone NIM was at 5.17% vs 4.45% a year ago. NII grew to Rs. 5099 Cr Vs Rs.4021 Cr last year.

- Standalone CAR was at 22.6% with Tier I ratio at 21.5%.

- Credit cost on advances for Q3FY22 were 26 bps annualised (excluding COVID reversal) Q1FY23: 16 bps.

- The bank maintained o COVID-19 provision of Rs. 438 cr (Rs. 44 cr reversed in Q2FY23)

- Standalone GNPA was at 2.08% vs 3.19% last year and 2.24% in Q1.

- The segments showing the biggest growth in customer assets were Home Loans which grew 40% YoY , SME which grew 25% YoY & Consumer durables & credit cards at around 80% each.

- Average CA grew 7% YoY while SA and TD grew 2% and 20% YoY respectively.

- Insurance AUM was at Rs 53,785 Cr, registering a growth 13.8% YoY. GWP grew 11.5% YoY.

- Kotak Securities saw an overall market share in Q2FY23 of 5.1% vs 2.4% last year.

- Kotak AMC saw Overall Market share on AAUM rise to 6.31% in Q3FY22 vs 6.04% last year.

Investor Conference Call Highlights:

- The company is seeing an improvement in the mix of unsecured retail, which includes all of unsecured retail plus microfinance, which has now moved to about 8.5% of the total lending book.

- As interest rates have tightened, the co. saw some bleed, particularly in the savings account book mainly because of its high net worth and an affluent customer base who have moved their money out of the savings deposit rate to liquid and fixed income instruments offering short-term higher rates leading to lower CASA ratio.

- Term deposits grew by 20% while Current accounts grew by 13%. Savings accounts within 10 lakhs grew well.

- The company took an MTM hit of Rs.63 crore, HTM book continues to be at a low 36% of its total investment book & modified duration also continues to be low at 1.05 years.

- The company closed the quarter with a total customer base of 36.6 million.

- In the SME segment, the growth remained robust; YoY 25% and QoQ at 9%. The bank was very successful in acquiring New-to-Bank customers

- The commercial vehicle industry saw strong demand & SOH grew by 26%.

- The construction equipment industry saw strong demand from September onwards & SOH grew by 24%.

- The tractor industry has seen an uptick in demand owing to better cash flows from the last harvest and the pickup of commercial deployment. SOH grew by 24%.

- The microfinance business continues its growth momentum in Q2 & the portfolio almost doubled YoY.

- With a drop in commodity prices, the co. saw a little reduction in the working capital in the commodity space. The cash flow of the customers, however, is quite comfortable and the CAPEX investments in this segment are seeing an uptick primarily in the processing capacity and for augmenting the Agri infrastructure, which is the warehouse, cold storage, supply chain, etc.

- The co. saw a robust growth trajectory in consumer assets lending in this quarter clocking YoY growth of about 39% while the mortgage business lending grew by about 40% on a YoY basis.

- The co. saw another good quarter on credit cards with the acquisition of over 7.25 lakh cards in the quarter. Spends using the card saw robust growth this quarter showing 93% growth on a YoY basis while credit card advances grew by 16% QoQ.

- The company saw good traction in its agency business and a lot of retail customers have started using its platform to make Customs Duty, GST, and Taxes which shall help build flows and balances in the CASA accounts while Government business is also a key focus area.

- The ADV for the total volume alone has reached 64.7 lakh crore, of which options is 63.47 lakh crore. This is compared to 30.4 lakh crore in the same period last year, which is more than a 2x increase just in options.

- The company launched a trading platform-Kotak Neo sometime in the last quarter And in a short span of time, a large percentage of daily volume is happening there.

- The share of credit substitutes which are shorter-term loans is increasing since it helps to optimize returns in terms of PSL costs, risk, and pricing.

- TDs less than Rs.2 Crs is 60% of the total TDs.

- The management believes that the current credit cycle is like a Cinderella time & taking a call on how long this positive credit cycle remains is very closely linked to the terminal rates of interest and the external account situation of the country. Therefore the company is having a singular focus on risk-adjusted returns & investing heavily in technology and also the growth of both the asset and liability business.

- The company’s strategy for granular growth in deposits is to make customer engagements easy & use the digital routes for acquiring more customers.

- On being asked about lack of aggression in branch expansion, the management said “s that the density requirements of branches compared to the past maybe less, therefore branches are still needed. But instead of being at a distance of 100 meters from your home, I’m sure people can live with a branch which is half a kilometer or a kilometer from the home”.

- The management explains that the absolute percentage level of CASA out of the total deposits, the cost at which the balance deposits delta cost goes up versus on the asset side, and the terminal rate at which the repo rate sort of slows down, are the three most important variables in terms of how the pricing and the spreads will go.

Analyst’s View:-

Kotak Mahindra Bank is the third-biggest private bank in the country by market capitalization. It has deservedly earned its stellar reputation over the years. The bank has seen good growth in the home loan space while the vehicle finance business has also seen a good recovery. The bank has also launched several new digital initiatives and will continue this momentum for 6 more months at least. It remains to be seen how the threat of inflation and rising interest rates will affect the bank and how long will it take for the bank to bring in operating leverage from its digital technology to compete with other players with its low branch density plan. Nonetheless, given the bank’s track record and the capability and vision of the management over the years, Kotak Mahindra Bank remains a pivotal banking stock for every Indian investor.

Q4FY22 Updates

Financial Results & Highlights

| Standalone financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 8892 | 7953 | 11.8% | 8260 | 7.7% | 33393 | 31847 | 4.9% |

| PBT | 3646 | 2228 | 63.6% | 2832 | 28.7% | 11361 | 9303 | 22.1% |

| PAT | 2767 | 1682 | 64.5% | 2131 | 29.8% | 8572 | 6965 | 23.1% |

| Consolidated financials (in Crs) | ||||||||

| Q4FY22 | Q4FY21 | YoY % | Q3FY22 | QoQ % | FY22 | FY21 | YoY% | |

| Sales | 16794 | 15725 | 6.8% | 14176 | 18.5% | 58883 | 56296 | 4.6% |

| PBT | 5087 | 3363 | 51.3% | 4410 | 15.4% | 15948 | 13168 | 21.1% |

| PAT | 3892 | 2589 | 50.3% | 3402 | 14.4% | 12089 | 9990 | 21.0% |

Financial Results & Highlights

- The company had a decent quarter with revenues increasing by 7 YoY while PAT rose 50% YoY mainly due to the low base last year from high provisioning.

- Consolidated CAR was at 23.7% with tier 1 capital at 22.8%.

- Consolidated assets grew to Rs 327,074 Cr in Q4 vs Rs 268,130 Cr last year.

- RoA was at 2.94% vs 2.2% last year.

- The Consolidated Book value per share was at Rs 487 per share.

- 71% of the total PAT came from the bank vs 65% a year ago.

- Standalone CASA was at 60.7% vs 60.4% a year ago.

- Standalone NIM was at 4.78% vs 4.39% a year ago. NII grew to Rs 4521 Cr vs 3843 Cr last year.

- Standalone CAR was at 22.7% with Tier I ratio at 21.7%.

- of Customers stood at 32.7Mn Vs 26Mn.

- Net NPA stood at 0.64% Vs 1.21%.

- The company’s COVID-19 provision reversed stood at 453 cr while it continues to carry Rs.547 cr.

- Credit cost on advances for Q4FY22 27 bps annualised (excluding COVID reversal).

- Standalone GNPA was at 2.34% vs 3.25% last year.

- Average CA grew 32% YoY while SA and TD grew 11% and 20% YoY respectively.

- Insurance AUM as of 31st March was at Rs.51,800 cr registering a growth of 20.3% YoY. GWP grew 17.3%.

- Kotak securities saw an overall market share in Q4FY22 of 3.7% vs 2.2% last year.

- Kotak Mahindra Capital saw many big issues including Adani Wilmar & Manyavar.

- Kotak Mahindra Prime & Investments saw ROA of 2.1% & 3.5% respectively.

- Kotak AMC saw the Overall Market share on AAUM rise to 7.4% in Q4FY22 vs 7.3% last year. AAUM grew by 35% YoY compared to industry growth of 20%.

Investor Conference Call Highlights:

- The company’s slippage ratio for the 4th quarter on an annualized basis is down to 1.08%.

- The management believes that the company will be able to weather higher interest rate situations due to CASA ratio being over 60% & shorter tenure loan book.

- During the quarter, the added 2 million customers as against 1.1 million customers in the same quarter last year

- The company’s average fixed rate savings deposit grew YTD YoY 11%, current accounts 26%, and sweep term deposits 15%

- The company in Q4 acquired six lakhs plus FASTag, maintaining its position as the fourth highest issuer.

- The company’s embedded value in the insurance biz during the year grew by 8.2% to Rs.10,679 crores.

- The company’s VNB margin grew by 29.5% to Rs.895 crores for ’21-22. While VNB margin was at 31.1%.

- Individual conservation ratio was at 89.4% while the Share of the protection business was 32.9%.

- Gross return premium grew 17.3% YoY during FY’22 while Individual APE new business growth for Q4’22 was 11.8% against private industry growth of 8.5%.

- Individual renewal premium grew by 15.6% and AUM for the year grew by 20.3% to Rs.51,800 crores.

- OPEX ratio improved to 12.8% Vs 13.6% YoY..

- The cash market share for this quarter was 11.5% against 9.7% for the same period last year

- The KS overall market volume on a daily basis was Rs.1,74,000 crores against Rs.49,000 crores in the same quarter last year.

- The company’s equity AUM market share increased to 5.4% while SIP inflows for March ’22 grew 34% YoY to Rs.7.2 billion.

- The company’s Operating tech cost as a part of the overall tech cost is about 7.5%.

- The management currently has no plans of increasing savings deposit rates.

- The management believes that the government agency business will play a major role in driving deposit growth in the coming period.

- The company’s growth strategy is to increase the unsecured retail as a percentage of its balance sheet.

Analyst’s View

Kotak Mahindra Bank is the third-biggest private bank in the country by market capitalization. It has deservedly earned its stellar reputation over the years. The bank had a decent performance in Q4 with a 7% increase in Q4 revenues despite a drop in other income due to MTM loss. But PAT was up 50% with lower provisioning in Q4 and a reversal of provisioning. The bank has seen good growth across all its lending segments.. The bank has also launched several new digital initiatives and will continue this momentum for 6 more months at least. It remains to be seen how the threat of inflation and rising interest rates will affect the bank and how long will it take for the bank to bring in operating leverage from its digital technology to compete with other players with its low branch density plan. Nonetheless, given the bank’s track record and the capability and vision of the management over the years, Kotak Mahindra Bank remains a pivotal banking stock for every Indian investor.

Q3FY22 Updates

Financial Results & Highlights

| Consolidated Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 14176 | 14671 | -3.4% | 15341 | -7.6% | 42088 | 40571 | 3.7% |

| PBT | 4410 | 3455 | 27.6% | 3930 | 12.2% | 10860 | 9804 | 10.8% |

| PAT | 3402 | 2601 | 30.8% | 2988 | 13.9% | 8197 | 7400 | 10.8% |

| Standalone Financials (In Crs) | ||||||||

| Q3FY22 | Q3FY21 | YoY % | Q2FY22 | QoQ % | 9MFY22 | 9MFY21 | YoY% | |

| Sales | 8260 | 7949 | 3.9% | 8408 | -1.8% | 24500 | 23839 | 2.8% |

| PBT | 2832 | 2484 | 14.0% | 2696 | 5.0% | 7715 | 7074 | 9.1% |

| PAT | 2131 | 1853 | 15.0% | 2032 | 4.9% | 5805 | 5282 | 9.9% |

Financial Results & Highlights

- The company had a mixed quarter with revenues falling slightly at 3.4% decline YoY while PAT rose 30% YoY mainly due to the low base last year from high provisioning.

- Consolidated CAR was at 24.5% with tier 1 capital at 23.7%.

- Consolidated assets grew 20% YoY to Rs 3.09 Lac Cr in Q3 vs Rs 2.55 Lac Cr last year.

- RoA was at 2.6% vs 2.21% last year.

- Consolidated Book value per share was at Rs 467 per share.

- 63% of the total PAT came from the bank vs 71% a year ago.

- Standalone CASA was at 59.9% vs 58.9% a year ago.

- Standalone NIM was at 4.62% vs 4.36% a year ago. NII grew to Rs 4334 Cr vs 3876 Cr last year. Rs 279 Cr of COVID provisioning was reversed in Q3.

- Standalone CAR was at 23.6% with Tier I ratio at 22.4%.

- The bank continues to carry COVID-19 provision of Rs 1,000 cr.

- Credit cost on advances for Q3FY22 35 bps annualised (excluding COVID reversal) Q2FY22: 63 bps.

- Standalone GNPA was at 2.71% vs 3.27% last year and 3.19% in Q2.

- The segments showing the biggest growth in customer assets were Home Loans which grew 38% YoY and SME which grew 21% YoY.

- Average CA grew 32% YoY while SA and TD grew 11% and 20% YoY respectively.

- Insurance AUM as on 31st Dec was at Rs 49,221 Cr, registering a growth 23.8% YoY. GWP grew 18.5% YoY while Group premium grew 28% YoY.

- Kotak securities saw an overall market share in Q3FY22 of 3.0% vs 2.0% last year.

- Kotak Mahindra Capital saw many big issues so far including Star Insurance, Nykaa, Mapmyindia, and Rategain. It also did rights issues for Airtel and Indian Hotels.

- Kotak Mahindra Prime acquired the car finance arm of Ford India in Q3.

- Kotak AMC saw Overall Market share on AAUM rise to 7.4% in Q3FY22 vs 7.3% last year. PAT from the unit saw a 53.6% rise in Q3 to Rs 149 Cr. AMC AUM has risen 23% YoY to Rs 3.86 Lac Cr.

Investor Conference Call Highlights:

- Fees and services have continued to be a good growth area according to the management with a 33% YoY rise.

- The company added 21 lakh customers in Q3, versus 8 lakhs in the same quarter last year, a nearly 3x growth in new customer acquisitions.

- The management states that having a CASA above 60% will be very good for the bank as interest rates rise.

- Growth in advances was 18% year-on-year and 8% Q-on-Q.

- The consumer bank grew at 29% Y-o-Y and 10% Q-on-Q, which is nearly 40% annualized.

- Slippages for the quarter were down to 0.3% of advances.

- The overall duration of the fixed income bond book is at a low of around 1.5 years.

- Kotak Prime ended the current quarter with a profit of INR 254 crores as against INR 149 crores a year ago.

- Absolute GNPA went down from INR 7,658 crores to INR 6,983 crores.

- SMA2 continued to be low at INR 298 crores.

- On the SME side, the momentum of growth continues. Y-o-Y growth is about 21%. NPV acquisition remained robust throughout the quarter and can see this momentum carrying forward.

- Overall, the segment, the corporate and SME together have grown at about 16.5% Y-o-Y.

- Retail lending businesses showed robust growth in Q3 helped Company to gain market share in many products. As a consumer asset aggregate level, Company grew 29% Y-o-Y and 10% Q-o-Q.

- Mortgages had its best-ever quarter on fresh volumes for home loans, a price leadership campaign of 6.5% during the festival season helped acquire quality customers.

- Mortgages grew at 38% Y-o-Y and 12% quarter-on-quarter.

- The company had one of its best quarters in the cards segment with the issuance of 3.9 lakh new cards.

- CASA and TD below INR 5 crores comprised 88% of the deposits.

- In Q3, the company continued building on the API stack of partners, with 391 APIs live currently.

- The company added new 4 new partners in Kaymall, including Myntra in the in-app shopping mall.

- The company plans to leverage the regulatory network of account aggregators and open for retail and SME lending in the upcoming quarters.

- The company migrated 14,000-plus customers to the new CMS portal which is simple to operate with superior interfaces and customer experience according to the management.

- On the transaction banking side, the company saw 7 lakh+ transactions, which is a 46% Y-o-Y growth for YTD December.

- The unsecured business saw 12% YoY and 16% QoQ growth in Q3.

- The gross income premium of Kotak Life Insurance for the quarter increased to Rs 2,108 crores from Rs 2,023 crores in the previous year, showing an increase of 15.5%.

- From a service initiative, a multi-legal chat box in 9 languages, 15 service options was launched, and the company migrated its telephone services into the cloud with multilevel IVR capability enhancing customer inbound call.

- Kotak Mahindra Prime Disbursements during the quarter have been better than the comparable quarter of the previous financial year, but it continues to be slightly impacted by supply constraints faced by the manufacturers according to the management.

- Equity AUM saw a bounce-back of 67% YoY in the AMC.

- The gross accretion of NPA has slowed down and realizations have started to come up according to the management. It also states that restructuring requests have also gone down which is a good sign for the bank.

- The management is not worried about the growth in the unsecured business as it forms only 5% of the overall book. Once it becomes more prominent, the company will formulate a formal policy regarding it, says the management.

- The management states that the company continues to attract millennial customers with a major portion coming from the age range of 25-40.

- The opportunity on the unsecured lending is mainly from personal loans, credit cards, and consumer durable financing which can be scaled up using analytics on a large amount of data available on the bank’s customer set.

- The management states that by June 2022, a lot of the digital initiatives will start to bear fruit. It remains confident that the bank can keep up the growth momentum even if inflation and interest rates rise in the near future.

- The management states that opex has risen mainly due to a rise in retail loans which are front-ended. Hence the opex to income should come down in the future. The company is also spending on developing its digital initiatives which are also expected to keep opex at elevated levels for some time.

- In Corporate Banking, the bank is looking at increasing the scope for its services like forex, transaction banking, investment banking opportunities, and others. Thus, the function of this business segment is much bigger than just its core offerings according to the management.

- The company remains a largely retail-focused bank with the prime focus on aggressively acquiring new customers according to the management.

- The uniform interest rate provided by Kotak on SA is 3.5%.

- The bank is not doing any form of IPO financing currently.

Analyst’s View

Kotak Mahindra Bank is the third-biggest private bank in the country by market capitalization. It has deservedly earned its stellar reputation over the years. The bank has seen a mixed performance in Q3 with a 3.4% drop in Q3 revenues due to a drop in other income. But PAT was up 30% with lower provisioning in Q3 and a reversal of provisioning of Rs 278 Cr. The bank has seen good growth of 38% YoY in the home loan space while the vehicle finance business has also seen a good recovery. The bank has also launched several new digital initiatives and will continue this momentum for 6 more months at least. It remains to be seen how the threat of inflation and rising interest rates will affect the bank and how long will it take for the bank to bring in operating leverage from its digital technology to compete with other players with its low branch density plan. Nonetheless, given the bank’s track record and the capability and vision of the management over the years, Kotak Mahindra Bank remains a pivotal banking stock for every Indian investor.

Q4FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 8398 | 8294 | 1.25% | 7944 | 5.72% | 32299 | 32301 | -0.01% |

| PBT | 2228 | 1678 | 32.78% | 2484 | -10.31% | 9303 | 7805 | 19.19% |

| PAT | 1682 | 1267 | 32.75% | 1854 | -9.28% | 6965 | 5947 | 17.12% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY21 | Q4FY20 | YoY % | Q3FY21 | QoQ % | FY21 | FY20 | YoY% | |

| Sales | 16176 | 12085 | 33.85% | 14639 | 10.50% | 56704 | 50300 | 12.73% |

| PBT | 3364 | 2674 | 26% | 3455 | -2.63% | 13168 | 11422 | 15.29% |

| PAT | 2589 | 1905 | 36% | 2602 | -0.50% | 9990 | 8593 | 16.26% |

Detailed Results

- The net standalone revenues were up 1.25% YoY in Q4. Consolidated revenue was up at a 34% gain YoY in Q4.

- Consolidated profit rose 36% YoY in Q4. Standalone profit rose 33% YoY in Q4.

- FY21 saw profit growth of 16% YoY and sales growth of 13% YoY.

- On a standalone basis, NII grew 8% YoY in Q4. NIM was at 4.39% vs 4.72% a year ago.

- Standalone CASA was at 60.4% vs 56.2% a year ago.

- Avg Savings deposits rose 27% YoY in FY21. Avg current deposits rose 17% YoY in FY21.

- Advances were up 1.7% YoY at Rs 223,689 Cr vs Rs 219,748 Cr.

- Standalone CAR was at 22.3% with Tier I ratio at 21.4%.

- Standalone GNPA was at 3.25% and NNPA was at 1.21%. Total provisions were at 95% of GNPA.

- COVID-19 provisioning as on date remains at Rs 1279 Cr.

- Standalone total assets grew 6.4% YoY.

- Consolidated CAR was at 23.4% with tier 1 capital at 22.6%.

- Consolidated NIM fell to 4.45% vs 4.73% last year.

- The book value per share was at Rs 426 per share.

- Overall NNPA for consolidated was at 1.23%

- AUM of Kotak Mahindra Life Insurance grew 34.2% YoY.

- Kotak securities saw market share shrink to 9.3% in FY21 vs 10% last year.

- Kotak AMC saw overall market share on AAUM rise to 7.3% vs 6.9% a year ago.

Investor Conference Call Highlights

- Total unsecured lending was down to 5.8% of the total balance sheet from 7.5% a year ago.

- The fees and services revenues grew 25% YoY.

- 94% of savings account transactions were through digital or non-branch modes this year.

- CASA and TDs below INR 5 crores comprised 91% of deposits versus 86% in Q4 last year.

- The cost of SA is at 3.74% this quarter versus 5.23% in Q4 last year.

- Kotak announced a competitive mortgage rate of 6.6% in March making it one of the lowest price players in this segment. The bank remains focused on penetrating the salaried segment for this business.

- Personal loans are now back to 80-85% of pre-covid levels in March.

- CV business improved QoQ but was down 20% YoY for FY21.

- Disbursement in construction equipment has higher than in Q3 driven by government infrastructure projects.

- The passenger vehicle segment was impacted due to localized lockdowns.

- Tractor volumes grew 26% YoY in FY21 & disbursements from Kotak here outpaced industry growth.

- Debt capital markets had a record year with no underwritten book left in their books.

- The primary operational focus for the next 12-18 months remains the upgradation of technology in the whole corporate business.

- The nonbanking entities contributed 35% of the total profit.

- Kotak Insurance saw IEV grow by 17.7% to Rs 9869 Cr with VNB of Rs 691 Cr & margin of 28.6%.

- APE grew 37.8% in Q4. Group business grew 48.9% while individual renewal premium grew 8.5% YoY.

- The digital onboarding of customers through Genie nearly completed 95%. The management states that 60% of claims today are getting settled in 2 days.

- Kotak Securities did an average market volume daily of INR 49,256 crores in Q4 vs INR 25,603 crores last year.

- Kotak AMC saw Equity AUM rise 25% YoY.

- The asset management across mutual funds, insurance, alternate PMS and offshore grew by 43% YoY to INR 3,23,762 crores. The wealth priority and investment advisory business grew by 41% YoY to INR 3,82,000 crores.

- Uday Kotak’s current term is slated to end by Dec 2023. The management reassures that it will take decisions to ensure continuity of growth and succession planning will be done adequately with time.

- The management remains committed to its current strategy on asset growth and will not be changing it in the medium term.

- The write-offs done in H2 were at Rs 530 Cr of which Rs 500 Cr was done in Q4.

- Other expenses have risen on account of recovery and new customer acquisition costs.

- The bank has continued to invest in different avenues like payments, etc to increase wallet share from customers and to add on to future growth avenues.

- Other income was high due to good earnings from the treasury division.

- Credit cost excluding COVID provision at the end of the year stood at 84bps of net advances vs. 67bps in FY20.

- The bank remains committed to its vision of moving away from the physical side of the banking business and make the density of branch network requirements lower.

- The management stated that it also open to inorganic opportunities as seen with the merger with ING Vysya bank.

- The bank is adding roughly 0.5 million customers every month across all channels.

Analyst’s View

Kotak Mahindra Bank is the second-biggest private bank in the country by market capitalization. It has deservedly earned its stellar reputation over the years. The bank has performed well in Q4FY21 with 33% sales growth and 36% PAT growth. The company has done well to keep its books resilient and remains committed to expanding on the secured lending side while remaining cautious on the unsecured side. It has also seen a good rise in the digital channels with 94% of savings transactions occurring digitally. The bank still has 2 years and 7 months in the tenure of Uday Kotak as CEO and has assured that it will complete all procedures in time and maintain the growth state of the bank. It remains to be seen how the lending segments are affected going forward by the 2nd wave of COVID-19 and how long will it take for the bank to bring in operating leverage from its digital technology to compete with other players with its low branch density plan. Nonetheless, given the bank’s track record and the capability and vision of the management over the years, Kotak Mahindra Bank remains a pivotal banking stock for every Indian investor.

Q3FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 8125 | 8077 | 0.59% | 8288 | -1.97% | 24098 | 24008 | 0.37% |

| PBT | 2484 | 1944 | 27.78% | 2929 | -15.19% | 7075 | 6127 | 15.47% |

| PAT | 1854 | 1596 | 16.17% | 2184 | -15.11% | 5282 | 4681 | 12.84% |

| Consolidated Financials (In Crs) | ||||||||

| Q3FY21 | Q3FY20 | YoY % | Q2FY21 | QoQ % | 9MFY21 | 9MFY20 | YoY% | |

| Sales | 14835 | 13542 | 9.55% | 13591 | 9.15% | 40750 | 38215 | 6.63% |

| PBT | 3455 | 2889 | 20% | 3914 | -11.73% | 9805 | 8747 | 12.10% |

| PAT | 2576 | 2329 | 11% | 2933 | -12.17% | 7350 | 6655 | 10.44% |

Detailed Results

- The net standalone revenues were flat YoY in Q3. Consolidated revenue was up at an 9.55% gain YoY in Q3.

- Consolidated profit rose 11% YoY in Q3. Standalone Preprovision profit rose 29% YoY in Q3.

- On a standalone basis, NII grew 17% YoY. NIM was at 4.51% vs 4.69% a year ago.

- Standalone CASA was at 58.9% vs 53.7% a year ago.

- Avg Savings deposits rose 29% YoY. Avg current deposits rose 13% YoY.

- Advances were flat YoY at Rs 214,103 Cr vs Rs 216,774 Cr.

- Standalone CAR was at 23.6% with Tier I ratio at 23%.

- Standalone GNPA was at 2.26% and NNPA was at 0.5%. Proforma GNPA: 3.27%; NNPA: 1.24%.

- COVID-19 provisioning as on date was at Rs 1279 Cr.

- Standalone total assets grew 20% YoY.

- Average SA size rose 29% YoY while the average CA size rose 13% YoY in 9M FY21. Cost of SA was down 146 bps YoY to 3.81%.

- Consolidated CAR was at 24.9% with tier 1 capital at 24.3%.

- Consolidated NIM was flat YoY at 4.58% vs 4.66% last year.

- The book value per share was at Rs 412 per share.

- Overall NNPA for consolidated was at 0.53%

- AUM of Kotak Mahindra Life Insurance grew 21.7% YoY.

- Kotak securities saw market share shrink to 9.1% in 9M vs 10% last year.

- Kotak AMC saw overall market share on AAUM rise to 7.3% vs 6.6% a year ago.

Investor Conference Call Highlights

- The management states that growth momentum in loans is expected to continue ahead. The management has stated that Kotak shall focus on secured lending and will remain cautious on unsecured lending.

- Unsecured loans are at near 6% of total loans and around 40% of the incremental rise in proforma NPAs is from this segment.

- CASA and term deposits make up for almost 92% of total deposits.

- Restructuring requests from customers are expected to be low in Q4.

- Collection efficiency on the secured portfolio has come back to pre-covid levels. In the unsecured portfolio, it is rising and is expected to come back to pre-covid levels soon.

- Total ECLGS disbursement was around Rs 9400 Cr by Q3 and it has crossed Rs 9700 Cr in Jan.

- The management has stated that it has given out ECLGS to 50-60% of accounts eligible for the scheme.

- The management has stated that the required density of branches should be less with more coverage area for each branch. Thus it will be restrained when opening up new branches.

- The management expects cost reductions to be sustainable and yields should remain high to maintain or expand margins from current levels.

- The CV loan book remains stressed as 10-15% of the book is in buses that have yet to come back to pre-covid levels.

- For borrowers where even one account turned 90+dpd, the entire outstanding balance (including other accounts) was considered as NPA. 3QFY21 Provisioning also includes interest reversal for the whole moratorium period (6 months), wherever applicable.

- Mortgage segment saw its best ever month in Dec and momentum in this segment is expected to sustain. The focus in this segment will remain on salaried customers.

- In the CV loan segment, utilization in the goods segment was near pre-covid level but operator economics were affected due to higher fuel prices. Collection efficiency is near pre-covid levels.

- In the Agri customers segment, demand is rising and customers are reporting regular cashflows.

- Disbursals have risen higher in the tractor finance segment as collections in the segment are at normal levels and volumes are expected to rise going forward.

- 80% of the ECLGS was towards small consumer business and commercial business. The rest of the amount was towards the lower end of corporate.

- In the Rs 0.1 mn to Rs 10 mn bucket in SA, KMB offers 4%, which is 75bps better than the top 3 private banks.

- Digital uptake by consumers continued, led by mobile channels. As digital picks up, the approach towards branches would be refined. Other productivity measures, including work from home, are being implemented. As volumes increase, tech-related efficiencies will kick in.

- The bank has a 5% market share in mobile banking in terms of transaction value. Transaction volume/value is up 73/40% YoY.

- PAT declined 20% YoY for Kotak Prime. PAT for Kotak Life was flat YoY and it rose 44% YoY for Kotak securities.

- The PAT from AMC business was also flat YoY.

- GNPA in Kotak Prime was 2.46% while, on a proforma basis, it was over 4%.

- Q3 employee costs were better due to the absence of pension costs which were present in Q2 and Q3FY20.

- Other expenses rose primarily due to an increase in ad and promotional activity expenses as well as a pick-up in collection/recovery related costs.

Analyst’s View

Kotak Mahindra Bank is the second-biggest private bank in the country by market capitalization. It has deservedly earned its stellar reputation over the years. The bank has performed well in Q3FY21 with more than 29% growth in savings deposits and has gotten 17% YoY growth in NII despite flat YoY growth in advances. The company has done well to keep its books resilient and focus on expanding on the secured lending side while remaining cautious on the unsecured side. It has also seen a very good rise in the digital channels with more than 73% YoY rise in digital transactions and plans to use this consumer shift to keep its branch density low to be able to better compete with peers who have a much larger physical presence. It remains to be seen how the proforma NPAs will affect the bank going forward and whether the company will be able to better compete with other players with its low branch density plan. Nonetheless, given the bank’s track record and the capability and vision of the management over the years, Kotak Mahindra Bank remains a pivotal banking stock for every Indian investor.

Q2FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 8288 | 7986 | 3.78% | 7685 | 7.85% | 15973 | 15931 | 0.26% |

| PBT | 2929 | 2101 | 39.41% | 1662 | 76.23% | 4591 | 4183 | 9.75% |

| PAT | 2184 | 1724 | 26.68% | 1244 | 75.56% | 3429 | 3085 | 11.15% |

| Consolidated Financials (In Crs) | ||||||||

| Q2FY21 | Q2FY20 | YoY % | Q1FY21 | QoQ % | H1FY21 | H1FY20 | YoY | |

| Sales | 13591 | 12543 | 8.36% | 12323 | 10.29% | 25915 | 24673 | 5.03% |

| PBT | 3914 | 2945 | 32.90% | 2435 | 60.74% | 6350 | 5858 | 8.40% |

| PAT | 2933 | 2399 | 22.26% | 1840 | 59.40% | 4774 | 4326 | 10.36% |

Detailed Results

- The net standalone revenues rose 4% YoY in Q2. Consolidated revenue was up at an 8.4% gain YoY in Q2.

- Consolidated profit rose 22% YoY in Q2 Standalone Preprovision profit rose 31% YoY in Q2.

- On a standalone basis, NII grew 16.8% YoY. NIM was at 4.52% vs 4.61% a year ago.

- Standalone CASA was at 57.1% vs 53.6% a year ago.

- Avg Savings deposits rose 25.7% YoY to Rs 1,08,990 Cr. Avg current deposits rose 6% YoY to Rs 40,454 Cr.

- Advances fell slightly YoY at Rs 204,845 Cr vs Rs 213,299 Cr.

- Standalone CAR was at 23.4% with Tier I ratio at 22.8%.

- Standalone GNPA was at 2.55% and NNPA was at 0.64%. Proforma GNPA: 2.70%; NNPA: 0.74.

- COVID-19 provisioning as of 30th Sep 2020 was at Rs 1279 Cr.

- Standalone total assets grew 18% YoY to Rs 3,74,765 Cr.

- Average SA size rose 32% YoY while the average CA size rose 10% YoY. Cost SA was down 150 bps YpY to 3.87%. LCR was >170%.

- Consolidated CAR was at 24.5% with tier 1 capital at 23.9%.

- Consolidated NIM was flat YoY at 4.58% vs 4.56% last year.

- The book value per share was at Rs 399 per share.

- Overall NNPA for consolidated was at 0.7%

- AUM of Kotak Mahindra Life Insurance grew 18.5% YoY to Rs 35,980 Cr.

- Kotak securities saw market share shrink to 7.7% in H1 vs 9.4% last year.

- Kotak AMC saw market share rise to 6.9% vs 6.6% a year ago.

Investor Conference Call Highlights

- The total provisioning on the credit count is now 177% of our total net NPS.

- The bank has moved to the lower tax rate from Q2 onwards.

- The distribution and syndication income showed a growth of 50% on a Y-o-Y basis and 19% on a QoQ basis.

- General banking fees were down 15% YoY due to lower volumes in various segments.

- The bank continues to see a surge in customers’ usage of digital channels with a preference for mobile in Q2.

- In mobile banking, Kotak has a 5.1% share of the mobile transaction value in the industry.

- Digital payments saw an increase of 73% YoY and the average ticket size in both UPI and payment gateway transactions has increased Y-o-Y.

- The bank launched 2 new credit card variants between September and October for the mass affluent segment and a secure credit card for customers who do not have a stable footprint.

- Collections are coming back to normal and were aided with the increased means through digital transactions.

- The bank also launched MyImage Card for customers who can apply for and download the images on their debit and credit cards.

- The bank’s agribusiness portfolio comprises SMEs involved in primary and secondary processing of agricultural commodities and is mostly based out of non-urban locations. This business has seen good growth due to good crop harvest and collections have been above normal levels.

- The bank overall contributed 74% of the post-tax profits.

- In the life insurance business, the gross written premium for the second quarter grew by 10% YoY and the single premium business grew by 15% YoY. The individual APE new business payments for the first half grew by 2% Y-o-Y against the private industry de-growth of 11%.

- Digitization has been a big focus area for life insurance for increasing efficiency and enhancing customer experiences.

- The broking industry saw record volumes for average cash turnover in Q2 at Rs 62,000 Cr per day vs Rs 35,000 Cr a year ago.

- The daily options market turnover for retail broking has also risen 40-50% YoY.

- Kotak Mahindra Capital Company saw many marquee transactions like QIPs for ICICI, HDFC, Mahindra Finance, and YES BANK, Phoenix Mills, IPOs for CAMS, etc.

- The company has also been contracted for the restructuring of Motherson Sumi and subsidization of Tata Motor’s passenger vehicle business.

- The management states that the deposit rate cut was not for short-term financial gains but as part of a larger strategy for sustainable growth of earnings of the firm while preserving the deposit franchise.

- The management has stated that consumer behaviour has not been affected too much by the rate cut and the attrition rate has been normal.

- The management is confident about the asset quality of the company. It is looking to concentrate on urban advances as employees with lower salaries in urban areas have been the worst-hit financially from COVID-19. Thus the company has also dropped its unsecured credit card book and unsecured personal loan and business loan book by design.

- The company will continue to spend money on building the franchise (mostly on digital) and taking cost on risk.

- Kotak is currently at 2% to 2.5% of the total banking sector market share.

- Emphasis on digital and tech has been the primary driver for the bank in expanding the customer base without significantly expanding the branch network.

- The management maintains that the primary focus for the bank is on execution and to approach growth through the route of customer acquisition and engagement and selling.

- In commercial vehicle and construction equipment, Sep collections are close to the pre-covid level.

- In the unsecured retail business, collections are improving but they are far from the pre-covid level.

- Overall collections for the bank are at Feb levels near 95%.

Analyst’s View

Kotak Mahindra Bank is the second-biggest private bank in the country by market capitalization. It has deservedly earned its stellar reputation over the years. The bank has performed resiliently in Q2FY21 with more than 32% growth in savings deposits and has gotten 17% YoY growth in NII despite slightly lower advances. The company has done well to keep its books resilient and focus on the development of the liability side during the pandemic. It has also seen a very good rise in the digital channels with more than 73% YoY rise in digital transactions and plans to use this consumer shift to better compete with peers who have a much larger physical presence. It remains to be seen how the COVID-19 situation will unravel and what final impact will the end of the moratorium unravel for the company. Nonetheless, given the bank’s track record and the capability and vision of the management over the years, Kotak Mahindra Bank remains a pivotal banking stock for every Indian investor.

Q1FY21 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 7685 | 7945 | -3.27% | 8294 | -7.34% |

| PBT | 1662 | 2082 | -20.17% | 1675 | -0.78% |

| PAT | 1244 | 1360 | -8.53% | 1267 | -1.82% |

| Consolidated Financials (In Crs) | |||||

| Q1FY21 | Q1FY20 | YoY % | Q4FY20 | QoQ % | |

| Sales | 12323 | 12130 | 1.59% | 12085 | 1.97% |

| PBT | 2435* | 2913 | -16.41% | 2674** | -8.94% |

| PAT | 1840 | 1927 | -4.51% | 1952 | -5.74% |

*Contains Provision of Rs 1119 Cr. **Contains provision of Rs 1262 Cr.

Detailed Results

-

- The net standalone revenues fell 3% YoY in Q1. Consolidated revenue was flat at 1.6% gain YoY in Q1.

- Consolidated profit fell 4.5% YoY in Q1.

- On a standalone basis, NII grew 17.8% YoY. NIM was at 4.4% vs 4.48% a year ago.

- Standalone CASA was at 56.7% vs 50.7% a year ago.

- Avg Savings deposits rose 34% YoY to Rs 1,05,673 Cr. Avg current deposits rose 10% YoY to Rs 36,066 Cr.

- Advances were flat YoY at Rs 203,998 Cr vs Rs 208,030 Cr.

- Standalone CAR was at 21.2% with Tier I ratio at 20.6%.

- Standalone GNPA was at 2.7% and NNPA was at 0.87%.

- Disbursals till June was at Rs 550 Cr while disbursals till July 23rd was at Rs 4000 Cr all under the MSME scheme.

- COVID-19 provisioning as of 30th June 2020 was at Rs 1266 Cr.

- The bank raised Rs 7442 Cr through QIP and maintains LCR of >150%.

- The company maintained a consolidated CAR of 23% vs 18.4% a year ago.

- The book value per share was at Rs 383.8 per share.

- AUM of Kotak Mahindra Life Insurance grew 17.4% YoY to Rs 34223 Cr.

- The company has an overall cash surplus of Rs 76,443 Cr out of which Rs 59,543 Cr is in Kotak Mahindra Bank.

- Kotak securities saw market share shrink to 7.6% vs 10% last year.

- Kotak AMC saw market share rise to 6.8% vs 6.3% a year ago.

Investor Conference Call Highlights

- Around 9.65% of the loan book is under moratorium 2.0. Around 80% of these loans are secured.

- The fees and services income declined by 33% YoY in Q1.

- Other banking-related fees fell 40% YoY due to lower volumes from COVID-19.

- Employee costs went down 6% due to senior management taking pay cuts.

- On average, around 94% to 95% of branches remained open right through the quarter.

- The cost of savings account is at 4.22% vs 5.51% last year.

- Kotak was the first bank to launch a zero contact video KYC digital savings account.

- For disbursement of the MSME loan, Kotak developed a completely end-to-end paperless digital documentation called e-Sign.

- Slippages for Q1 was at Rs 796 Cr.

- Since the start of the year, 97% of recurring deposits & 87% of fixed deposits have come from digital channels.

- In the life insurance subsidiary, new business premium in individual APE grew by 8% YoY vs industry decline of 18% YoY. The overall premium went down to Rs 1207 Cr from Rs 1640 Cr due to the extension of the grace period in lockdown. PAT for the entity grew 20.7% YoY. 95% of policies were sold through Genie and Banca channels

- In Kotak securities, the average daily volume for retail businesses grew to Rs 59,000 Cr from Rs 36,000 Cr last year. Demat accounts have risen to 4.31 Cr from 3.67 Cr a year ago. Kotak Securities’ mobile trading app has seen a greater than 2x jump in mobile trading volumes in this period.

- In Kotak AMC, Q1 Average AUM fell 10% QoQ primarily driven by mark-to-market changes.

- The asset management business remains the first and only signatory to the United Nations Principles of Responsible Investment in India.

- The management sees a huge opportunity in the markets related and distribution-related businesses at this point in time, with the advent of technology to drive market share and get a disproportionately higher share of fee and franchise incomes.

- At the wholesale bank-level, the moratorium 2.0 is at less than 5% for real estate loans. The management remains cautious in this segment and has moved the portfolio to higher-rated developers and larger developers.

- The management remains confident that the portfolio is well guarded for the bank and it should require minimal restructuring.

- From a risk perspective, the bank has focussed in various segments like MSME loans which are under the sovereign guarantee, and in special situations fund where the company has put in about 15% to 20% of its capital alongside fund investors. In the consumer space, the focus remains on secured retail.

- On the bank side, the company’s primary focus remains the cost of funds and customer franchises. The management believes that there is still room for the cost of funds in savings to go down further from current levels. This was the driver for NII growth despite flat YoY growth in advances.

- The management maintains that mortgages remain a big market for the company.

- Pre-COVID, the channel split for operations was at 80:20 for physical to digital. This has now turned to 10:90 for the company. The management believes that in the long term equilibrium will come to 50:50.

- The management remains confident that due to the shift towards digital, it will be able to compete better with banks that have far more branches that Kotak’s 1600 branches.

Analyst’s View

Kotak Mahindra Bank is the second-biggest private bank in the country by market capitalization. It has deservedly earned its stellar reputation over the years. The bank has performed resiliently in Q1FY21 with more than 34% growth in savings deposits and has gotten 18% YoY growth in NII despite flat advances. The company has done well to keep its books resilient with more than 80% of loans under moratorium 2.0 being secured. It has also seen a very good rise in the digital channels and plans to use this consumer shift to better compete with peers who have a much larger physical presence. It remains to be seen how the COVID-19 situation will unravel and what final impact will the end of the moratorium unravel for the company. Nonetheless, given the bank’s track record and the capability and vision of the management over the years, Kotak Mahindra Bank remains a pivotal banking stock for every Indian investor.

Q4 2020 Updates

Financial Results & Highlights

| Standalone Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 8294.07 | 7672.56 | 8.10% | 8077.03 | 2.69% | 32301.72 | 28547.24 | 13.15% |

| PBT | 1677.81 | 2111 | -20.52% | 1944.07 | -13.70% | 7804.67 | 7385.79 | 5.67% |

| PAT | 1266.6* | 1407.8 | -10.03% | 1595.9 | -20.63% | 5947.18 | 4865.33 | 22.24% |

| Consolidated Financials (In Crs) | ||||||||

| Q4FY20 | Q4FY19 | YoY % | Q3FY20 | QoQ % | FY20 | FY19 | YoY% | |

| Sales | 12084.71 | 13823.33 | -12.58% | 13542.43 | -10.76% | 50299.69 | 45903.36 | 9.58% |

| PBT | 2674.46 | 2990.59 | -10.57% | 2889.47 | -7.44% | 11421.8 | 10575.72 | 8.00% |

| PAT | 1951.82** | 2038.22 | -4.24% | 2329.33 | -16.21% | 8607.08 | 7119.7 | 20.89% |

*Contains Provision of Rs 1047 Cr. **Contains provision of Rs 1262 Cr.

Detailed Results

-

- The net standalone revenues rose 8% YoY in Q4.

- Consolidated profit fell 12.5% YoY in Q4.

- On the other hand, FY20 saw revenue growth of 13% YoY and 22% YoY in standalone terms. Consolidated revenues and profits grew 9.6% YoY and 21 % YoY respectively.

- The consolidated net interest margin was 4.59% vs 4.24% a year ago.

- Total advances grew 2.6% YoY while AUM was flat YoY.

- The company maintained a consolidated CAR of 19.8% vs 17.9% a year ago.

- Book value per share was at Rs 348.3 per share.

- Total assets grew 12% YoY.

- The company has an overall cash surplus of Rs 67,314 Cr out of which Rs 49,015 Cr are in Kotak Mahindra Bank.

- At a standalone level, GNPAs was at 2.25% while net NPAs were at 0.71% on 31st March 2020.

- Advances for standalone entity grew 6.8% YoY.

- The CASA ratio was at 56.2% vs 52.5% a year ago.

- The savings deposit base grew 31% YoY to over Rs 1 lakh crore. The average SA size also grew 21% YoY to Rs 85,656.

- The current account base also grew 10.5% YoY to Rs 43,013 Cr. The average CA size also grew 17% YoY to Rs 33,699.

- Costs of SA was at 5.23% vs 5.66% a year ago.

- Total deposits including CDs grew 16% YoY to Rs 2,62,821 Cr.

- ~44 lakh 811 accounts opened in FY20.

- The bank maintained PCR of 69% in FY20.

- The bank has made COVID provisioning of Rs 650 Cr. It is at 10% at account level.

- In Kotak Mahindra Life Insurance, VNB margin was at 28.8%. The individual new business mix was as follows:

- Participating products: 5%

- Non-participating products: 39%

- ULIP: 5%

- Claims settlement ratio was at 99.2%. The mix of new business channel was 44% for bancassurance and 56% for agency & others.

- Gross written premium rose 26.6% YoY while gross individual premium grew 20.8% YoY.

- Group premium grew 43.3% YoY. Policyholders’ AUM grew 14.6% YoY.

- Solvency ratio was at 2.9 times.

- In Kotak Mahindra AMC, overall average AUM grew 25% YoY to Rs 1,73,394 Cr. Equity AUM grew 31% YoY and now constitutes 41.6% of total AUM.

- Market share of the subsidiary grew to 6.9% (from 6.1%) and 6.1% (from 5.2%) in overall and equity terms respectively.

- Kotak securities has a modest year with market share maintained at 9.1%.

Investor Conference Call Highlights

- The management has stated that the company is looking at lending based on 3 aspects which are sector, whether the company has high fixed costs and whether the company has high leverage.

- The company added an average of 14,000 new customer accounts per day through its digital acquisition channel since the start of FY21.

- The management sees a good opportunity to grow the non-credit risk business areas for the bank including advisory, securities, wealth management and asset management.

- The other income for the bank grew 17% YoY to Rs 1489 Cr in standalone terms.

- Around 26% of borrowers went for the Moratorium in April.

- The bank has made significant efforts in online customer acquisition. It has extended 811 accounts into all channels including corporate salary, branches and others. The bank is also the first in India with Google Assistant integration where bank customers can ask for balances via Google Assistant.

- The breakdown of the bank’s lending divisions is as follows:

- Corporate & Business banking: Rs 84,855 Cr

- Commercial Vehicles/Construction Vehicles: Rs 19,253 Cr

- Agriculture: Rs 21,188 Cr

- Tractor Finance: Rs 7,569 Cr

- Home Loans: Rs 46,881 Cr

- Secured Working Capital: Rs 19,839 Cr

- PL, BL & Consumer Durables: Rs 9,754 Cr

- Credit Cards: Rs 4,701 Cr

- Others: Rs 5,708 Cr

- In Corporate & Business Banking division, SME lending is around Rs 21,000 Cr. In the commercial vehicle/construction vehicles division, SME lending is at Rs 19,000 Cr. In the secured working capital division, almost all of the loans are in SMEs.

- The management has stated that the bank shall remain cautious in lending without sovereign guarantee and it will step up on lending if sovereign guarantee is applied.

- Savings growth in April and May so far has been positive YoY for the bank.

- Despite dropping the savings rate twice in the recent past, the current rates are still greater than industry average which shows that there is good room for reduction in cost of savings accounts for the bank according to the management.

- The bank shall remain aggressive in assessing lending targets and will be assessing them mainly on future potential rather than past track record since COVID-19 may have caused many irreversible changes in particular sectors.

- The factors affecting VNB margin were the drop in interest rates, increase in expenses, change in channel mix and change in product mix.

- The total exposure to real estate for the bank on standalone terms is around Rs 6,000 Cr while total exposure on consolidated terms is Rs 10,000 Cr.

- The management has stated that the company is not targeting any particular spread or band of margin and is basically looking to operate at the optimal balance of risk to return.

- The management has stated that the entire senior management of the company has opted for a voluntary 15% cut in salaries for the coming year.

- The management expects the demand for office space to go down especially for the bank due to the coming into prevalence of working from home.

- The management also believes that there will a significant increase in digital journeys for all processes and functions in the future. Thus spending on digital and technology is going to go up.

- The management also expects business models to become more adaptive flexible to be able to respond better to unforeseen changes in the world as in the case of COVID-19.

- The management admits that the unsecured channel is the area with most worry right now.

- The management has observed that the barriers to entry into banking and financial services have essentially reduced in the past decade and more and more SFBs and more NBFCs have come up which has resulted in various execution issues and lots of differences in underwriting standards. Although the entry has been eased for players in the industry, exit still remains unclear. Thus the only visible exits are either a bank ceases to exist or gets acquired or consolidated with another player in the future.

- The management admits that the average balance for 811 accounts is very small. The major draw for the bank here is to migrate the 811 account to full KYC account and convert the person to a regular customer.

- The management has stated that the bank will continue to take term deposits but will focus on smaller tickets. The preferred strategy is to have TDs of up to Rs 1 Cr only here.

- The management expects the entire unsecured segment including credit cards and unsecured loans to be in pain going forward. In secured loans, the management expects CV/CE segment to be in the most pain going forward.

- In the home loan segment, the bank had been very aggressive in the past year and was focusing primarily on existing bank customers through the bank branches. The focus was particularly around large cities like Mumbai, Delhi, Bangalore, Ahmedabad, Pune, etc.

- The management credit costs to be higher than at present going forward.

- The management believe that going forward as risk becomes more concentrated due to industry consolidation, banking industry will have to get more responsible in terms of lending covenants and fiduciary responsibility of ratings agencies will be required to higher than before.

- The management has stated that the bank will look at various productivity measures to assess cist saving avenues while continuing to invest in recovery infrastructure for retail since retail figures tend to shoot up in step fashion on recovery.

Analyst’s View

Kotak Mahindra Bank is the second-biggest private bank in the country by market capitalization. It has deservedly earned its stellar reputation over the years. The bank has performed very well in FY20 with more than 31% growth in deposits despite instituting two savings rate cuts in the year. The company has also managed to achieve savings deposit growth in April and May despite instituting the latest savings rate cut in April itself. It is a testament to the vision of the management that even in such trying times of COVID-19, the aim of the bank is to better its underwriting processes looking at future potential, institute cost savings and focus on digital and technology to stay agile and take advantage of upcoming opportunities in the banking space. It remains to be seen how the COVID-19 situation will unravel and what final impact it will have on the company’s performance and the performance of the vulnerable but essential MSME sector. Nonetheless, given the bank’s track record and the capability and vision of the management over the years, Kotak Mahindra Bank remains a pivotal banking stock for every Indian investor.

Disclaimer

This is not a piece of investment advice. Please read our terms and conditions.